This version of the form is not currently in use and is provided for reference only. Download this version of

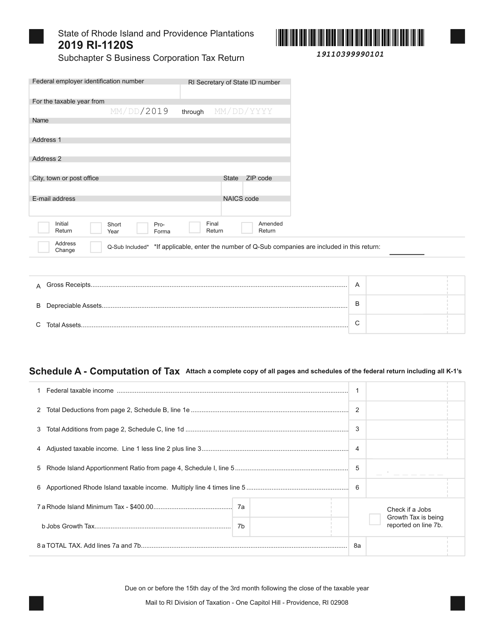

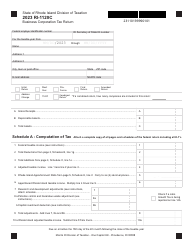

Form RI-1120S

for the current year.

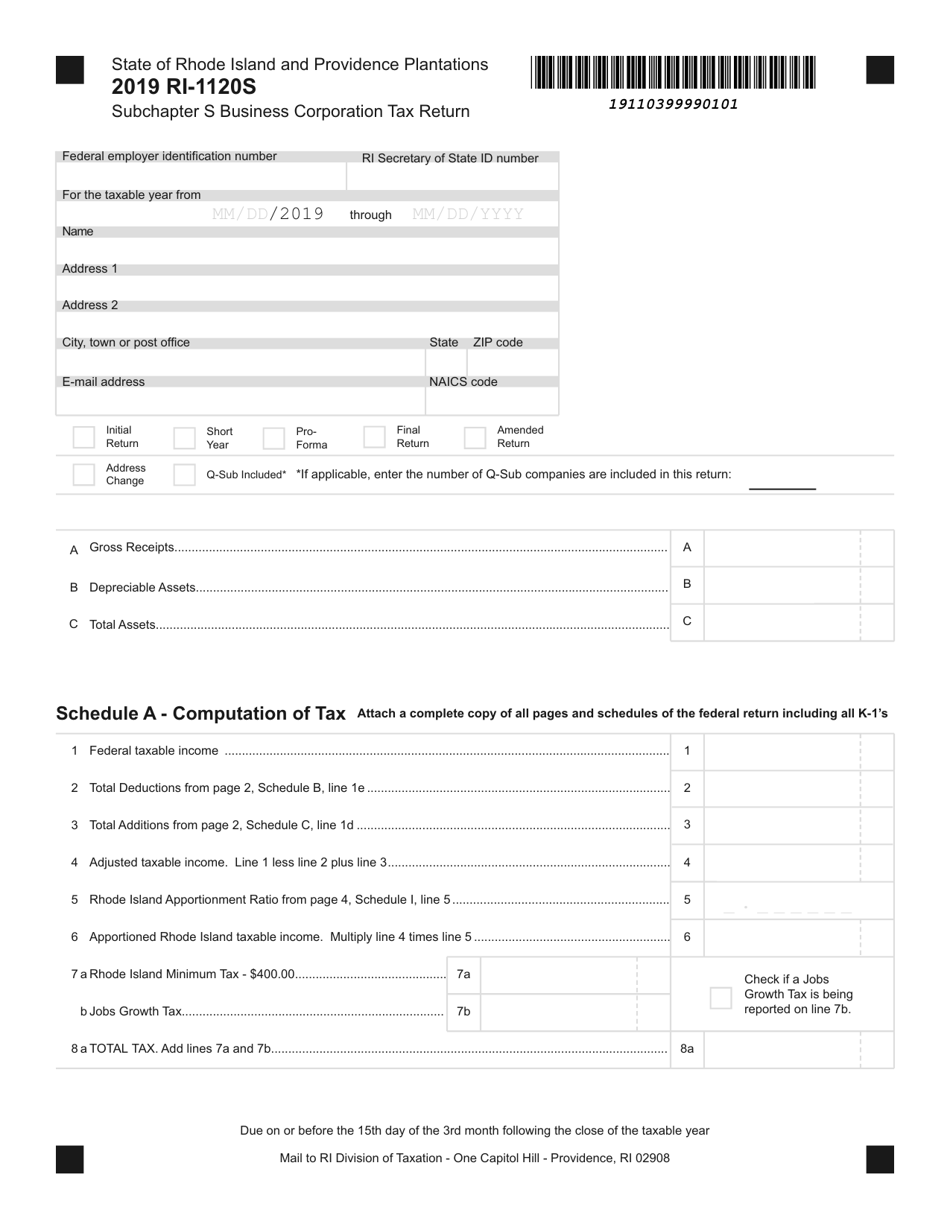

Form RI-1120S Subchapter S Business Corporation Tax Return - Rhode Island

What Is Form RI-1120S?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-1120S?

