This version of the form is not currently in use and is provided for reference only. Download this version of

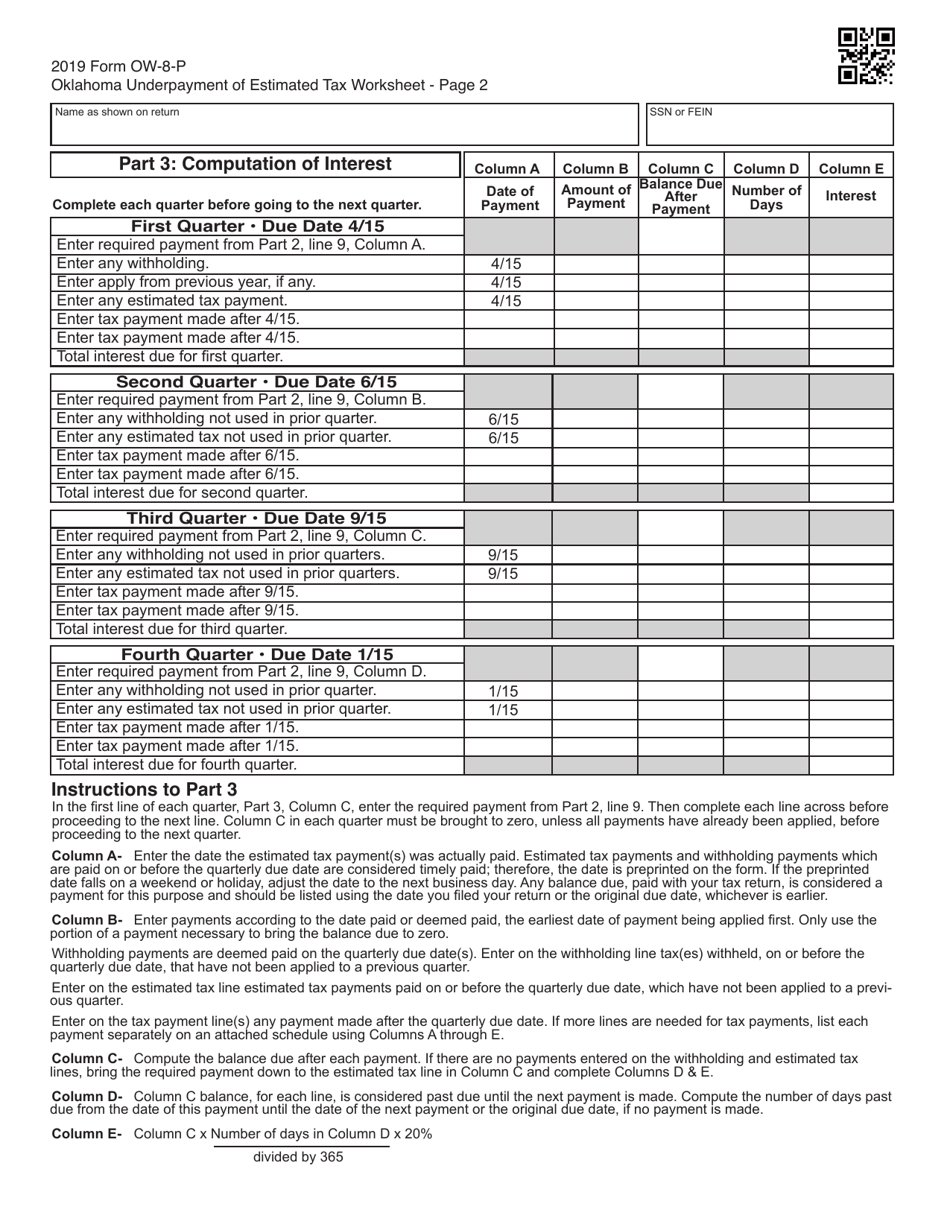

Form OW-8-P

for the current year.

