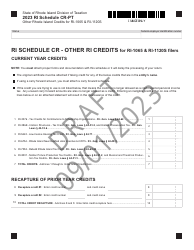

This version of the form is not currently in use and is provided for reference only. Download this version of

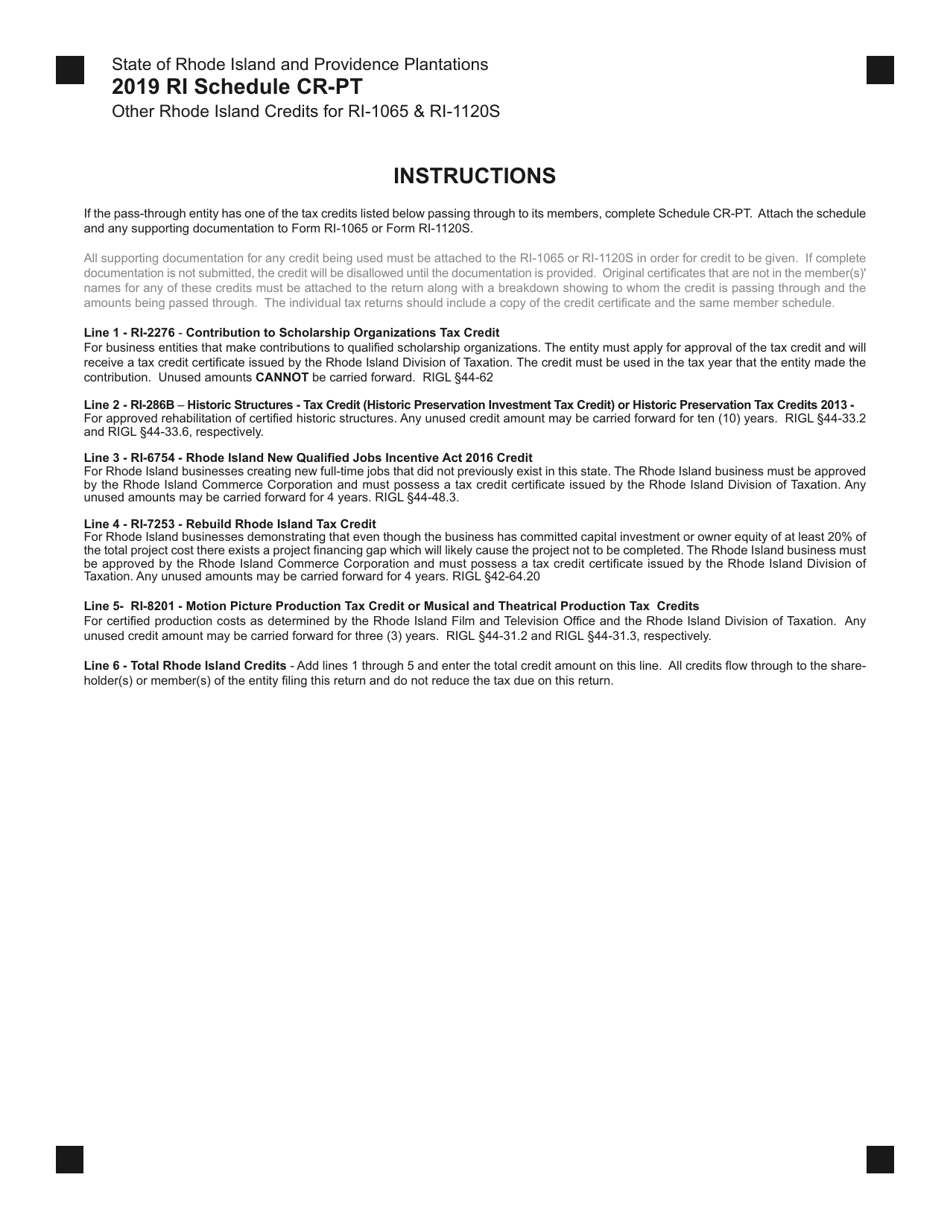

Schedule CR-PT

for the current year.

