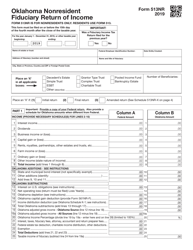

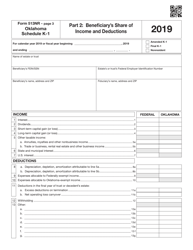

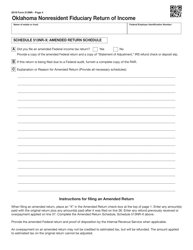

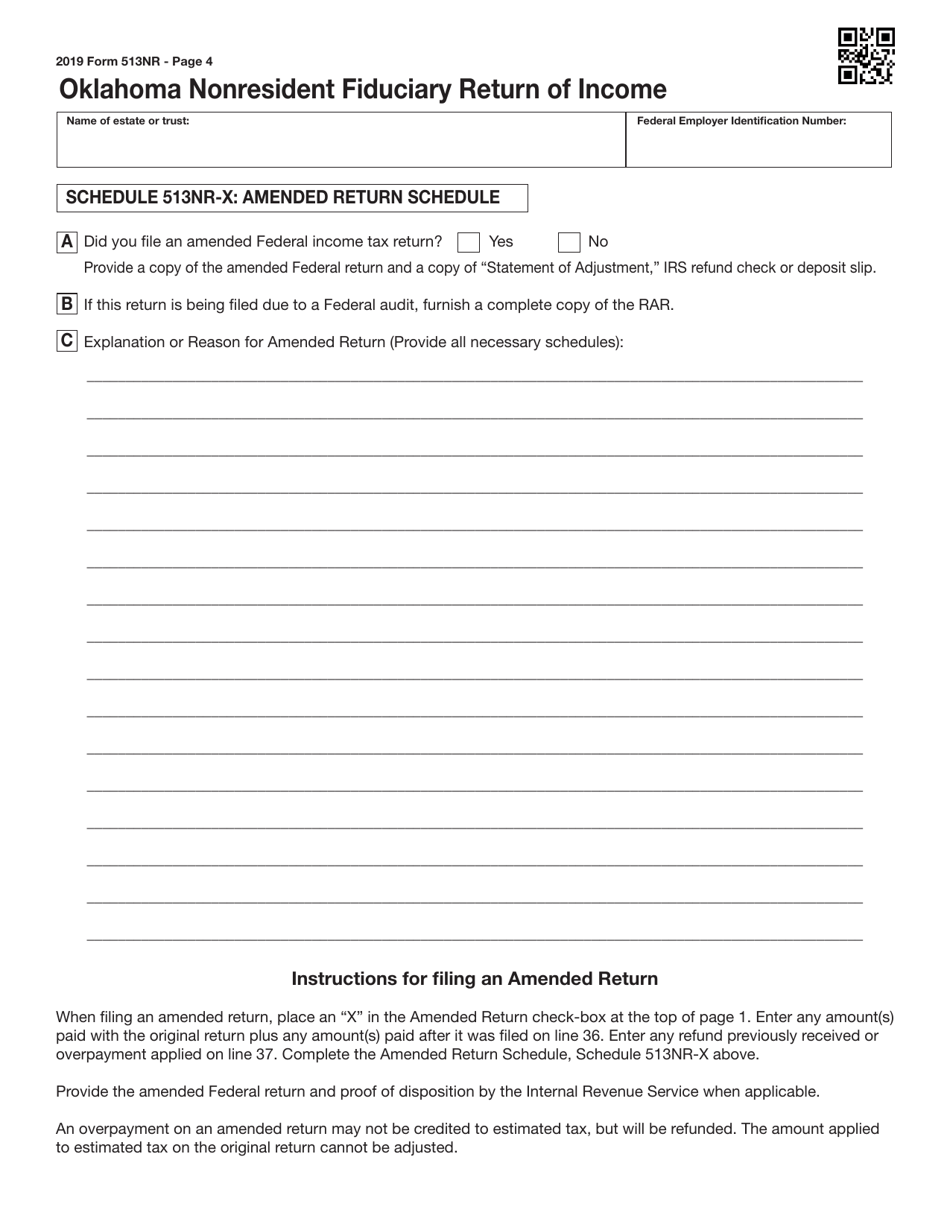

Form 513NR Oklahoma Nonresident Fiduciary Return of Income - Oklahoma

What Is Form 513NR?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 513NR?

A: Form 513NR is the Oklahoma Nonresident Fiduciary Return of Income form.

