This version of the form is not currently in use and is provided for reference only. Download this version of

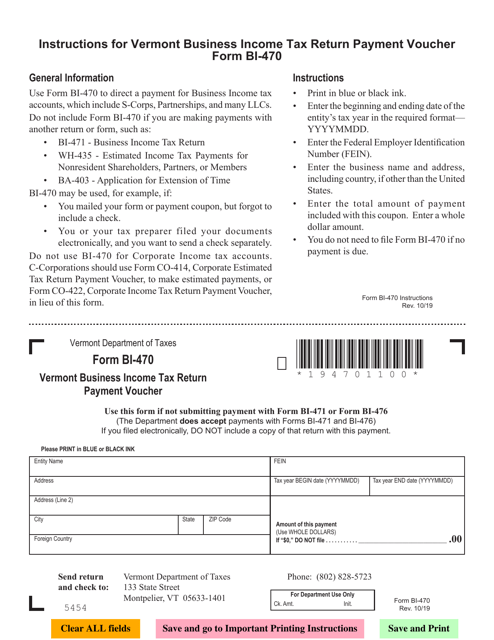

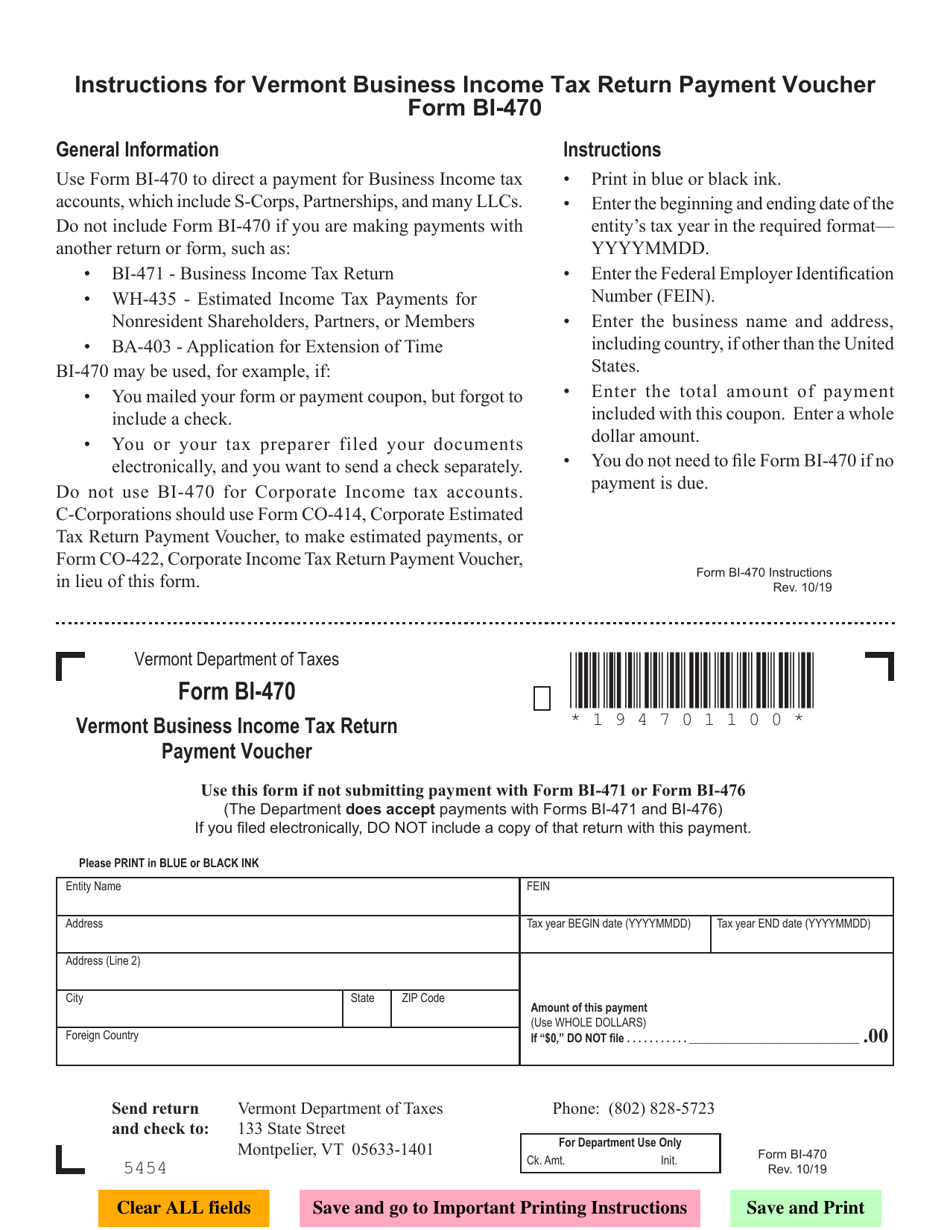

Form BI-470

for the current year.

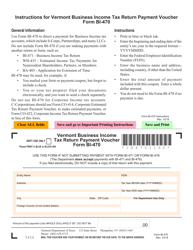

Form BI-470 Vermont Business Income Tax Return Payment Voucher - Vermont

What Is Form BI-470?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BI-470?

A: Form BI-470 is the Vermont Business Income TaxReturn Payment Voucher.

Q: What is the purpose of Form BI-470?

A: The purpose of Form BI-470 is to make a payment for your Vermont business income tax.

Q: Who needs to file Form BI-470?

A: Anyone who owes Vermont business income tax needs to file Form BI-470.

Q: What is the deadline for filing Form BI-470?

A: The deadline for filing Form BI-470 is the same as the deadline for filing your Vermont business income tax return.

Q: Can I file Form BI-470 electronically?

A: No, Form BI-470 cannot be filed electronically. It must be mailed or submitted in person.

Q: What information do I need to fill out Form BI-470?

A: You will need your business information, including your tax identification number, the amount you owe, and your contact information.

Q: Is there a penalty for late payment of Vermont business income tax?

A: Yes, there is a penalty for late payment of Vermont business income tax. Be sure to submit your payment on time to avoid penalties.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BI-470 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.