This version of the form is not currently in use and is provided for reference only. Download this version of

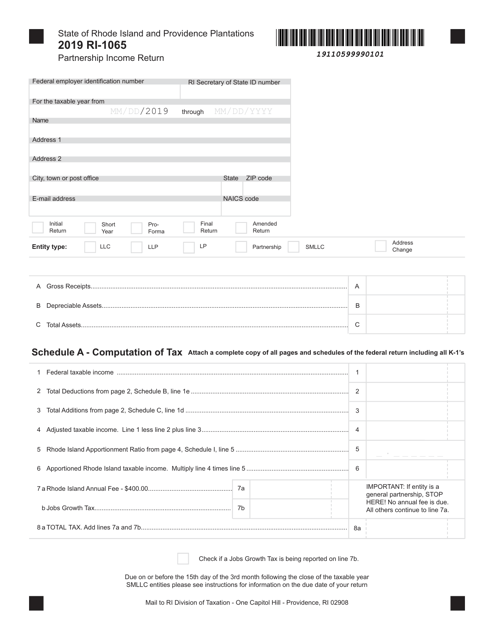

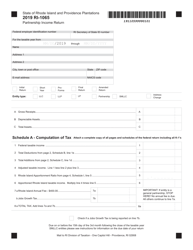

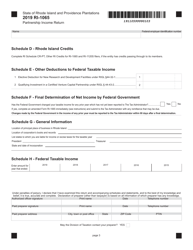

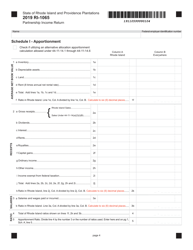

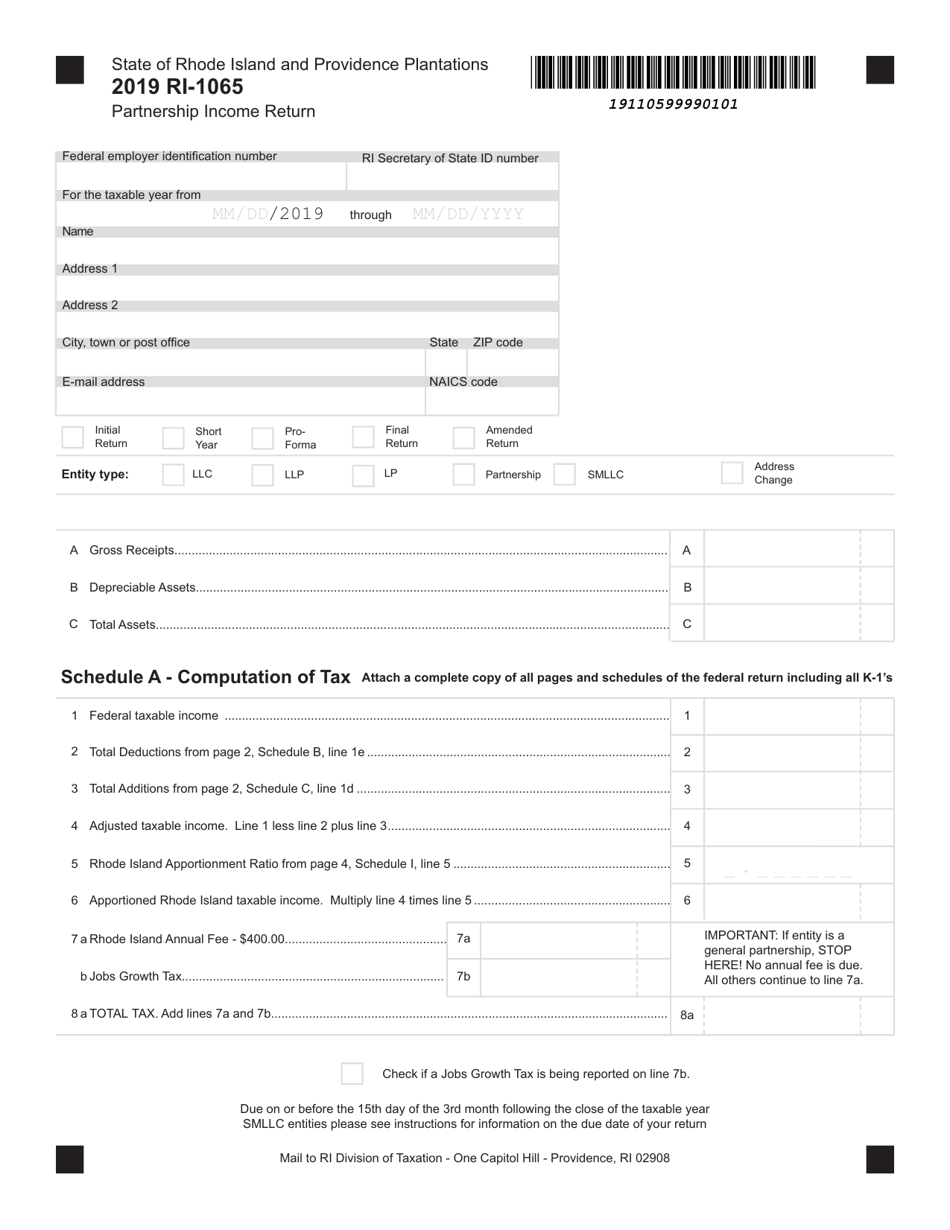

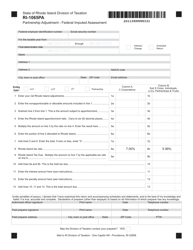

Form RI-1065

for the current year.

Form RI-1065 Partnership Income Return - Rhode Island

What Is Form RI-1065?

