This version of the form is not currently in use and is provided for reference only. Download this version of

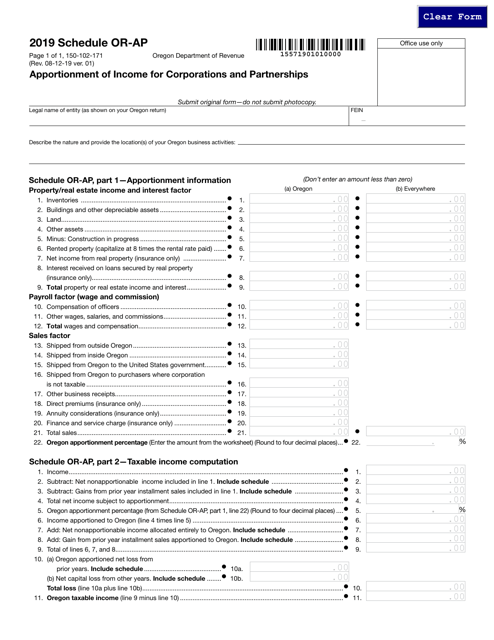

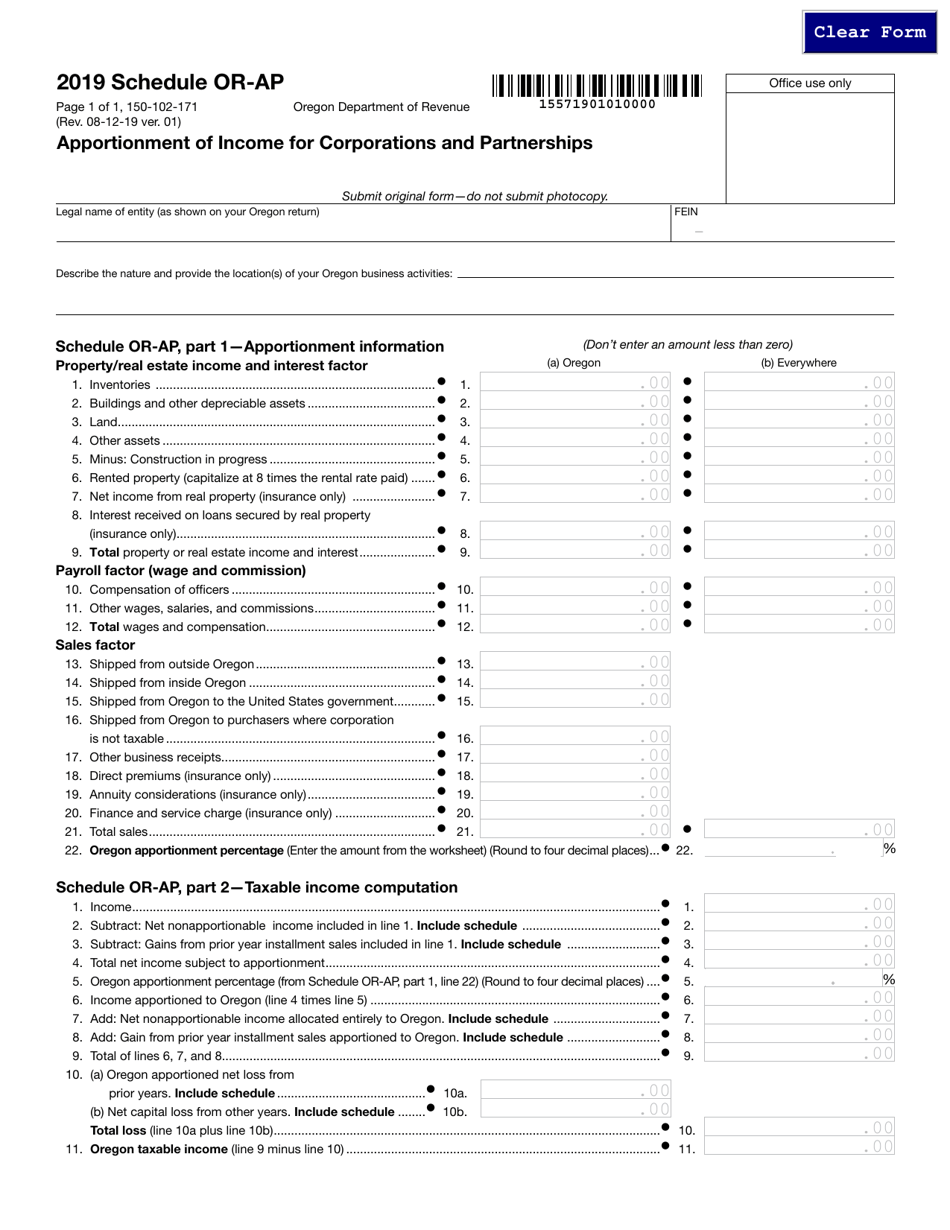

Form 150-102-171 Schedule OR-AP

for the current year.

Form 150-102-171 Schedule OR-AP Apportionment of Income for Corporations and Partnerships - Oregon

What Is Form 150-102-171 Schedule OR-AP?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-102-171?

A: Form 150-102-171 is a schedule used for apportionment of income for corporations and partnerships in Oregon.

Q: Who should use Form 150-102-171?

A: Corporations and partnerships that have income from multiple states and operate in Oregon should use this form.

Q: What is the purpose of Form 150-102-171?

A: The purpose of this form is to determine the portion of the income that should be apportioned to Oregon for tax purposes.

Q: Is Form 150-102-171 mandatory?

A: Yes, if your corporation or partnership meets the criteria for filing this form, it is mandatory to use it to apportion your income in Oregon.

Form Details:

- Released on December 8, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-171 Schedule OR-AP by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.