This version of the form is not currently in use and is provided for reference only. Download this version of

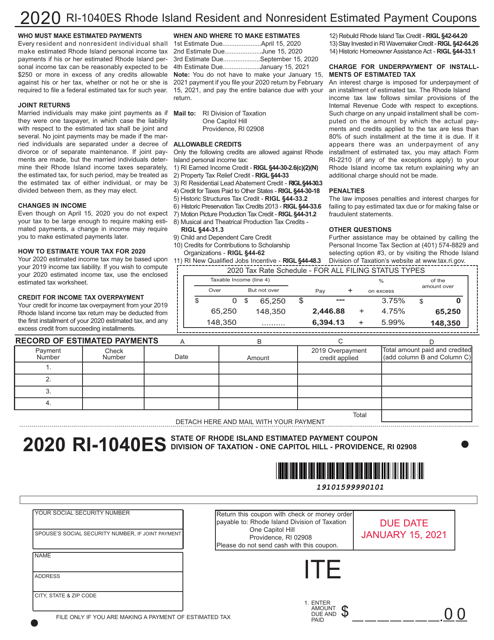

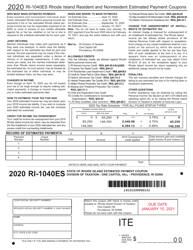

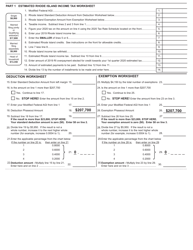

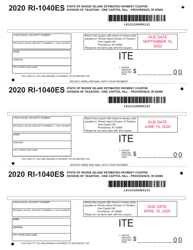

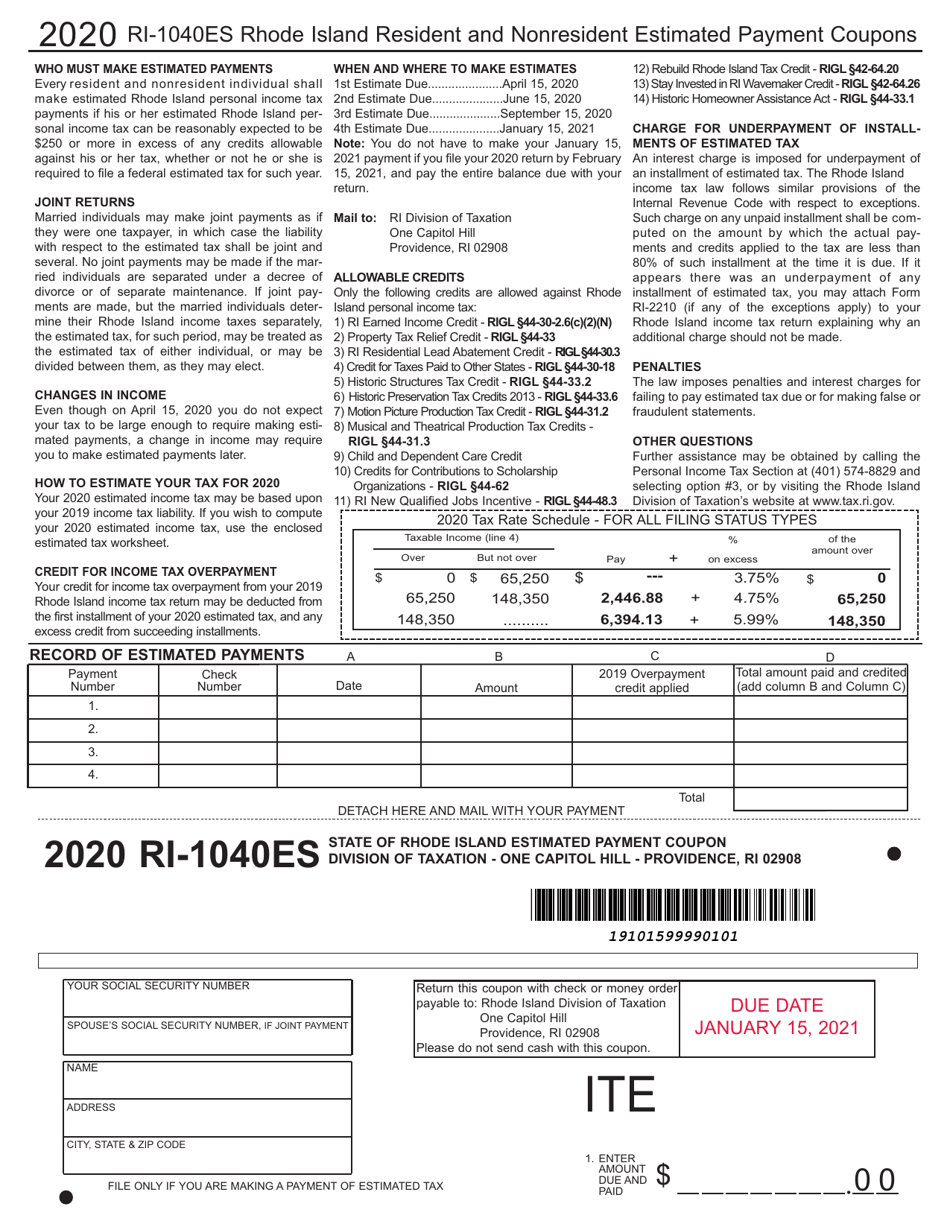

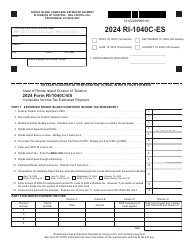

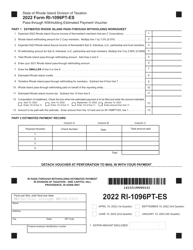

