This version of the form is not currently in use and is provided for reference only. Download this version of

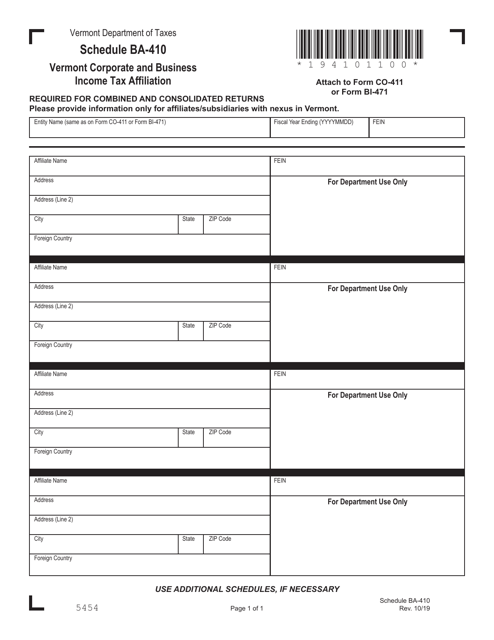

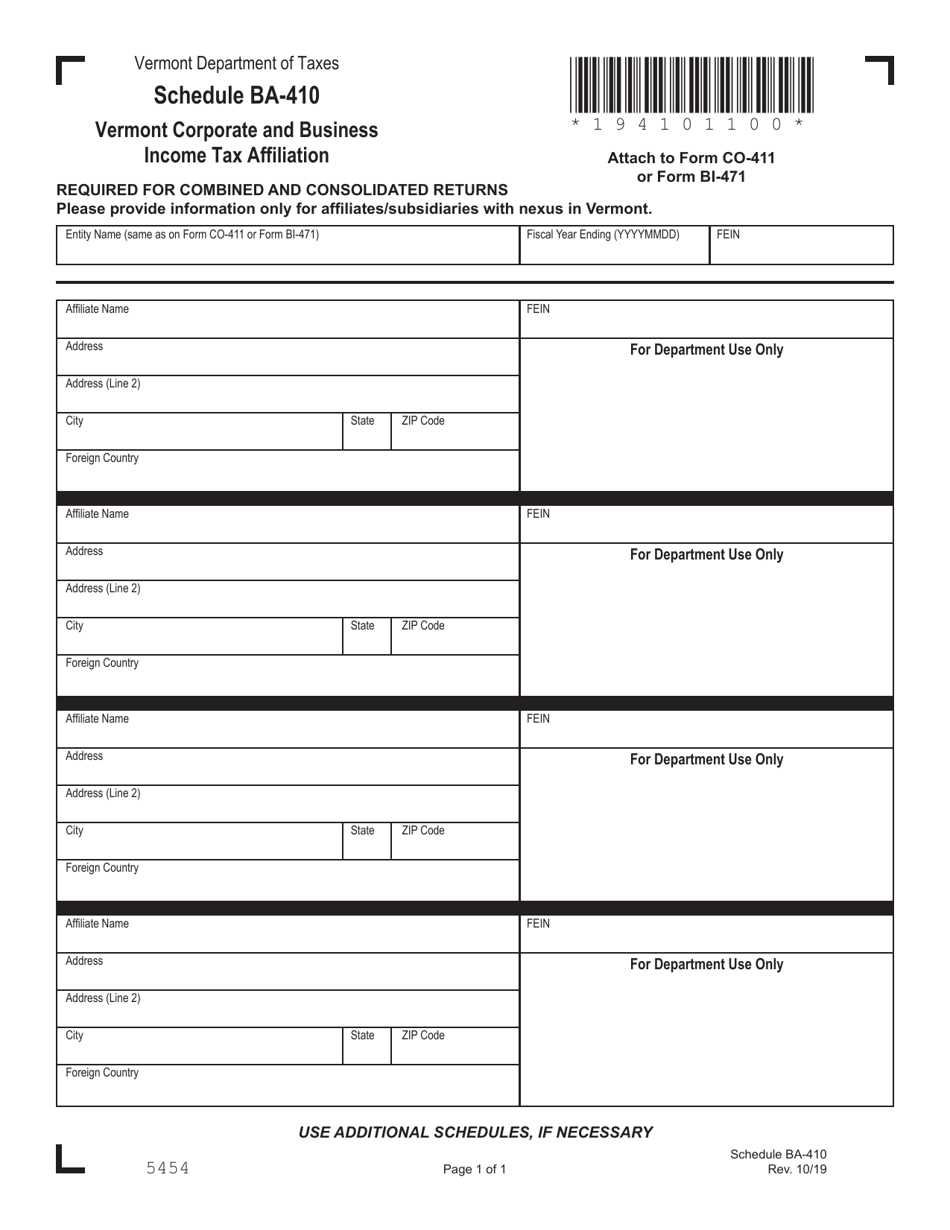

Schedule BA-410

for the current year.

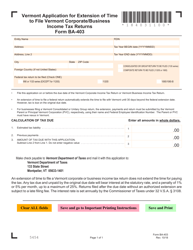

Schedule BA-410 Vermont Corporate and Business Income Tax Affiliation - Vermont

What Is Schedule BA-410?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule BA-410?

A: Schedule BA-410 is a form used for Vermont Corporate and Business Income Tax Affiliation.

Q: Who needs to file Schedule BA-410?

A: Taxpayers who have corporate or business income tax affiliation in Vermont need to file Schedule BA-410.

Q: What is corporate and business income tax affiliation?

A: Corporate and business income tax affiliation refers to the intercorporate relationships that may subject affiliated corporations or businesses to combined reporting or other affiliation-related tax rules.

Q: When is the deadline to file Schedule BA-410?

A: The deadline to file Schedule BA-410 is the same as the deadline for filing Vermont corporate and business income tax returns, which is usually April 15th.

Q: What information do I need to complete Schedule BA-410?

A: To complete Schedule BA-410, you will need information about the affiliated corporations or businesses, their intercorporate relationships, and their respective income and expenses.

Q: Are there any penalties for not filing Schedule BA-410?

A: Yes, failure to file Schedule BA-410 when required may result in penalties and interest.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule BA-410 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.