This version of the form is not currently in use and is provided for reference only. Download this version of

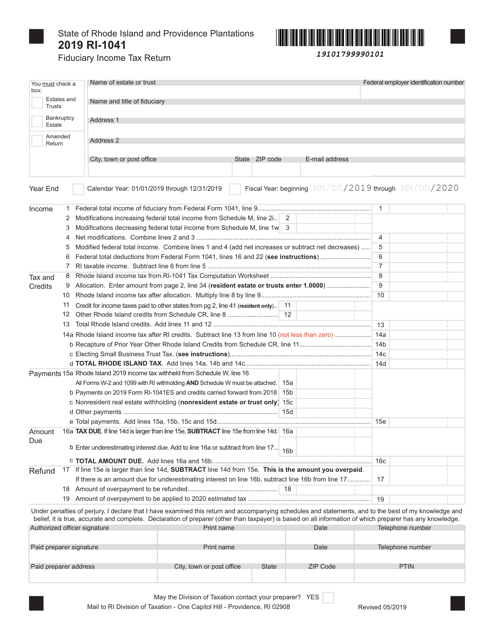

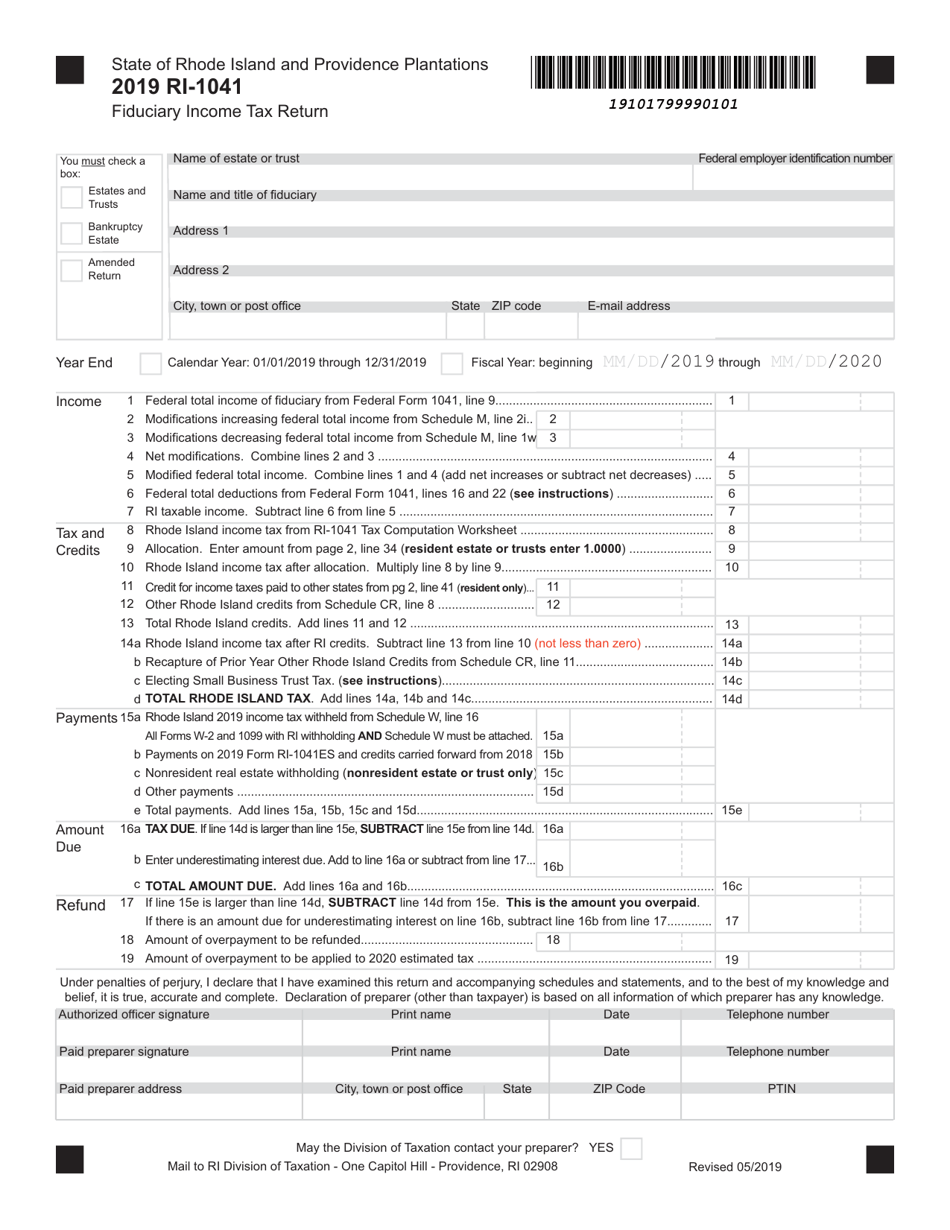

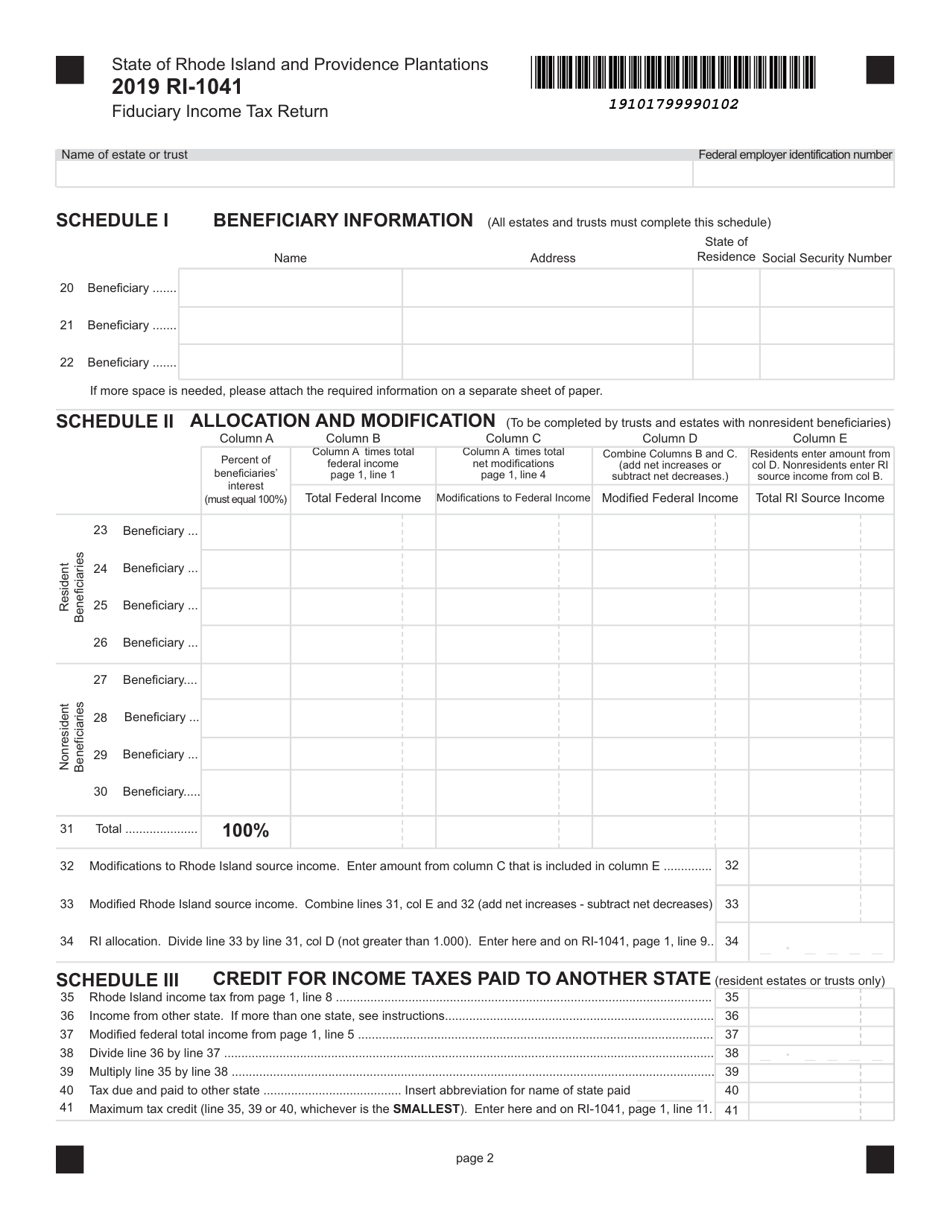

Form RI-1041

for the current year.

Form RI-1041 Fiduciary Income Tax Return - Rhode Island

What Is Form RI-1041?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1041?

A: Form RI-1041 is the Fiduciary Income Tax Return for the state of Rhode Island.

Q: Who needs to file Form RI-1041?

A: Form RI-1041 needs to be filed by any estate or trust that has taxable income or is required to file a federal fiduciary income tax return.

Q: What is the deadline for filing Form RI-1041?

A: The deadline for filing Form RI-1041 is April 15th, or the 15th day of the 4th month after the close of the taxable year.

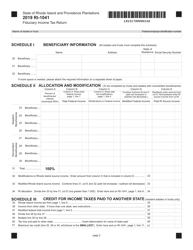

Q: What information is required to complete Form RI-1041?

A: To complete Form RI-1041, you will need information about the estate or trust, such as its name, address, and taxpayer identification number, as well as details about its income, deductions, and credits.

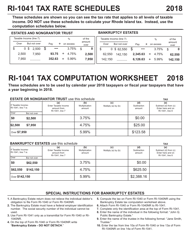

Q: Are there any special instructions for completing Form RI-1041?

A: Yes, there are specific instructions provided by the Rhode Island Division of Taxation that should be followed to accurately complete Form RI-1041.

Q: Are there any filing fees associated with Form RI-1041?

A: Yes, there may be a filing fee for submitting Form RI-1041. The exact amount can be found in the instructions for the form.

Q: What happens if I don't file Form RI-1041?

A: If you are required to file Form RI-1041 and fail to do so, you may be subject to penalties and interest on any tax owed.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1041 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.