This version of the form is not currently in use and is provided for reference only. Download this version of

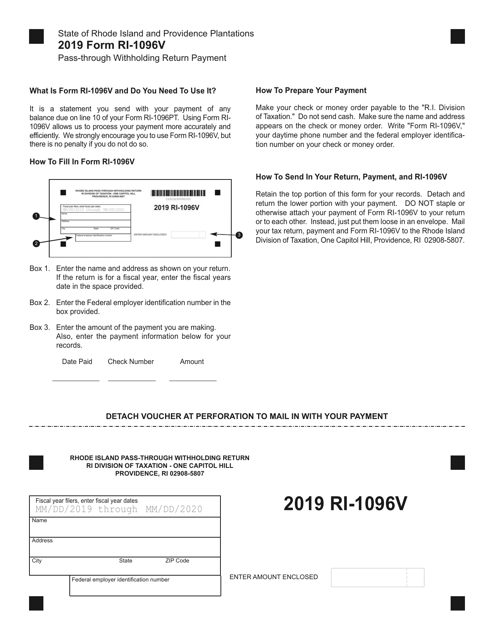

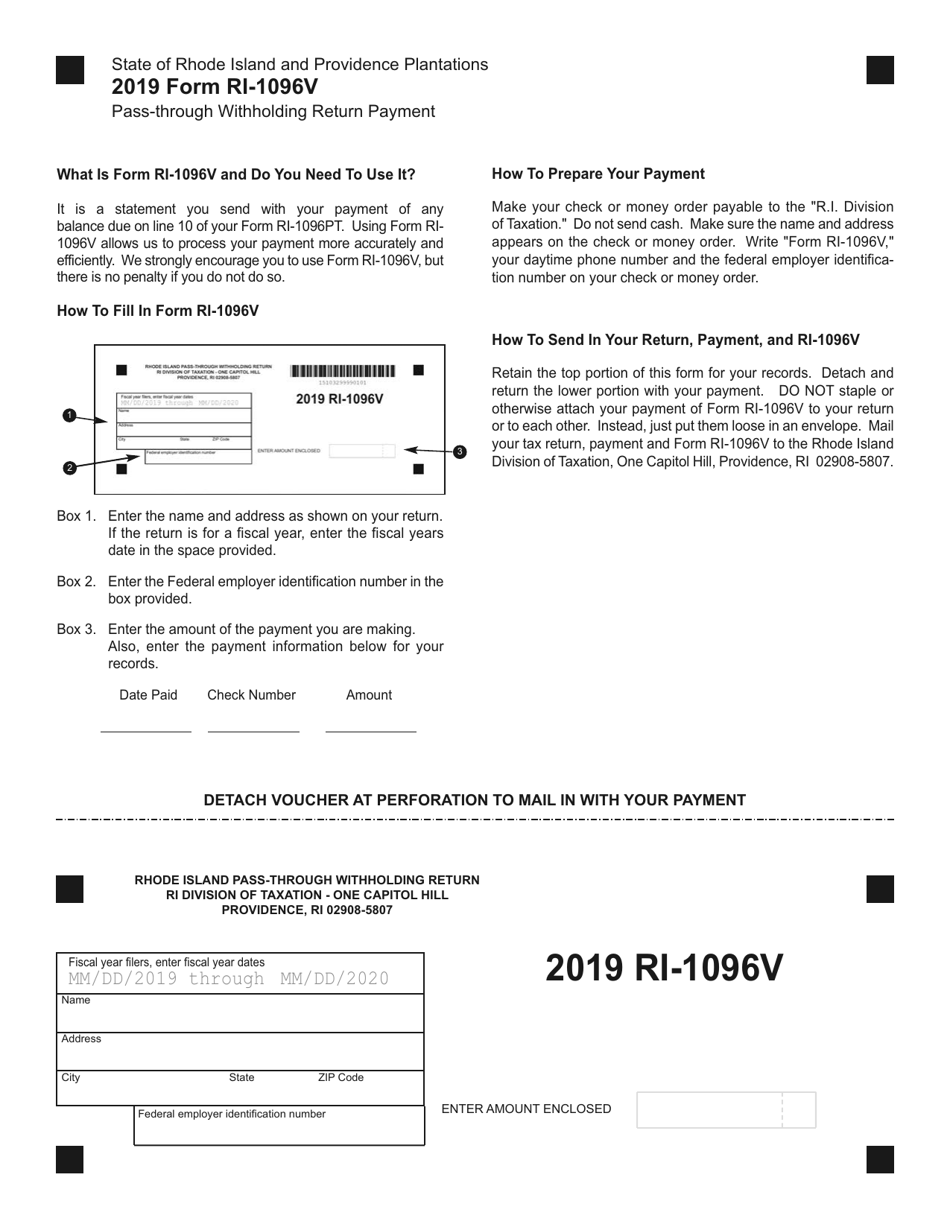

Form RI-1096V

for the current year.

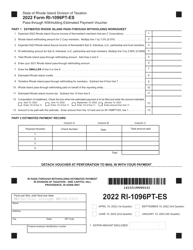

Form RI-1096V Pass-Through Withholding Return Payment - Rhode Island

What Is Form RI-1096V?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RI-1096V?

A: The Form RI-1096V is the Pass-Through Withholding Return Payment form for Rhode Island.

Q: What is the purpose of Form RI-1096V?

A: The purpose of Form RI-1096V is to report and pay pass-through withholding taxes to the state of Rhode Island.

Q: Who is required to file Form RI-1096V?

A: Any entity that has withheld Rhode Island income tax from pass-through income is required to file Form RI-1096V.

Q: When is Form RI-1096V due?

A: Form RI-1096V is due on or before the last day of the month following the end of the calendar quarter in which the tax was withheld.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-1096V by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.