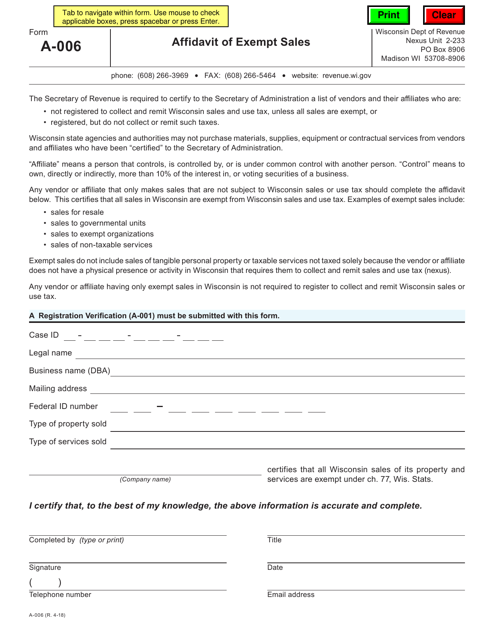

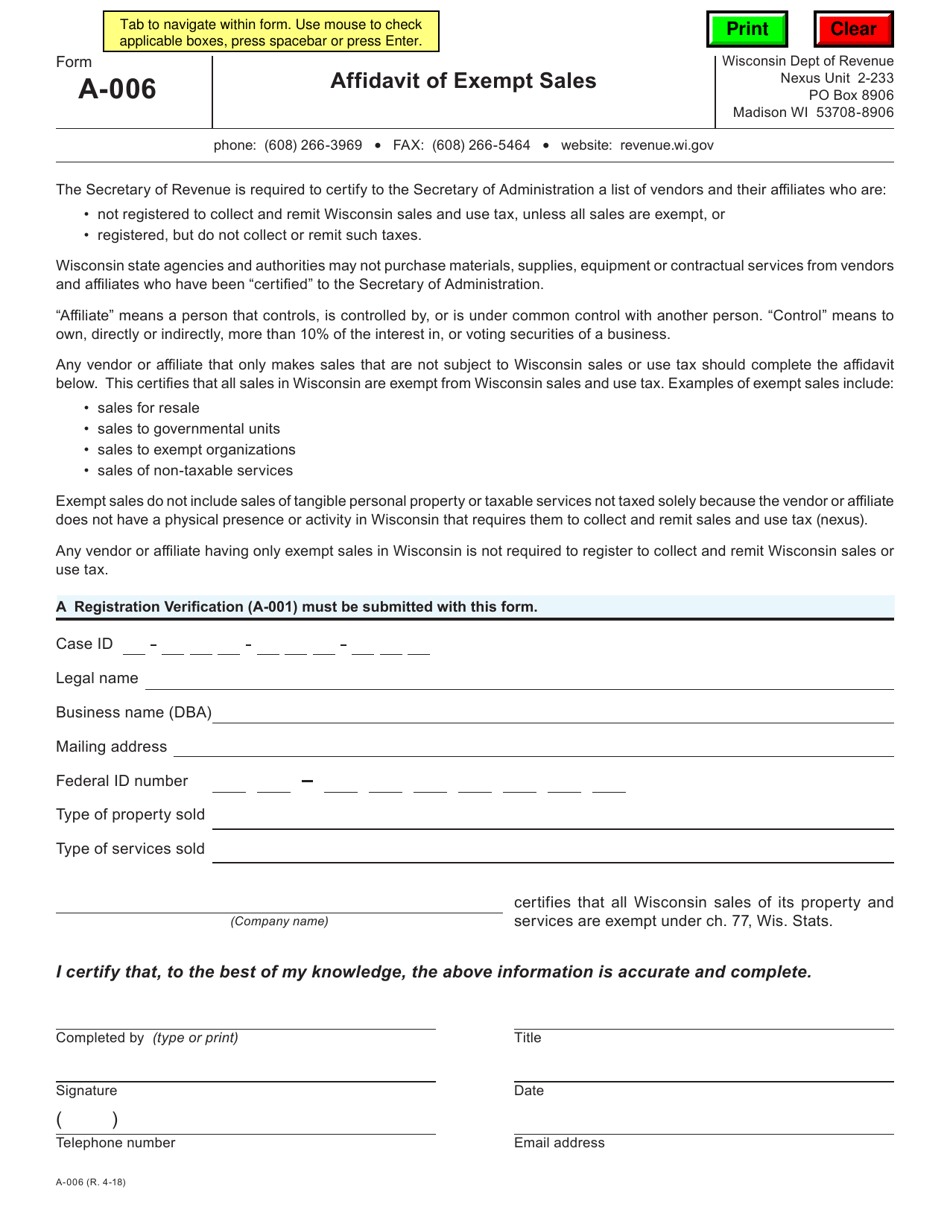

Form A-006 Affidavit of Exempt Sales - Wisconsin

What Is Form A-006?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-006?

A: Form A-006 is an Affidavit of Exempt Sales in Wisconsin.

Q: What is the purpose of Form A-006?

A: The purpose of Form A-006 is to claim exemption from Wisconsin sales tax on certain purchases.

Q: Who needs to fill out Form A-006?

A: Anyone who wants to claim exemption from Wisconsin sales tax on certain purchases needs to fill out Form A-006.

Q: What information is required on Form A-006?

A: Form A-006 requires information such as the buyer's name, address, and taxpayer identification number, as well as the seller's name and description of the exempt property.

Q: Are there any supporting documents required with Form A-006?

A: Yes, you may be required to provide supporting documents such as a resale certificate or exemption certificate with Form A-006.

Q: When should I submit Form A-006?

A: Form A-006 should be submitted to the Wisconsin Department of Revenue within a specified time period, usually within 90 days of the exempt purchase.

Q: What happens after I submit Form A-006?

A: The Wisconsin Department of Revenue will review your Form A-006 and may contact you for additional information or clarification.

Q: Is there a fee for filing Form A-006?

A: No, there is no fee for filing Form A-006.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-006 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.