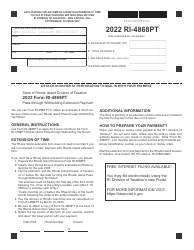

This version of the form is not currently in use and is provided for reference only. Download this version of

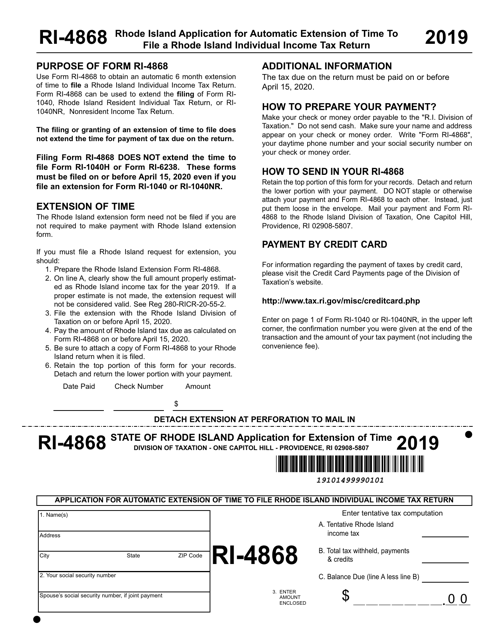

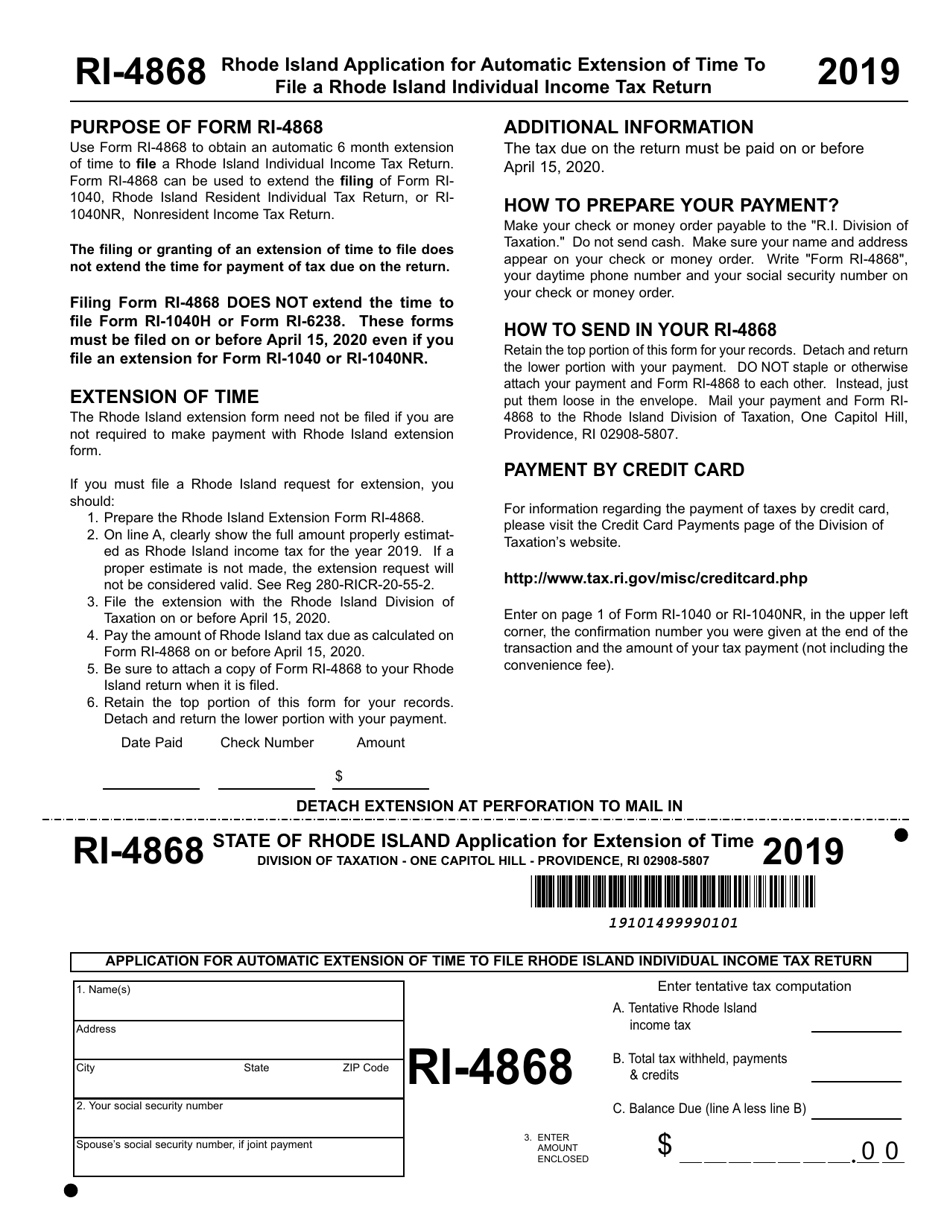

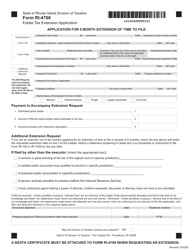

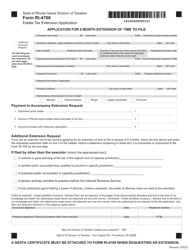

Form RI-4868

for the current year.

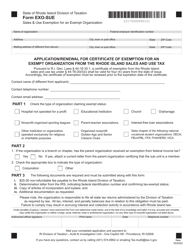

Form RI-4868 Application for Extension of Time - Rhode Island

What Is Form RI-4868?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-4868?

A: Form RI-4868 is the Application for Extension of Time for individuals who need more time to file their Rhode Island state tax return.

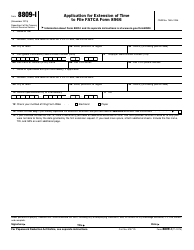

Q: Who can use Form RI-4868?

A: Any individual taxpayer who needs extra time to file their Rhode Island state tax return can use Form RI-4868 to request an extension.

Q: How long is the extension granted by Form RI-4868?

A: The extension granted by Form RI-4868 allows taxpayers an additional 6 months to file their Rhode Island state tax return.

Q: Are there any requirements to qualify for the extension?

A: No, there are no specific requirements to qualify for an extension using Form RI-4868.

Q: Is there a penalty for filing the extension request late?

A: No, there is no penalty for filing the extension request late as long as the actual tax return is filed before the extension deadline.

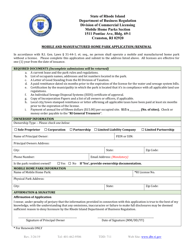

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-4868 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.