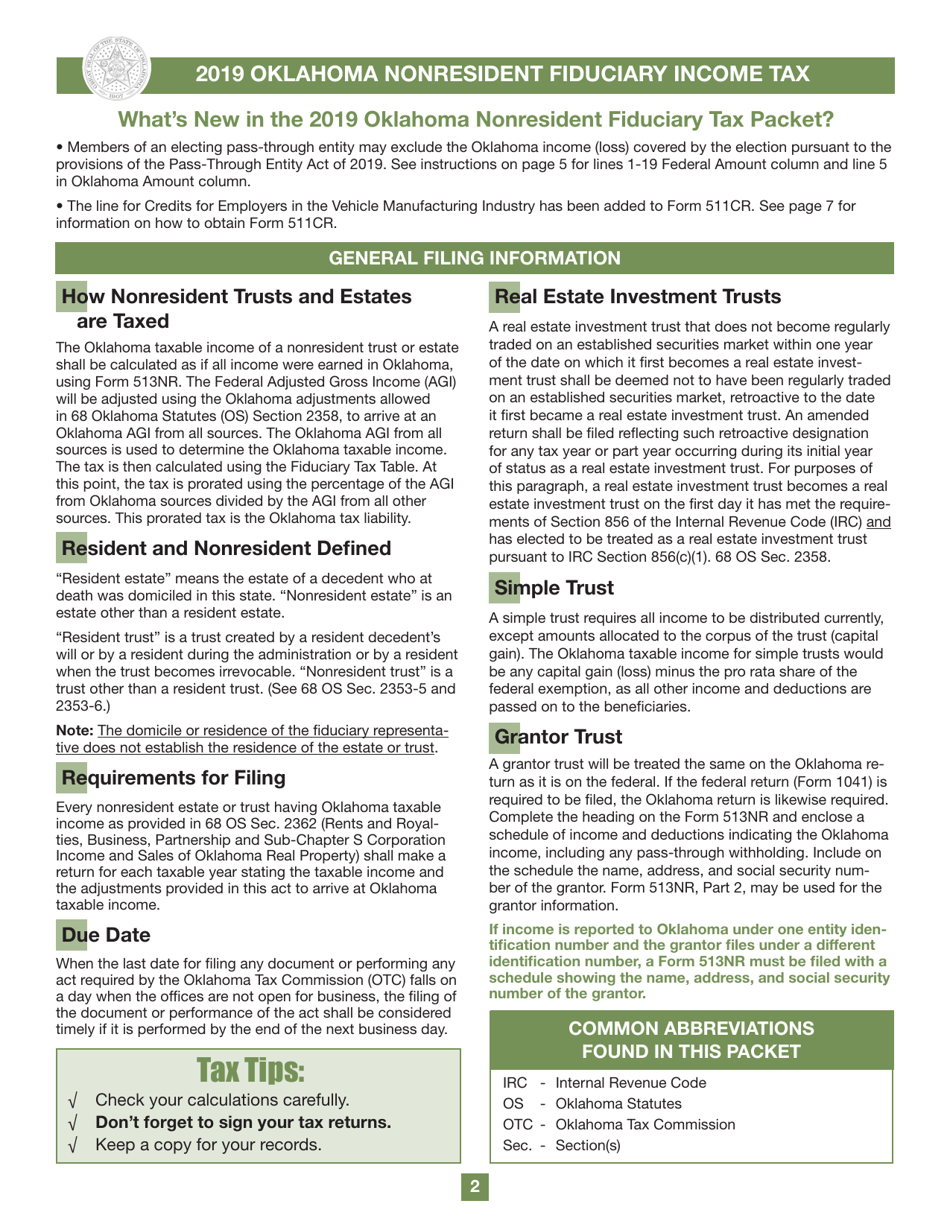

Q: Who needs to file Form 513NR?