A: Form RI-1120S is the tax return form for Subchapter S Business Corporations in Rhode Island.

Q: Who needs to file Form RI-1120S?

A: Subchapter S Business Corporations in Rhode Island need to file Form RI-1120S.

Q: What is a Subchapter S Business Corporation?

A: A Subchapter S Business Corporation is a type of corporation that elects to pass corporate income, deductions, and credits through to its shareholders for federal tax purposes.

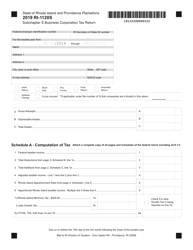

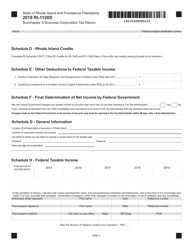

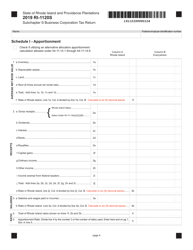

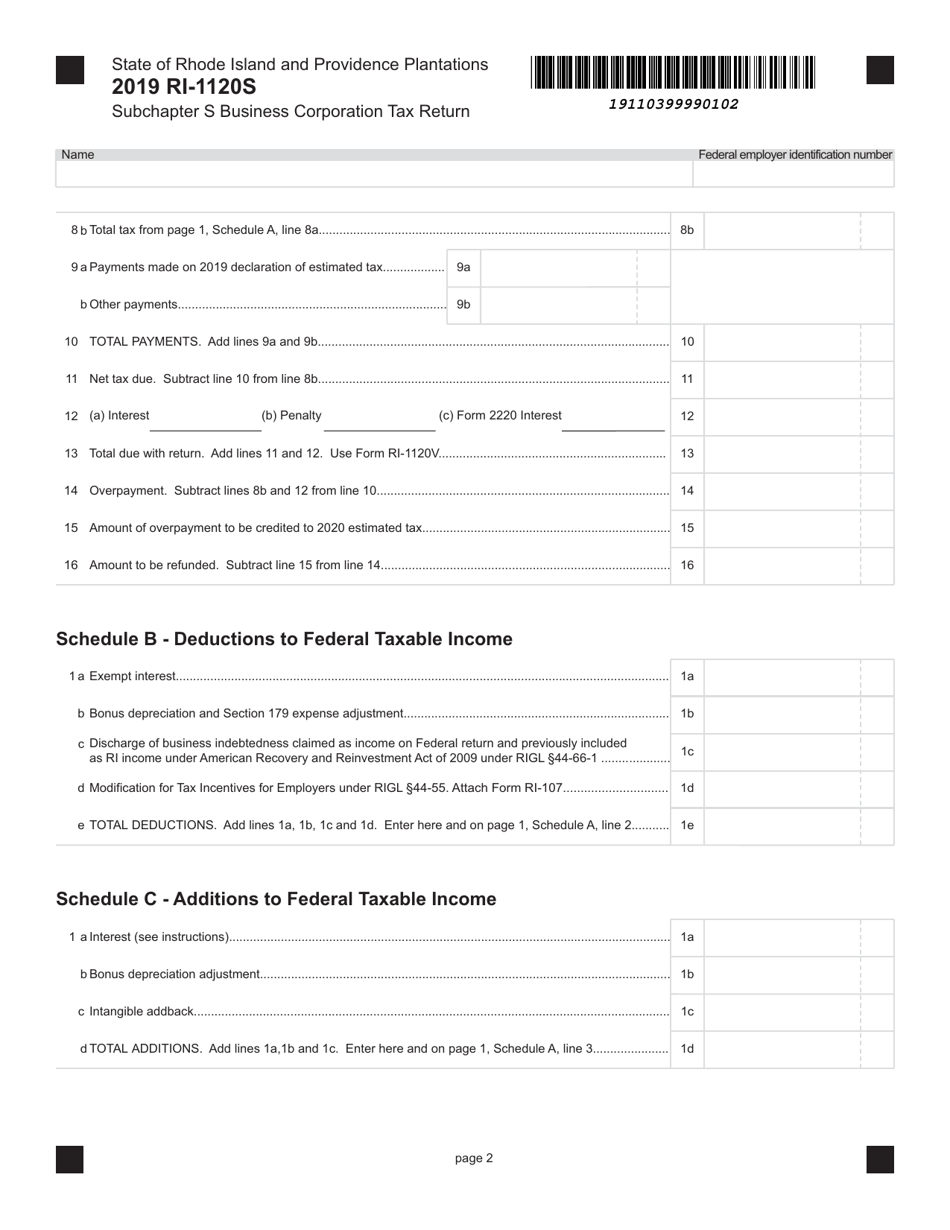

