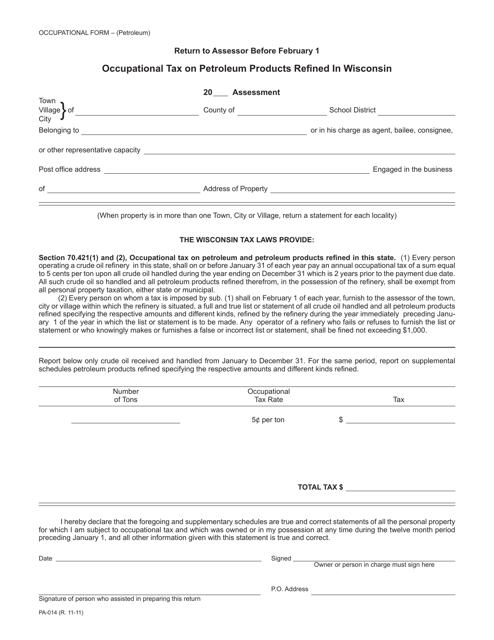

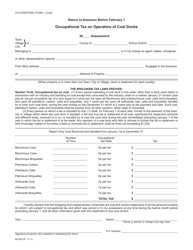

Form PA-014 Occupational Tax on Petroleum Products Refined in Wisconsin - Wisconsin

What Is Form PA-014?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-014?

A: Form PA-014 is the Occupational Tax on Petroleum Products Refined in Wisconsin form.

Q: What is the purpose of Form PA-014?

A: The purpose of Form PA-014 is to report and pay the occupational tax on petroleum products refined in Wisconsin.

Q: Who needs to file Form PA-014?

A: Companies or individuals who refine petroleum products in Wisconsin need to file Form PA-014.

Q: When is Form PA-014 due?

A: Form PA-014 is due by the 25th day of the month following the end of the calendar quarter.

Q: Are there any penalties for late filing or payment of Form PA-014?

A: Yes, there are penalties for late filing or payment of Form PA-014. It's important to file and pay on time to avoid these penalties.

Q: What do I need to include with Form PA-014?

A: You need to include the appropriate tax payment along with Form PA-014 when you file.

Q: What if I have questions or need assistance with Form PA-014?

A: If you have questions or need assistance with Form PA-014, you can contact the Wisconsin Department of Revenue for help.

Form Details:

- Released on November 1, 2011;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PA-014 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.