This version of the form is not currently in use and is provided for reference only. Download this version of

Form PA-5/661

for the current year.

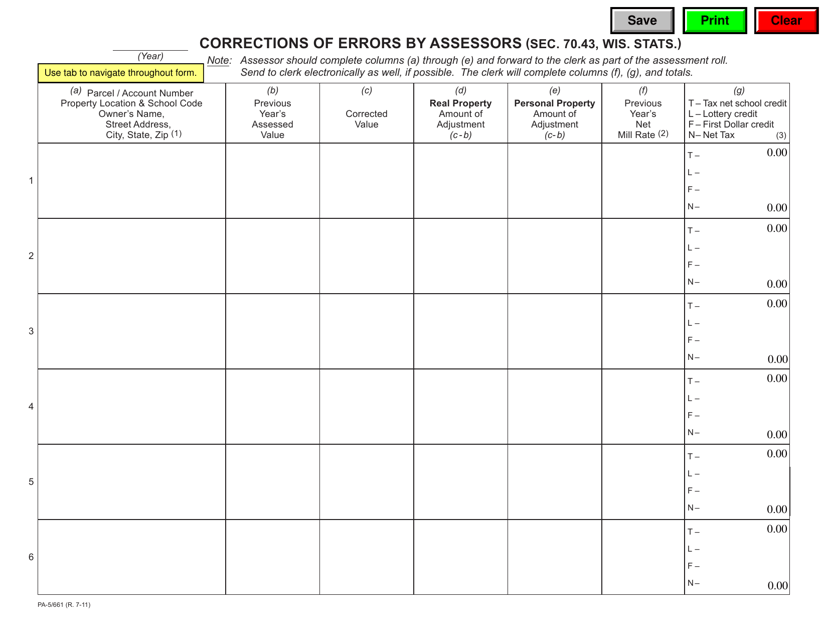

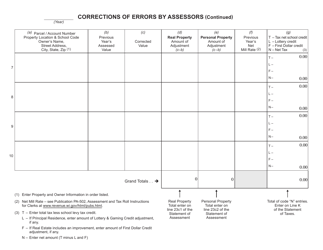

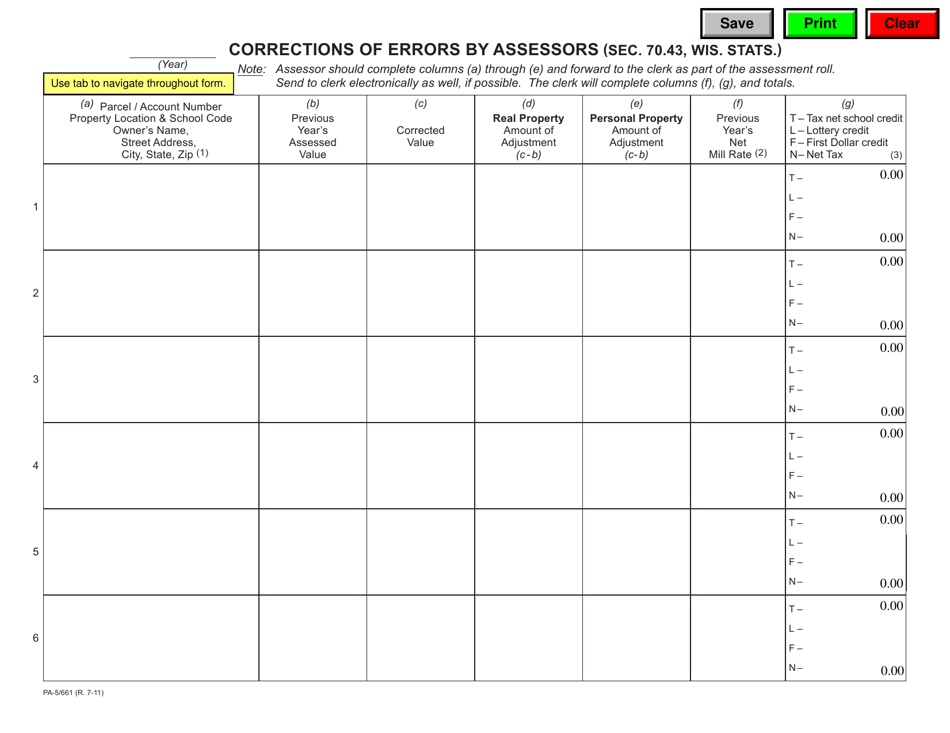

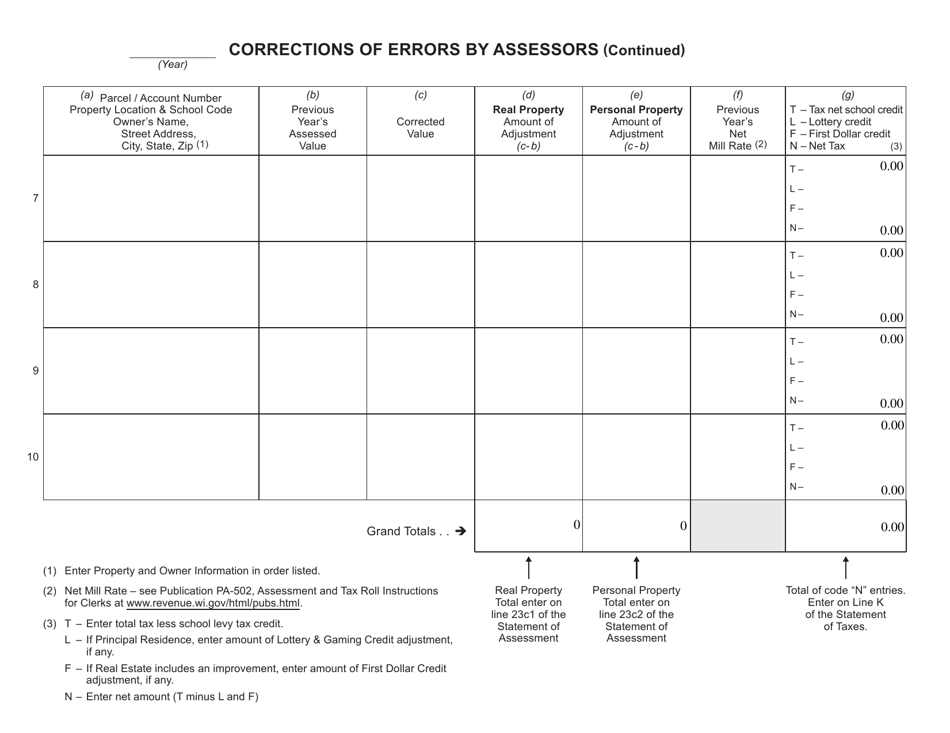

Form PA-5 / 661 Corrections of Errors by Assessors - Wisconsin

What Is Form PA-5/661?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-5/661?

A: Form PA-5/661 is a document used in Wisconsin for making corrections to errors made by assessors.

Q: Who uses Form PA-5/661?

A: Assessors use Form PA-5/661 to rectify errors made in property assessments.

Q: What type of errors can be corrected using Form PA-5/661?

A: Form PA-5/661 is used to correct errors related to property assessments, such as incorrect property classifications or incorrect assessment values.

Q: What is the deadline for submitting Form PA-5/661?

A: The deadline for submitting Form PA-5/661 varies depending on the circumstances. It is advisable to contact the local assessor's office for specific deadlines.

Q: Are there any fees associated with submitting Form PA-5/661?

A: There are no fees associated with submitting Form PA-5/661.

Q: Can Form PA-5/661 be used to correct errors made by property owners?

A: No, Form PA-5/661 is specifically meant for assessors to correct errors made in property assessments, not for property owners to correct their own mistakes.

Form Details:

- Released on July 1, 2011;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-5/661 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.