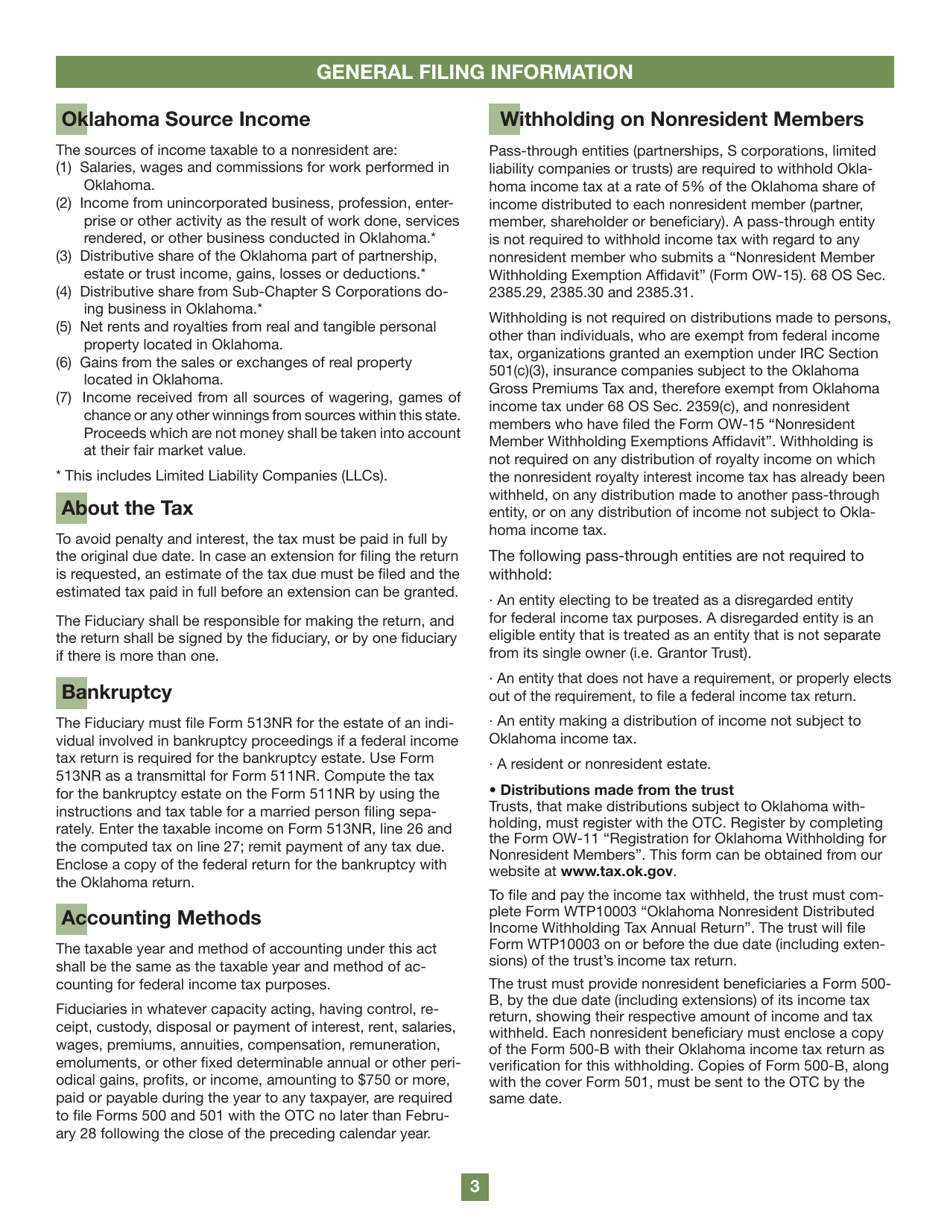

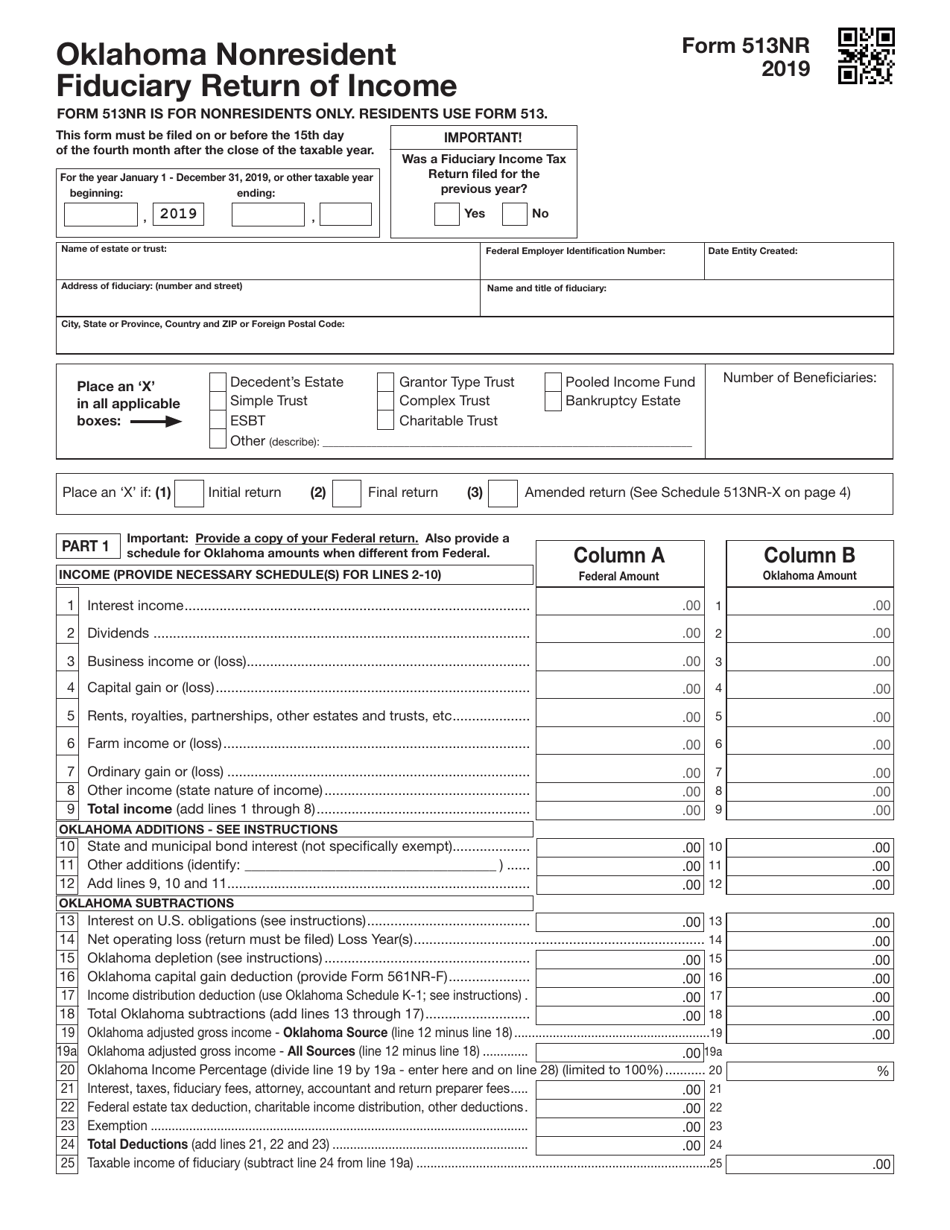

