This version of the form is not currently in use and is provided for reference only. Download this version of

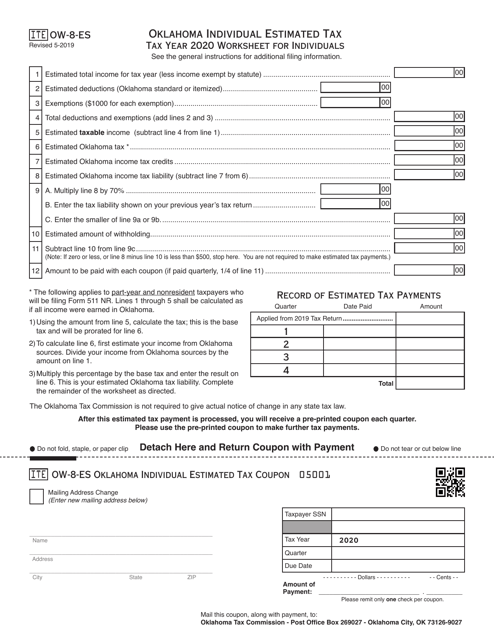

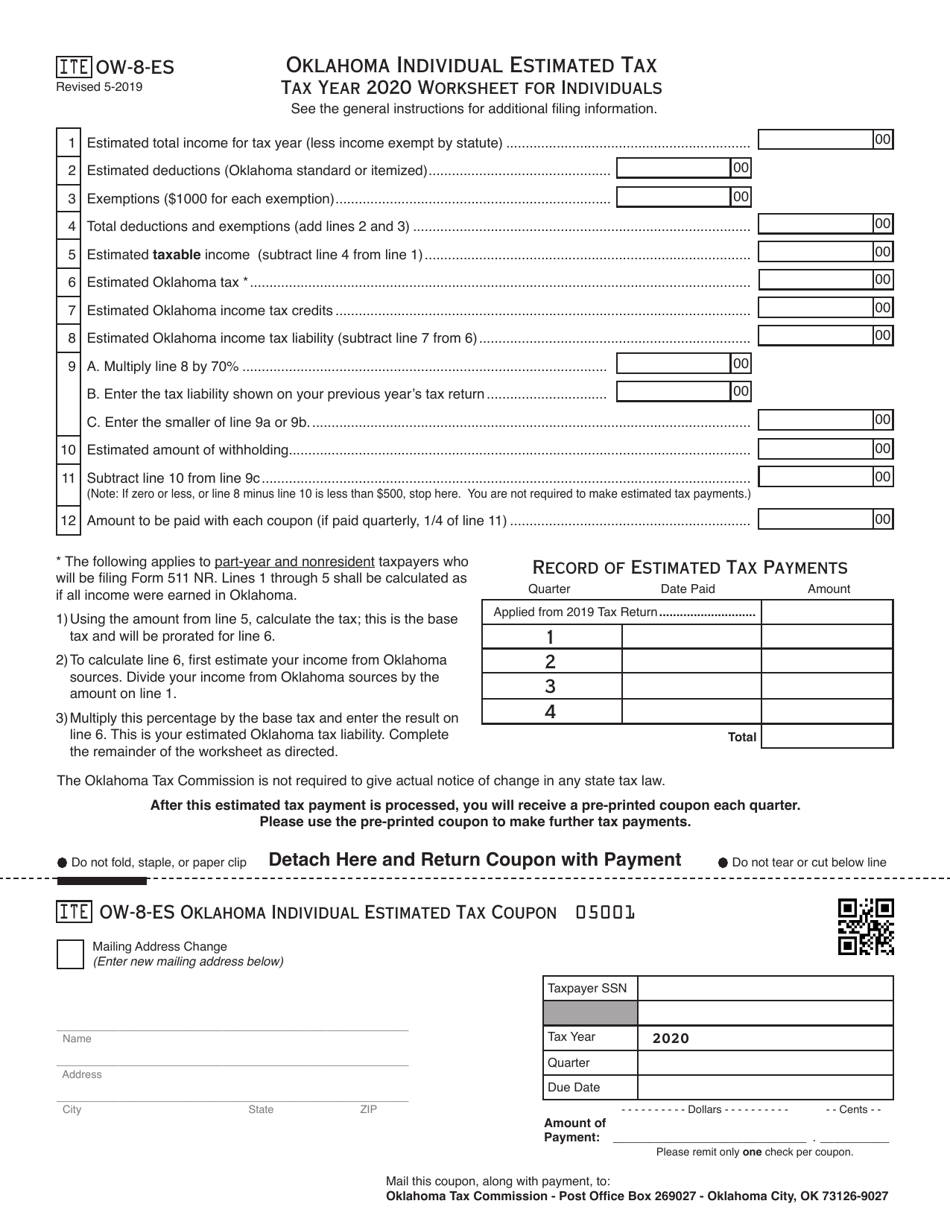

Form OW-8-ES

for the current year.

