This version of the form is not currently in use and is provided for reference only. Download this version of

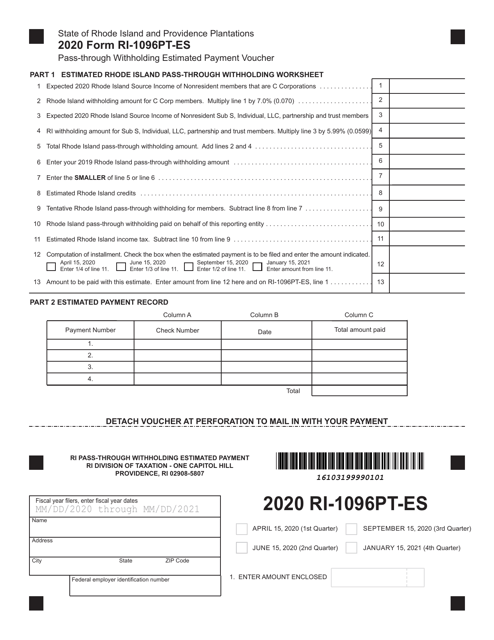

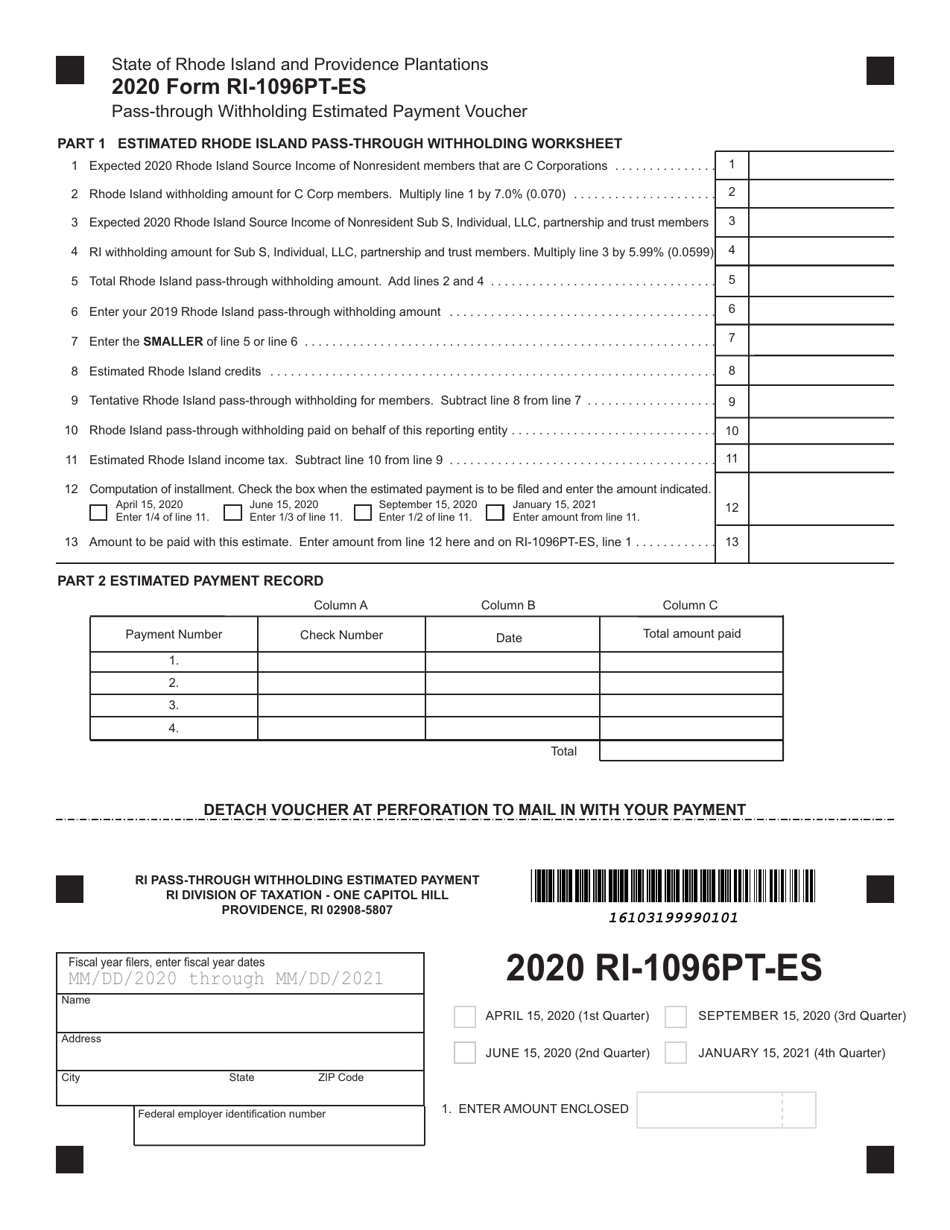

Form RI-1096PT-ES

for the current year.

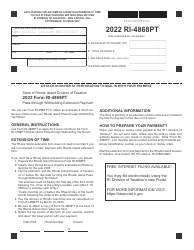

Form RI-1096PT-ES Pass-Through Withholding Estimated Payment Voucher - Rhode Island

What Is Form RI-1096PT-ES?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1096PT-ES?

A: Form RI-1096PT-ES is a pass-through withholding estimated payment voucher for Rhode Island.

Q: Who needs to file Form RI-1096PT-ES?

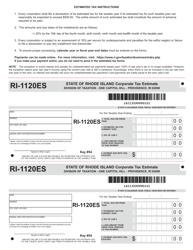

A: Unlike regular individual taxpayers, pass-through entities such as partnerships, LLCs, and S corporations use Form RI-1096PT-ES to make estimated withholding payments for Rhode Island.

Q: What is the purpose of Form RI-1096PT-ES?

A: The purpose of Form RI-1096PT-ES is to report and pay the withholding taxes on income passed through to partners, members, or shareholders by pass-through entities.

Q: When is Form RI-1096PT-ES due?

A: Form RI-1096PT-ES is due on a quarterly basis. The due dates are April 15th, July 15th, October 15th, and January 15th.

Q: How do I fill out Form RI-1096PT-ES?

A: To fill out Form RI-1096PT-ES, you will need to provide your entity's information, including your tax identification number, as well as the total amount of Rhode Island taxable income and the corresponding withholding tax amount.

Q: What happens if I don't file Form RI-1096PT-ES?

A: If you fail to file Form RI-1096PT-ES and make the required estimated withholding payments, you may be subject to penalties and interest charges.

Q: Can I make changes to Form RI-1096PT-ES after filing?

A: If you need to make changes to Form RI-1096PT-ES after filing, you should file an amended form as soon as possible to correct any errors or omissions.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1096PT-ES by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.