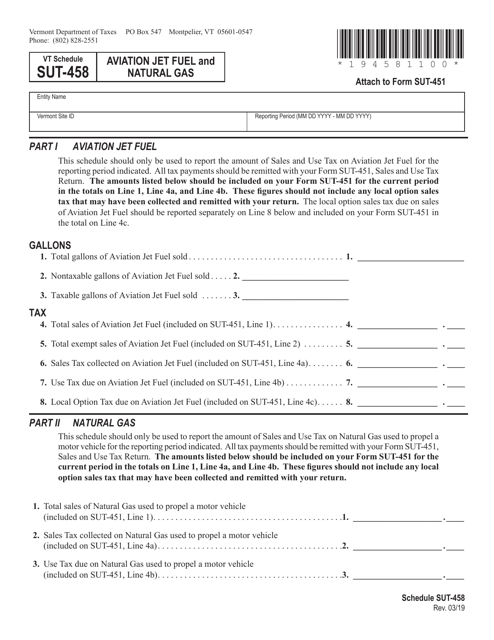

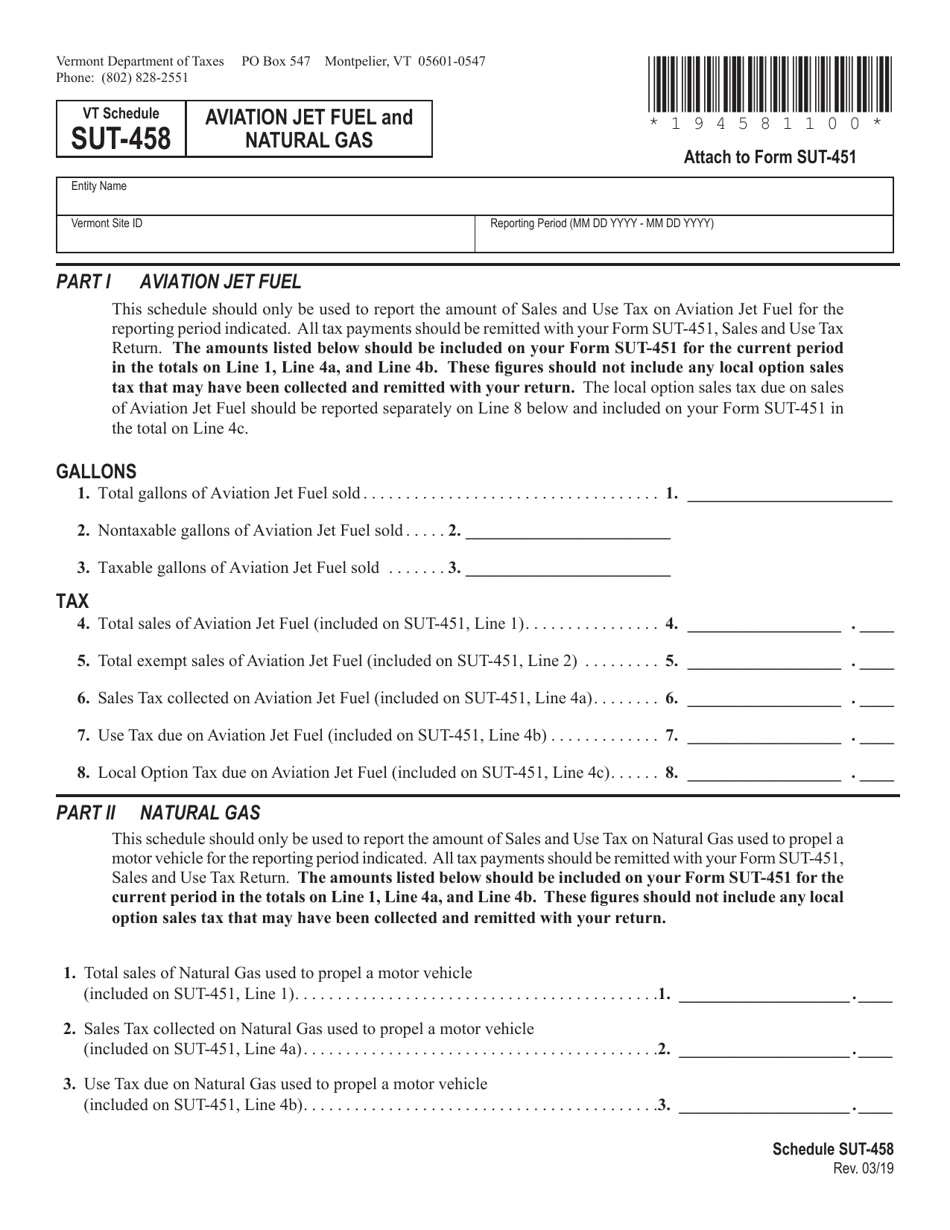

Schedule SUT-458 Aviation Jet Fuel and Natural Gas - Vermont

What Is Schedule SUT-458?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule SUT-458?

A: Schedule SUT-458 is a tax schedule relating to aviation jet fuel and natural gas in the state of Vermont.

Q: What does SUT stand for?

A: SUT stands for Sales and Use Tax.

Q: What is the purpose of Schedule SUT-458?

A: The purpose of Schedule SUT-458 is to determine the appropriate tax rates and rules for aviation jet fuel and natural gas in Vermont.

Q: Who is required to file Schedule SUT-458?

A: Businesses and individuals who distribute, sell, or use aviation jet fuel and natural gas in Vermont are required to file Schedule SUT-458.

Q: What information is needed to complete Schedule SUT-458?

A: To complete Schedule SUT-458, you will need to provide information about the quantity and value of aviation jet fuel and natural gas distributed, sold, or used in Vermont.

Q: What are the tax rates for aviation jet fuel and natural gas in Vermont?

A: The tax rates for aviation jet fuel and natural gas in Vermont are specified in Schedule SUT-458 and may vary depending on the type of fuel and the intended use.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule SUT-458 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.