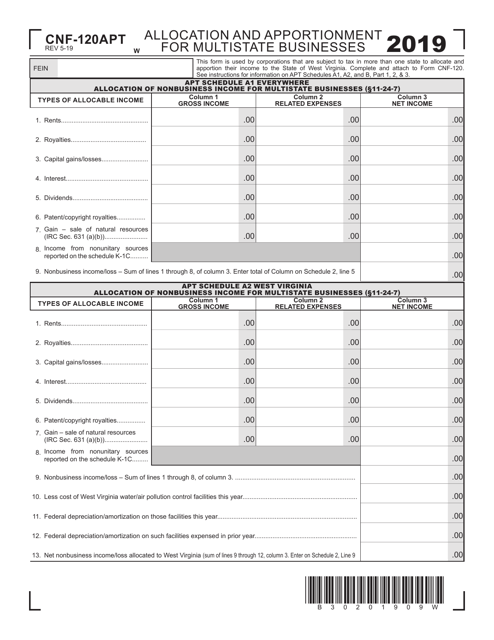

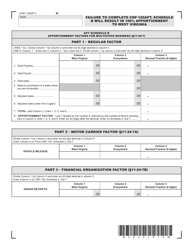

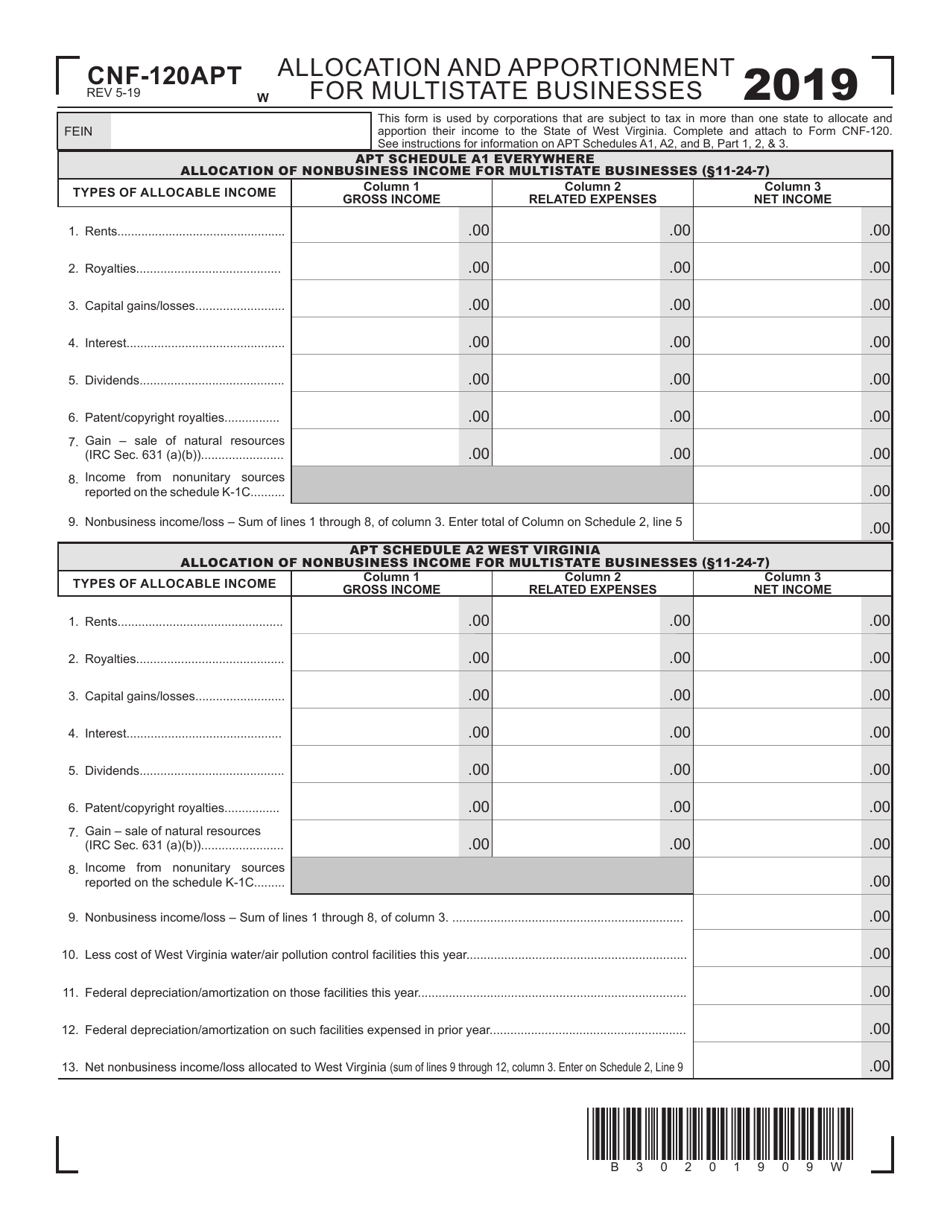

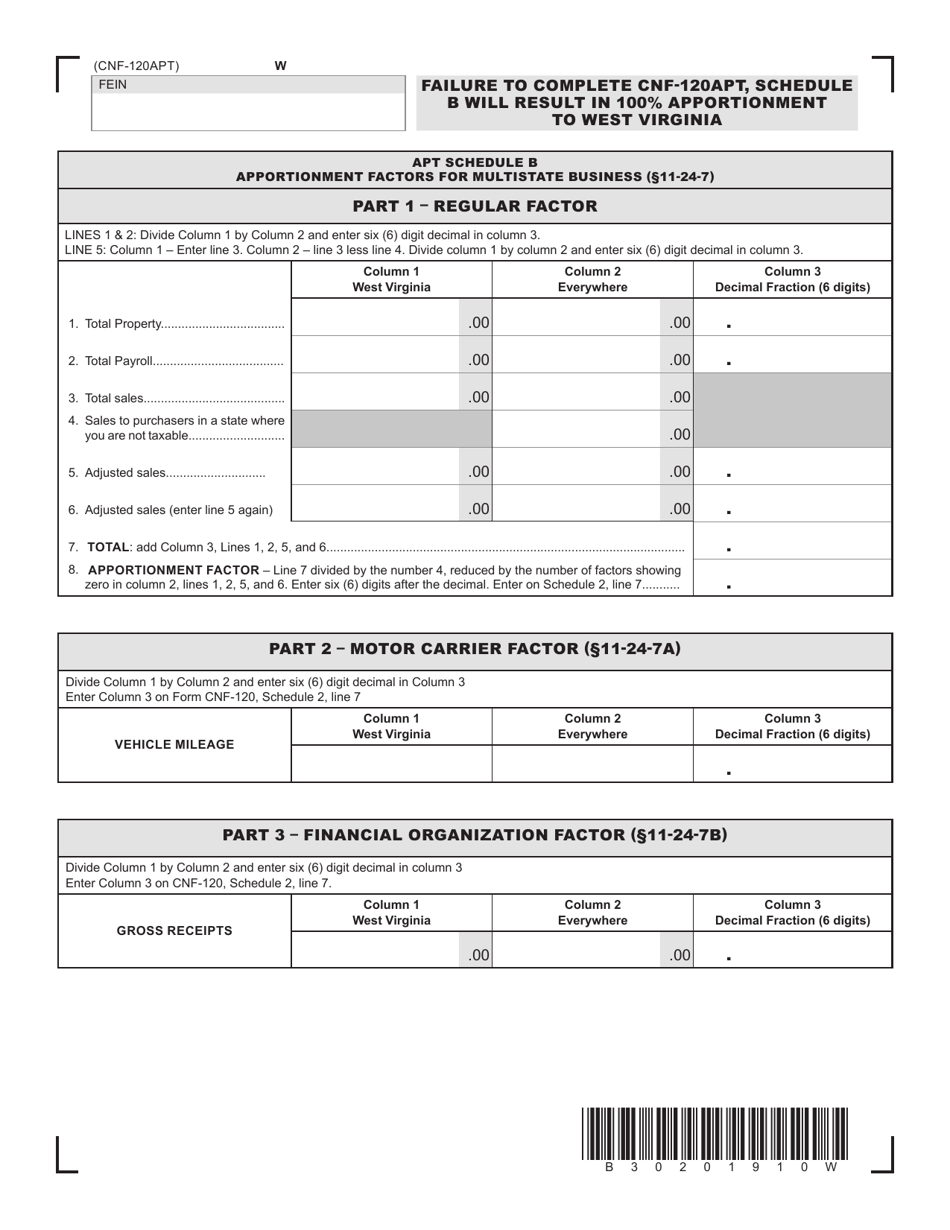

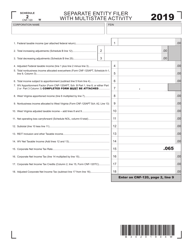

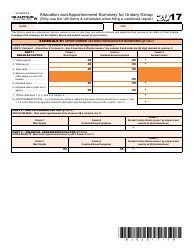

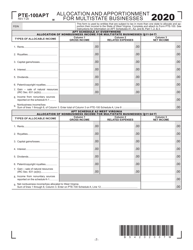

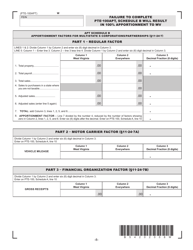

Form CNF-120APT Allocation and Apportionment for Multistate Businesses - West Virginia

What Is Form CNF-120APT?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CNF-120APT?

A: Form CNF-120APT is a form used for allocation and apportionment of income for multistate businesses in West Virginia.

Q: Who needs to file Form CNF-120APT?

A: Multistate businesses operating in West Virginia need to file Form CNF-120APT.

Q: What is the purpose of Form CNF-120APT?

A: The purpose of Form CNF-120APT is to determine the portion of income that should be allocated and apportioned to West Virginia for tax purposes for multistate businesses.

Q: What information is required to complete Form CNF-120APT?

A: Form CNF-120APT requires information regarding the total income of the multistate business, as well as the amount of income derived from West Virginia and other states.

Q: When is the deadline to file Form CNF-120APT?

A: Form CNF-120APT must be filed by the due date of the annual tax return for the multistate business.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CNF-120APT by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.