This version of the form is not currently in use and is provided for reference only. Download this version of

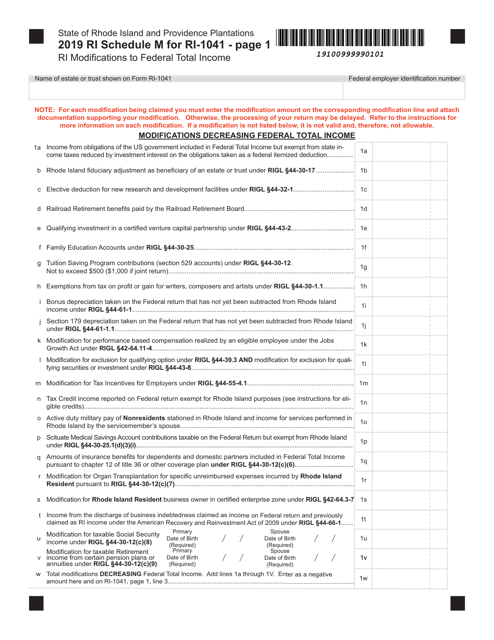

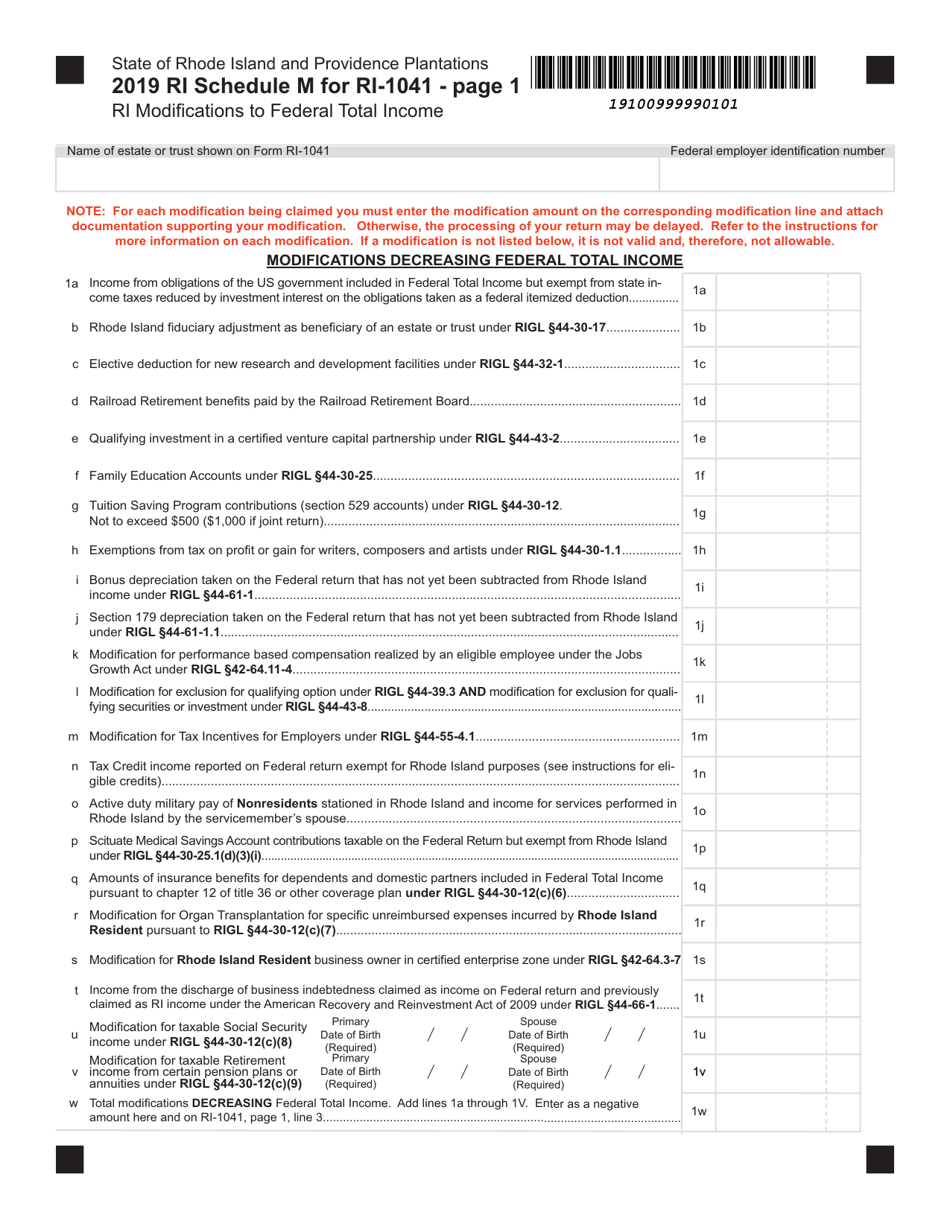

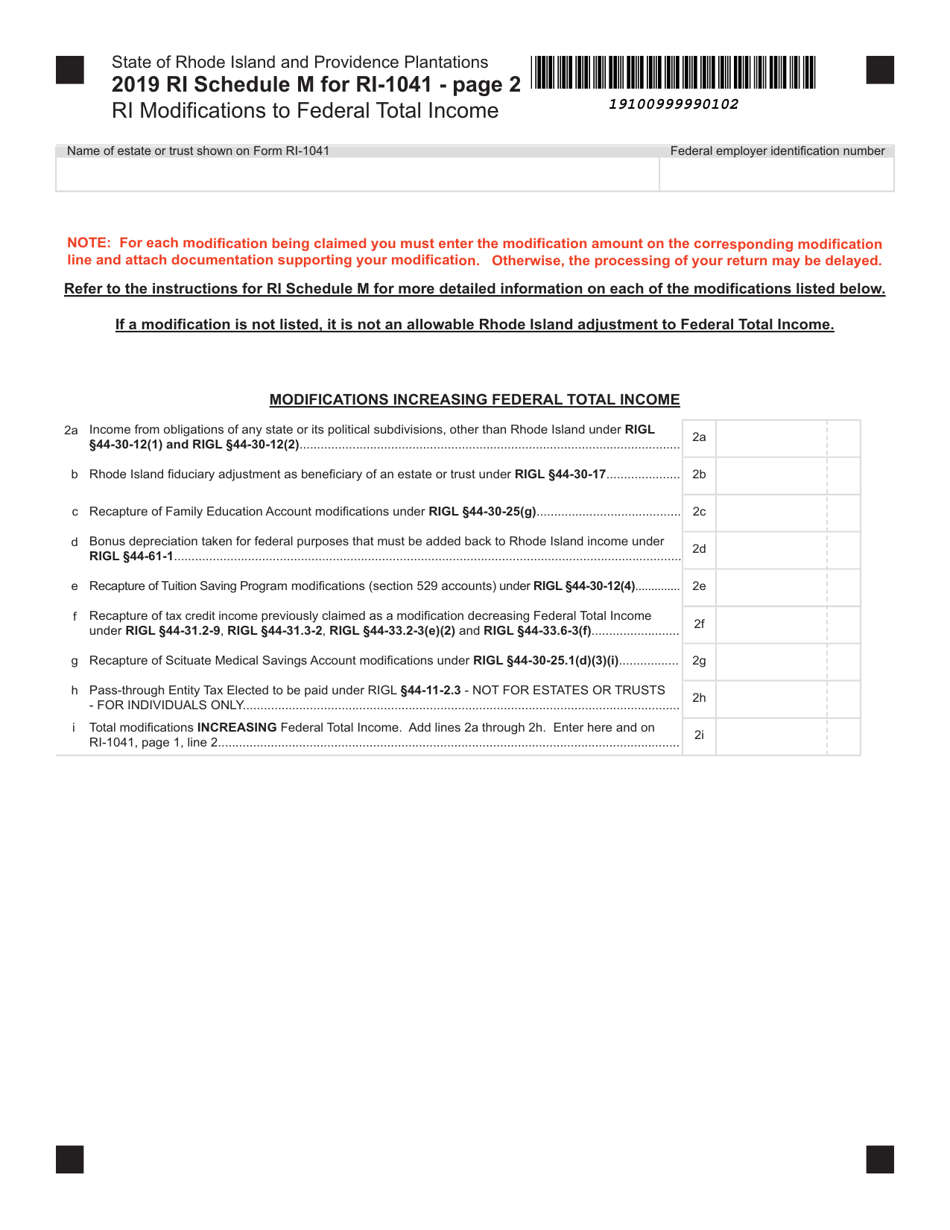

Form RI-1041 Schedule M

for the current year.

Form RI-1041 Schedule M Ri(modifications to Federal Total Income - Rhode Island

What Is Form RI-1041 Schedule M?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.The document is a supplement to Form RI-1041, Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RI-1041 Schedule M Ri?

A: RI-1041 Schedule M Ri is a form used to report modifications to the Federal Total Income specifically for Rhode Island state taxes.

Q: What is the purpose of RI-1041 Schedule M Ri?

A: The purpose of RI-1041 Schedule M Ri is to calculate the adjustments or modifications that need to be made to the Federal Total Income for Rhode Island state tax purposes.

Q: What modifications are included in RI-1041 Schedule M Ri?

A: RI-1041 Schedule M Ri includes various modifications such as additions and subtractions to the Federal Total Income that are specific to Rhode Island state tax laws.

Q: Why do I need to complete RI-1041 Schedule M Ri?

A: You need to complete RI-1041 Schedule M Ri to accurately calculate your Rhode Island state tax liability by accounting for the modifications required by state tax laws.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1041 Schedule M by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.