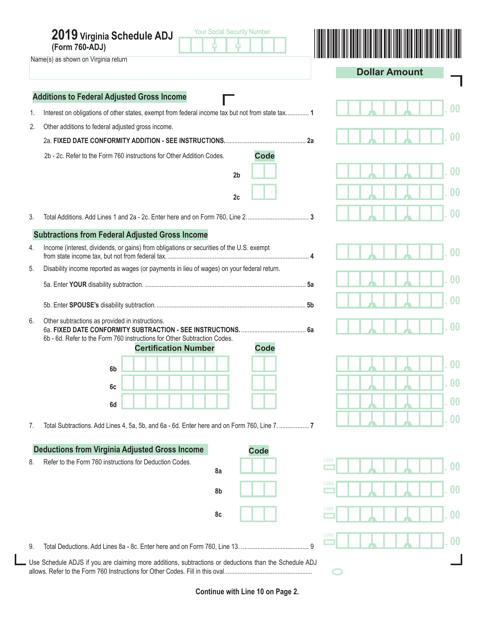

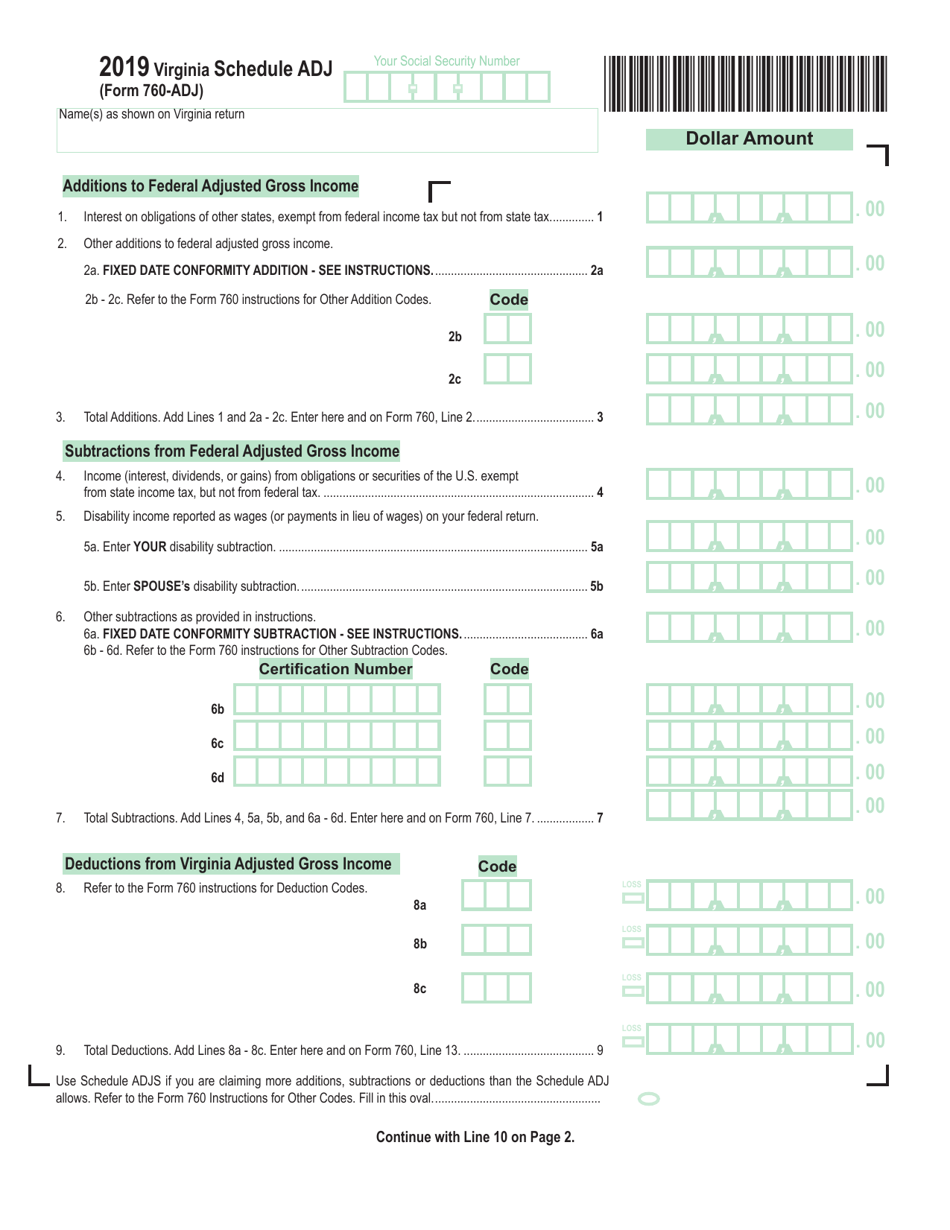

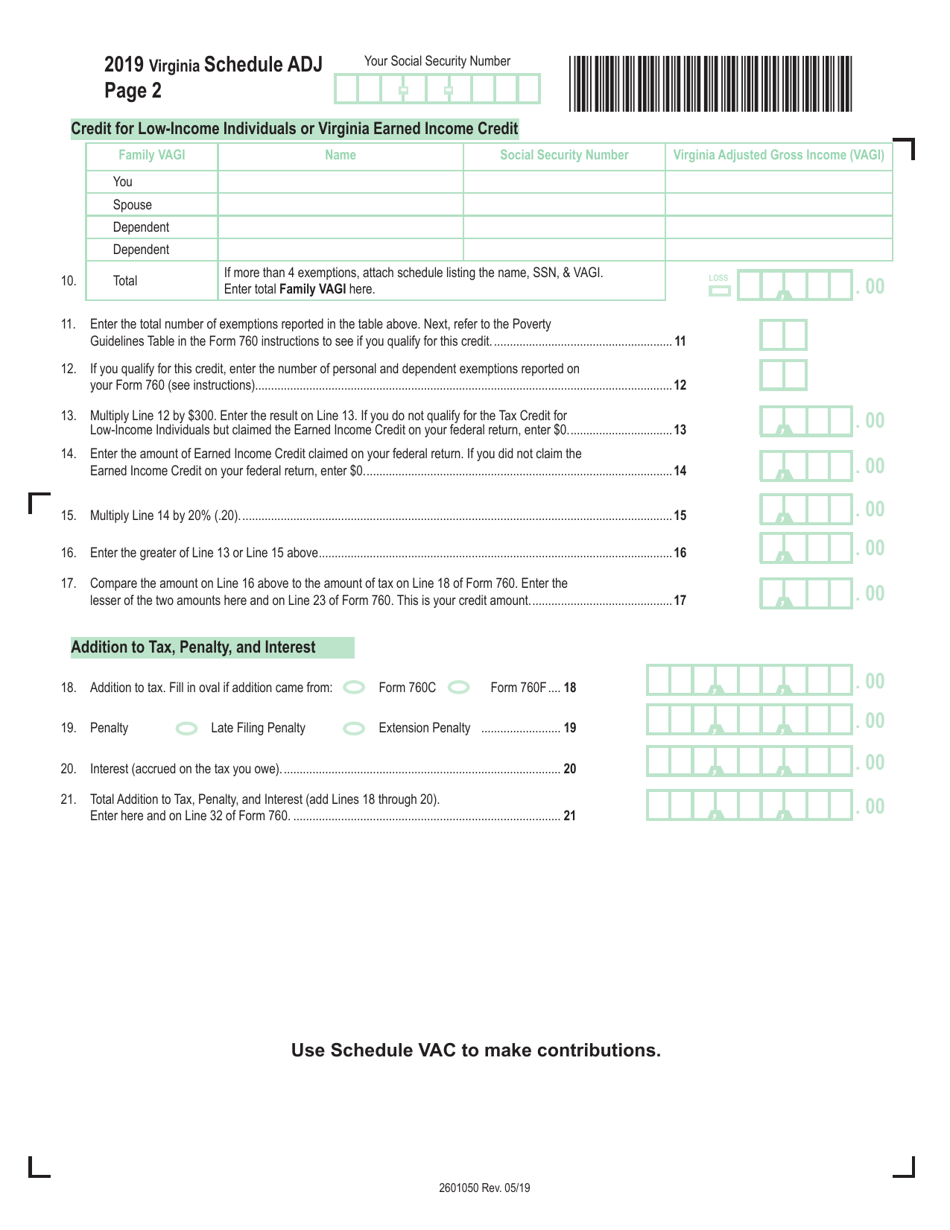

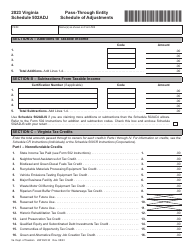

Form 760 Schedule ADJ Virginia Schedule of Adjustments - Virginia

What Is Form 760 Schedule ADJ?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia.The document is a supplement to Form 760, Resident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 760 Schedule ADJ?

A: Form 760 Schedule ADJ is a Virginia tax form that is used to report adjustments made to your Virginia taxable income.

Q: What is the purpose of Schedule ADJ?

A: The purpose of Schedule ADJ is to accurately calculate your Virginia taxable income by accounting for various adjustments.

Q: Who needs to file Schedule ADJ?

A: You need to file Schedule ADJ if you have any adjustments to your Virginia taxable income that need to be reported.

Q: What types of adjustments can be reported on Schedule ADJ?

A: Some examples of adjustments that can be reported on Schedule ADJ include deductions, exemptions, and additions to income.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 760 Schedule ADJ by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.