This version of the form is not currently in use and is provided for reference only. Download this version of

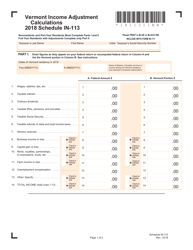

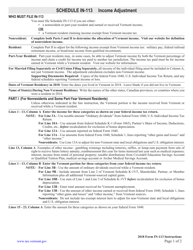

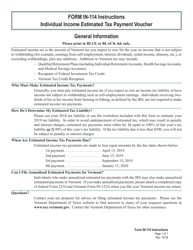

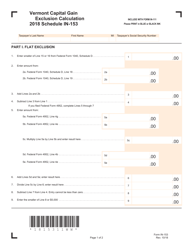

Instructions for Schedule IN-113

for the current year.

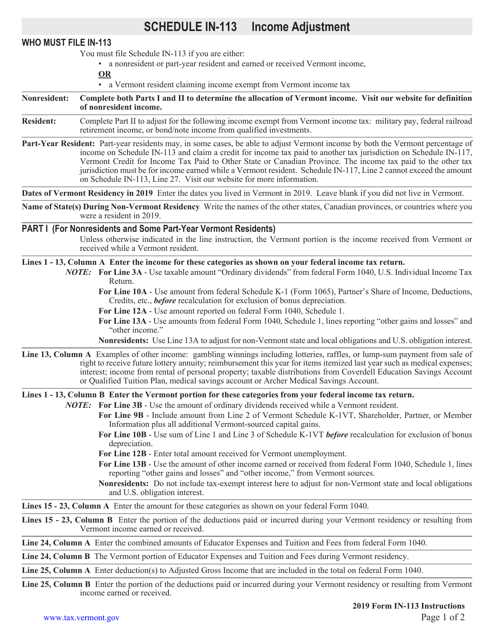

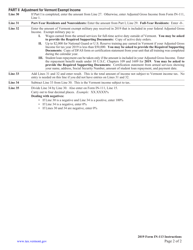

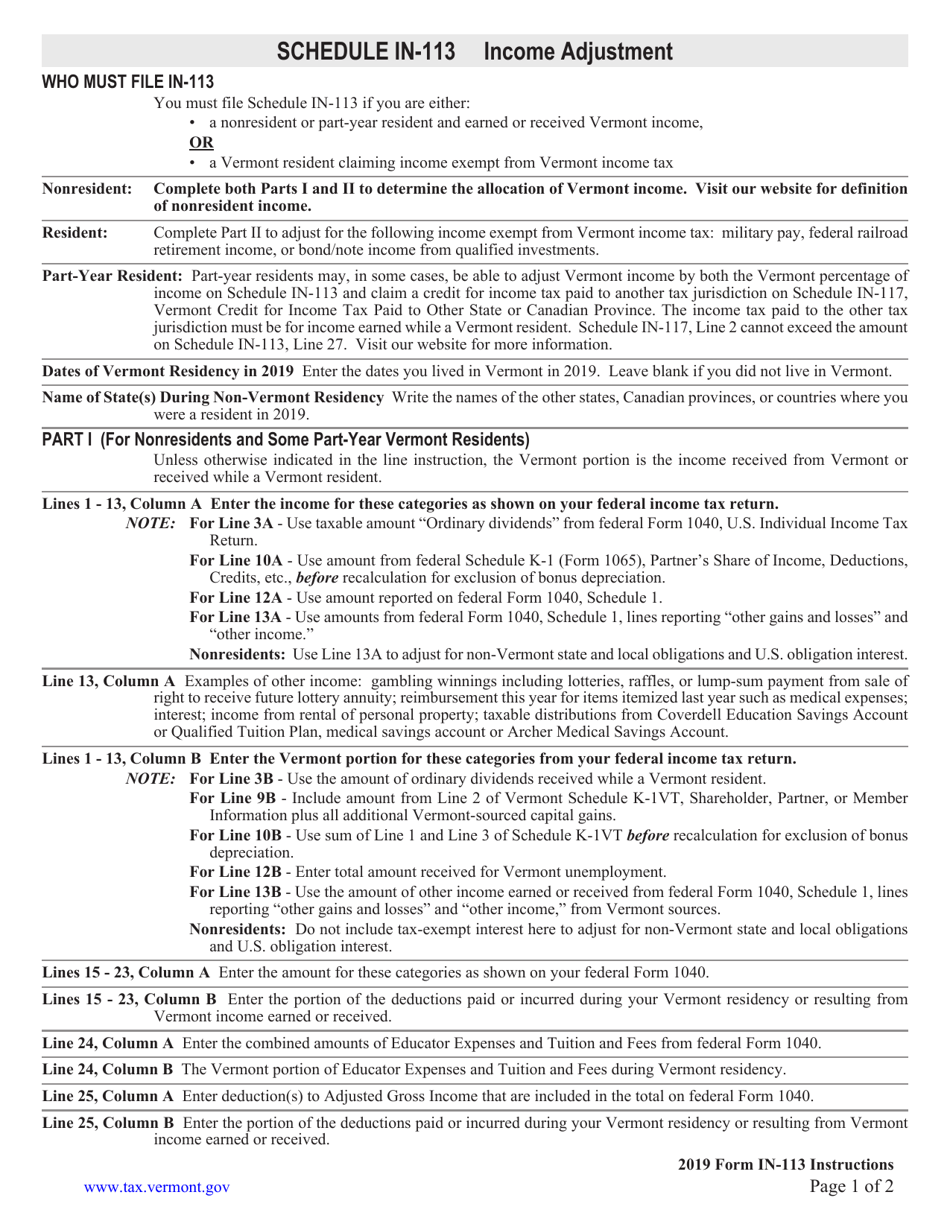

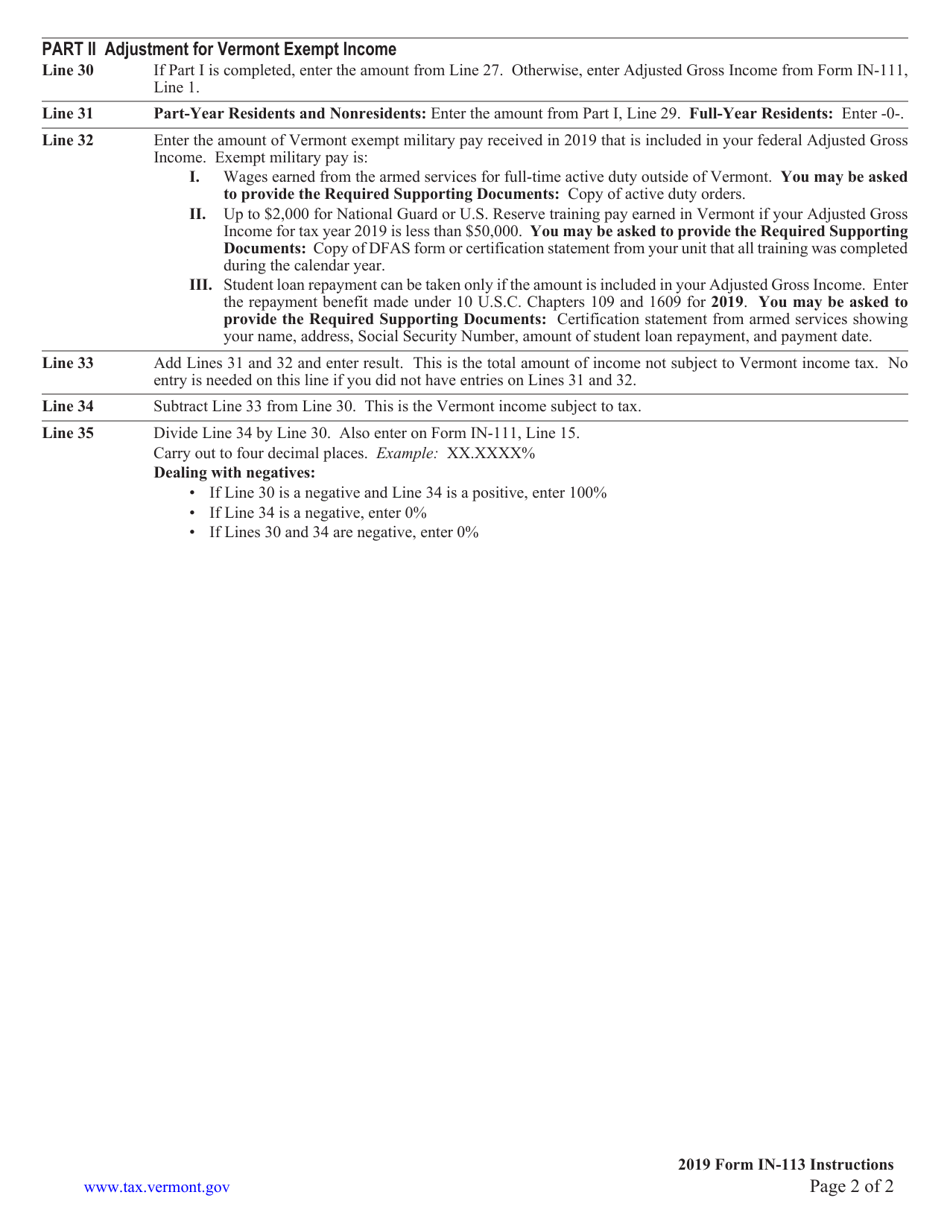

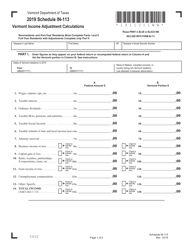

Instructions for Schedule IN-113 Vermont Income Adjustment Calculations - Vermont

This document contains official instructions for Schedule IN-113 , Vermont Income Adjustment Calculations - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule IN-113?

A: Schedule IN-113 is a form used in Vermont to calculate income adjustments.

Q: Why do I need to complete Schedule IN-113?

A: You need to complete Schedule IN-113 to determine if you have any income adjustments that can reduce your taxable income.

Q: What are income adjustments?

A: Income adjustments are deductions or additions made to your income for specific reasons, such as student loan interest or alimony payments.

Q: Which income adjustments are included in Schedule IN-113?

A: Schedule IN-113 includes a list of common income adjustments, such as educator expenses, self-employment taxes, and health savings account contributions.

Q: How do I calculate income adjustments on Schedule IN-113?

A: You will need to refer to the instructions provided on the form, which will guide you through the process of calculating your income adjustments.

Q: What should I do if I'm not sure how to complete Schedule IN-113?

A: If you are unsure about how to complete Schedule IN-113, you can seek assistance from a tax professional or contact the Vermont Department of Taxes for guidance.

Q: When is the deadline to file Schedule IN-113?

A: The deadline to file Schedule IN-113 is the same as the deadline for filing your Vermont income tax return, which is typically April 15th.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.