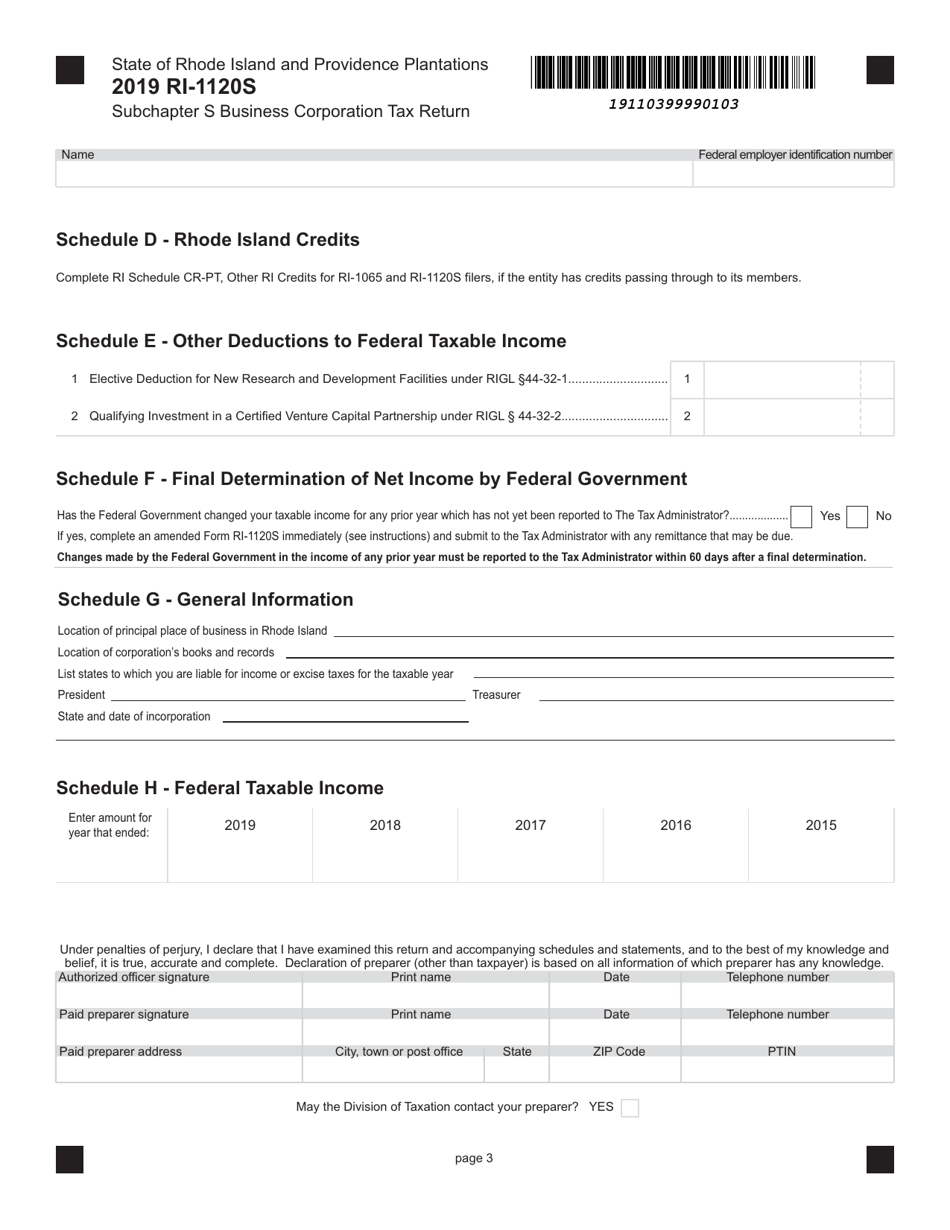

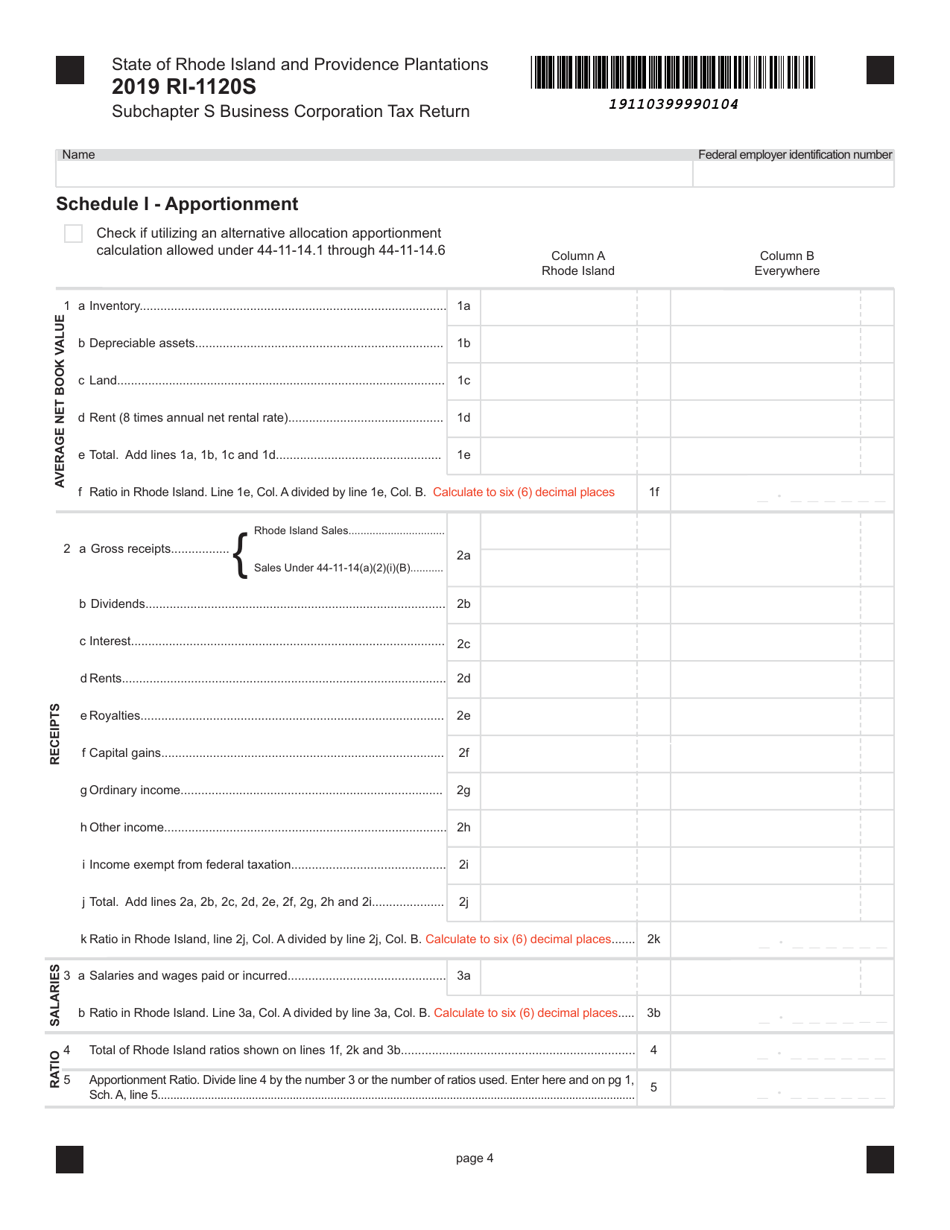

Q: What information is required on Form RI-1120S?

A: Form RI-1120S requires information about the corporation's income, deductions, credits, and other relevant financial information.

Q: When is Form RI-1120S due?

A: Form RI-1120S is due on or before the 15th day of the 4th month following the close of the corporation's tax year.

Q: Are there any penalties for late filing of Form RI-1120S?

A: Yes, there are penalties for late filing of Form RI-1120S. The penalties vary depending on the length of the delay and the amount of tax owed.

Q: Can I e-file Form RI-1120S?

A: Yes, Form RI-1120S can be e-filed using approved tax preparation software.

Q: Do I need to include supporting documentation with Form RI-1120S?

A: Yes, supporting documentation such as schedules, statements, and attachments may be required to be submitted with Form RI-1120S.

Q: Can I get an extension to file Form RI-1120S?

A: Yes, extensions of time to file Form RI-1120S can be requested. However, an extension does not extend the time to pay any taxes owed.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120S by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.