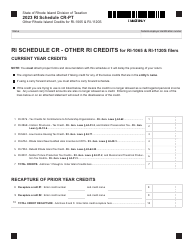

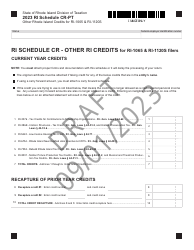

This version of the form is not currently in use and is provided for reference only. Download this version of

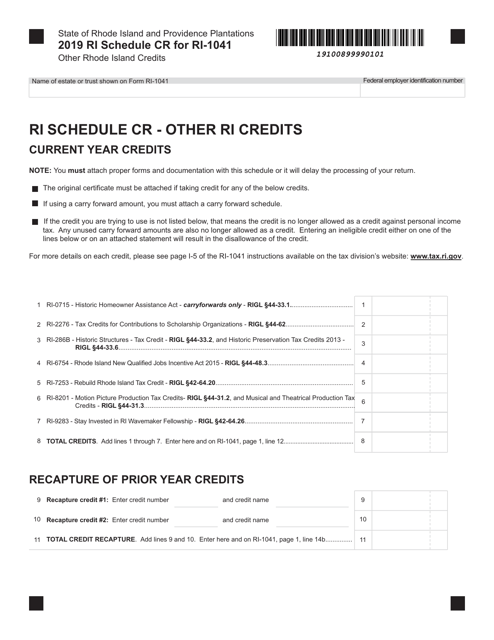

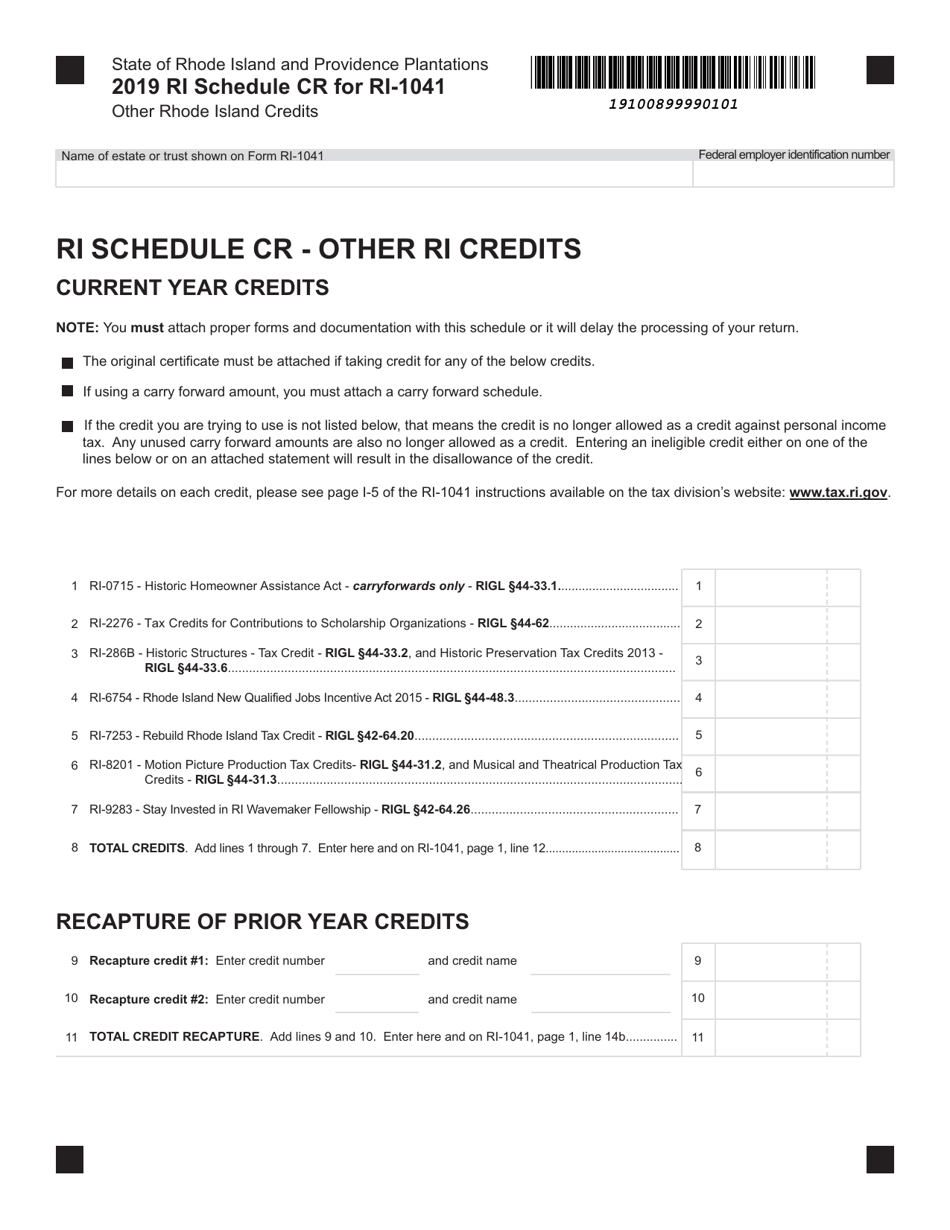

Form RI-1041 Schedule CR

for the current year.

Form RI-1041 Schedule CR Other Rhode Island Credits - Rhode Island

What Is Form RI-1041 Schedule CR?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.The document is a supplement to Form RI-1041, Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1041 Schedule CR?

A: Form RI-1041 Schedule CR is a tax form used to claim other tax credits in the state of Rhode Island.

Q: What are other tax credits?

A: Other tax credits are credits that can reduce the amount of tax owed or provide a refund in certain situations.

Q: Who can file Form RI-1041 Schedule CR?

A: Form RI-1041 Schedule CR is typically filed by individuals or businesses that qualify for specific tax credits in Rhode Island.

Q: What types of credits can be claimed on Form RI-1041 Schedule CR?

A: Form RI-1041 Schedule CR allows for the claiming of various credits, including those for renewable energy, historic preservation, and job creation.

Q: When is Form RI-1041 Schedule CR due?

A: The due date for filing Form RI-1041 Schedule CR is typically the same as the due date for the Rhode Island income tax return.

Q: Do I need to attach any documents to Form RI-1041 Schedule CR?

A: In some cases, you may be required to provide supporting documentation for the credits claimed on Form RI-1041 Schedule CR. It is important to review the instructions for the form to determine the specific requirements.

Q: What should I do if I have questions about Form RI-1041 Schedule CR?

A: If you have questions about Form RI-1041 Schedule CR or need assistance with completing the form, you can contact the Rhode Island Division of Taxation or consult a tax professional.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1041 Schedule CR by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.