This version of the form is not currently in use and is provided for reference only. Download this version of

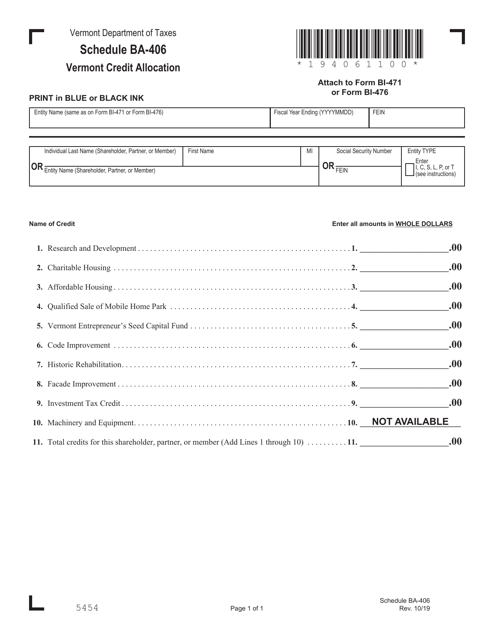

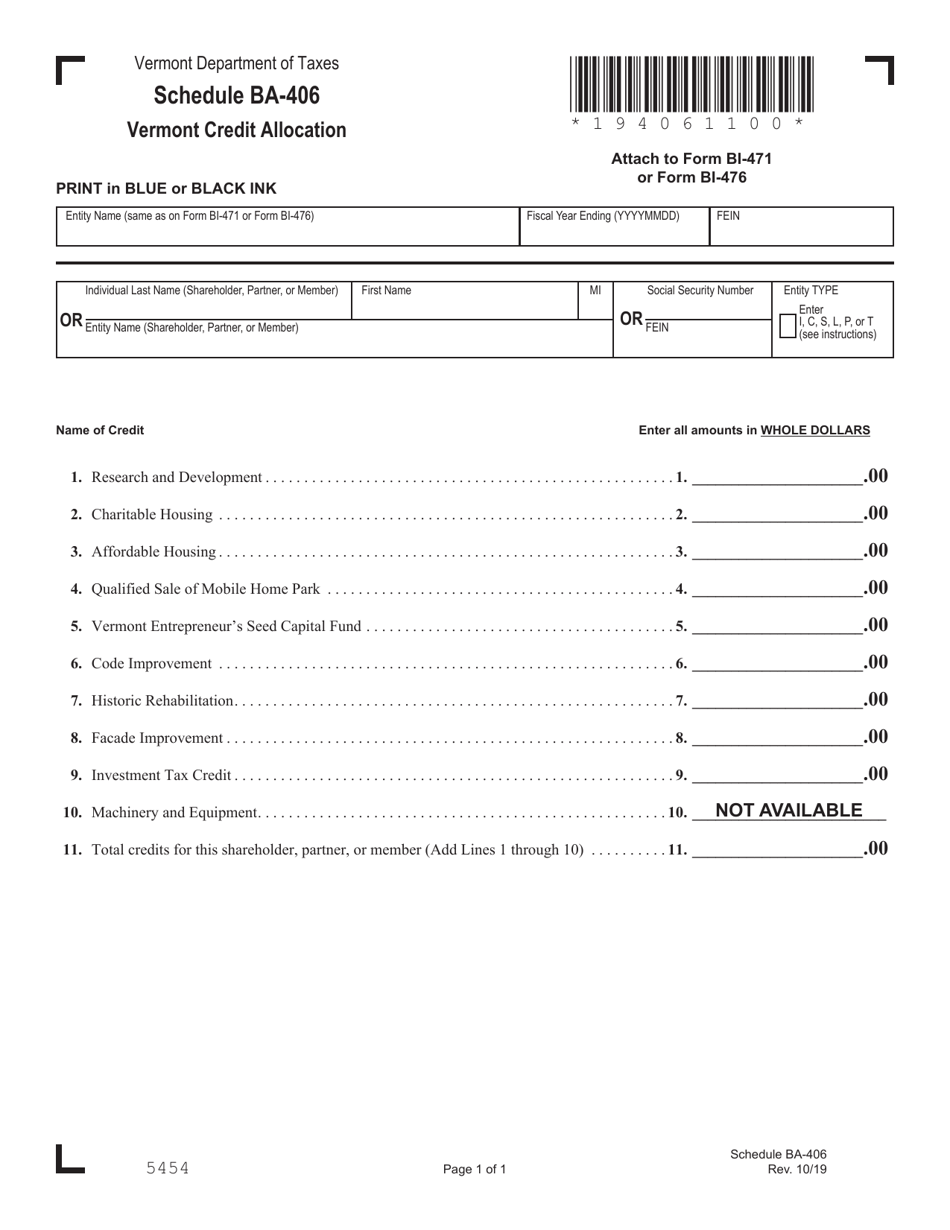

Schedule BA-406

for the current year.

Schedule BA-406 Vermont Credit Allocation - Vermont

What Is Schedule BA-406?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule BA-406?

A: Schedule BA-406 is a Vermont state tax form used to allocate credits in the state of Vermont.

Q: What is a credit allocation?

A: Credit allocation is the process of distributing available tax credits to eligible taxpayers or entities.

Q: Who uses Schedule BA-406?

A: Taxpayers or entities in Vermont who are eligible for tax credits.

Q: What types of credits can be allocated using Schedule BA-406?

A: Schedule BA-406 can be used to allocate various types of Vermont state tax credits, such as renewable energy credits or affordable housing credits.

Q: Is Schedule BA-406 mandatory?

A: If you are eligible for tax credits in Vermont, you may need to use Schedule BA-406 to allocate them, depending on the specific requirements of the credits.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule BA-406 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.