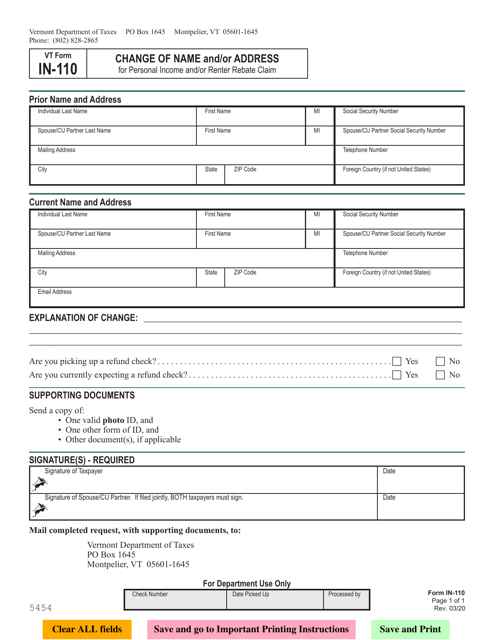

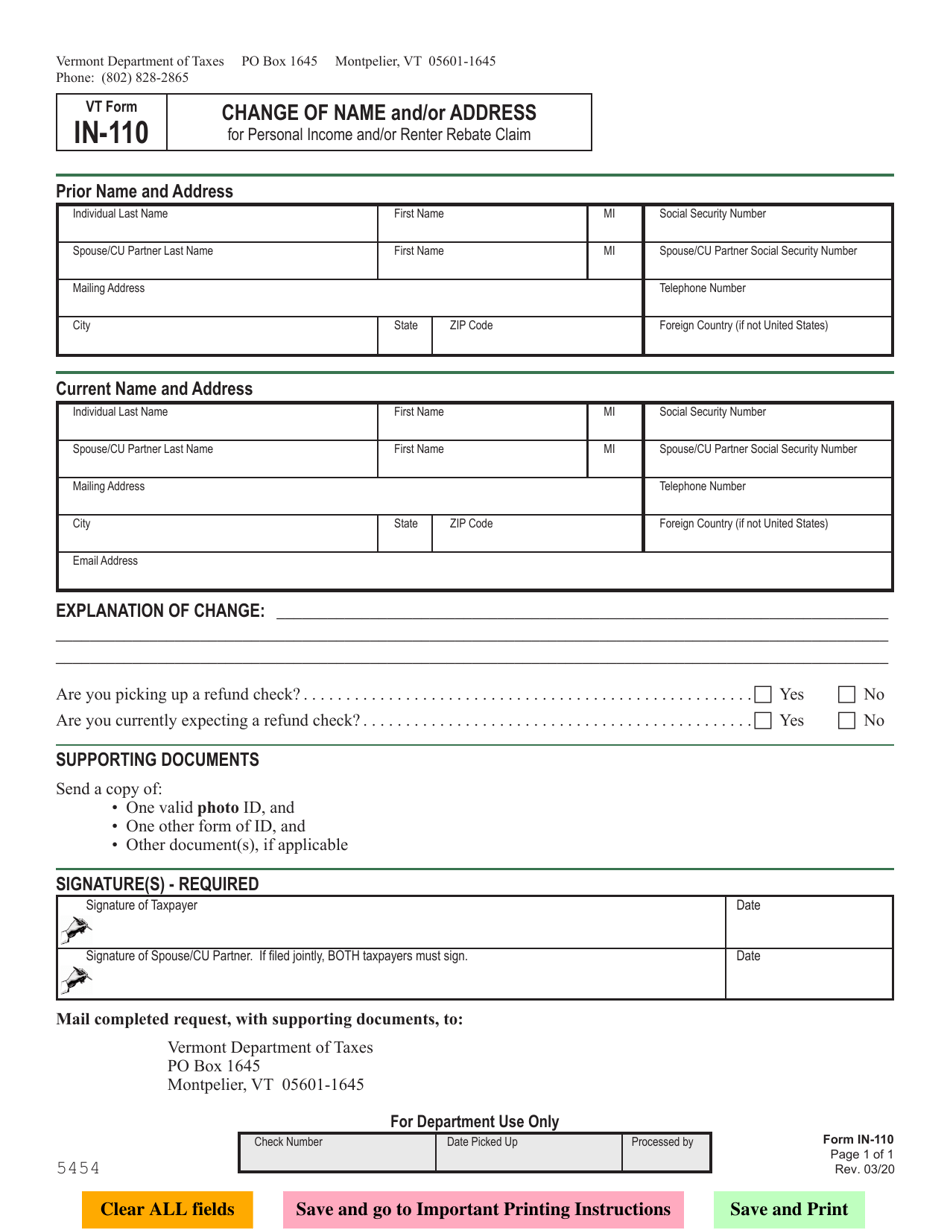

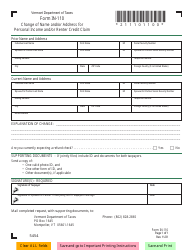

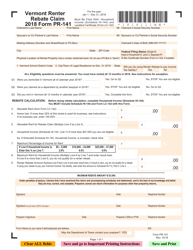

VT Form IN-110 Change of Name and / or Address for Personal Income and / or Renter Rebate Claim - Vermont

What Is VT Form IN-110?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form VT Form IN-110 used for?

A: VT Form IN-110 is used to report a change of name and/or address for personal income and/or renter rebate claim in Vermont.

Q: Who should file form VT Form IN-110?

A: Anyone who has had a change of name and/or address and needs to update their personal income and/or renter rebate claim in Vermont should file form VT Form IN-110.

Q: What information do I need to provide on form VT Form IN-110?

A: You will need to provide your old name and address, new name and address, Social Security number, and signature on form VT Form IN-110.

Q: What should I do with form VT Form IN-110 once I have completed it?

A: Once you have completed form VT Form IN-110, you should mail it to the address provided on the form or submit it in person to the Vermont Department of Taxes.

Q: Is there a deadline to file form VT Form IN-110?

A: There is no specific deadline to file form VT Form IN-110, but it is recommended to update your information as soon as possible to ensure accurate processing of your personal income and/or renter rebate claim.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form IN-110 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.