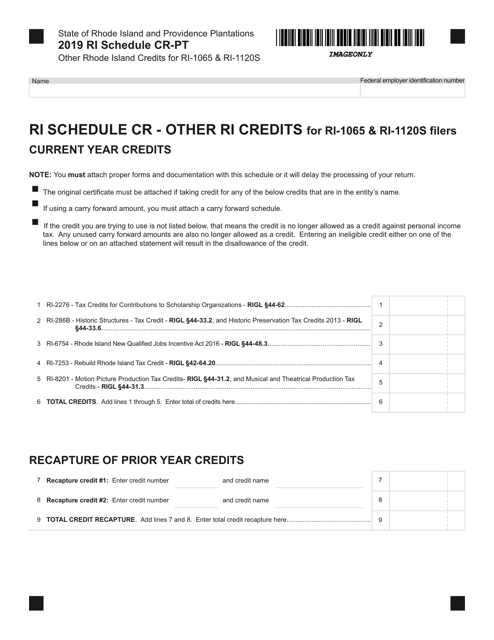

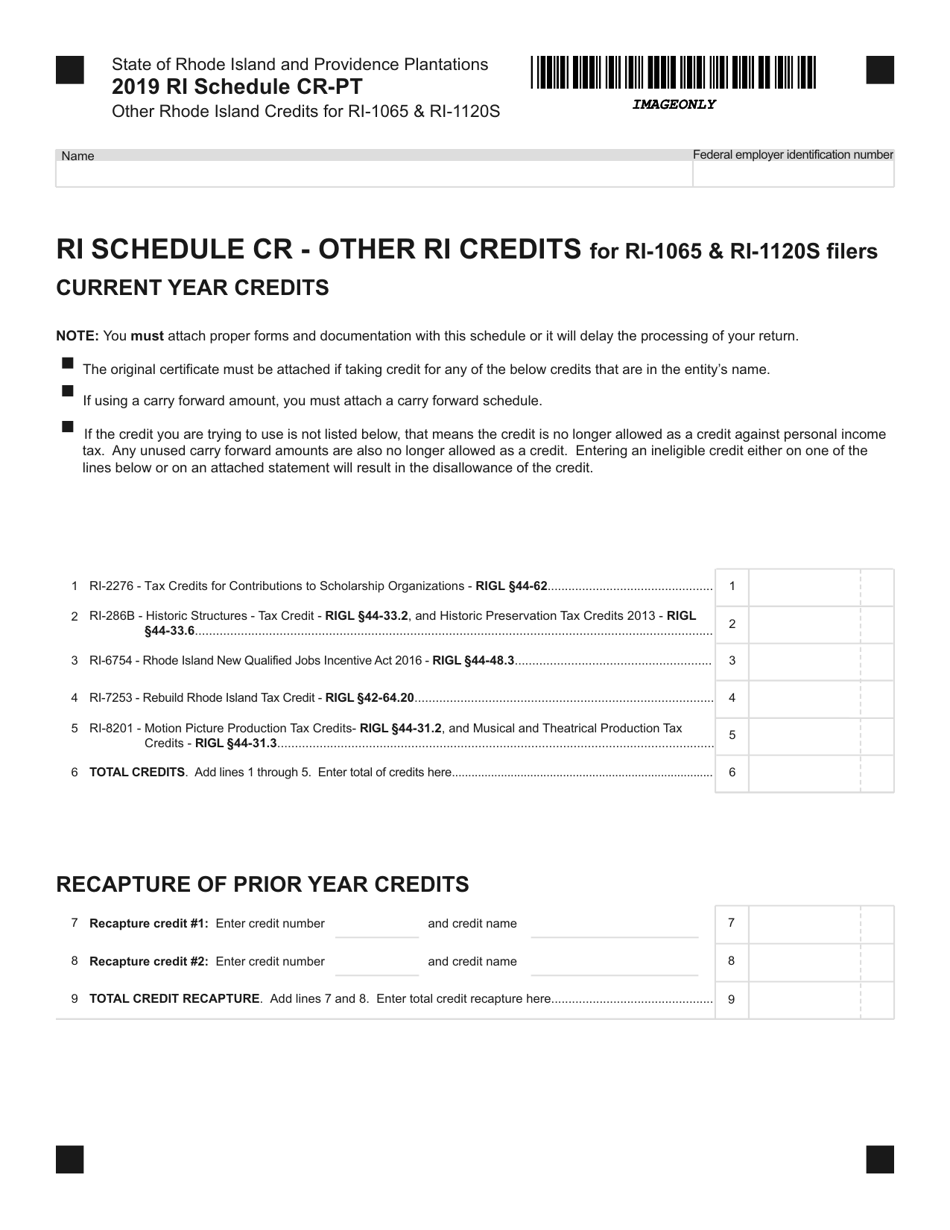

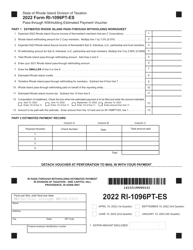

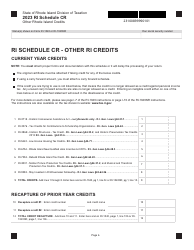

Schedule CR-PT Other Rhode Island Credits for Ri-1065 & Ri-1120s - Rhode Island

What Is Schedule CR-PT?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule CR-PT?

A: Schedule CR-PT is a form used to claim other Rhode Island credits for partnerships and S corporations.

Q: Who needs to file Schedule CR-PT?

A: Partnerships and S corporations that want to claim other Rhode Island credits.

Q: What are the other Rhode Island credits?

A: The other Rhode Island credits include the Economic DevelopmentTax Credit, the Historic Preservation Tax Credit, and the Renewable Energy Tax Credit, among others.

Q: How do I complete Schedule CR-PT?

A: You need to complete all the required information on the form, including the credits you want to claim and any supporting documentation.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule CR-PT by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.