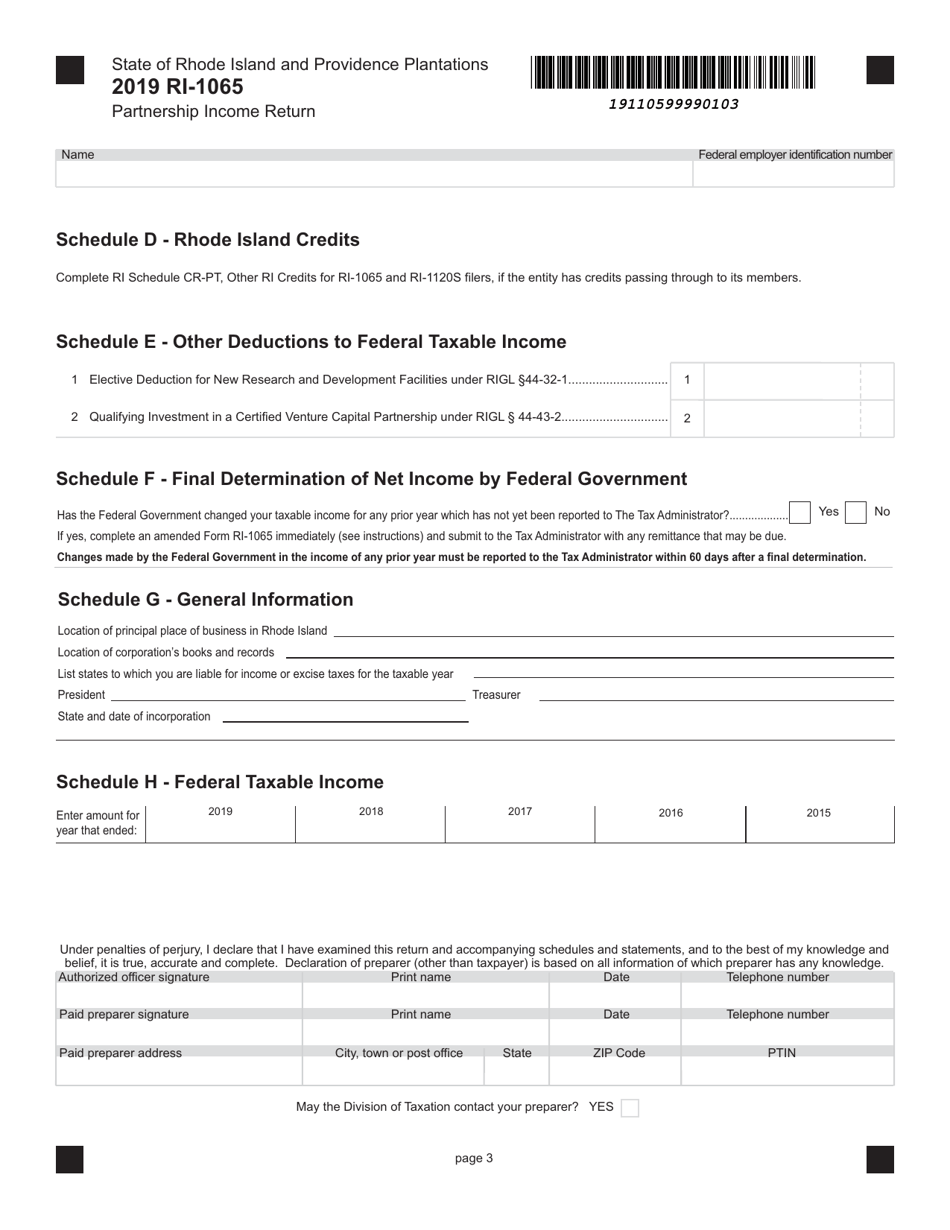

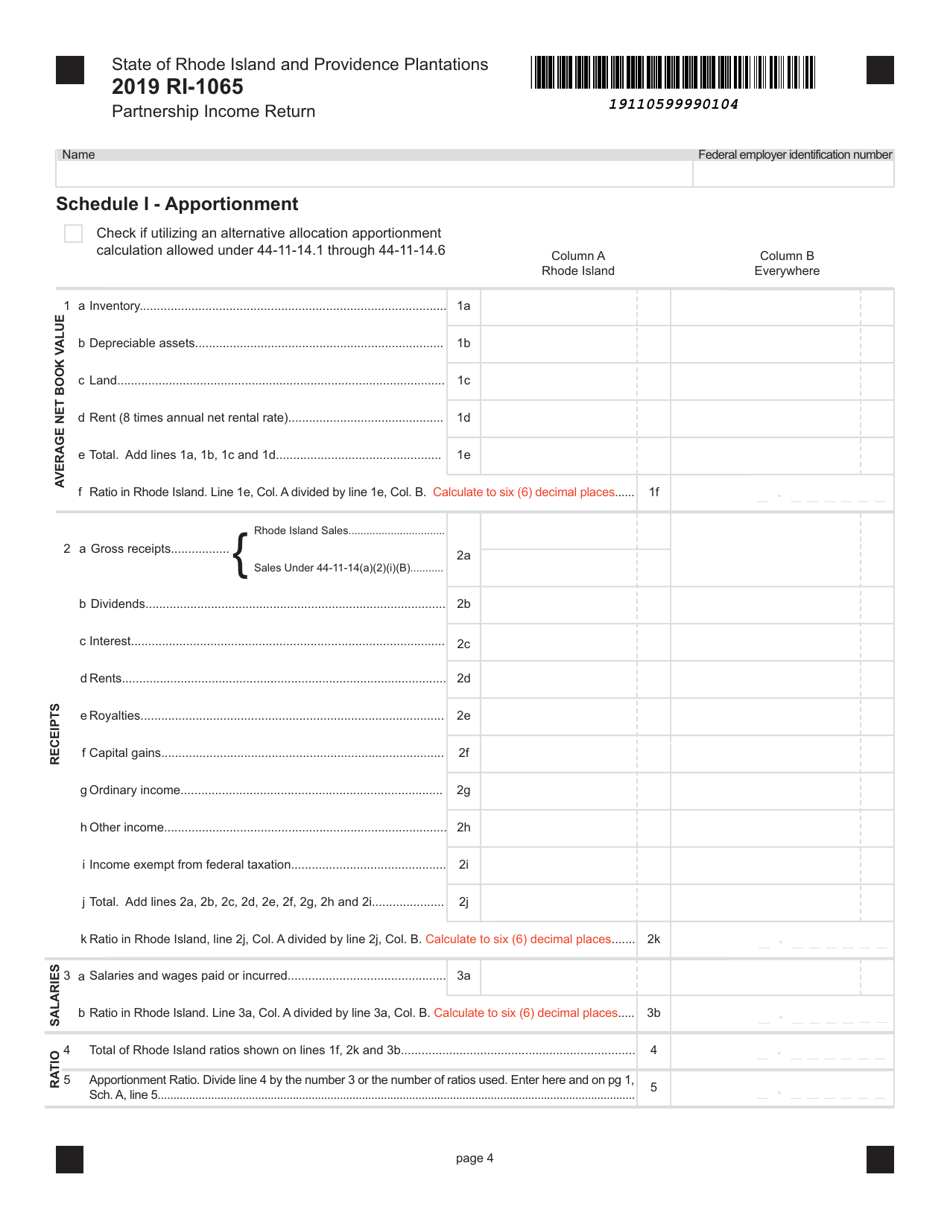

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-1065?

