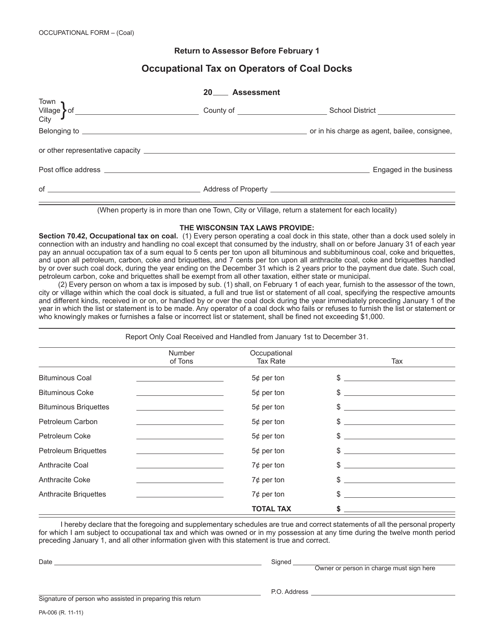

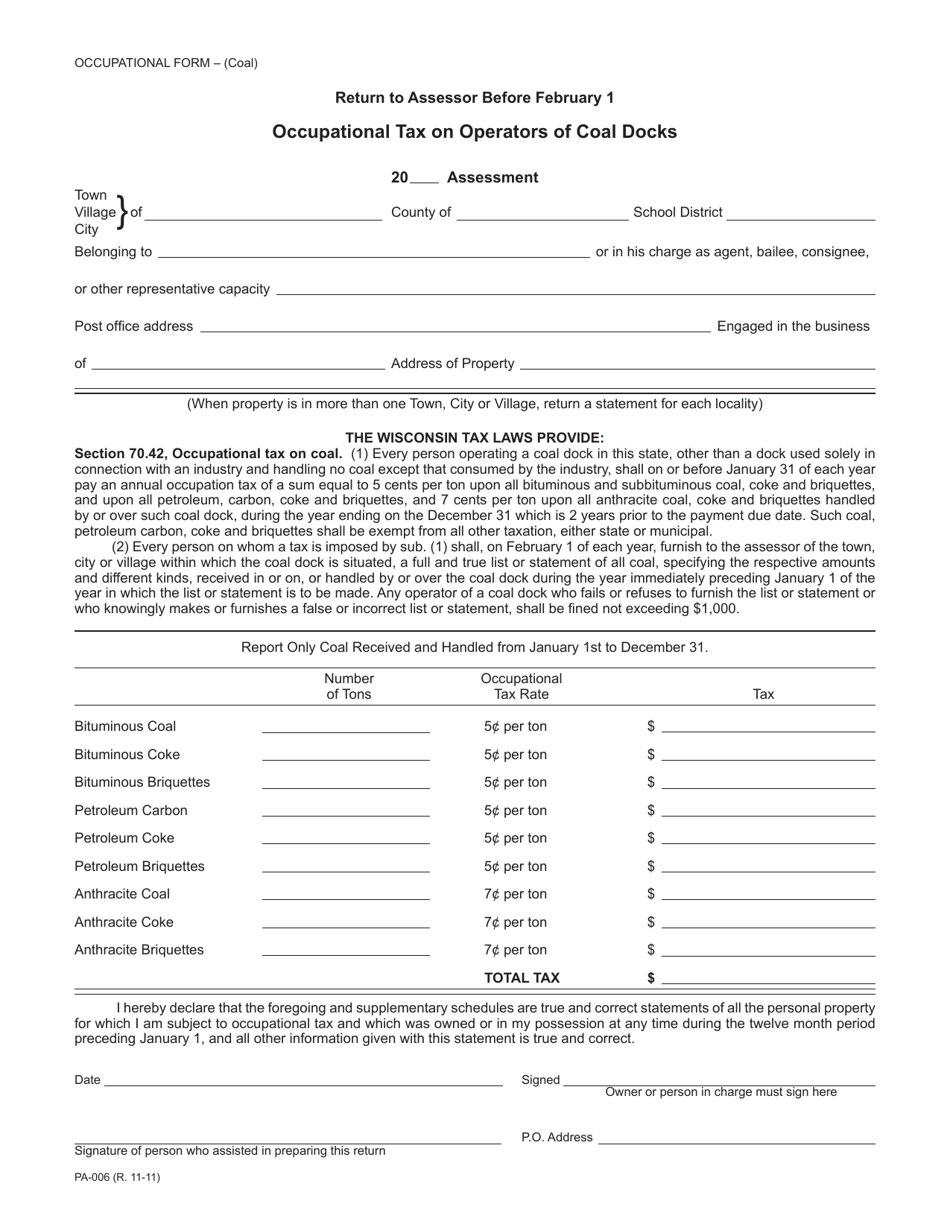

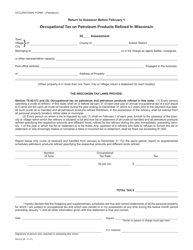

Form PA-006 Occupational Tax on Operators of Coal Docks - Wisconsin

What Is Form PA-006?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-006?

A: Form PA-006 is a Wisconsin tax form for reporting occupational tax on operators of coal docks.

Q: Who needs to file Form PA-006?

A: Operators of coal docks in Wisconsin must file Form PA-006.

Q: What is the purpose of Form PA-006?

A: The purpose of Form PA-006 is to report and pay the occupational tax on operators of coal docks.

Q: How often does Form PA-006 need to be filed?

A: Form PA-006 must be filed annually.

Q: Is there a deadline for filing Form PA-006?

A: Yes, Form PA-006 must be filed by March 1st of each year.

Q: Are there any penalties for late filing of Form PA-006?

A: Yes, there are penalties for late filing of Form PA-006.

Q: Is there a fee for filing Form PA-006?

A: Yes, there is a fee for filing Form PA-006.

Q: Are there any additional requirements for operators of coal docks in Wisconsin?

A: Operators of coal docks in Wisconsin may have additional reporting and compliance requirements.

Q: Can I e-file Form PA-006?

A: No, Form PA-006 cannot be e-filed, it must be filed by mail.

Form Details:

- Released on November 1, 2011;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PA-006 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.