Form RI-1040ES

for the current year.

Form RI-1040ES Rhode Island Resident and Nonresident Estimated Payment Coupons - Rhode Island

What Is Form RI-1040ES?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RI-1040ES?

A: The Form RI-1040ES is a Rhode Island Resident and Nonresident Estimated Payment Coupon.

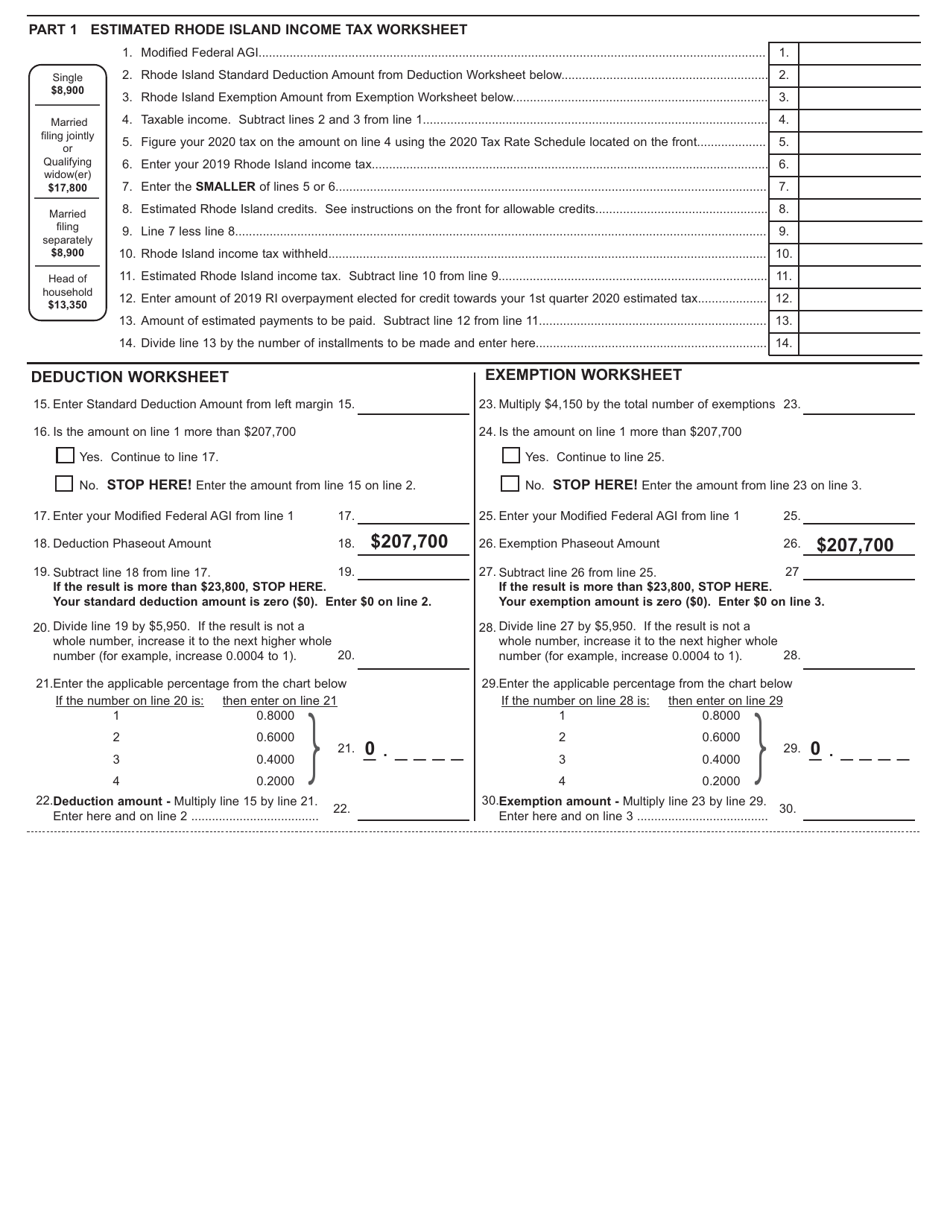

Q: What is the purpose of Form RI-1040ES?

