This version of the form is not currently in use and is provided for reference only. Download this version of

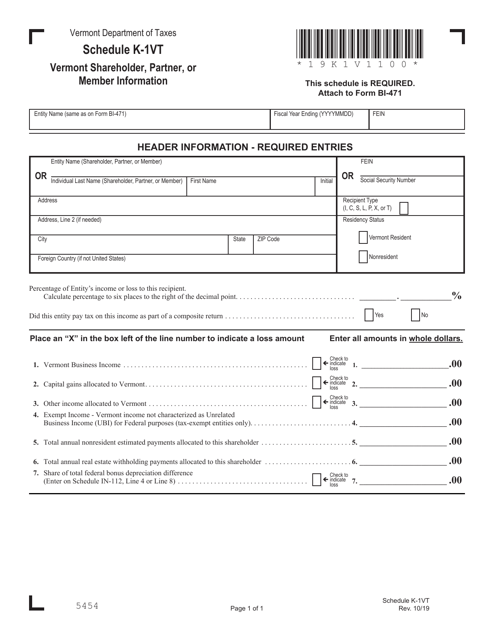

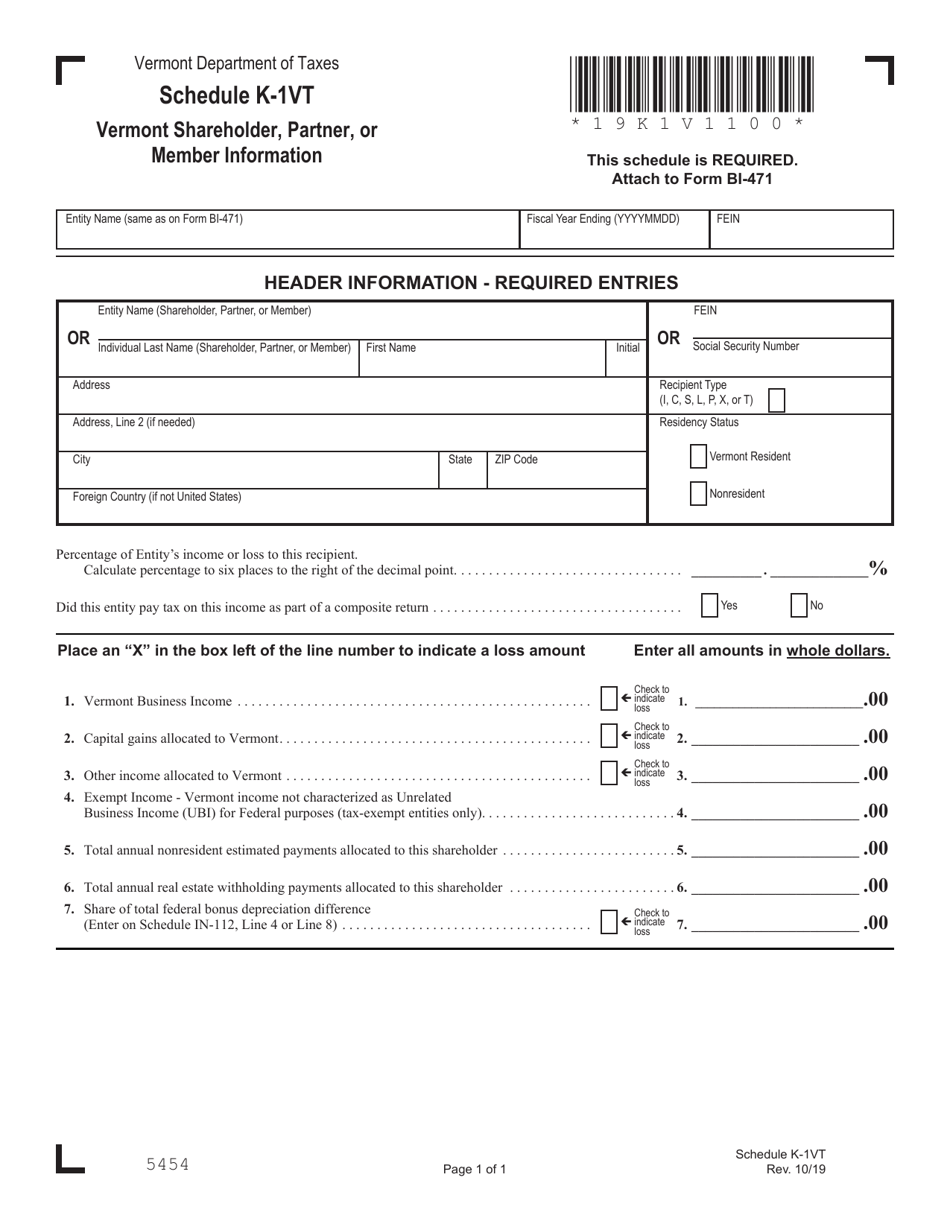

Schedule K-1VT

for the current year.

Schedule K-1VT Vermont Shareholder, Partner, or Member Information - Vermont

What Is Schedule K-1VT?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-1VT?

A: Schedule K-1VT is a tax form used to report Vermont shareholder, partner, or member information.

Q: Who needs to file Schedule K-1VT?

A: Individuals or entities who are shareholders, partners, or members of Vermont businesses need to file Schedule K-1VT.

Q: What information is reported on Schedule K-1VT?

A: Schedule K-1VT reports the individual's or entity's share of income, deductions, credits, and other tax items from a Vermont business.

Q: Is Schedule K-1VT only for residents of Vermont?

A: No, Schedule K-1VT is required for both residents and non-residents who have ownership in a Vermont business.

Q: When is Schedule K-1VT due?

A: Schedule K-1VT is generally due on the same date as the Vermont income tax return, which is typically April 15th.

Q: Do I need to include Schedule K-1VT with my federal tax return?

A: No, Schedule K-1VT is specific to Vermont and should be filed with the Vermont income tax return, not the federal tax return.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule K-1VT by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.