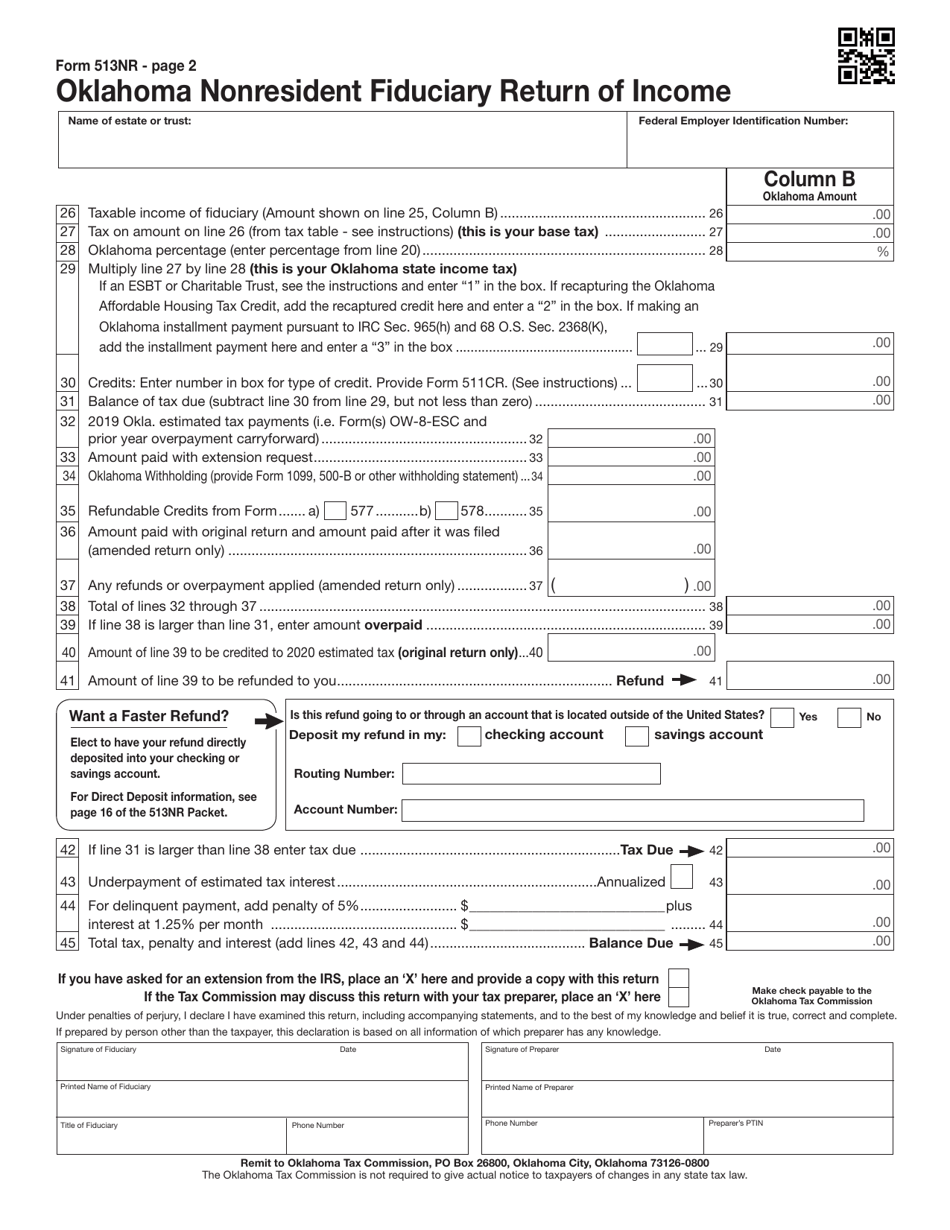

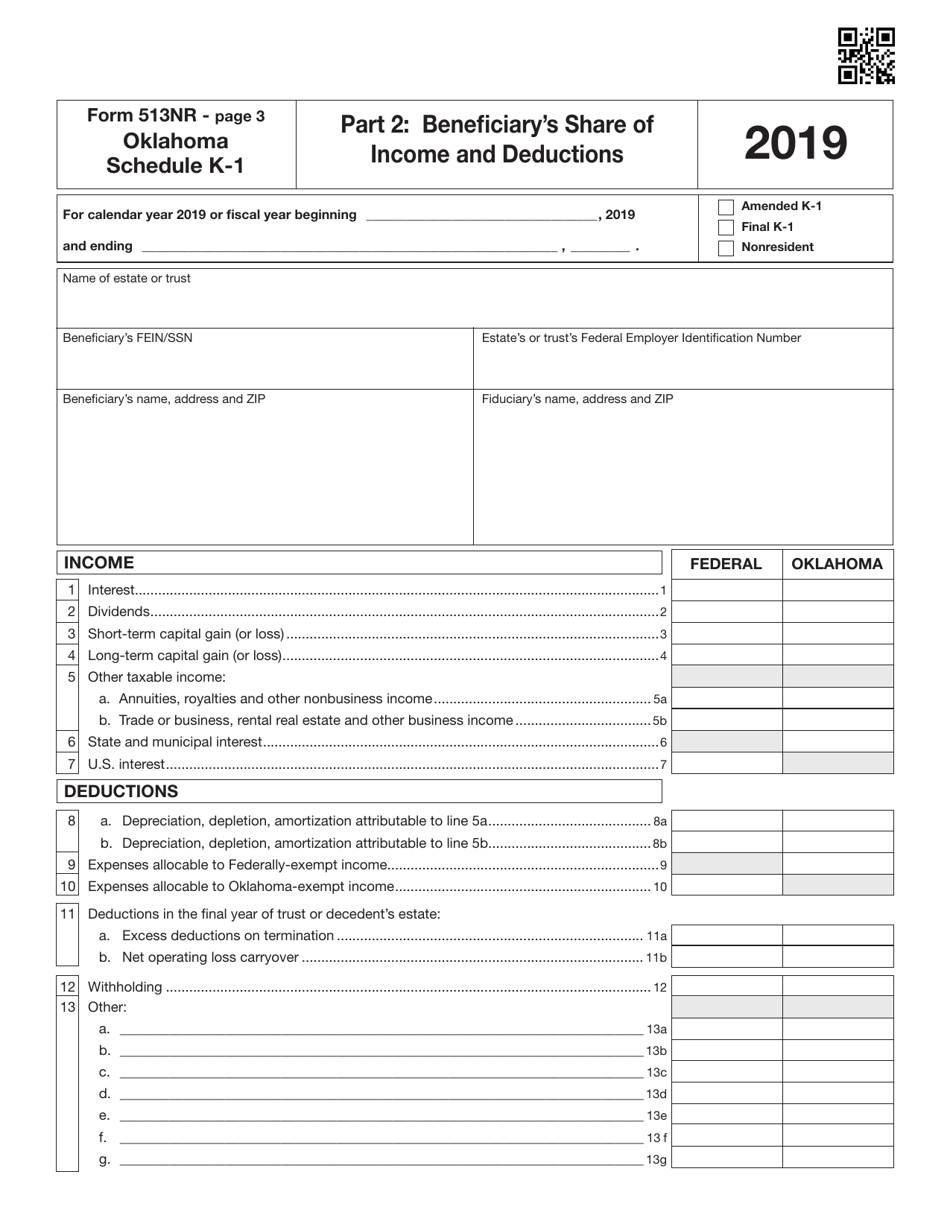

A: Any nonresident fiduciary who has income from Oklahoma sources must file Form 513NR.

Q: What is the purpose of Form 513NR?

