This version of the form is not currently in use and is provided for reference only. Download this version of

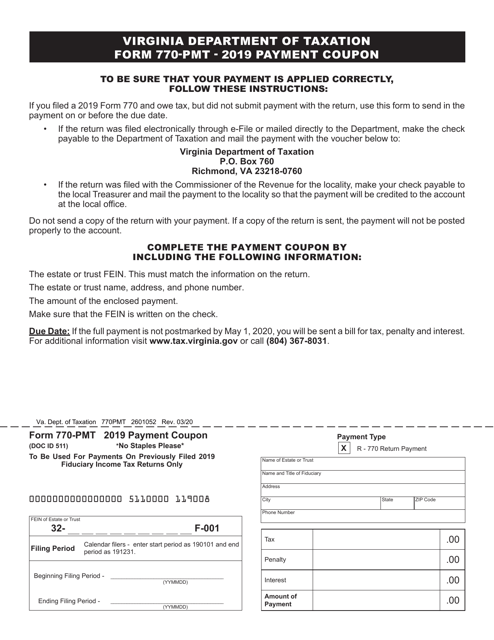

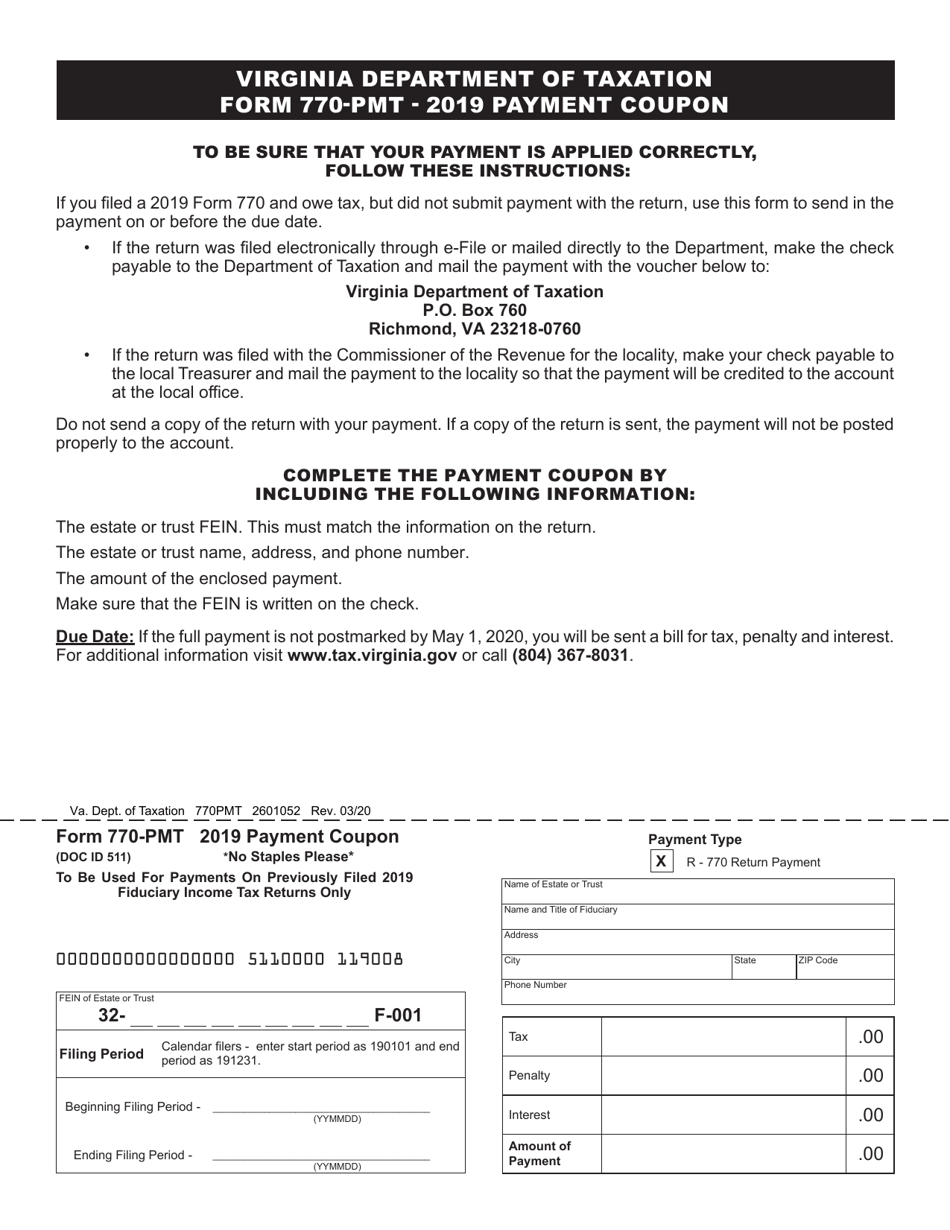

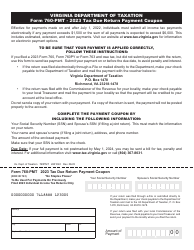

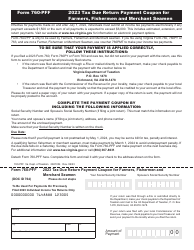

Form 770-PMT

for the current year.

Form 770-PMT Payment Voucher for Previously Filed Fiduciary Income Tax Returns - Virginia

What Is Form 770-PMT?

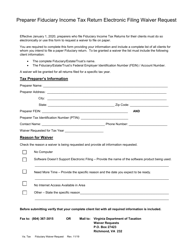

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 770-PMT?

A: Form 770-PMT is a payment voucher for previously filed fiduciary income tax returns in Virginia.

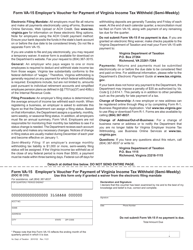

Q: Who needs to use Form 770-PMT?

A: Fiduciaries who have already filed their income tax returns in Virginia and need to make a payment towards their taxes should use Form 770-PMT.

Q: When do I need to use Form 770-PMT?

A: Form 770-PMT should be used when making a payment towards already filed fiduciary income tax returns in Virginia.

Q: How do I fill out Form 770-PMT?

A: You will need to provide your taxpayer information, the amount you are paying, and the tax year to which the payment relates on Form 770-PMT.

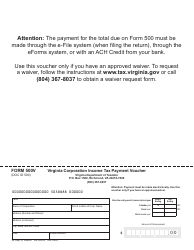

Q: Is there a deadline for filing Form 770-PMT?

A: The deadline for filing Form 770-PMT is the same as the deadline for filing the corresponding income tax return in Virginia.

Q: What happens if I don't file Form 770-PMT?

A: If you do not file Form 770-PMT and make the required payment, you may be subject to penalties and interest on the unpaid amount.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 770-PMT by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.