This version of the form is not currently in use and is provided for reference only. Download this version of

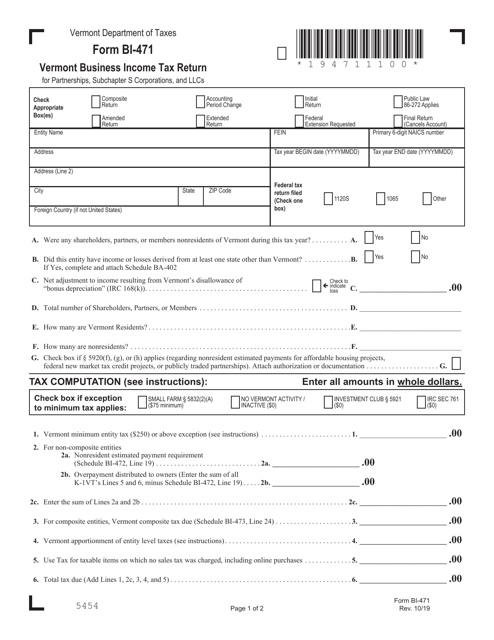

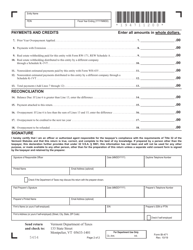

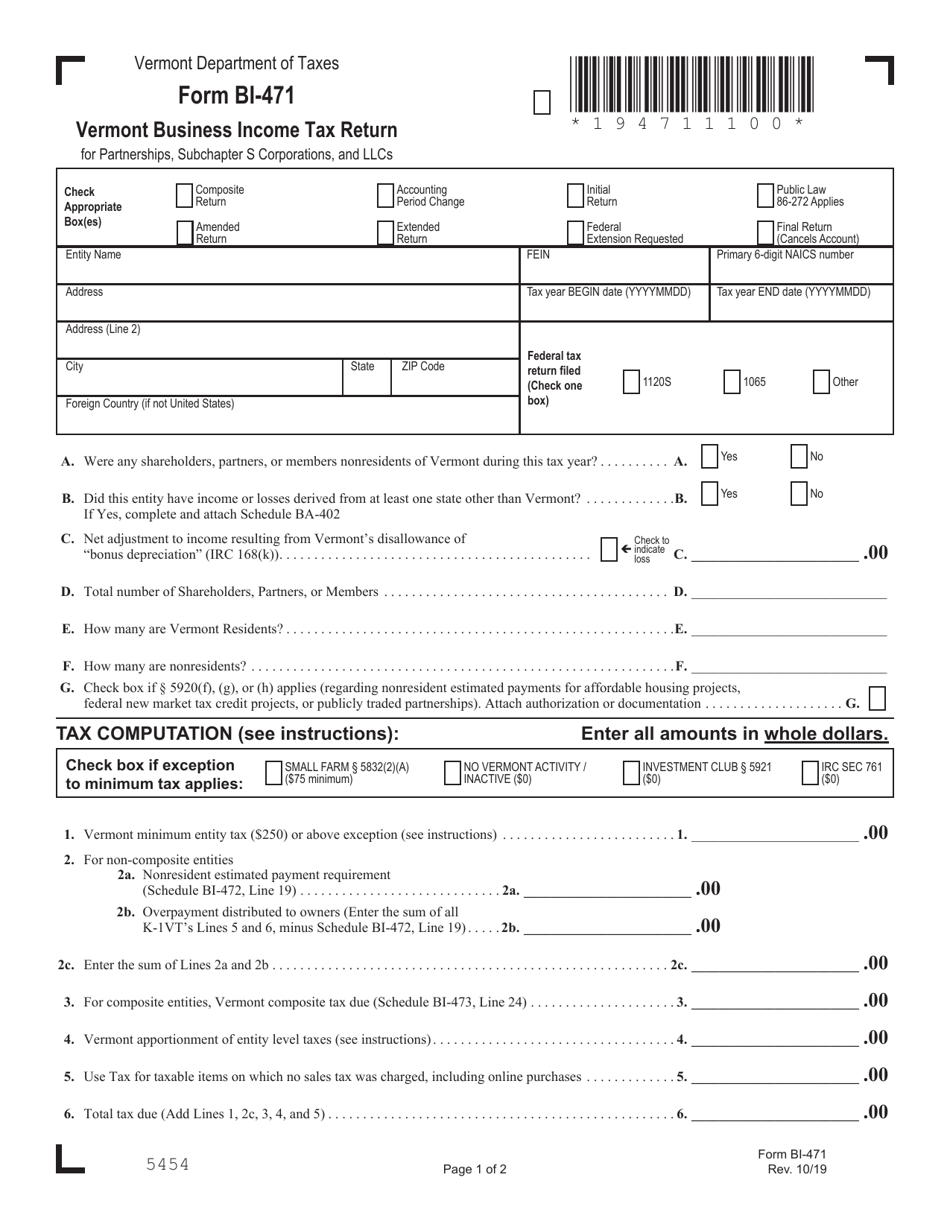

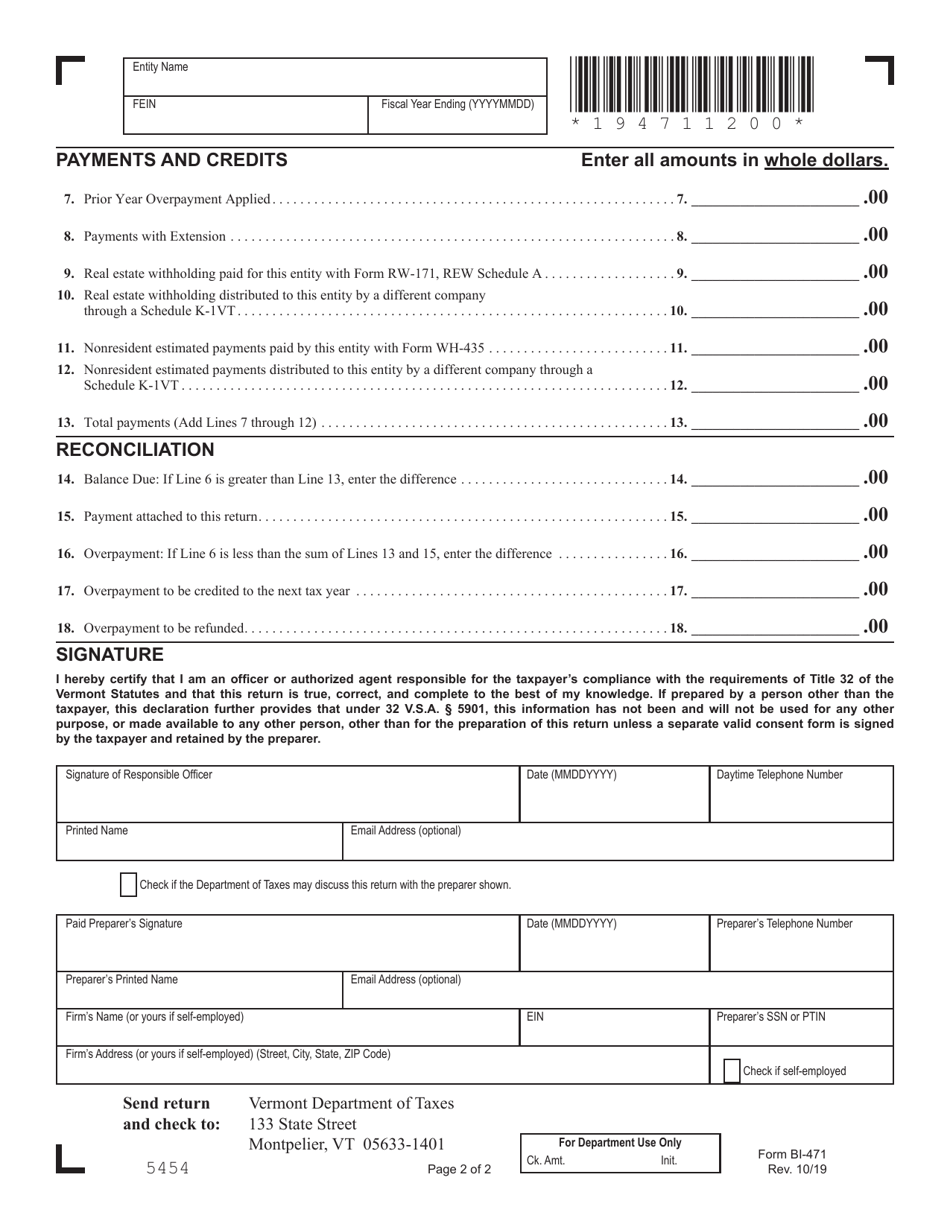

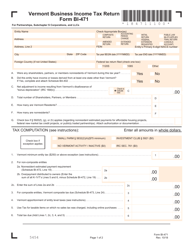

Form BI-471

for the current year.

Form BI-471 Vermont Business Income Tax Return - Vermont

What Is Form BI-471?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form BI-471?

A: Form BI-471 is the Vermont Business Income Tax Return for businesses in Vermont.

Q: Who needs to file Form BI-471?

A: Businesses operating in Vermont that have business income are required to file Form BI-471.

Q: What is the purpose of Form BI-471?

A: The purpose of Form BI-471 is to report business income and calculate the amount of tax owed to the State of Vermont.

Q: What information do I need to complete Form BI-471?

A: You will need to gather information such as your business income, deductions, and credits to complete Form BI-471.

Q: What is the deadline for filing Form BI-471?

A: The deadline for filing Form BI-471 is typically April 15th, or the next business day if April 15th falls on a weekend or holiday.

Q: Are there any penalties for late filing of Form BI-471?

A: Yes, there may be penalties for late filing of Form BI-471. It is important to file on time to avoid any penalties or interest charges.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BI-471 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.