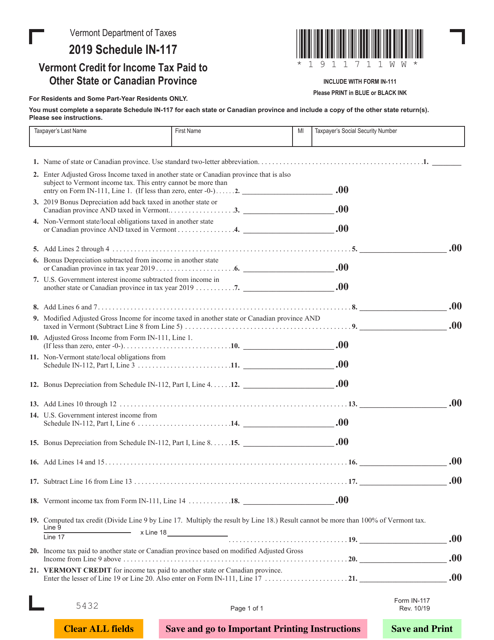

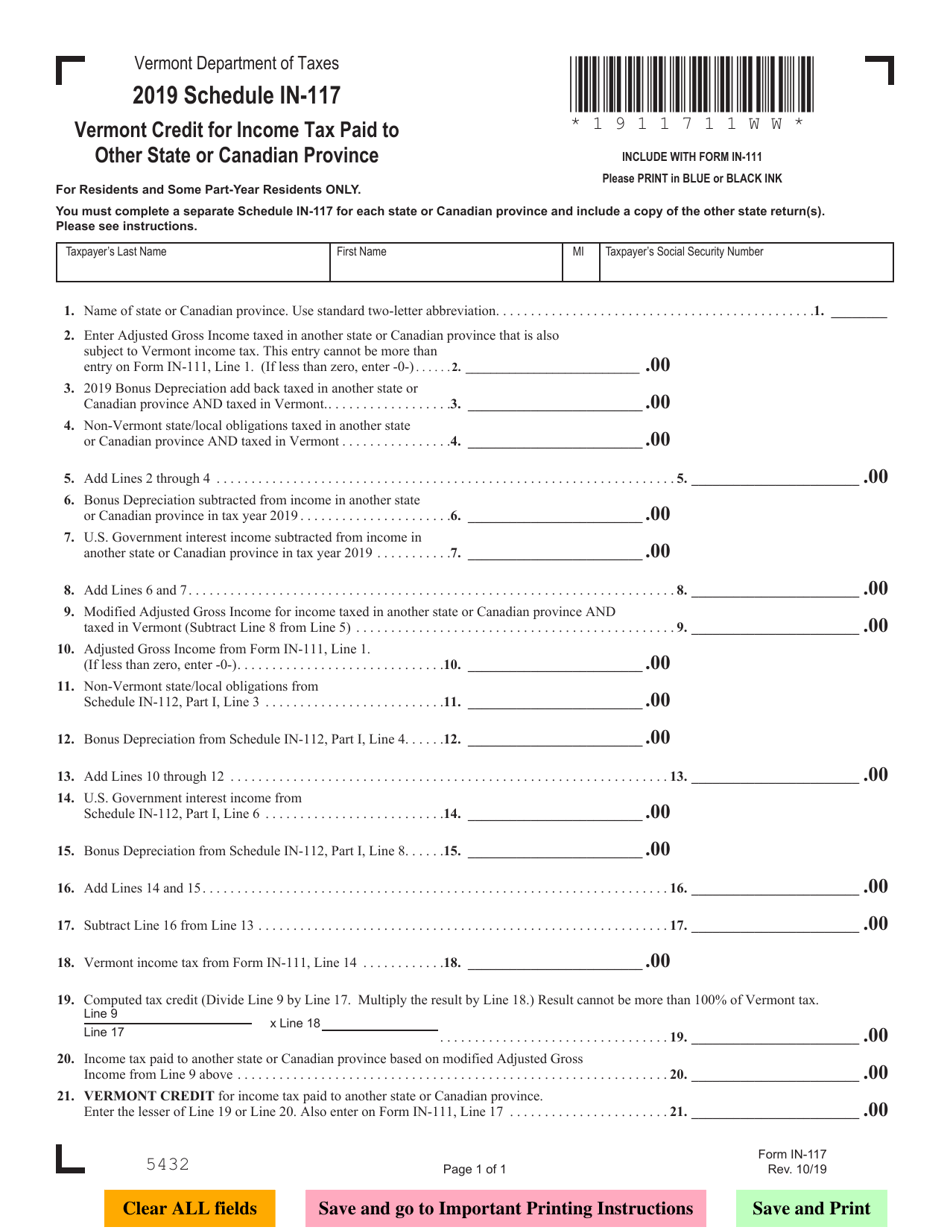

This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule IN-117

for the current year.

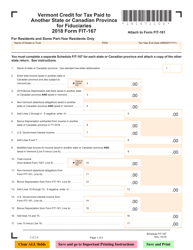

Schedule IN-117 Vermont Credit for Income Tax Paid to Other State or Canadian Province - Vermont

What Is Schedule IN-117?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule IN-117?

A: Schedule IN-117 is a form used by Vermont residents to claim a credit for income tax paid to another state or Canadian province.

Q: Who can use Schedule IN-117?

A: Vermont residents who have paid income tax to another state or Canadian province can use Schedule IN-117.

Q: What is the purpose of Schedule IN-117?

A: The purpose of Schedule IN-117 is to ensure that Vermont residents are not taxed on the same income by multiple jurisdictions.

Q: How does Schedule IN-117 work?

A: Schedule IN-117 allows Vermont residents to claim a credit for income tax paid to another state or Canadian province, reducing their overall tax liability.

Q: What kind of income can be claimed on Schedule IN-117?

A: Any income that is taxable in both Vermont and another state or Canadian province can be claimed on Schedule IN-117.

Q: What documentation is required for Schedule IN-117?

A: Documentation of the income tax paid to another state or Canadian province, such as a copy of the tax return or a statement from the tax authority, is required for Schedule IN-117.

Q: Are there any limitations on the credit claimed on Schedule IN-117?

A: Yes, there are limitations on the credit claimed on Schedule IN-117. The credit cannot exceed the amount of Vermont tax attributed to the income from the other jurisdiction.

Q: When is Schedule IN-117 due?

A: Schedule IN-117 is typically due on the same date as the Vermont individual income tax return, which is usually April 15th.

Q: Can I e-file Schedule IN-117?

A: Yes, you can e-file Schedule IN-117 along with your Vermont individual income tax return.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule IN-117 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.