This version of the form is not currently in use and is provided for reference only. Download this version of

Form PA-533

for the current year.

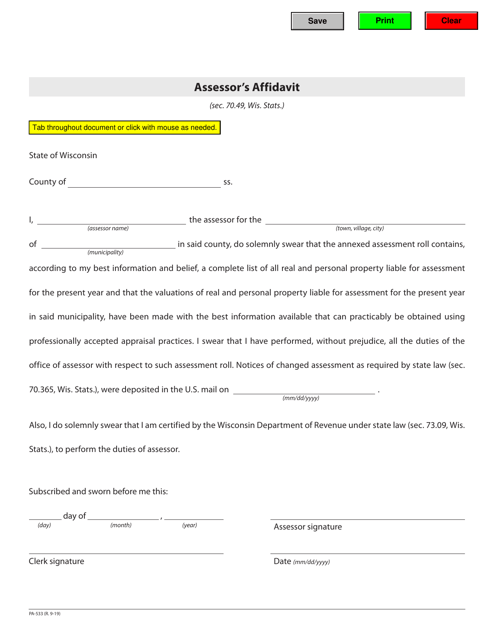

Form PA-533 Assessor's Affidavit - Wisconsin

What Is Form PA-533?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-533 Assessor's Affidavit?

A: Form PA-533 Assessor's Affidavit is a document used in Wisconsin for property assessment purposes.

Q: Who needs to complete Form PA-533 Assessor's Affidavit?

A: This form is typically completed by assessors or their authorized representatives.

Q: What is the purpose of Form PA-533 Assessor's Affidavit?

A: The purpose of this form is to provide information about property characteristics and ownership for assessment purposes.

Q: What information is required on Form PA-533 Assessor's Affidavit?

A: The form requires information such as property address, owner's name, legal description, and property characteristics.

Q: When should Form PA-533 Assessor's Affidavit be submitted?

A: This form is typically submitted annually to update property assessment records.

Q: Are there any fees associated with submitting Form PA-533 Assessor's Affidavit?

A: There are no fees associated with submitting this form.

Q: What are the potential consequences for not submitting Form PA-533 Assessor's Affidavit?

A: Failure to submit this form may result in inaccurate property assessments and potential penalties.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-533 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.