This version of the form is not currently in use and is provided for reference only. Download this version of

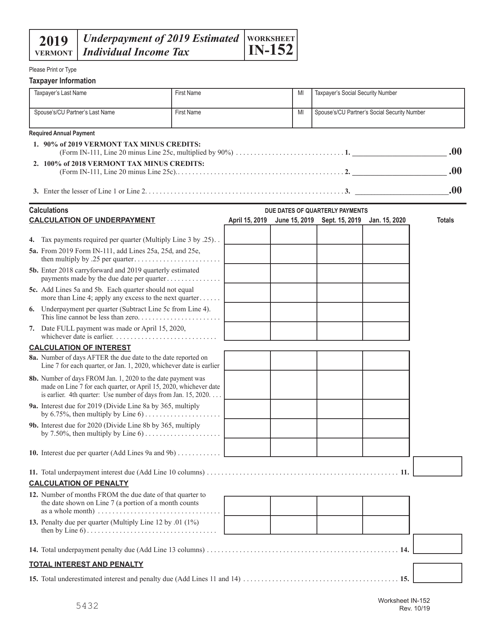

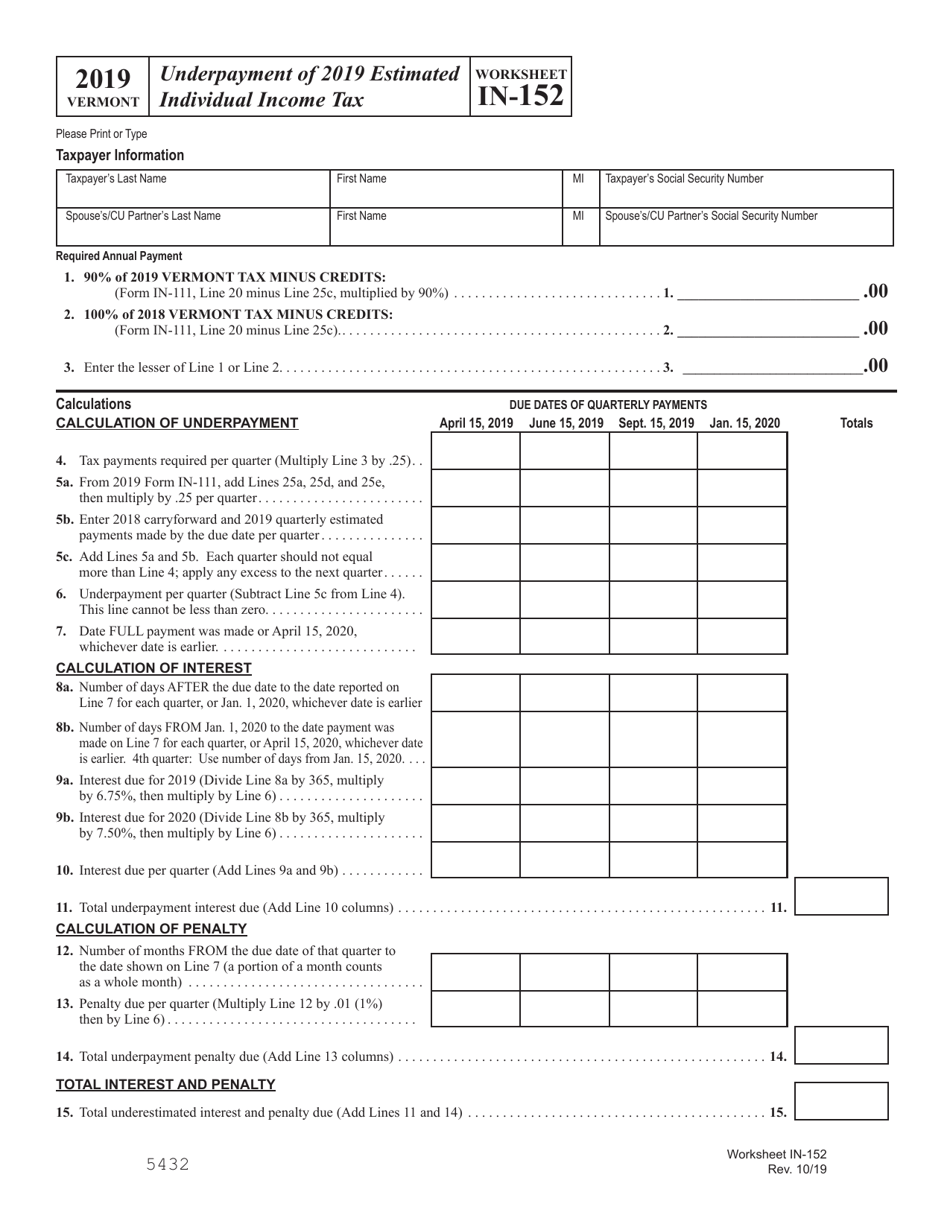

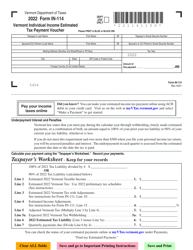

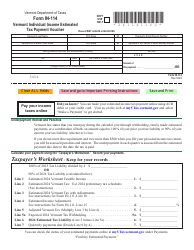

Worksheet IN-152

for the current year.

Worksheet IN-152 Underpayment of Estimated Individual Income Tax - Vermont

What Is Worksheet IN-152?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Worksheet IN-152?

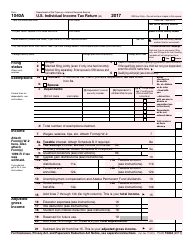

A: Worksheet IN-152 is used to calculate any underpayment of estimated individual income tax in Vermont.

Q: Why would I need to use Worksheet IN-152?

A: You would need to use Worksheet IN-152 if you have underpaid your estimated individual income tax in Vermont.

Q: How can I use Worksheet IN-152?

A: You can use Worksheet IN-152 by following the instructions provided on the form.

Q: Can I use Worksheet IN-152 for other states?

A: No, Worksheet IN-152 is specific to Vermont and is used to calculate underpayment of estimated individual income tax only in Vermont.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Worksheet IN-152 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.