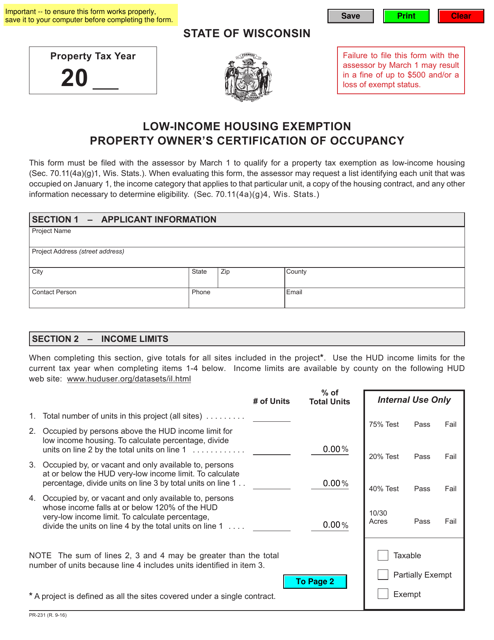

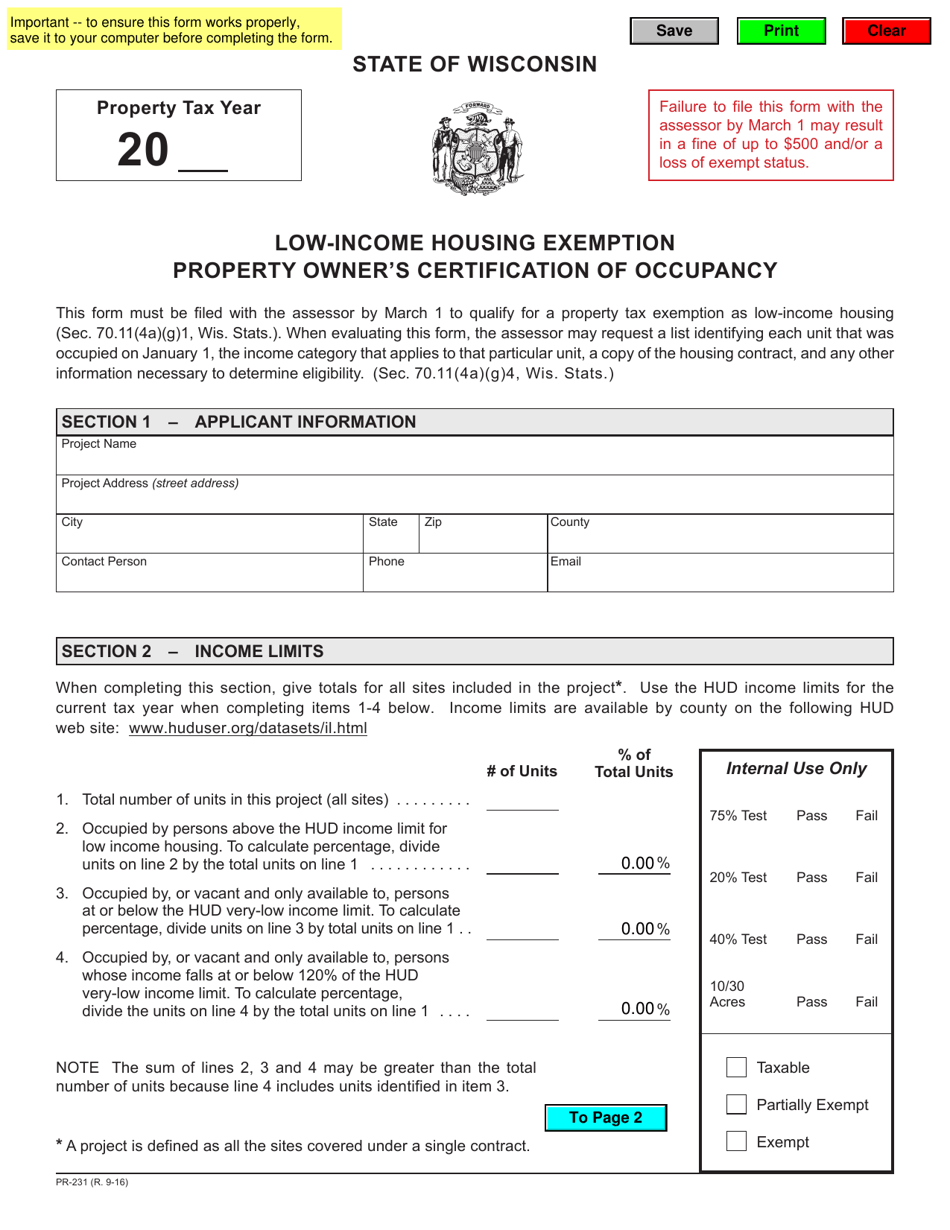

Form PR-231 Low-Income Housing Exemption Property Owner's Certification of Occupancy - Wisconsin

What Is Form PR-231?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PR-231?

A: Form PR-231 is the Property Owner's Certification of Occupancy for the Low-Income Housing Exemption in Wisconsin.

Q: What is the purpose of Form PR-231?

A: The purpose of Form PR-231 is to certify that a property owner's unit is eligible for the low-income housing exemption in Wisconsin.

Q: Who needs to fill out Form PR-231?

A: Property owners who want to claim the low-income housing exemption in Wisconsin need to fill out Form PR-231.

Q: Are there any eligibility requirements for the low-income housing exemption?

A: Yes, there are specific eligibility requirements for the low-income housing exemption. These requirements are outlined in the instructions for Form PR-231.

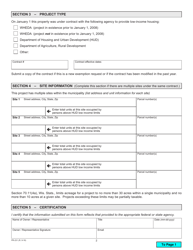

Q: What information is required on Form PR-231?

A: Form PR-231 requires information such as the property owner's name, address, and contact information, as well as details about the property being claimed for the exemption.

Q: Is there a deadline for submitting Form PR-231?

A: Yes, Form PR-231 must be submitted to the Wisconsin Department of Revenue by March 1st of each year.

Q: What happens after submitting Form PR-231?

A: After submitting Form PR-231, the Wisconsin Department of Revenue will review the application and notify the property owner of their eligibility for the low-income housing exemption.

Q: Are there any fees associated with claiming the low-income housing exemption?

A: No, there are no fees associated with claiming the low-income housing exemption in Wisconsin.

Q: Can I claim the low-income housing exemption for multiple properties?

A: Yes, you can claim the low-income housing exemption for multiple properties as long as they meet the eligibility requirements.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PR-231 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.