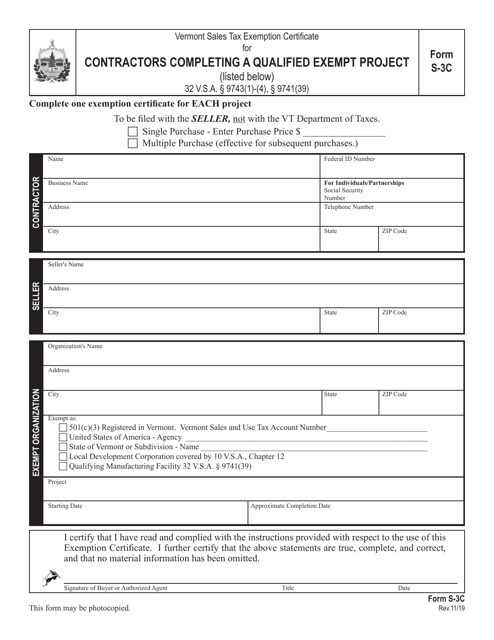

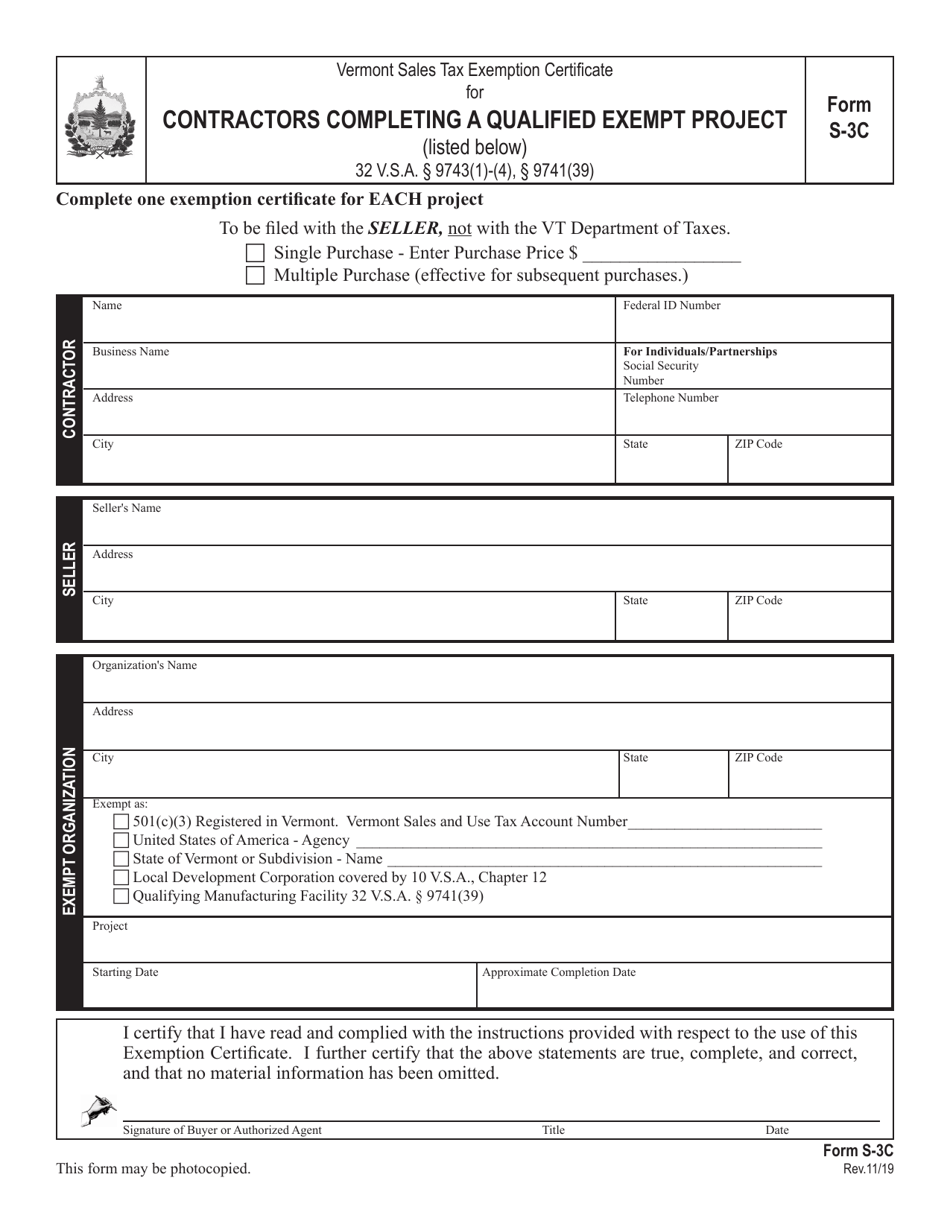

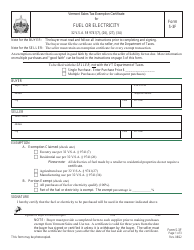

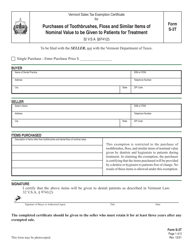

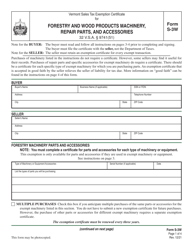

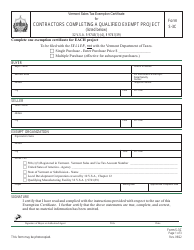

Form S-3C Vermont Sales Tax Exemption Certificate for Contractors Completing a Qualified Exempt Project - Vermont

