This version of the form is not currently in use and is provided for reference only. Download this version of

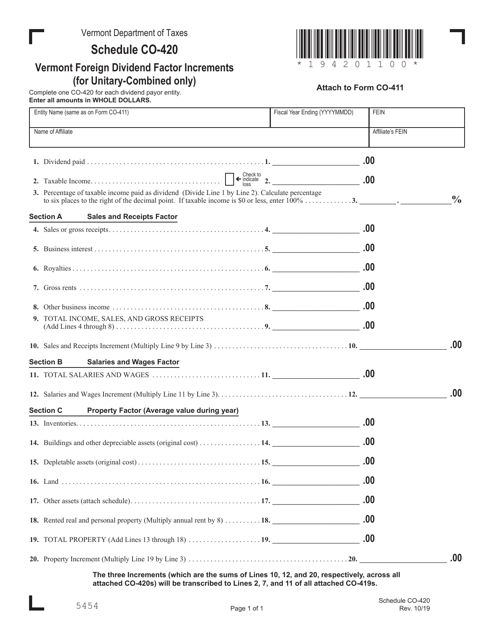

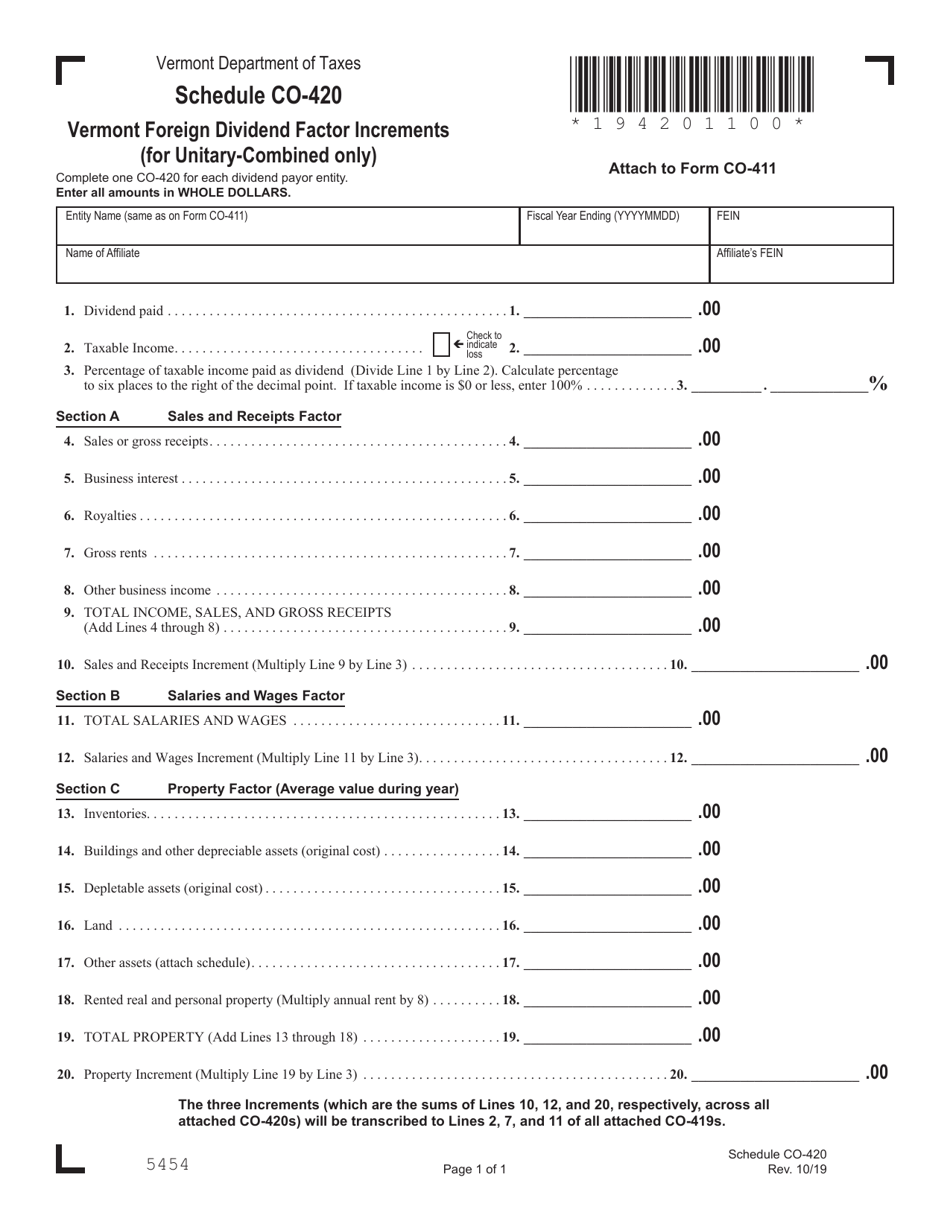

Schedule CO-420

for the current year.

Schedule CO-420 Vermont Foreign Dividend Factor Increments (For Unitary-Combined Only) - Vermont

What Is Schedule CO-420?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule CO-420?

A: Schedule CO-420 is a form used for reporting Vermont Foreign Dividend Factor Increments for Unitary-Combined filers.

Q: Who needs to file Schedule CO-420?

A: Unitary-Combined filers in Vermont need to file Schedule CO-420.

Q: What is a foreign dividend factor increment?

A: A foreign dividend factor increment is a calculation used to determine the portion of foreign dividends that is taxable.

Q: What is Unitary-Combined reporting?

A: Unitary-Combined reporting is a method of reporting income for a group of related corporations.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CO-420 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.