This version of the form is not currently in use and is provided for reference only. Download this version of

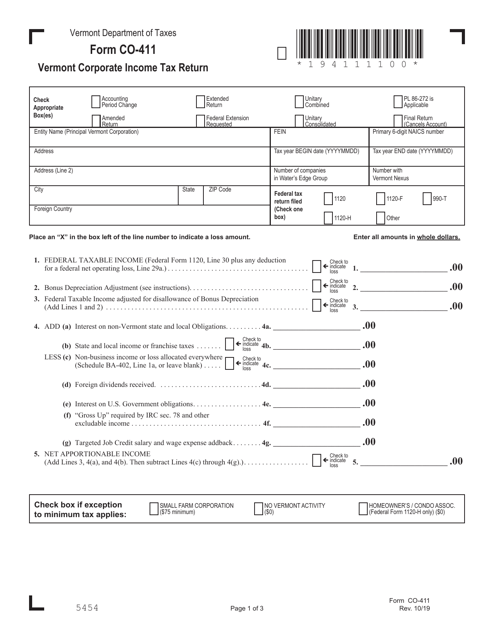

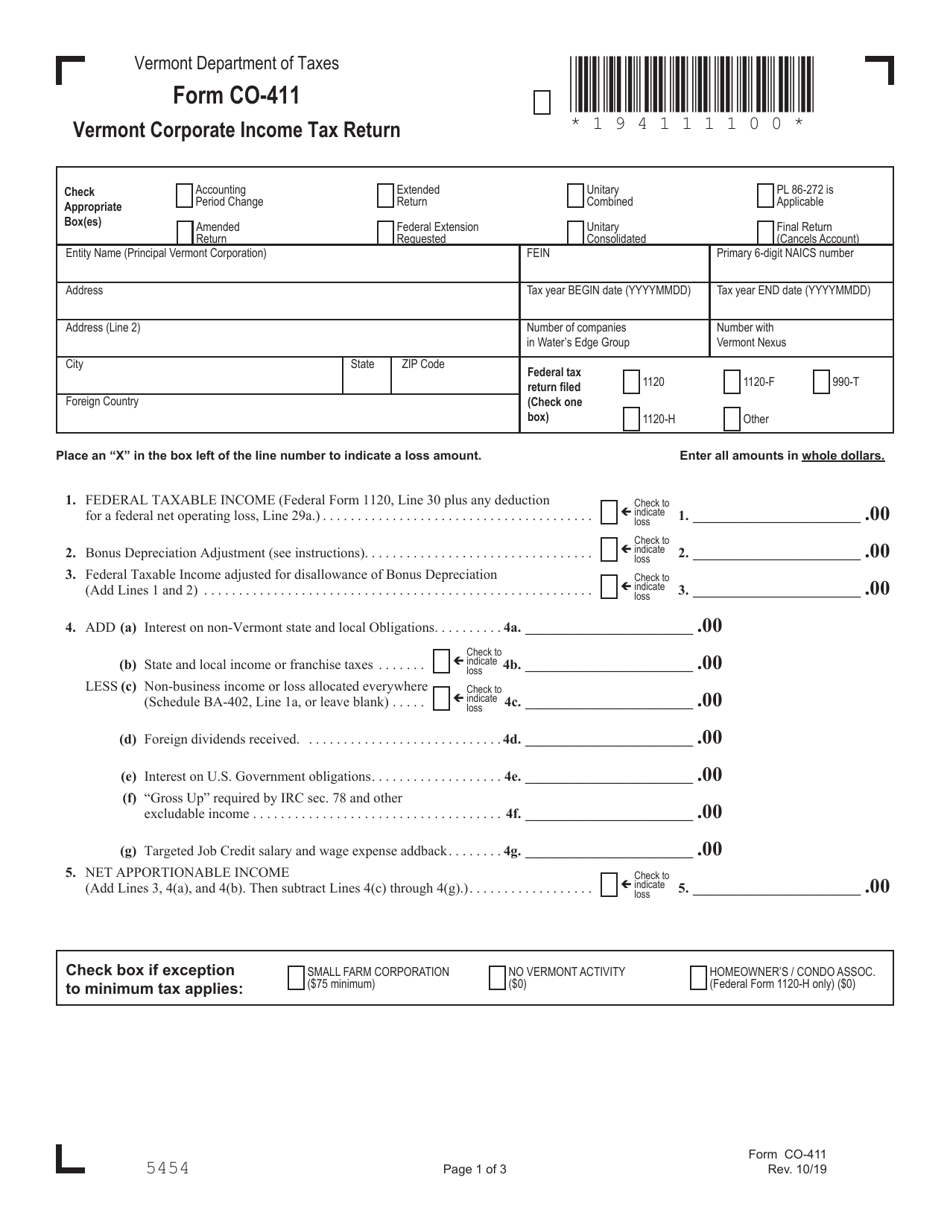

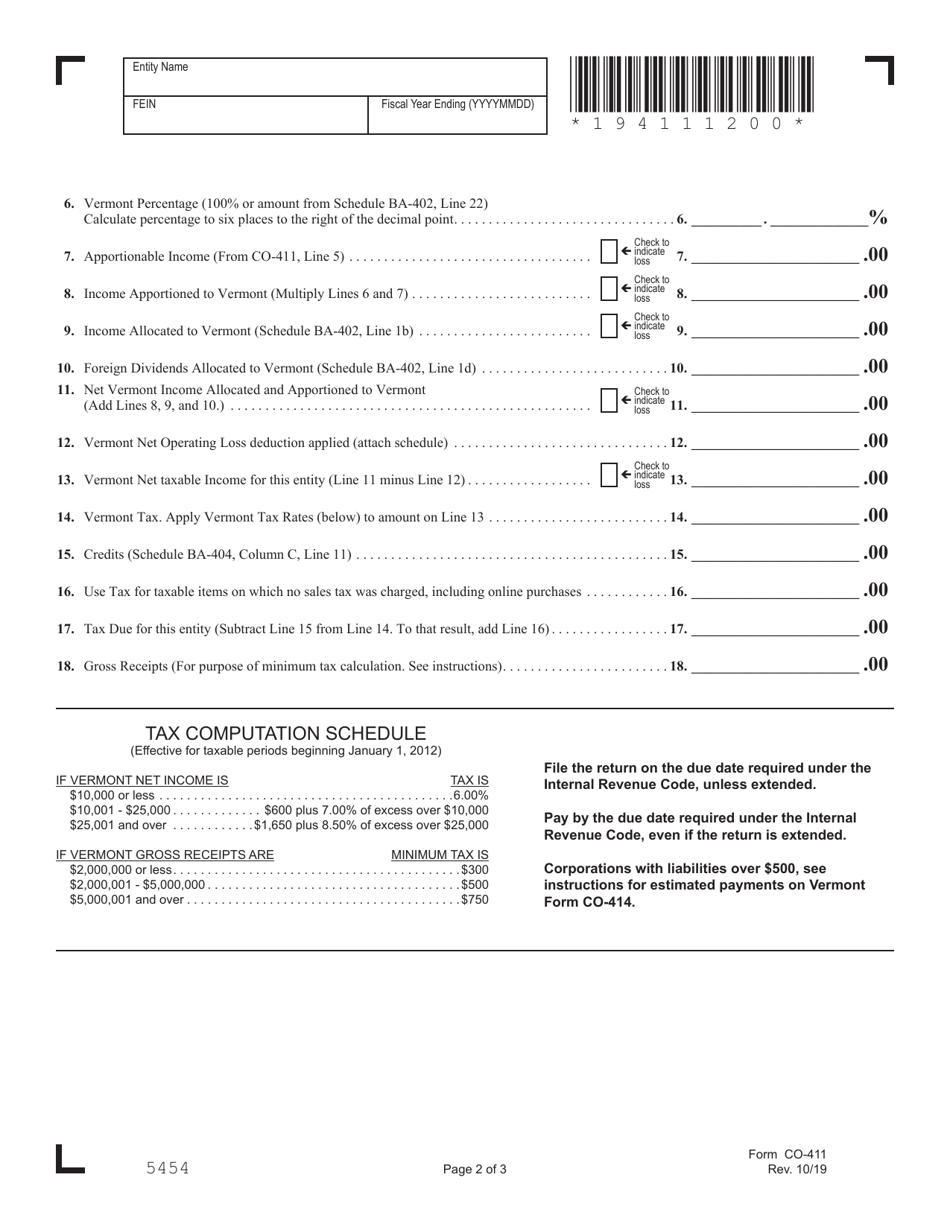

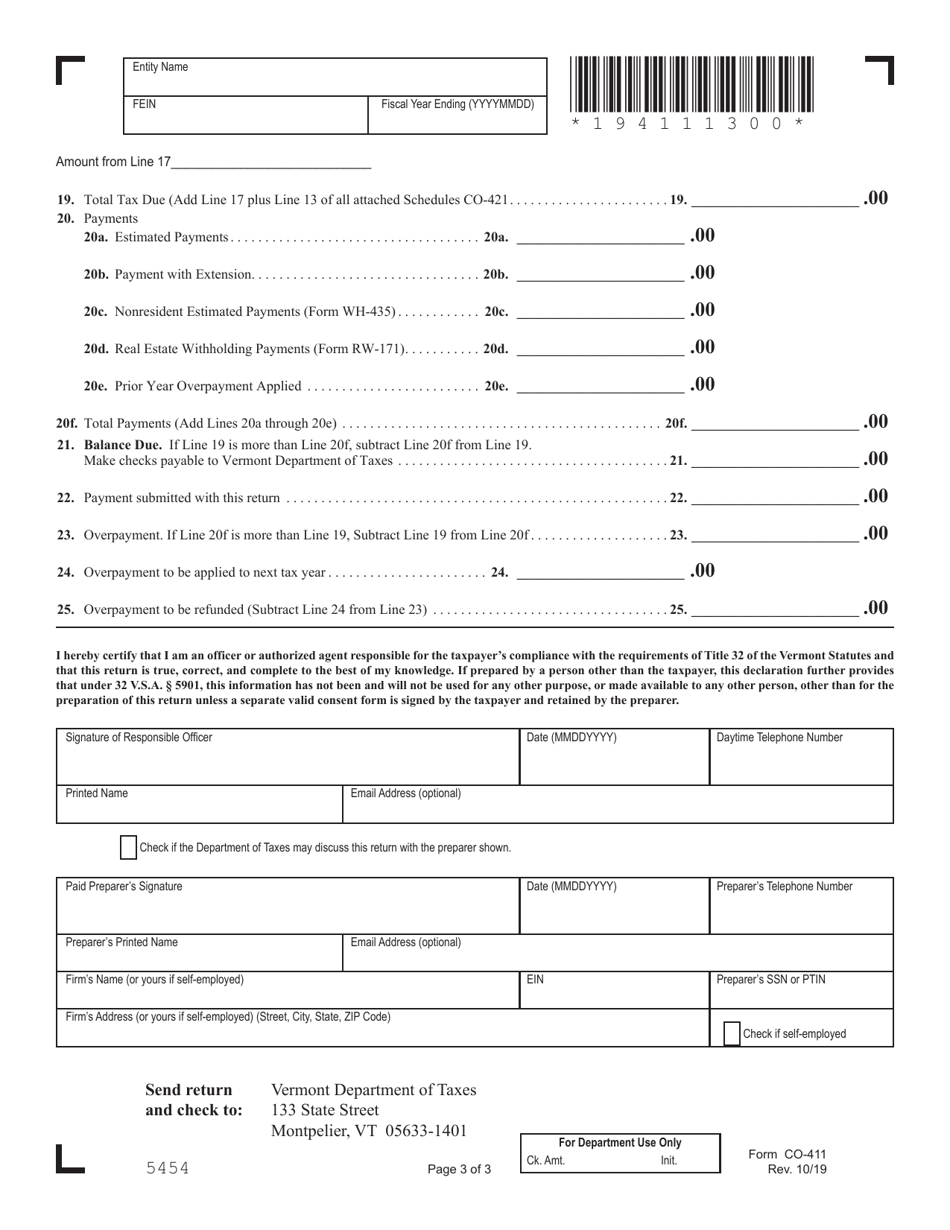

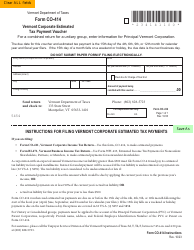

Form CO-411

for the current year.

Form CO-411 Vermont Corporate Income Tax Return - Vermont

What Is Form CO-411?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CO-411?

A: Form CO-411 is the Vermont Corporate Income Tax Return.

Q: Who is required to file Form CO-411?

A: Any corporation doing business in Vermont or having income from Vermont sources is required to file Form CO-411.

Q: What is the purpose of Form CO-411?

A: Form CO-411 is used to report a corporation's income, deductions, credits, and tax liability for the tax year.

Q: When is Form CO-411 due?

A: Form CO-411 is due on the 15th day of the 4th month following the close of the corporation's tax year.

Q: Are there any penalties for late filing of Form CO-411?

A: Yes, there are penalties for late filing of Form CO-411, including interest charges and potential late filing penalties.

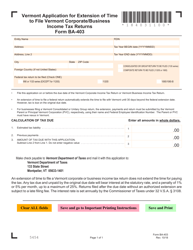

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CO-411 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.