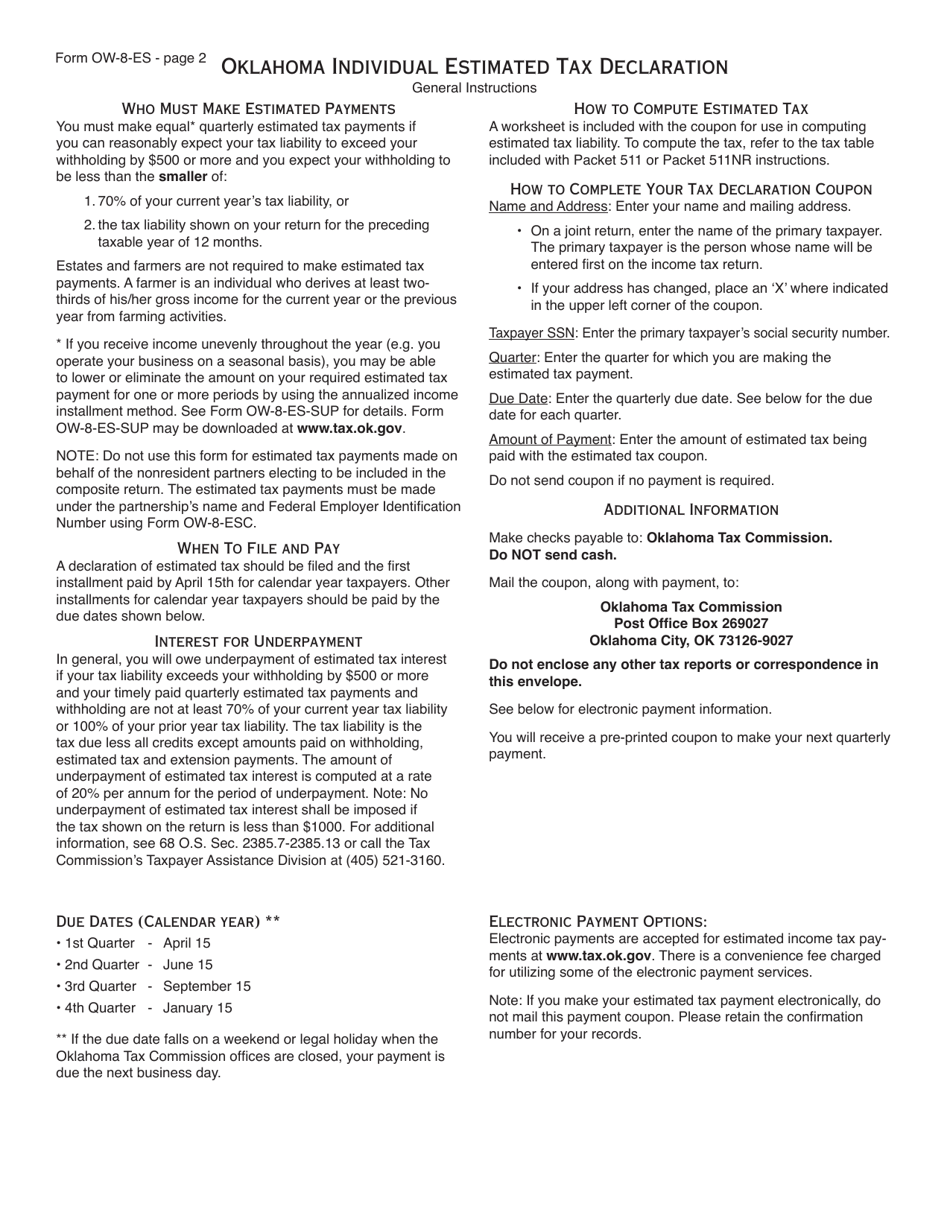

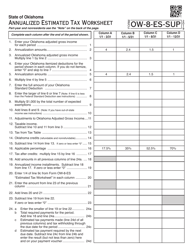

Form OW-8-ES Oklahoma Individual Estimated Tax Declaration - Oklahoma

What Is Form OW-8-ES?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OW-8-ES?

A: Form OW-8-ES is the Oklahoma Individual Estimated Tax Declaration form.

Q: Who needs to file Form OW-8-ES?

A: Oklahoma residents who expect to owe more than $500 in income tax for the tax year need to file Form OW-8-ES.

Q: What is the purpose of Form OW-8-ES?

A: Form OW-8-ES is used to help individuals estimate and pay their income tax liabilities throughout the year.

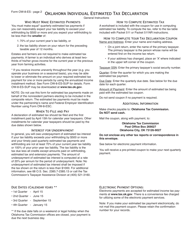

Q: When is Form OW-8-ES due?

A: Form OW-8-ES is due on April 15th of the tax year or the next business day if it falls on a weekend or holiday.

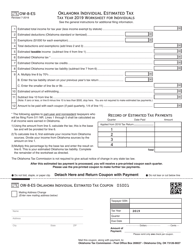

Q: How often do I need to file Form OW-8-ES?

A: Form OW-8-ES should be filed quarterly, with estimated tax payments due on April 15th, June 15th, September 15th, and January 15th of the following year.

Q: What happens if I don't file Form OW-8-ES?

A: If you are required to file Form OW-8-ES and fail to do so, you may be subject to underpayment penalties and interest charges on the amount owed.

Q: Can I make changes to my estimated tax payments?

A: Yes, if your income or deductions change during the year, you may need to adjust your estimated tax payments by filing an amended Form OW-8-ES.

Q: Do I need to submit any attachments with Form OW-8-ES?

A: No, you do not need to submit any attachments with Form OW-8-ES when filing.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OW-8-ES by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.