This version of the form is not currently in use and is provided for reference only. Download this version of

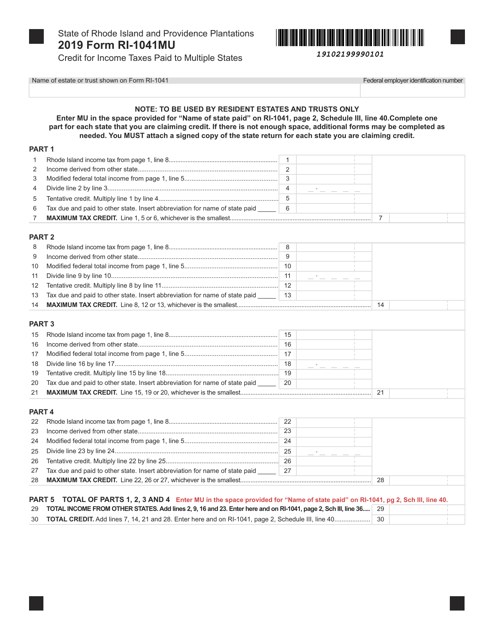

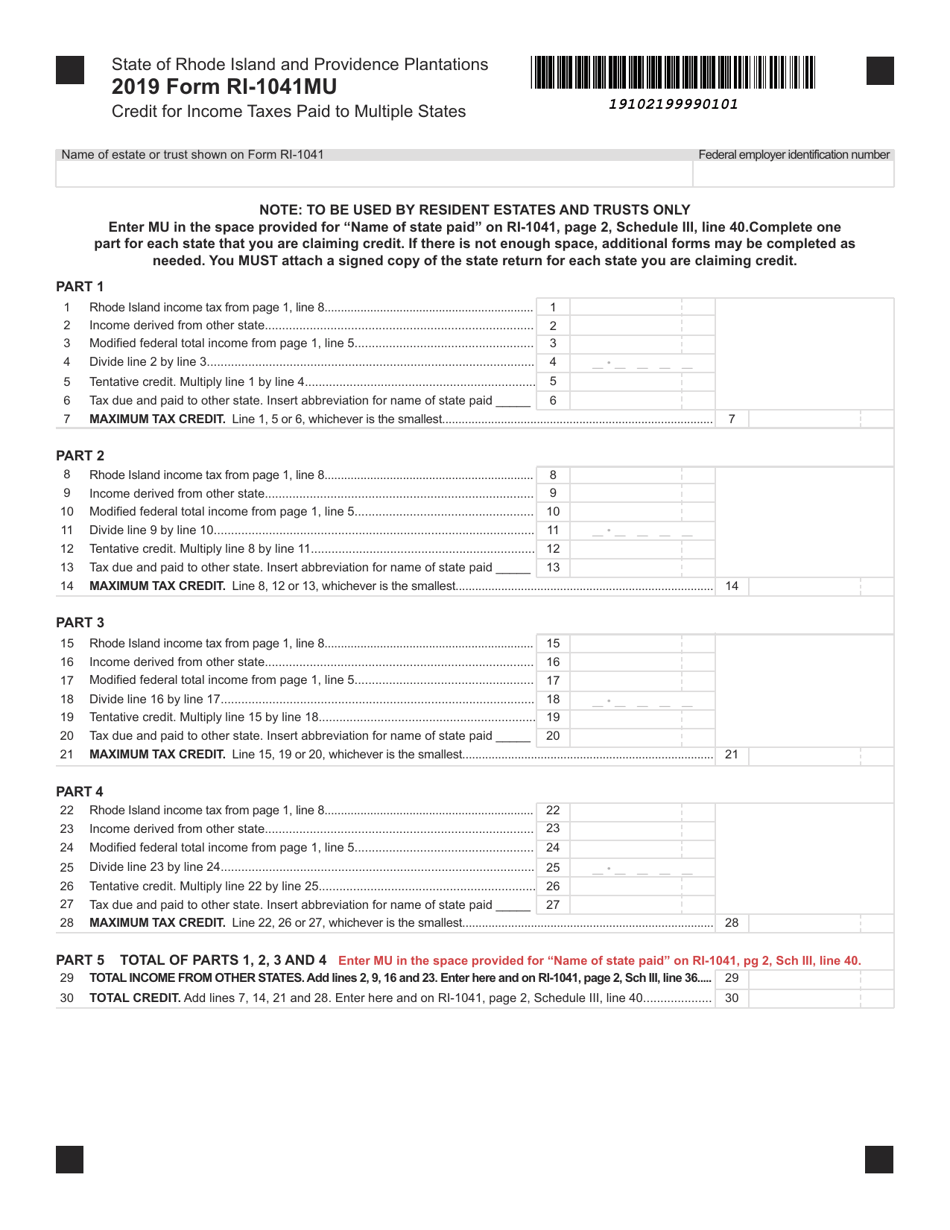

Form RI-1041MU

for the current year.

Form RI-1041MU Credit for Income Taxes Paid to Multiple States - Rhode Island

What Is Form RI-1041MU?

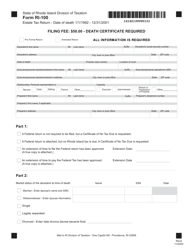

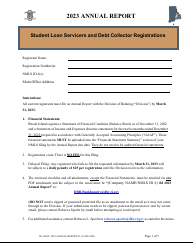

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1041MU?

A: Form RI-1041MU is a tax form used by residents of Rhode Island to claim a credit for income taxes paid to multiple states.

Q: Who should file Form RI-1041MU?

A: Residents of Rhode Island who have paid income taxes to multiple states should file Form RI-1041MU.

Q: What is the purpose of Form RI-1041MU?

A: The purpose of Form RI-1041MU is to calculate and claim a credit for income taxes paid to other states.

Q: What information is needed to complete Form RI-1041MU?

A: To complete Form RI-1041MU, you will need information about the income taxes you paid to other states, including the amounts paid and the states in which you paid them.

Q: When is the deadline for filing Form RI-1041MU?

A: The deadline for filing Form RI-1041MU is the same as the deadline for filing your Rhode Island income tax return, which is usually April 15th.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1041MU by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.