This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule K-1

for the current year.

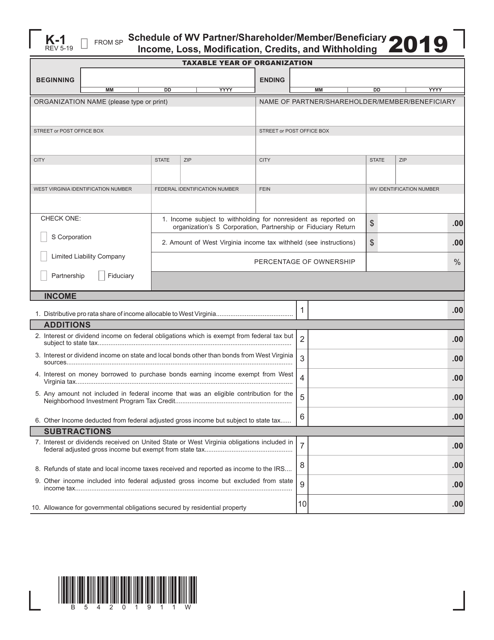

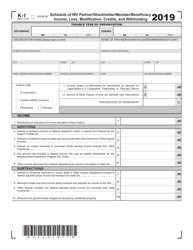

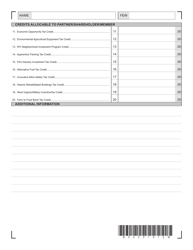

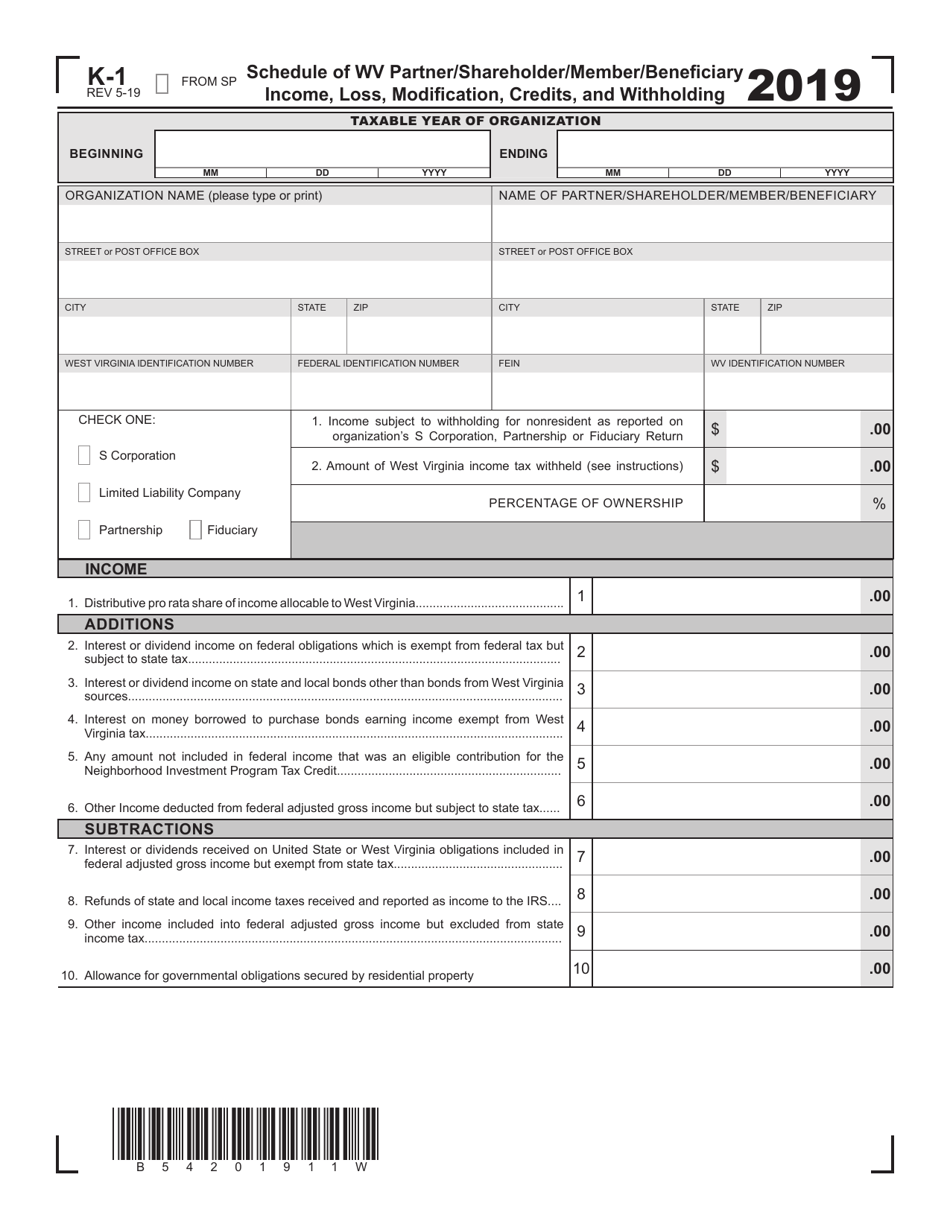

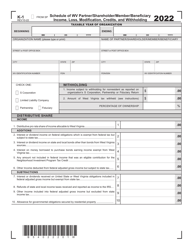

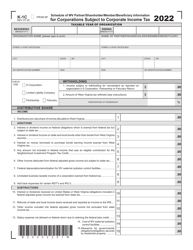

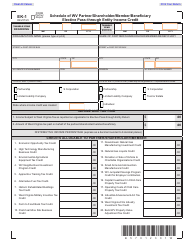

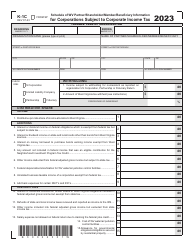

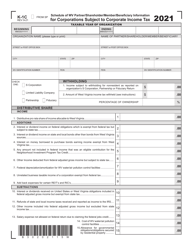

Schedule K-1 Schedule of Wv Partner / Shareholder / Member / Beneficiary Income, Loss, Modification, Credits, and Withholding - West Virginia

