This version of the form is not currently in use and is provided for reference only. Download this version of

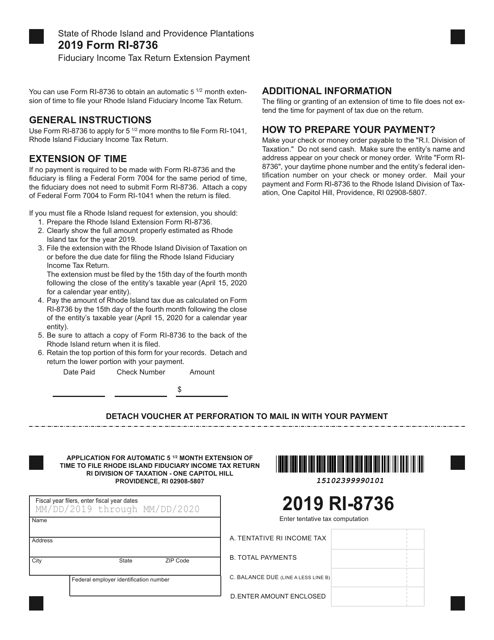

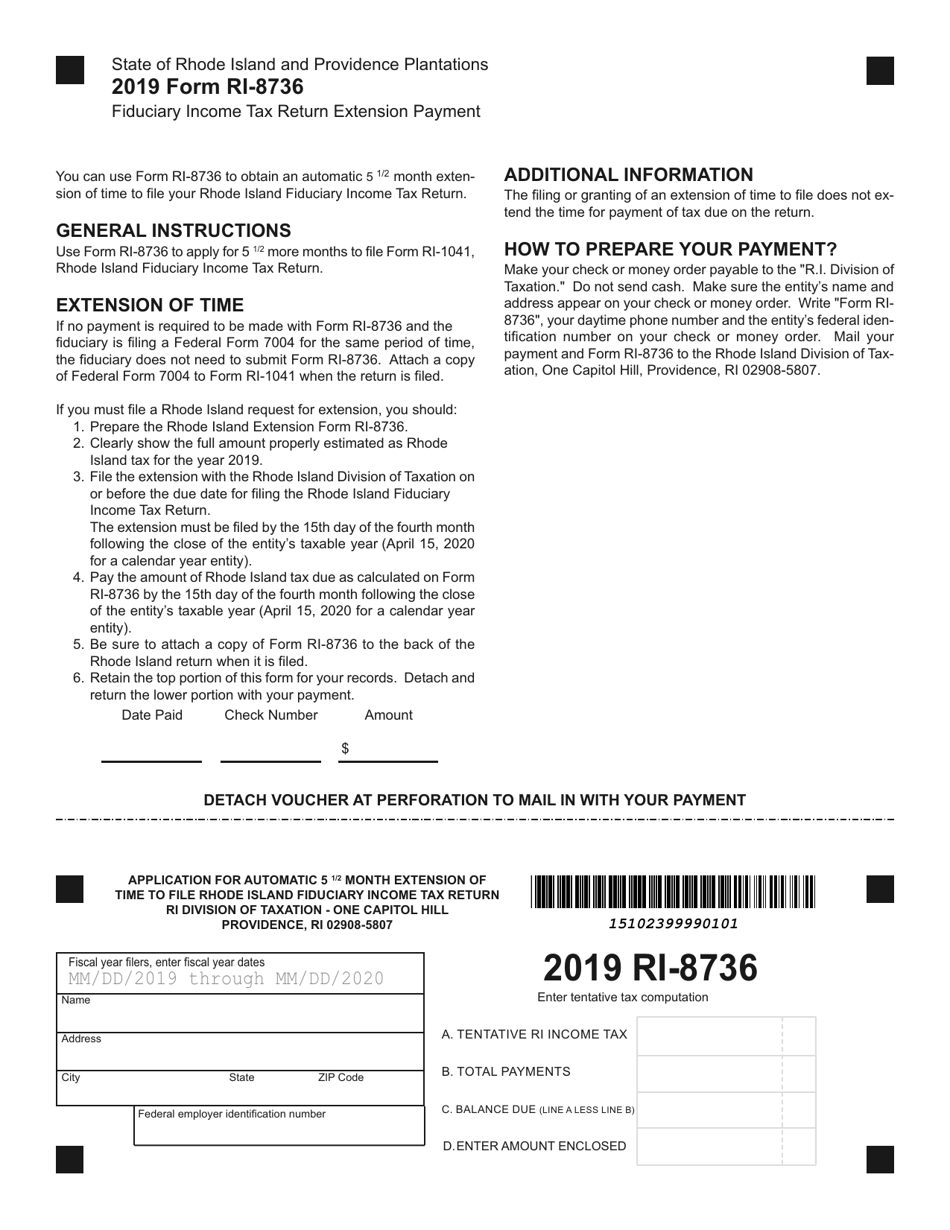

Form RI-8736

for the current year.

Form RI-8736 Fiduciary Income Tax Return Extension Payment - Rhode Island

What Is Form RI-8736?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-8736?

A: Form RI-8736 is the Fiduciary IncomeTax Return Extension Payment form for Rhode Island.

Q: What is a Fiduciary Income Tax Return?

A: A Fiduciary Income Tax Return is a tax return filed by a fiduciary, such as an executor or trustee, who is responsible for reporting and paying taxes on behalf of a decedent or a trust.

Q: Who needs to file Form RI-8736?

A: Anyone who needs an extension to file their Rhode Island Fiduciary Income Tax Return must file Form RI-8736.

Q: What is the purpose of Form RI-8736?

A: The purpose of Form RI-8736 is to request an extension of time to file the Fiduciary Income Tax Return in Rhode Island and make a payment toward the estimated tax liability.

Q: When is Form RI-8736 due?

A: Form RI-8736 must be filed and the payment must be made on or before the original due date of the Fiduciary Income Tax Return in Rhode Island.

Q: What happens if I don't file Form RI-8736?

A: If you don't file Form RI-8736 and make the required payment by the original due date of the Fiduciary Income Tax Return, you may be subject to penalties and interest.

Q: Is Form RI-8736 the same as the Fiduciary Income Tax Return?

A: No, Form RI-8736 is not the same as the Fiduciary Income Tax Return. It is only used to request an extension of time to file and make a payment toward the estimated tax liability.

Q: Can I e-file Form RI-8736?

A: Currently, Rhode Island does not offer electronic filing for Form RI-8736. It must be filed by mail.

Q: What if I need more time to file after getting an extension using Form RI-8736?

A: If you need more time to file after getting an extension using Form RI-8736, you can request an additional extension by filing Form RI-4868.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-8736 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.