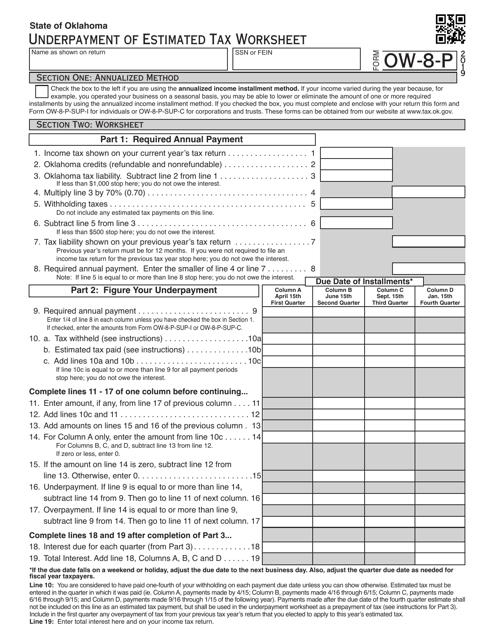

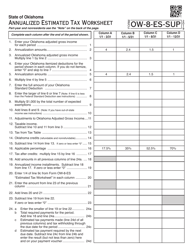

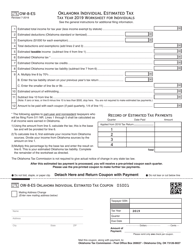

Form OW-8-P Underpayment of Estimated Tax Worksheet - Oklahoma

What Is Form OW-8-P?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

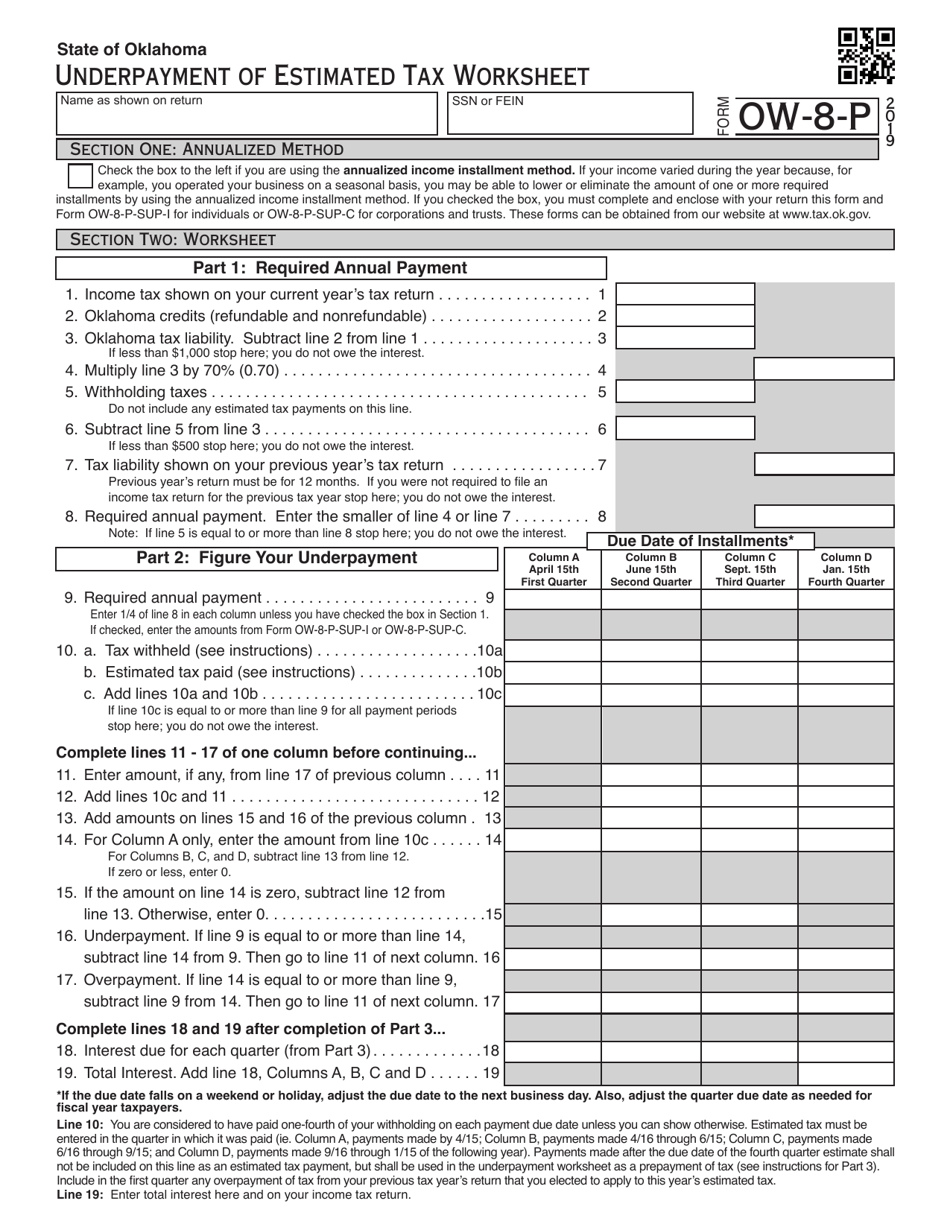

Q: What is Form OW-8-P?

A: Form OW-8-P is a worksheet used to calculate the underpayment of estimated tax liability in the state of Oklahoma.

Q: Who should use Form OW-8-P?

A: Individuals who made estimated tax payments in Oklahoma may need to use Form OW-8-P to calculate any underpayment of tax.

Q: What is the purpose of Form OW-8-P?

A: The purpose of Form OW-8-P is to determine if an individual owes any underpayment penalty on their estimated tax payments in Oklahoma.

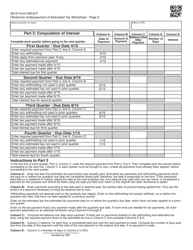

Q: How do I fill out Form OW-8-P?

A: You will need to provide information about your estimated tax payments, income, and deductions to complete Form OW-8-P.

Q: When is Form OW-8-P due?

A: Form OW-8-P is generally due with your Oklahoma individual income tax return, which is due by April 15th of each year.

Q: What happens if I don't file Form OW-8-P?

A: If you owed estimated taxes in Oklahoma and didn't file Form OW-8-P, you may be subject to an underpayment penalty.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OW-8-P by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.