What Is Schedule K-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

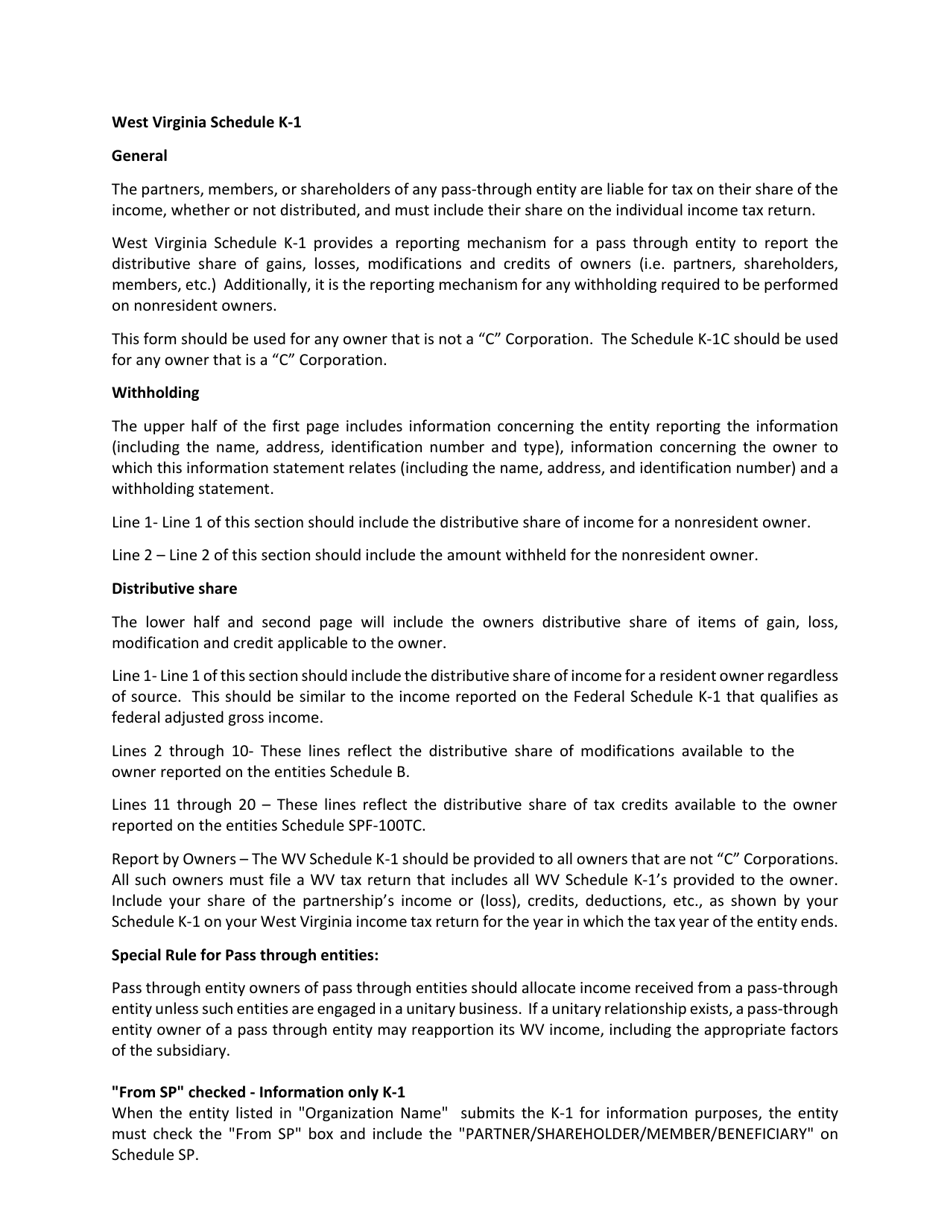

Q: What is Schedule K-1?

A: Schedule K-1 is a form used by partnerships, S corporations, estates, and trusts to report the income, deductions, and credits allocated to partners, shareholders, beneficiaries, or other equity holders.

Q: Who needs to file Schedule K-1?

A: Partnerships, S corporations, estates, and trusts need to file Schedule K-1 to report the allocation of income, deductions, and credits to their partners, shareholders, beneficiaries, or other equity holders.