A: Form RI-1065 is the Partnership Income Return form specific to Rhode Island.

Q: Who should file Form RI-1065?

A: Partnerships operating in Rhode Island should file Form RI-1065.

Q: What is the purpose of Form RI-1065?

A: Form RI-1065 is used to report partnership income, deductions, and credits to the state of Rhode Island.

Q: When is the deadline to file Form RI-1065?

A: The deadline to file Form RI-1065 is on or before the 15th day of the 4th month following the close of the taxable year.

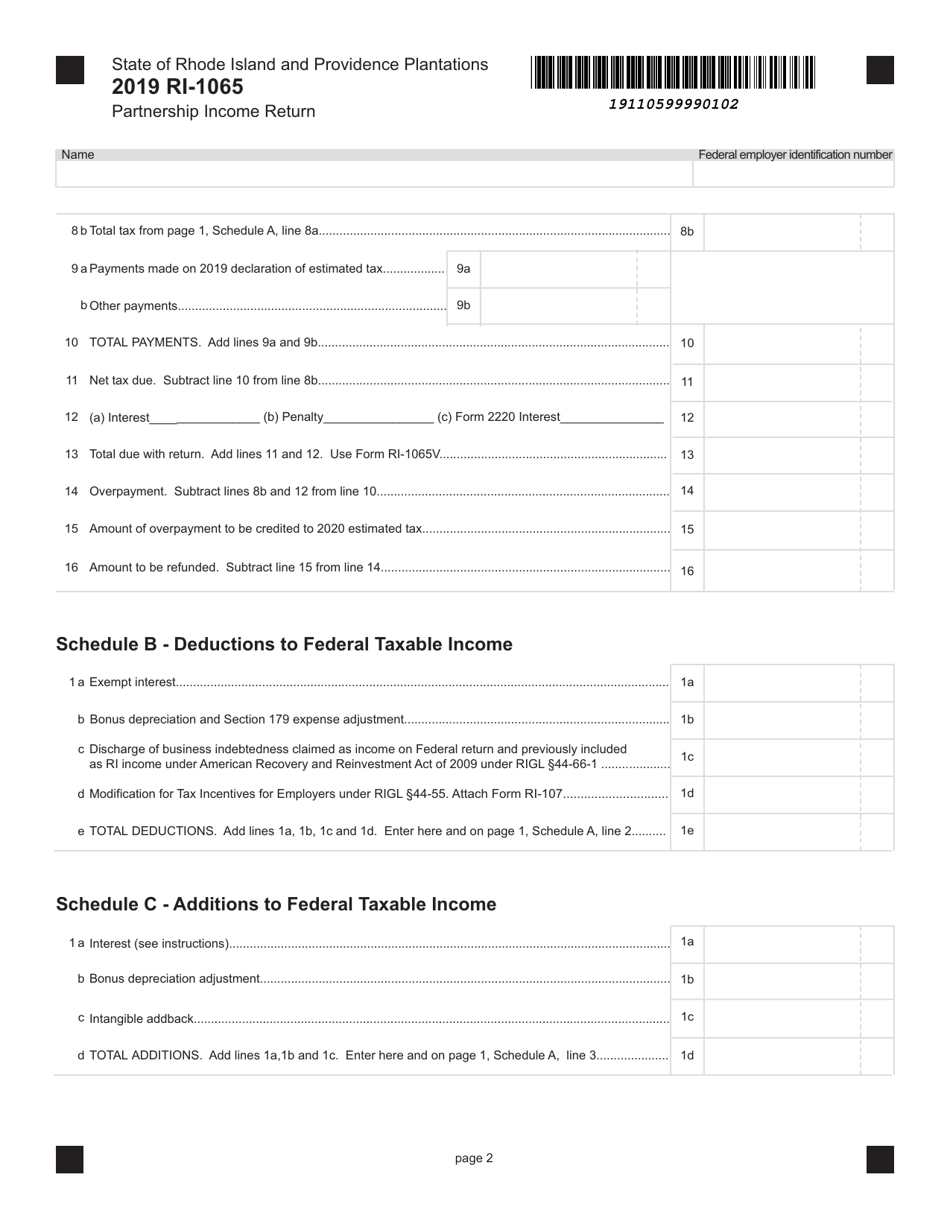

Q: Are there any penalties for late filing of Form RI-1065?

A: Yes, there are penalties for late filing of Form RI-1065. It is important to file the form by the deadline to avoid these penalties.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1065 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.