This version of the form is not currently in use and is provided for reference only. Download this version of

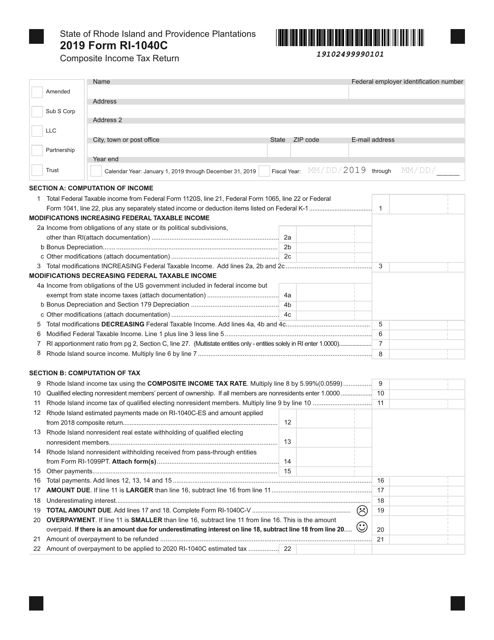

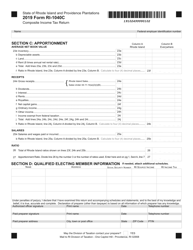

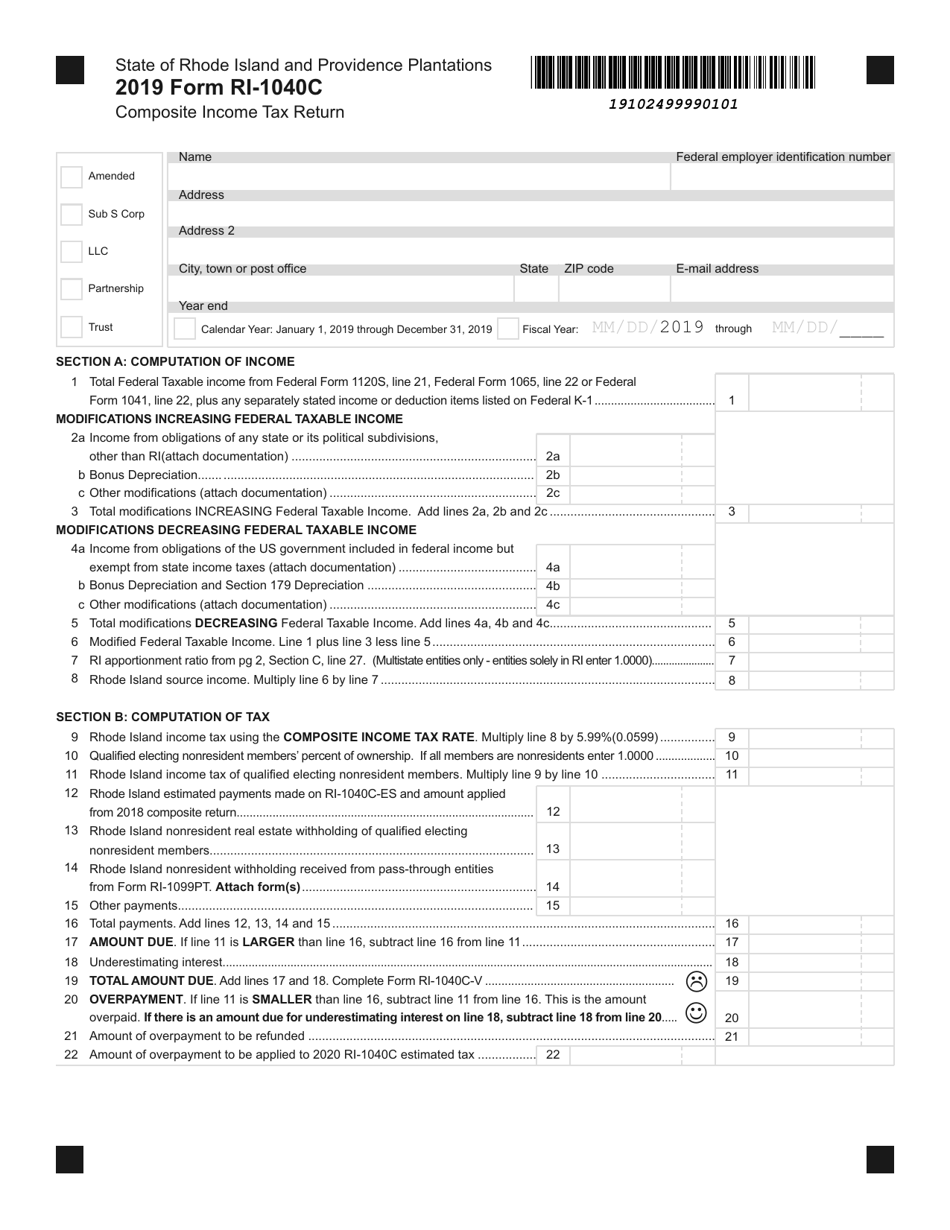

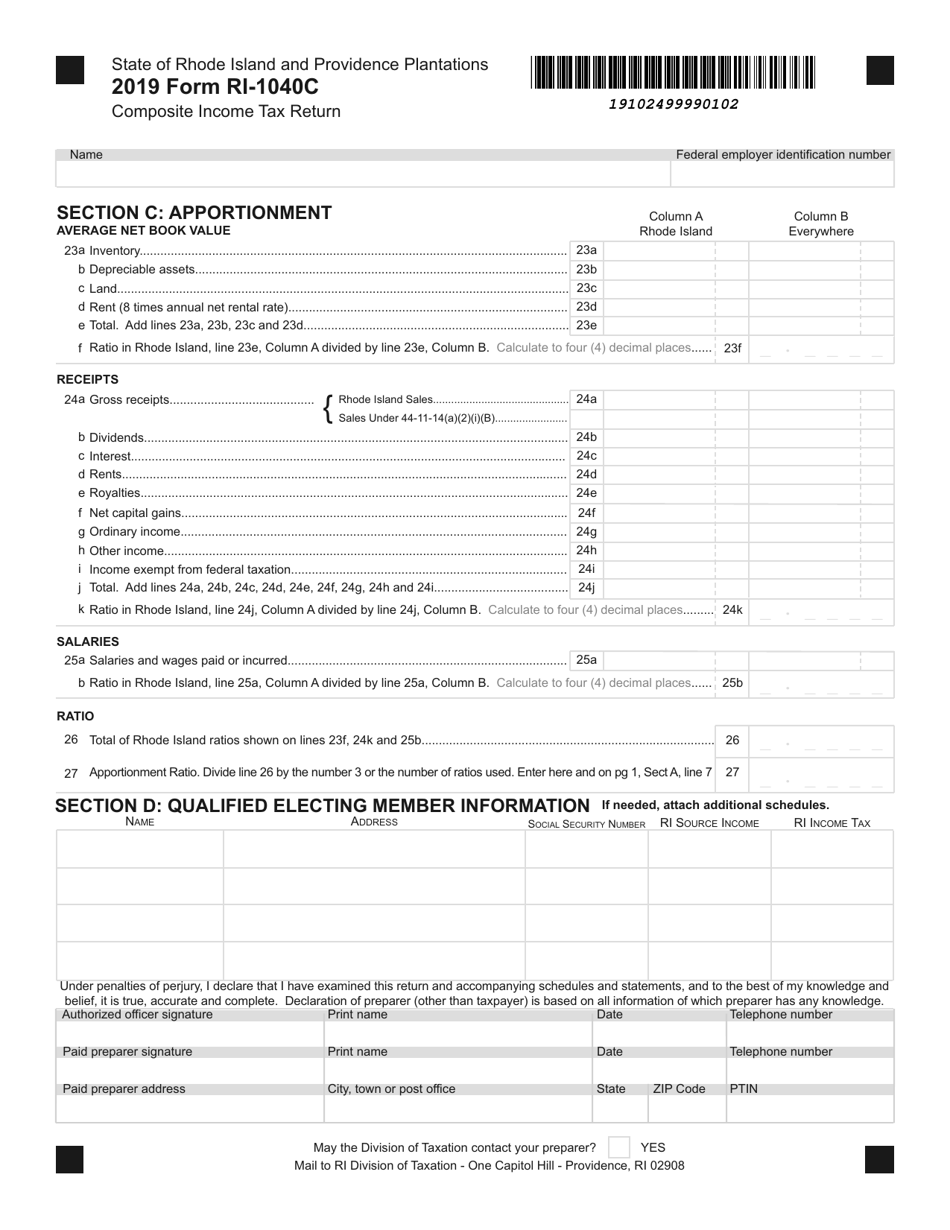

Form RI-1040C

for the current year.

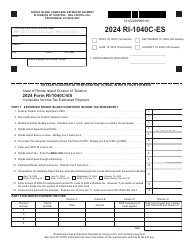

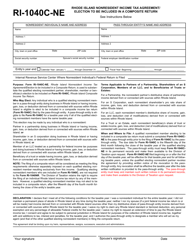

Form RI-1040C Composite Income Tax(return - Rhode Island

What Is Form RI-1040C?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1040C?

A: Form RI-1040C is the Composite Income Tax Return for nonresident shareholders of an S corporation or partnership in Rhode Island.

Q: Who needs to file Form RI-1040C?

A: Nonresident shareholders of an S corporation or partnership in Rhode Island need to file Form RI-1040C.

Q: What is the purpose of Form RI-1040C?

A: The purpose of Form RI-1040C is to report and pay the Rhode Island income tax on behalf of nonresident shareholders of an S corporation or partnership.

Q: When is Form RI-1040C due?

A: Form RI-1040C is due on the 15th day of the fourth month following the close of the taxable year.

Q: Are there any filing fees associated with Form RI-1040C?

A: No, there are no filing fees associated with Form RI-1040C.

Q: Can Form RI-1040C be filed electronically?

A: No, Form RI-1040C cannot be filed electronically. It must be filed by mail.

Q: What supporting documents do I need to include with Form RI-1040C?

A: You need to include copies of any Schedules K-1 received from the S corporation or partnership, as well as any other supporting documentation.

Q: Is there an extension available for filing Form RI-1040C?

A: Yes, you can request an extension to file Form RI-1040C by filing Form RI-4868.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040C by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.