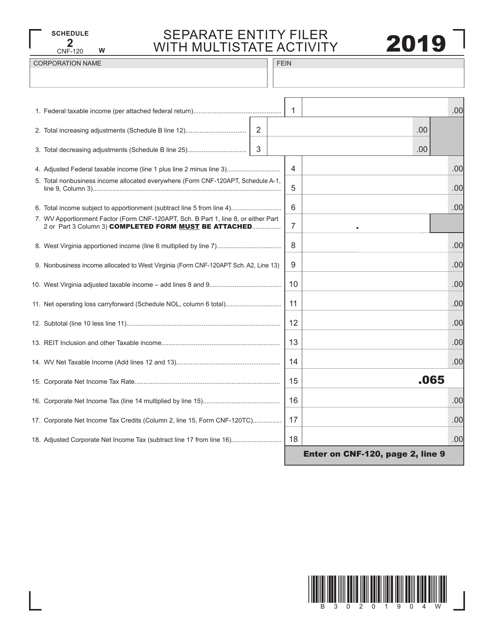

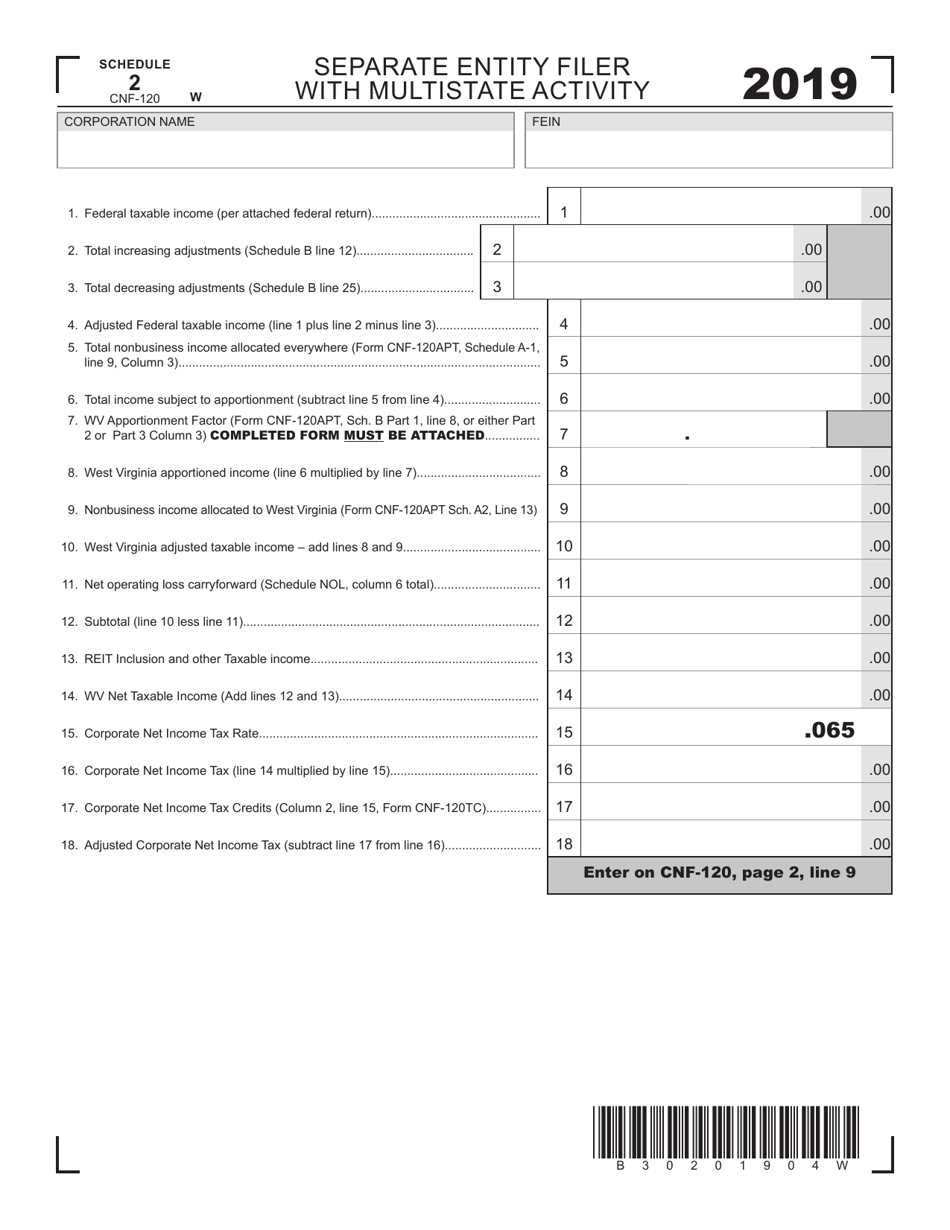

Form CNF-120 Schedule 2 Separate Entity Filer With Multistate Activity - West Virginia

What Is Form CNF-120 Schedule 2?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form CNF-120, Corporation Net Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CNF-120 Schedule 2?

A: CNF-120 Schedule 2 is a form used by separate entity filers with multistate activity in West Virginia.

Q: Who needs to file CNF-120 Schedule 2?

A: Separate entity filers with multistate activity in West Virginia need to file CNF-120 Schedule 2.

Q: What is a separate entity filer?

A: A separate entity filer is an entity that files its own tax return separate from its owners.

Q: What is multistate activity?

A: Multistate activity refers to business operations that take place in more than one state.

Q: What is the purpose of CNF-120 Schedule 2?

A: The purpose of CNF-120 Schedule 2 is to report multistate activity of separate entity filers in West Virginia.

Q: Are there any filing deadlines for CNF-120 Schedule 2?

A: Yes, separate entity filers with multistate activity in West Virginia must file CNF-120 Schedule 2 by a specific deadline. Please refer to the instructions on the form for the deadline.

Q: What information do I need to complete CNF-120 Schedule 2?

A: To complete CNF-120 Schedule 2, you will need information about your multistate activity, such as income earned and expenses incurred in West Virginia.

Q: Do I need to attach any additional documents with CNF-120 Schedule 2?

A: It depends on your specific situation. Please refer to the instructions on the form to determine if any additional documentation is required.

Q: Can I e-file CNF-120 Schedule 2?

A: Yes, you can e-file CNF-120 Schedule 2 if you meet the eligibility requirements for electronic filing.

Q: Is there a fee for filing CNF-120 Schedule 2?

A: There may be a fee for filing CNF-120 Schedule 2. Please refer to the instructions on the form or check with the West Virginia State Tax Department for the applicable fee.

Q: What if I have questions or need assistance with CNF-120 Schedule 2?

A: If you have questions or need assistance with CNF-120 Schedule 2, you can contact the West Virginia State Tax Department for guidance.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CNF-120 Schedule 2 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.