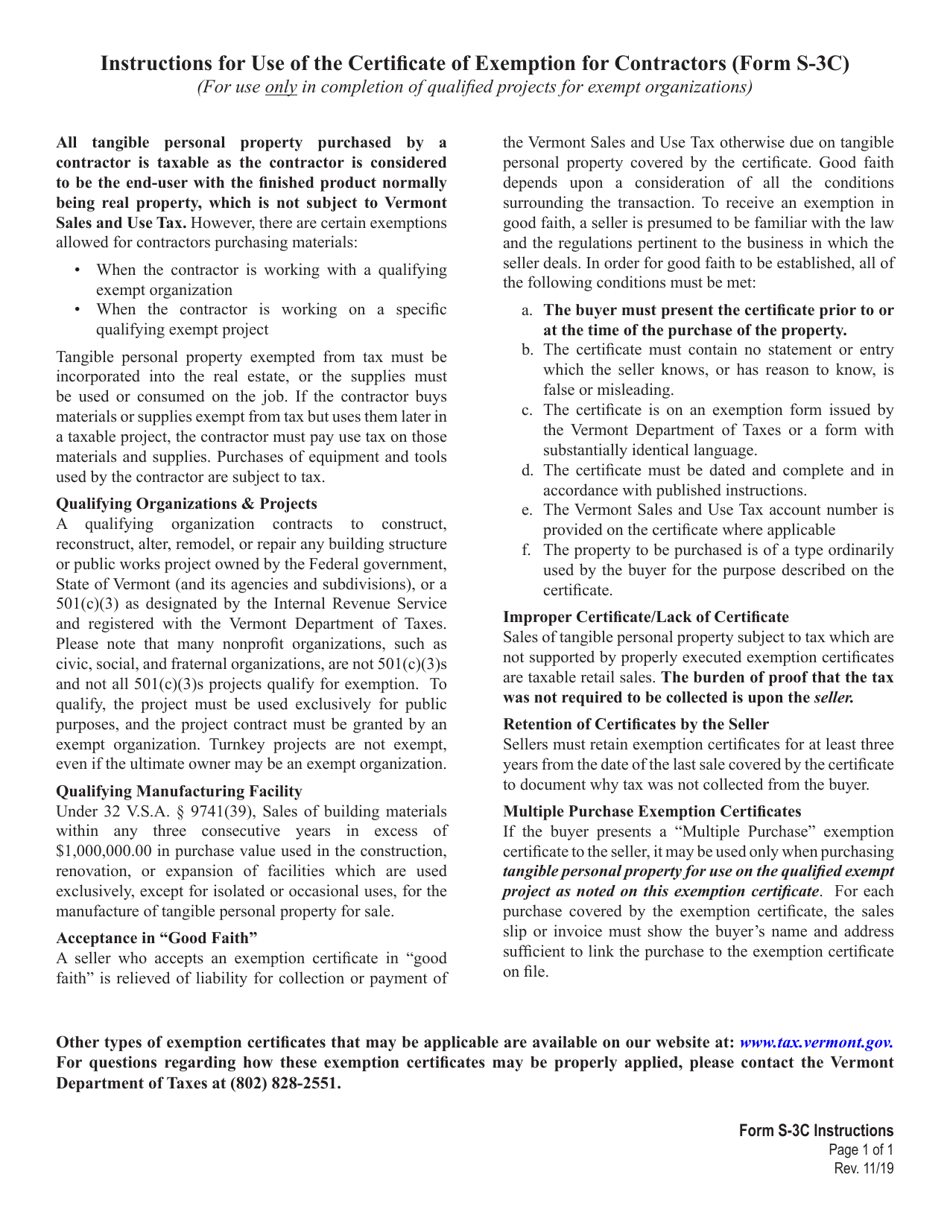

What Is Form S-3C?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S-3C?

A: Form S-3C is the Vermont Sales Tax Exemption Certificate specifically for contractors completing a qualified exempt project.

Q: Who can use Form S-3C?

A: Contractors who are working on a qualified exempt project in Vermont can use Form S-3C to claim a sales tax exemption.

Q: What is a qualified exempt project?

A: A qualified exempt project refers to construction, installation, or repair work that meets certain criteria to be eligible for a sales tax exemption in Vermont.

Q: How does Form S-3C help contractors?

A: Form S-3C allows contractors to claim an exemption from Vermont sales tax on materials and supplies purchased for a qualified exempt project.

Q: What information is required on Form S-3C?

A: Contractors need to provide their business information, project details, and an explanation of why the project qualifies for a sales tax exemption on Form S-3C.

Q: Is Form S-3C valid for all projects in Vermont?

A: No, Form S-3C is specific to qualified exempt projects and cannot be used for other purposes.

Q: What should contractors do with Form S-3C once completed?

A: Contractors should keep a copy of Form S-3C for their records and provide a copy to the vendor when purchasing materials for the exempt project.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form S-3C by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.