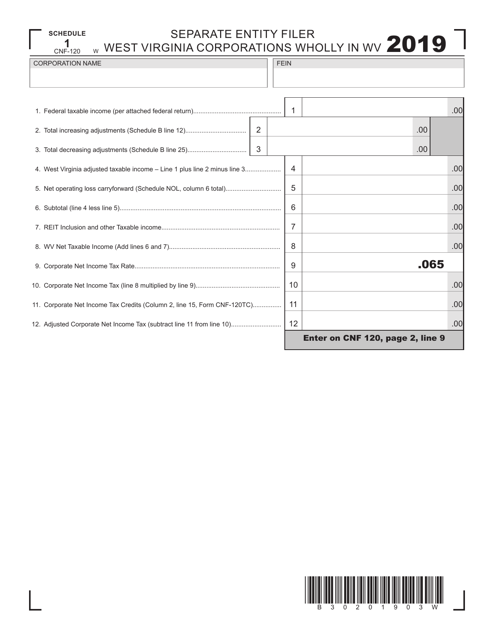

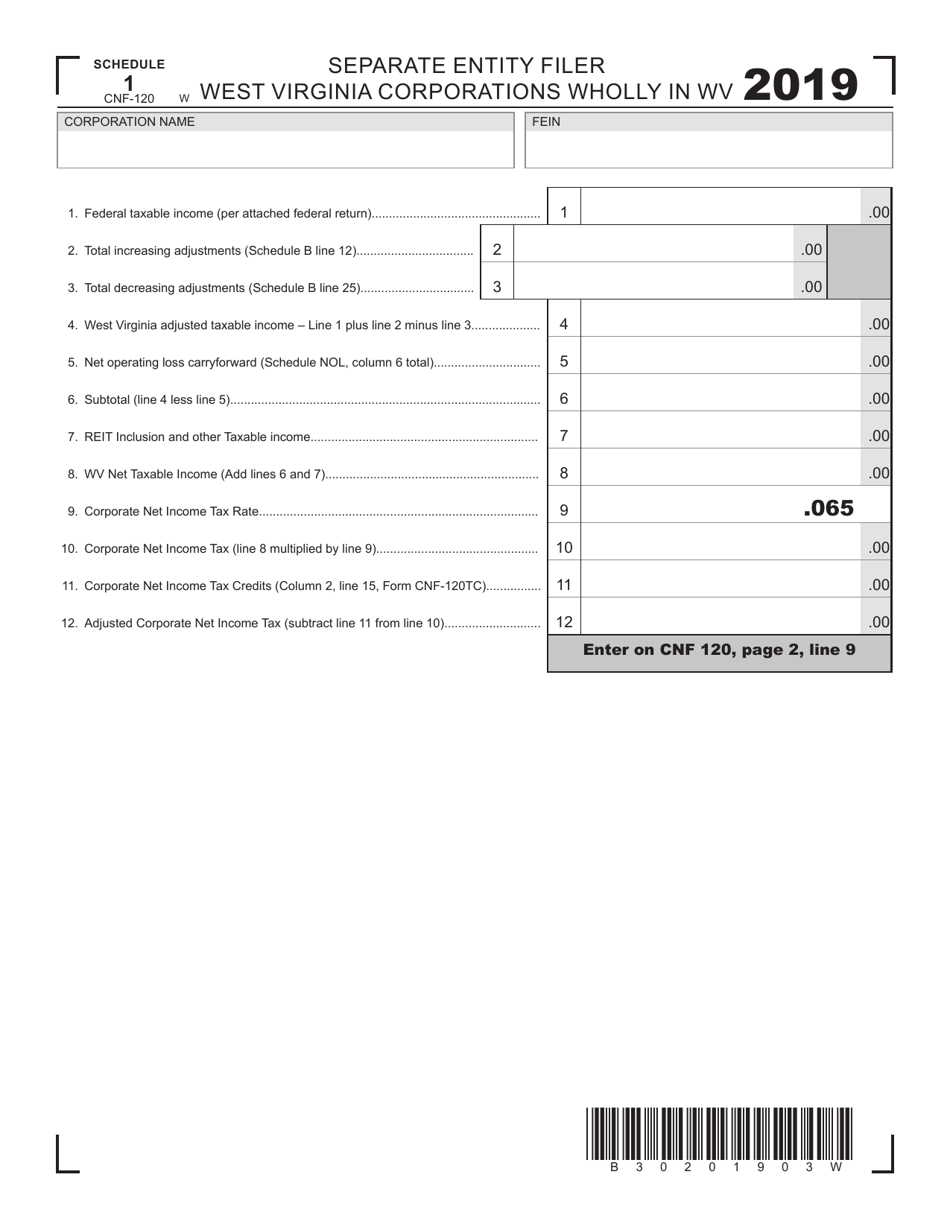

Form CNF-120 Schedule 1 Separate Entity Filer West Virginia Corporations Wholly in West Virginia - West Virginia

What Is Form CNF-120 Schedule 1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form CNF-120, Corporation Net Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CNF-120?

A: Form CNF-120 is a schedule for separate entity filers in West Virginia.

Q: Who should use Form CNF-120?

A: West Virginia corporations that are wholly located in West Virginia should use Form CNF-120.

Q: What is the purpose of Form CNF-120?

A: The purpose of Form CNF-120 is to report information about West Virginia corporations that are separate entities.

Q: What are the requirements to use Form CNF-120?

A: To use Form CNF-120, the corporation must be located solely in West Virginia.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CNF-120 Schedule 1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.