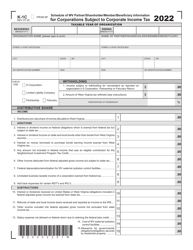

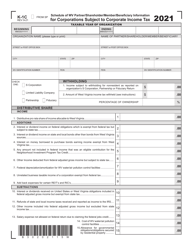

This version of the form is not currently in use and is provided for reference only. Download this version of

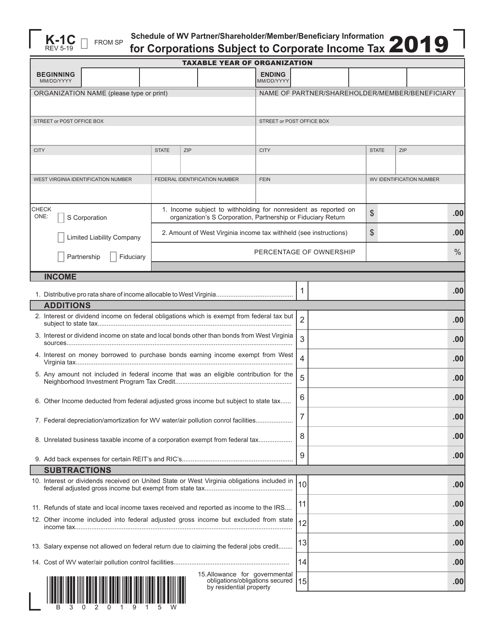

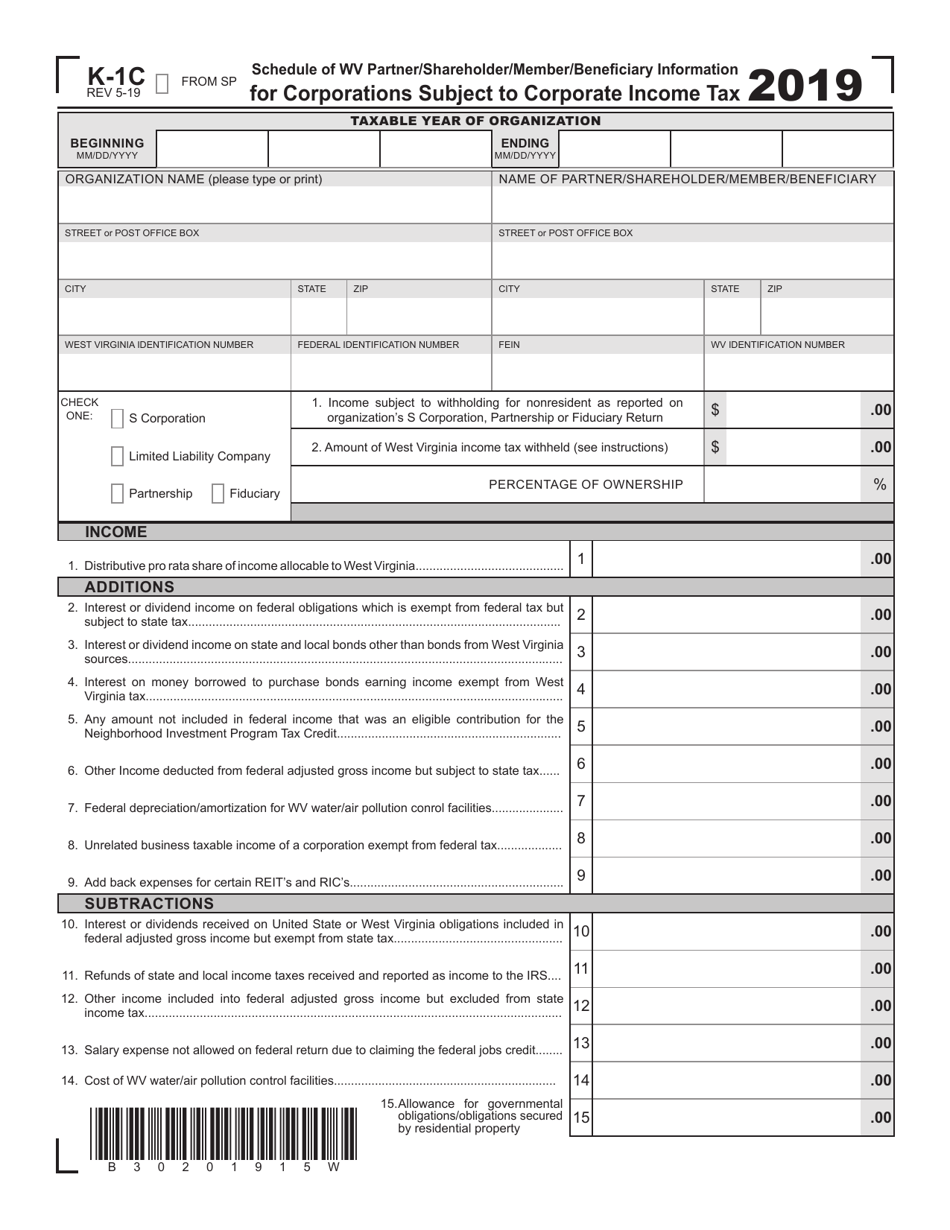

Schedule K-1C

for the current year.

