This version of the form is not currently in use and is provided for reference only. Download this version of

Form RI-1041V

for the current year.

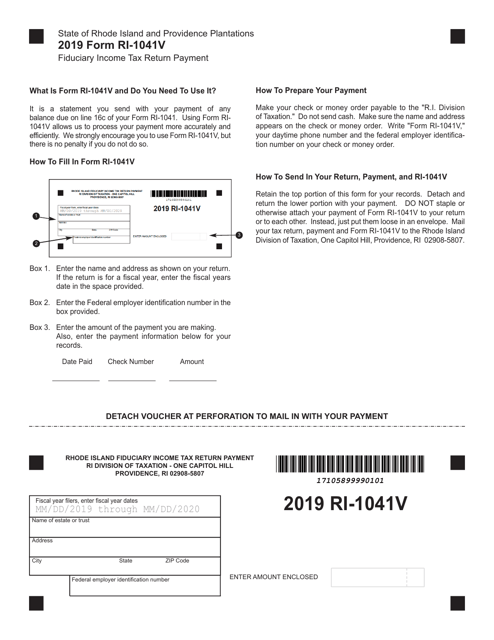

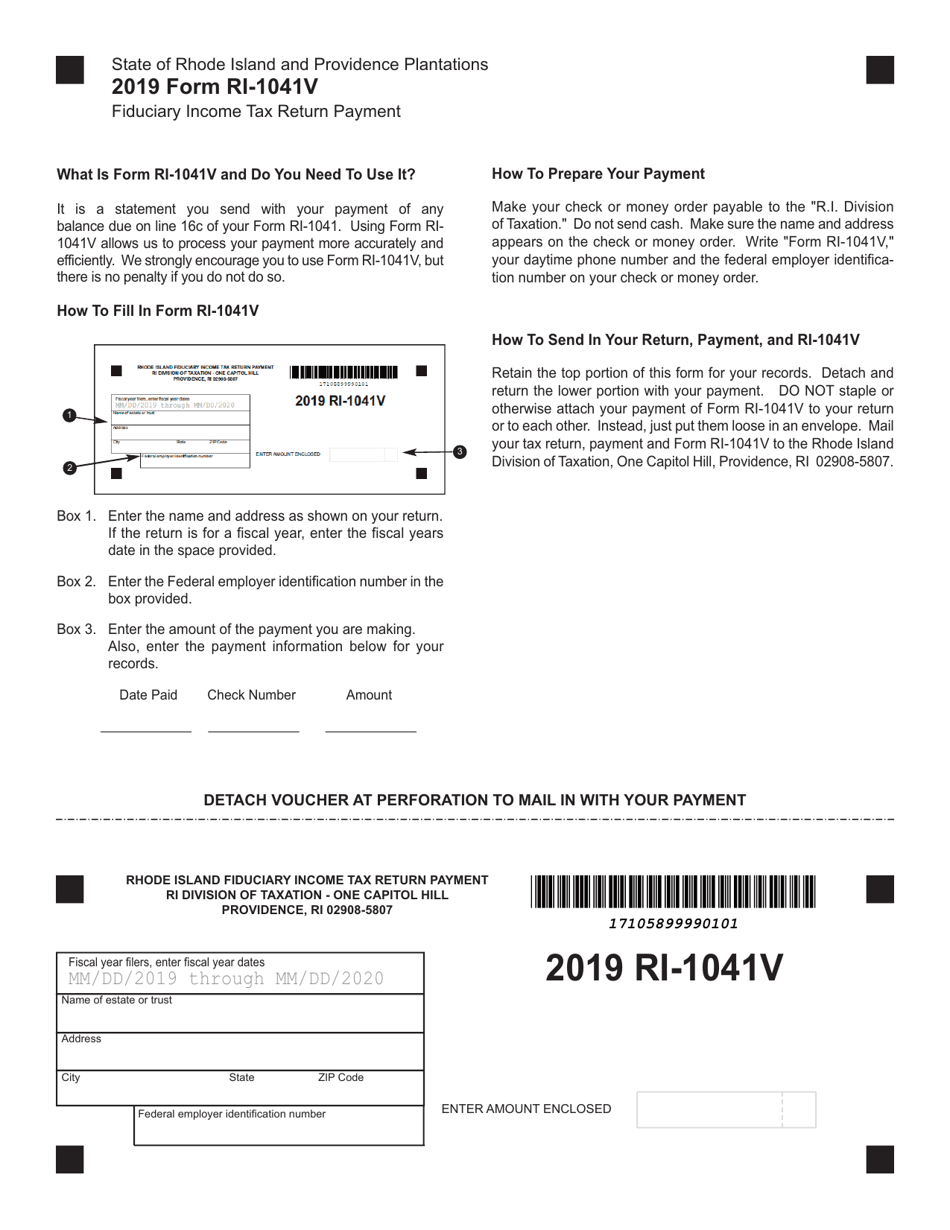

Form RI-1041V Fiduciary Income Tax Return Payment - Rhode Island

What Is Form RI-1041V?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1041V?

A: Form RI-1041V is the Fiduciary Income TaxReturn Payment form for Rhode Island.

Q: Who should use Form RI-1041V?

A: Form RI-1041V should be used by fiduciaries in Rhode Island who need to make a payment for their fiduciary income tax return.

Q: What is a fiduciary?

A: A fiduciary is someone who has been designated to manage and distribute assets on behalf of another person or entity, such as an executor or trustee.

Q: What is the purpose of Form RI-1041V?

A: The purpose of Form RI-1041V is to provide a means for fiduciaries to make a payment for their Rhode Island fiduciary income tax return.

Q: Can Form RI-1041V be used to file a tax return?

A: No, Form RI-1041V is only used for making payments for the fiduciary income tax return. The actual tax return must be filed separately using Form RI-1041.

Q: When is Form RI-1041V due?

A: Form RI-1041V should be submitted with the payment by the due date of the Rhode Island fiduciary income tax return, which is typically April 15th.

Q: Are there any penalties for late payment?

A: Yes, there may be penalties for late payment of the fiduciary income tax. It is important to submit the payment by the due date to avoid penalties.

Q: How should the payment be made?

A: The payment can be made by check or money order, payable to "Rhode Island Division of Taxation". The form provides details on where to send the payment.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1041V by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.