This version of the form is not currently in use and is provided for reference only. Download this version of

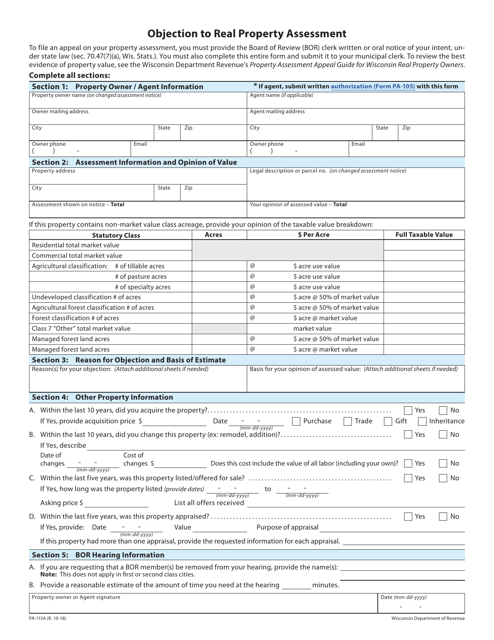

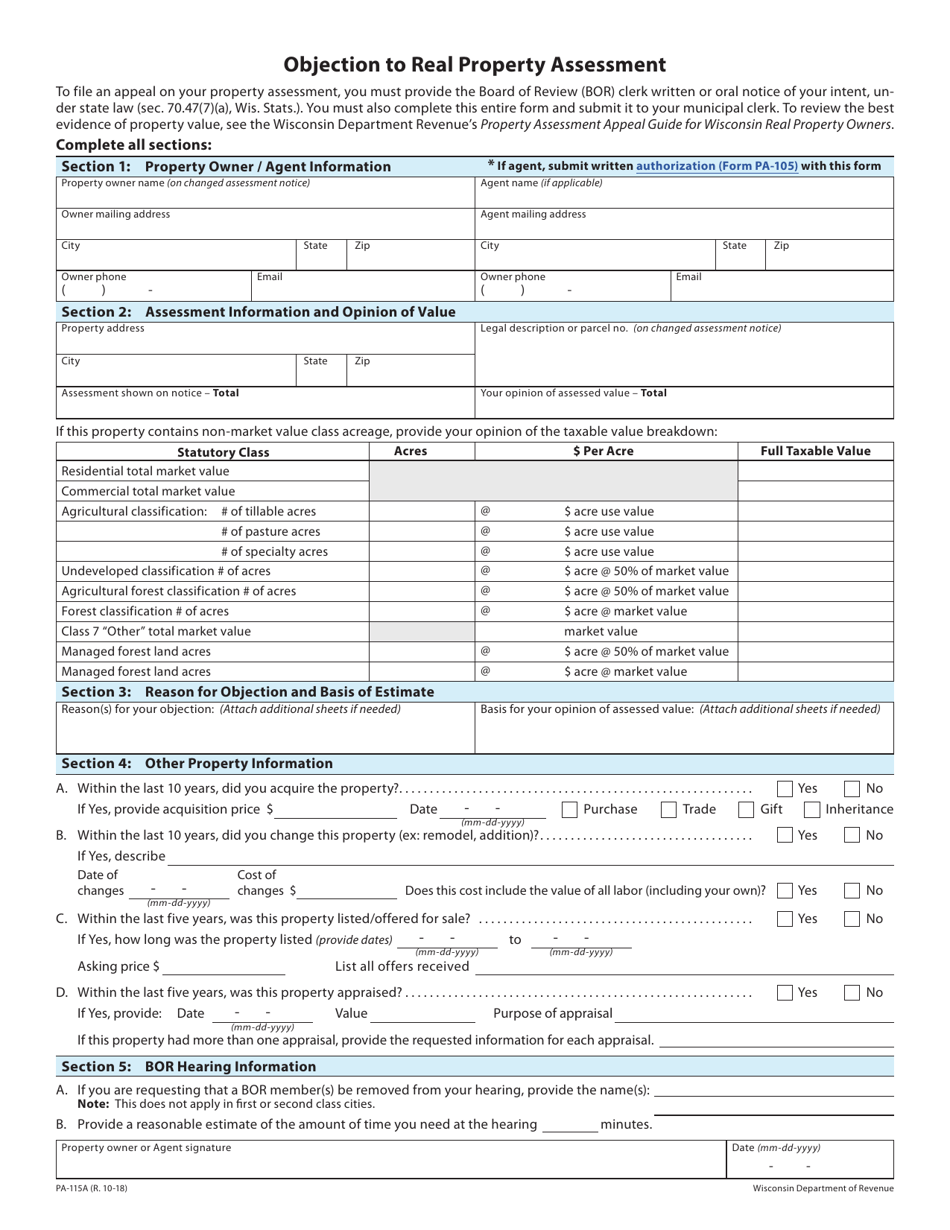

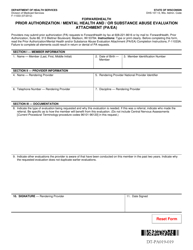

Form PA-115A

for the current year.

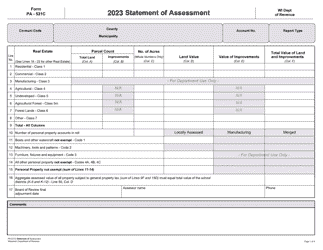

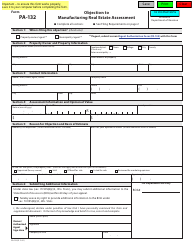

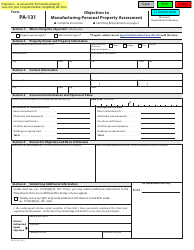

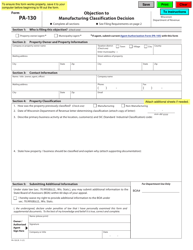

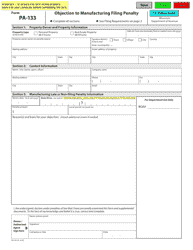

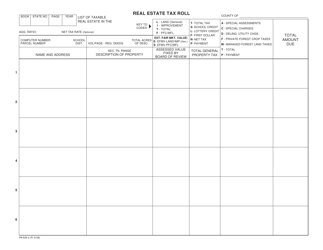

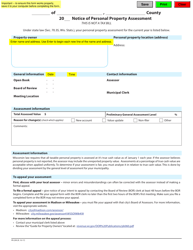

Form PA-115A Objection to Real Property Assessment - Wisconsin

What Is Form PA-115A?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-115A?

A: Form PA-115A is a document used in Wisconsin to file an objection to a real property assessment.

Q: How do I use Form PA-115A?

A: You can use Form PA-115A to formally object to the assessed value of your property and request a review by the Board of Review.

Q: When should I file Form PA-115A?

A: You must file Form PA-115A within the specified time frame provided by your municipality, which is usually within a certain number of days after the assessment roll is completed.

Q: What information do I need to fill out Form PA-115A?

A: You will need to provide information about your property, including its address, assessed value, and the reason for your objection.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PA-115A by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.