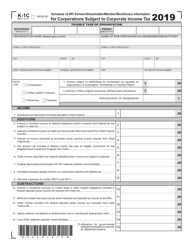

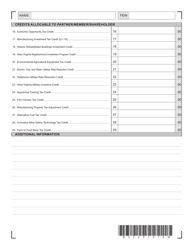

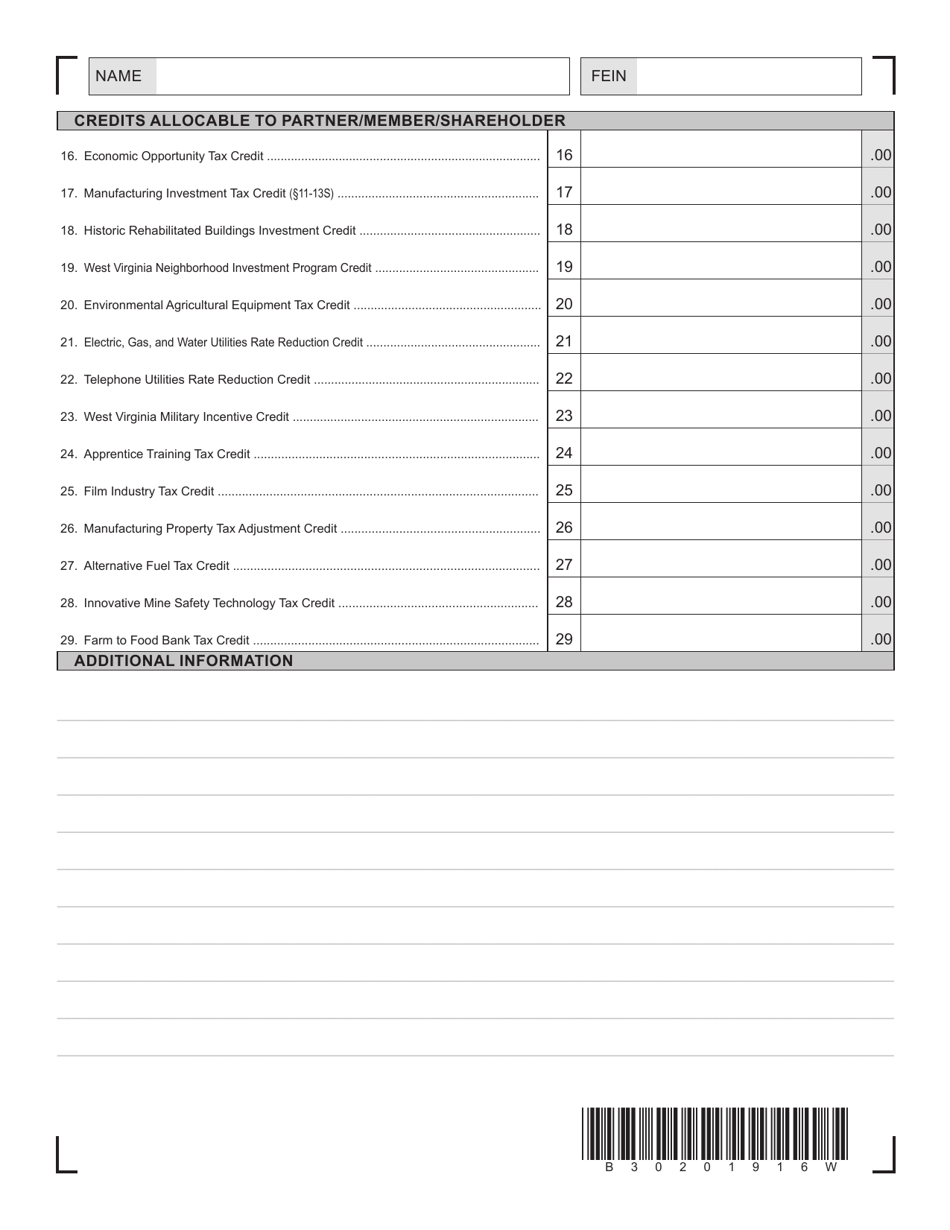

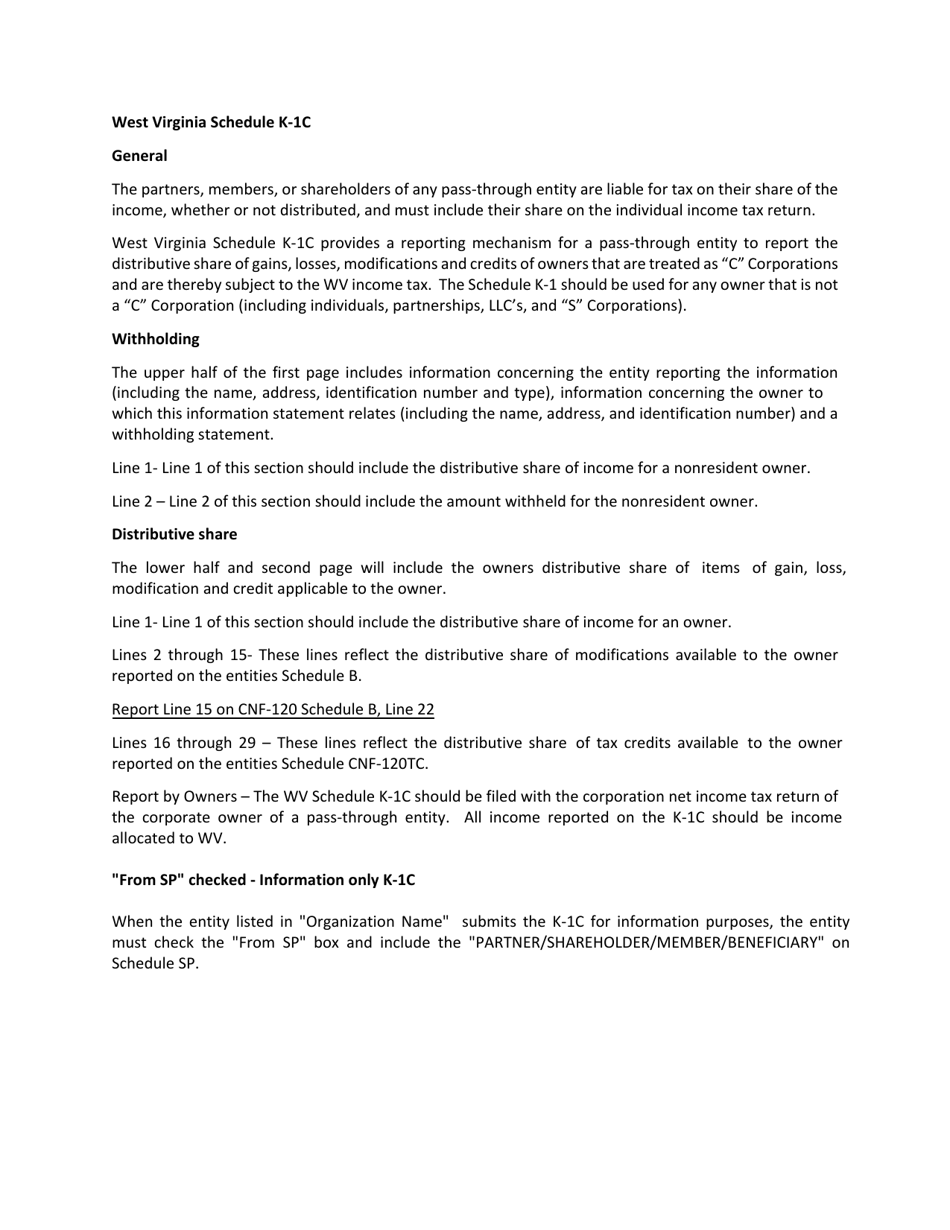

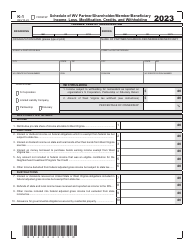

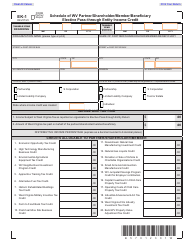

Schedule K-1C Schedule of Wv Partner / Shareholder / Member / Beneficiary Information for Corporations Subject to Corporate Income Tax - West Virginia

What Is Schedule K-1C?

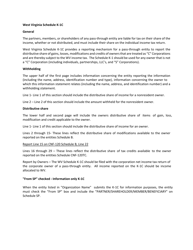

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-1C?

A: Schedule K-1C is a form used to report partner/shareholder/member/beneficiary information for corporations subject to corporate income tax in West Virginia.

Q: Who needs to file Schedule K-1C?

A: Corporations subject to corporate income tax in West Virginia that have partners, shareholders, members, or beneficiaries need to file Schedule K-1C.

Q: What information is reported on Schedule K-1C?

A: Schedule K-1C reports the names, addresses, and Social Security numbers or employer identification numbers (EINs) of the partners, shareholders, members, or beneficiaries of a corporation.

Q: When is Schedule K-1C due?

A: The due date for filing Schedule K-1C is generally the same as the due date for the corporation's tax return, which is the 15th day of the 4th month following the end of the tax year.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule K-1C by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.