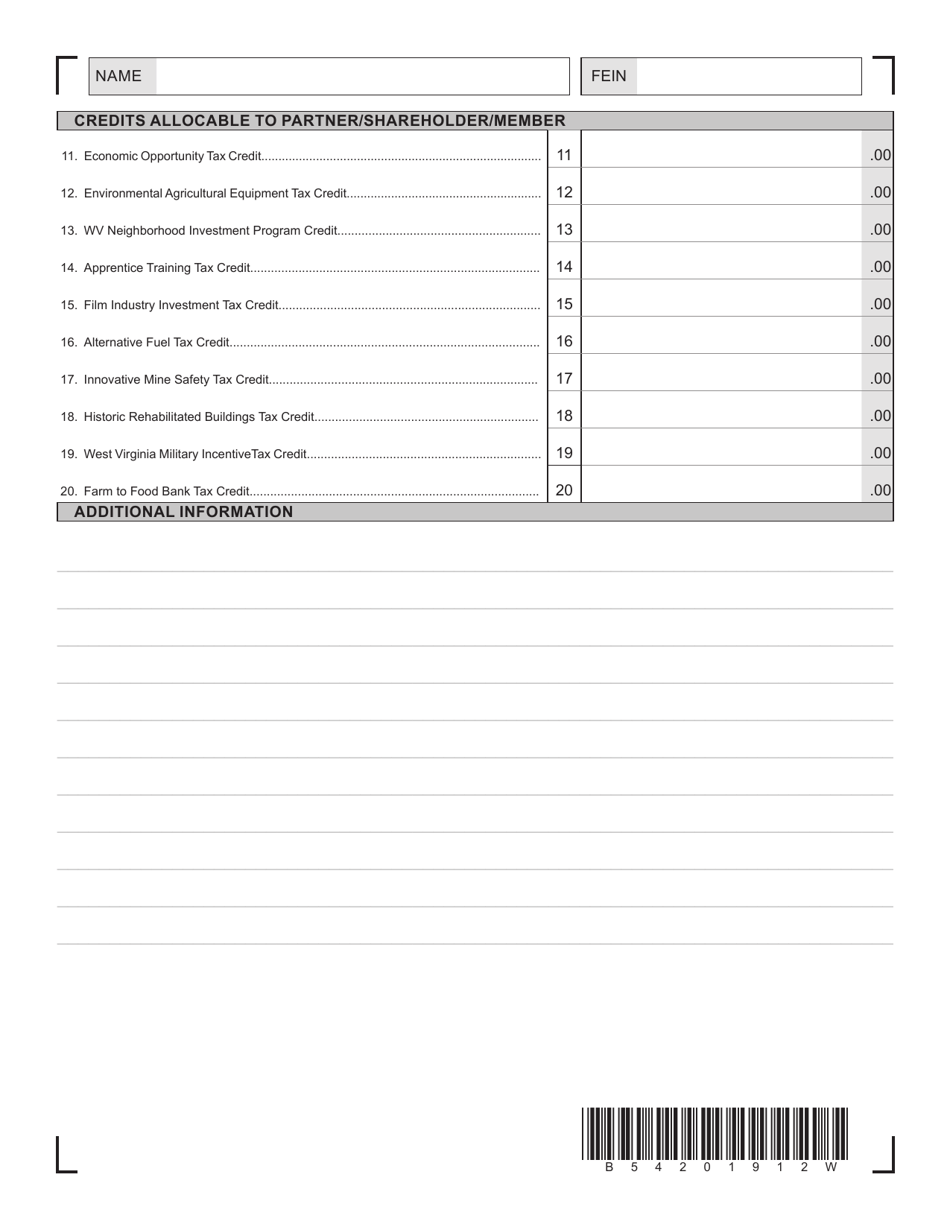

Q: What information is included in Schedule K-1?

A: Schedule K-1 includes information such as the partner's or shareholder's share of income or loss, various tax deductions or credits, and any amounts withheld for taxes.

Q: Why is Schedule K-1 important?

A: Schedule K-1 is important because it provides partners, shareholders, beneficiaries, or other equity holders with the information they need to report their share of income, deductions, and credits on their individual tax returns.

Q: What is the purpose of Schedule K-1 for West Virginia?

A: The purpose of Schedule K-1 for West Virginia is to report the allocation of income, loss, modifications, credits, and withholding specific to West Virginia state taxes.

Q: Who needs to file Schedule K-1 for West Virginia?

A: Partnerships, S corporations, estates, and trusts that have activities or income from West Virginia need to file Schedule K-1 for West Virginia.

Q: What information is included in Schedule K-1 for West Virginia?

A: Schedule K-1 for West Virginia includes information such as the partner's or shareholder's share of income or loss specific to West Virginia, modifications, credits, and any amounts withheld for West Virginia taxes.

Q: Is Schedule K-1 for West Virginia different from the federal Schedule K-1?

A: Yes, Schedule K-1 for West Virginia is different from the federal Schedule K-1 as it reports income, loss, modifications, credits, and withholding specific to West Virginia state taxes.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule K-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.