A: Form RI-1040ES is used to make estimated tax payments in Rhode Island.

Q: Who needs to file Form RI-1040ES?

A: Rhode Island residents and nonresidents who expect to owe at least $200 in Rhode Island income tax for the year must file Form RI-1040ES.

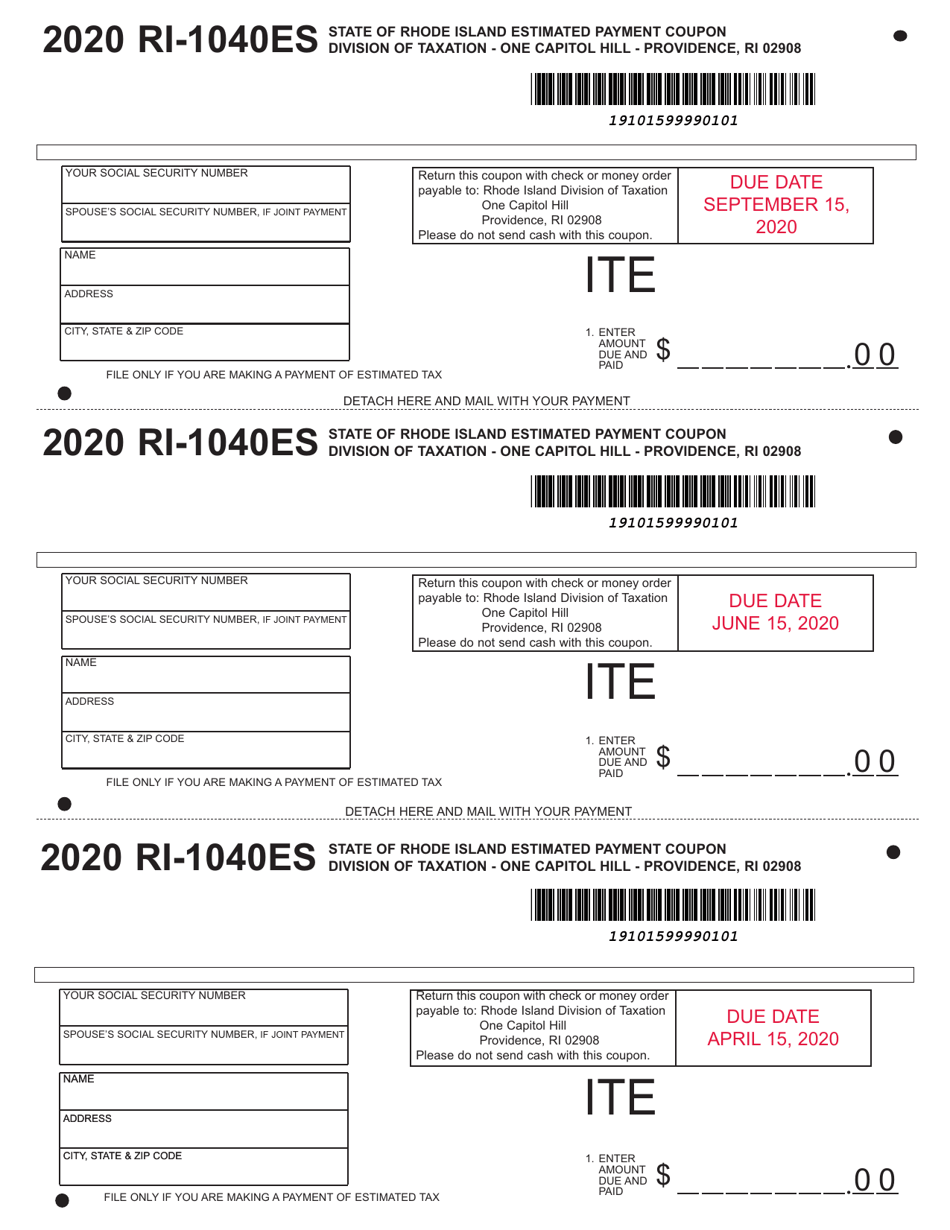

Q: When is Form RI-1040ES due?

A: Form RI-1040ES is due on or before the 15th day of the 4th, 6th, 9th, and 12th months of the taxable year.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040ES by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.