This version of the form is not currently in use and is provided for reference only. Download this version of

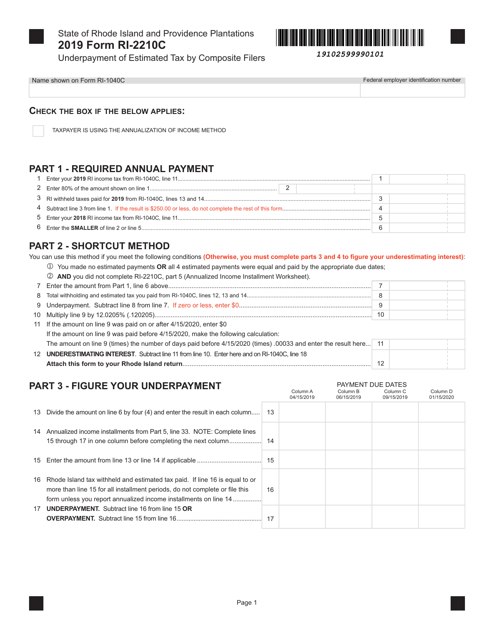

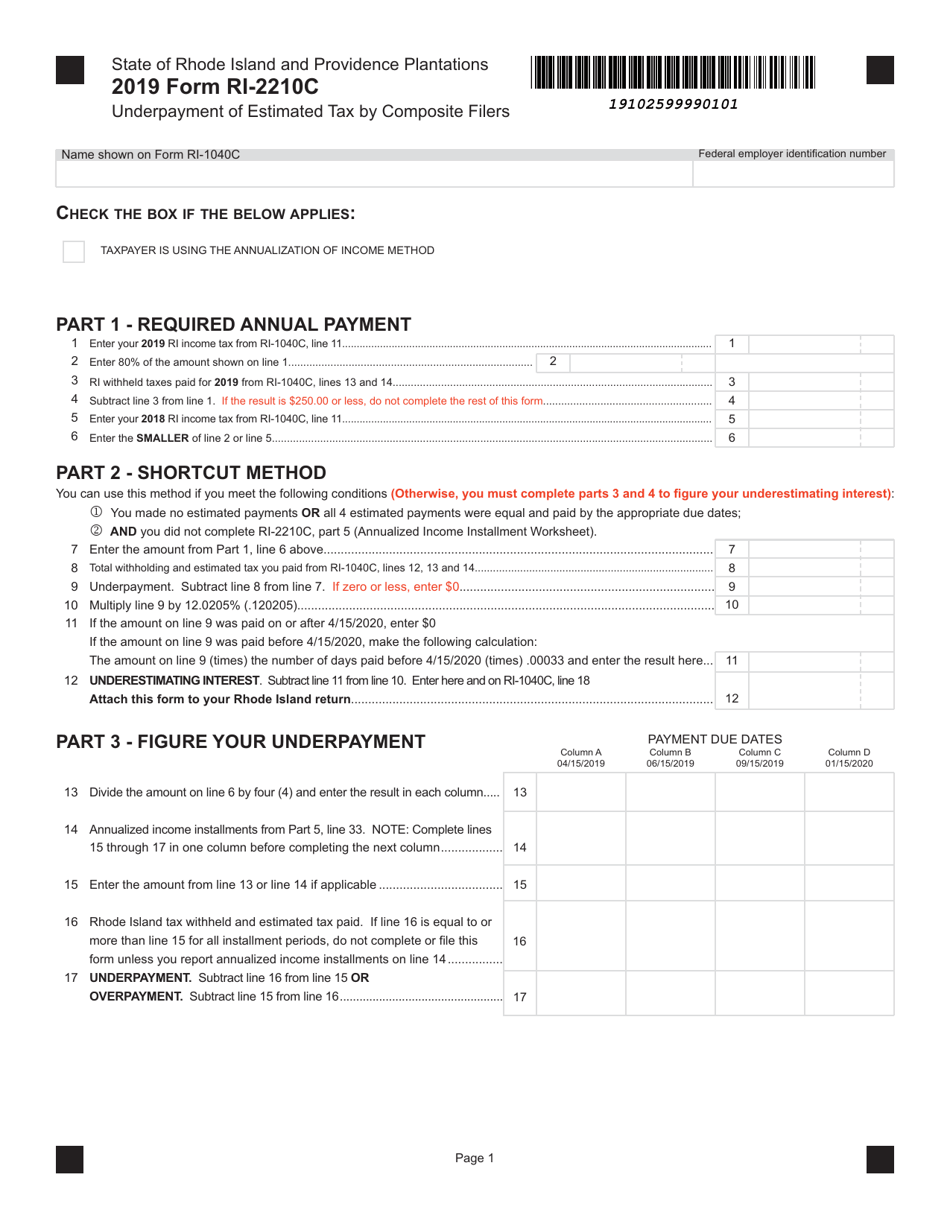

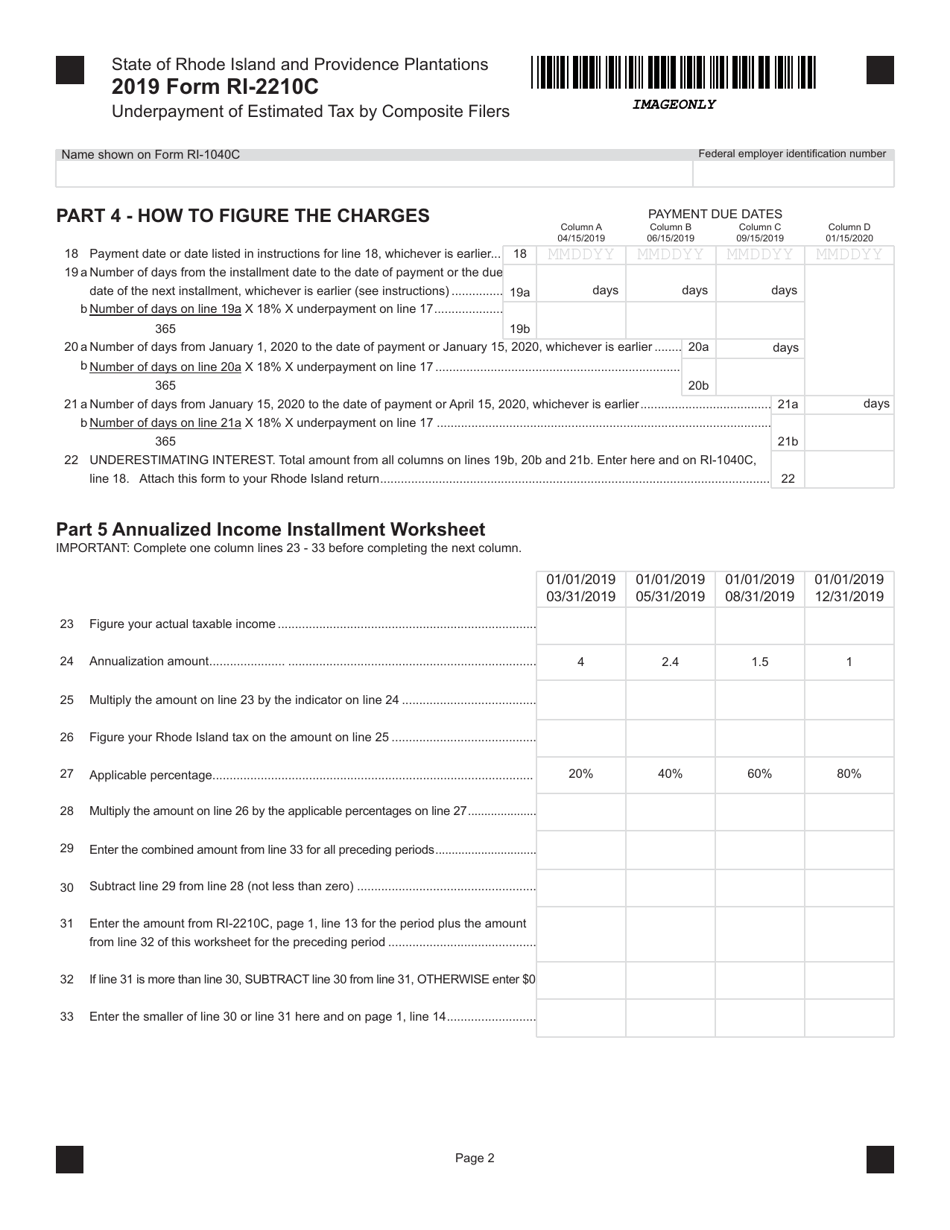

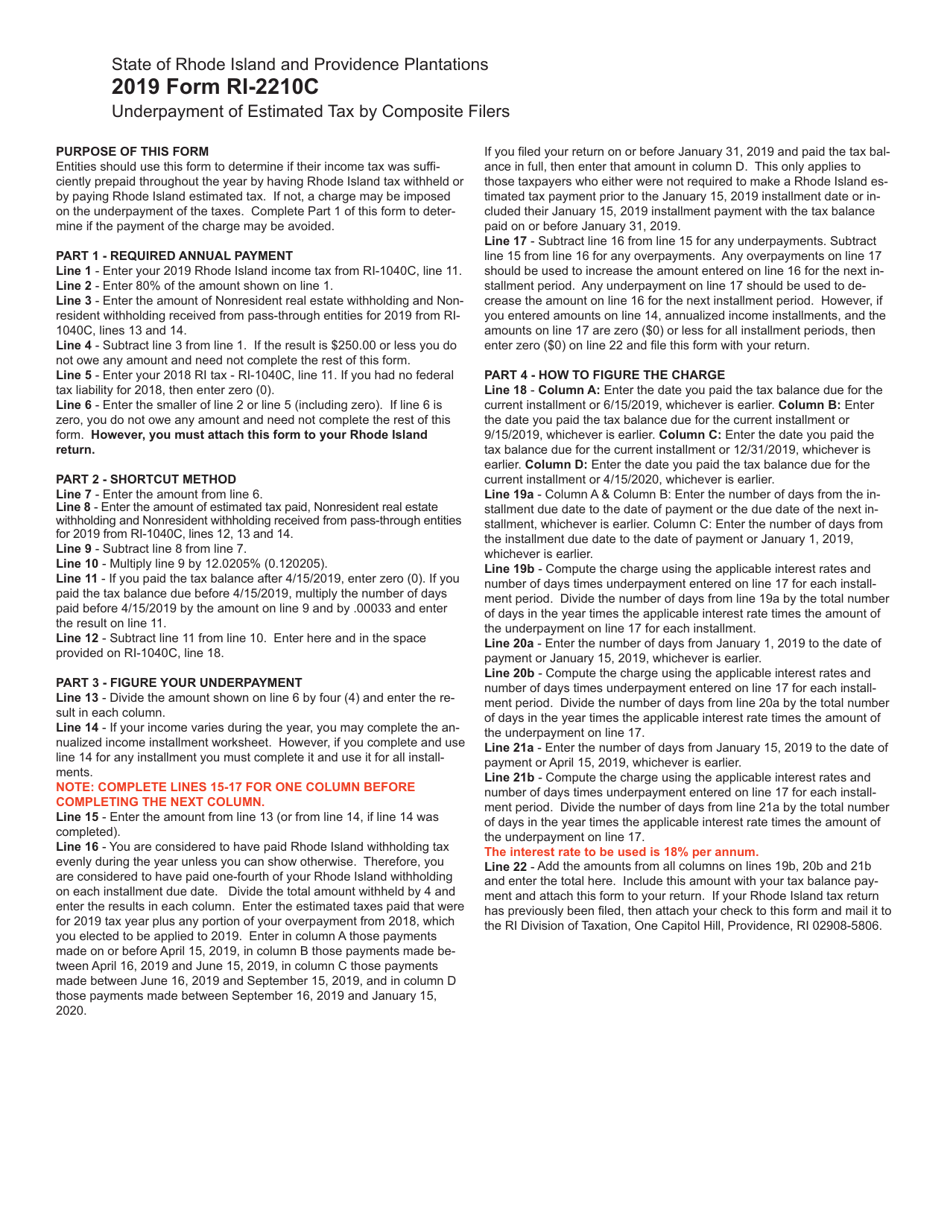

Form RI-2210C

for the current year.

Form RI-2210C Underpayment of Estimated Tax by Composite Filers - Rhode Island

What Is Form RI-2210C?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-2210C?

A: Form RI-2210C is used to calculate the underpayment of estimated tax by composite filers in Rhode Island.

Q: Who should file Form RI-2210C?

A: Composite filers in Rhode Island who have underpaid their estimated tax should file Form RI-2210C.

Q: What is the purpose of Form RI-2210C?

A: Form RI-2210C helps calculate the penalty for underpayment of estimated tax by composite filers in Rhode Island.

Q: When should Form RI-2210C be filed?

A: Form RI-2210C should be filed when a composite filer realizes they have underpaid their estimated tax.

Q: Are there any penalties for underpayment of estimated tax in Rhode Island?

A: Yes, there may be penalties for underpayment of estimated tax in Rhode Island, and Form RI-2210C helps calculate those penalties.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-2210C by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.