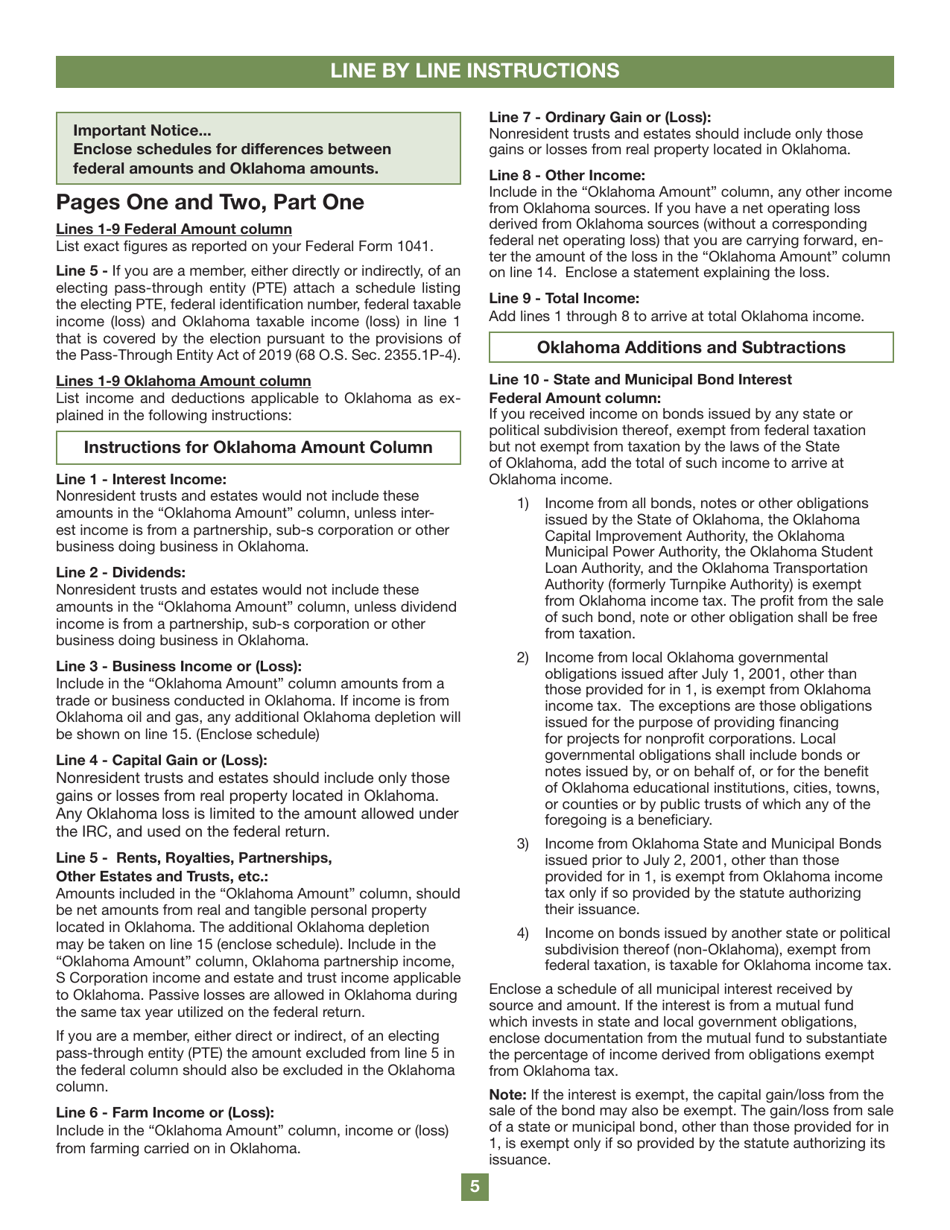

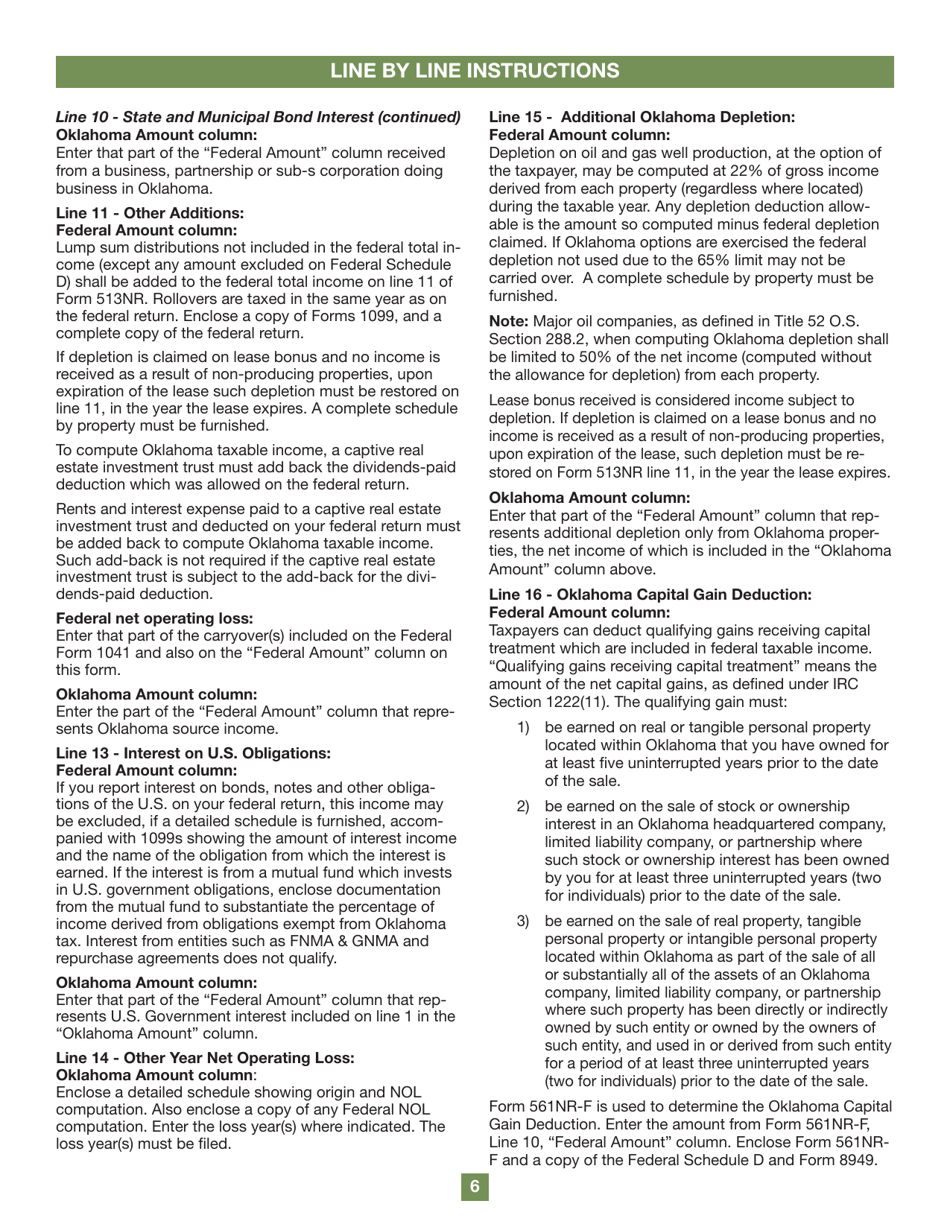

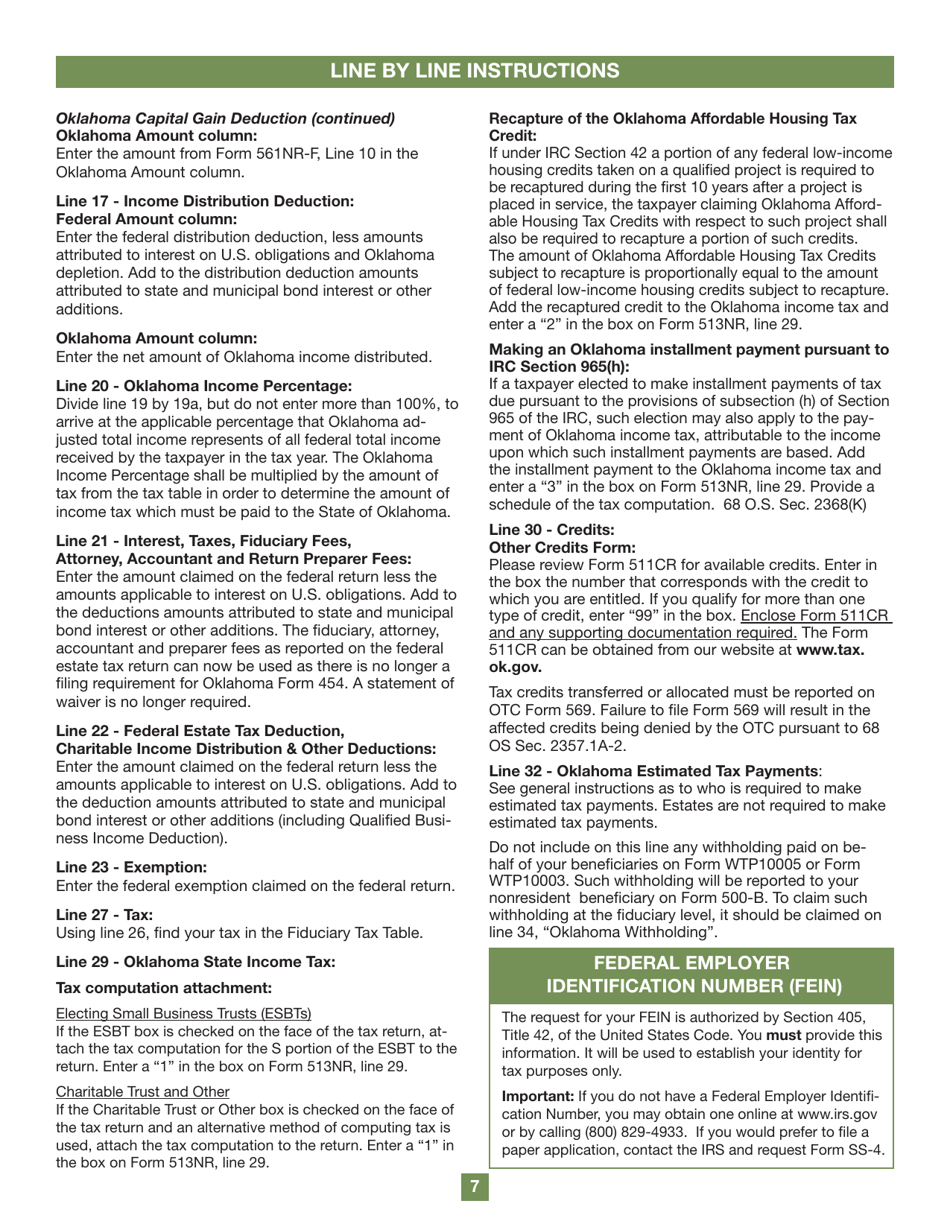

A: Form 513NR is used to report and calculate the Oklahoma taxable income of nonresident fiduciaries.

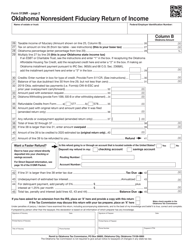

Q: When is Form 513NR due?

A: Form 513NR is due on or before the 15th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for late filing of Form 513NR?

A: Yes, there are penalties for late filing of Form 513NR, so it is important to submit the form on time.

Q: Can Form 513NR be filed electronically?

A: No, currently Form 513NR cannot be filed electronically and must be mailed to the Oklahoma Tax Commission.

Q: What should I include with Form 513NR?

A: You should include a copy of the federal fiduciary income tax return (Form 1041) and any supporting documents.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 513NR by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.