This version of the form is not currently in use and is provided for reference only. Download this version of

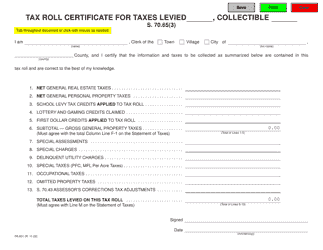

Form PA-5/659

for the current year.

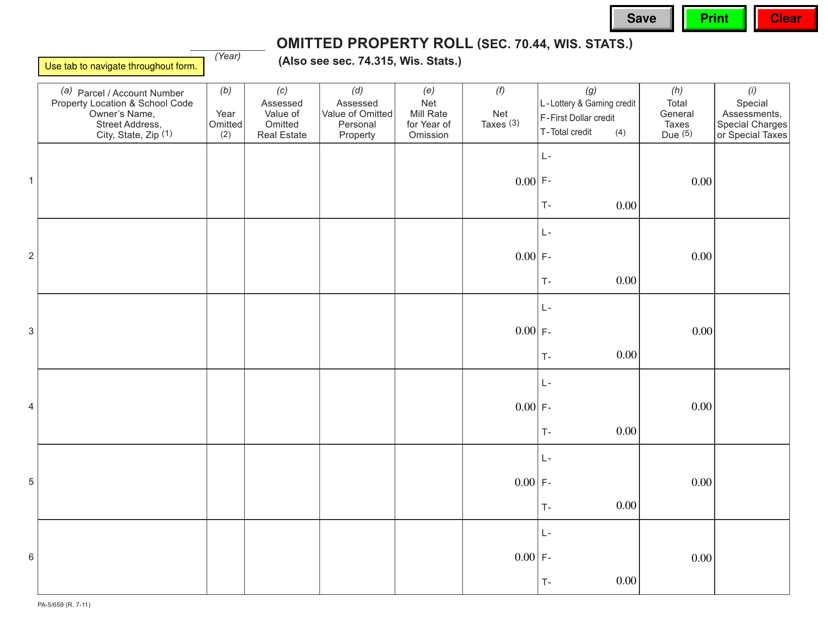

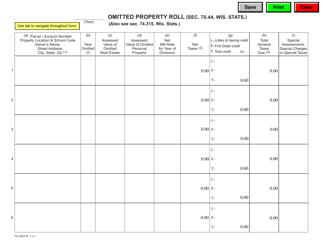

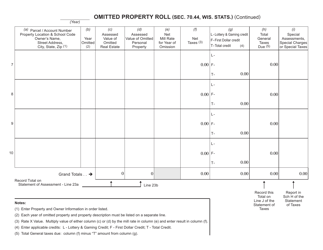

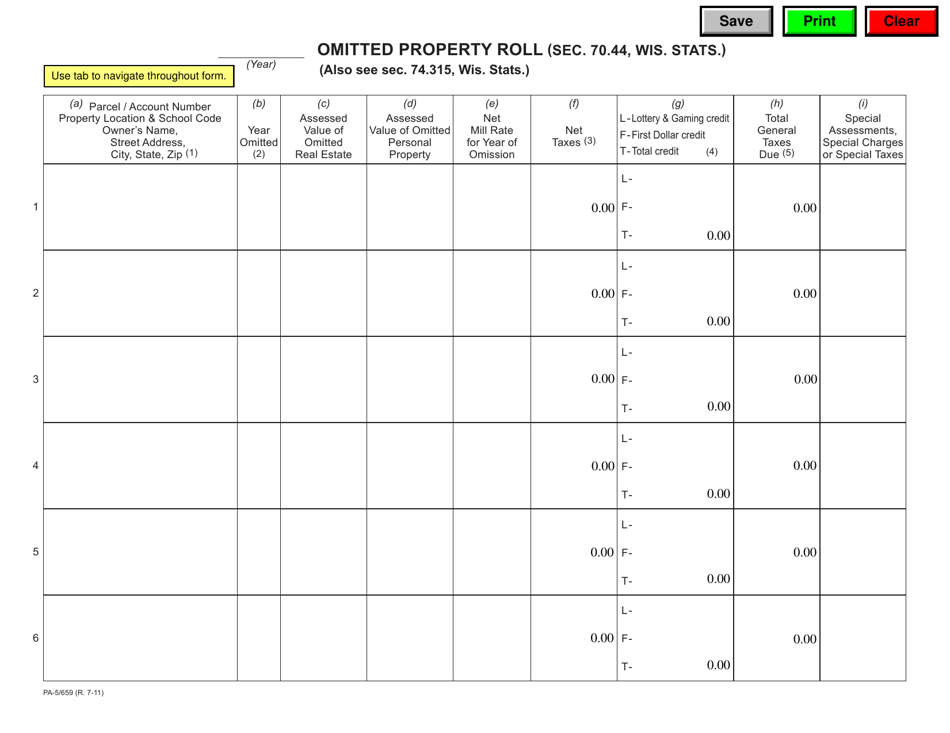

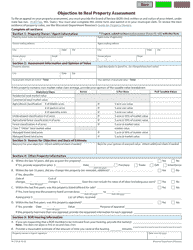

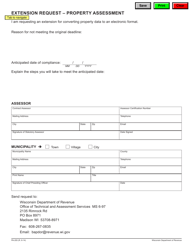

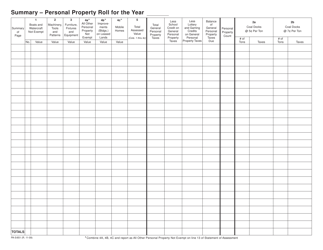

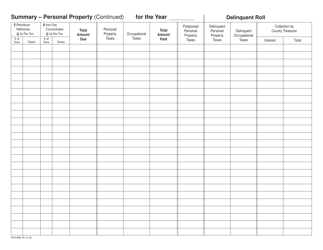

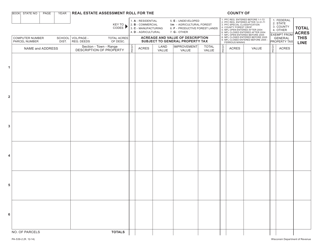

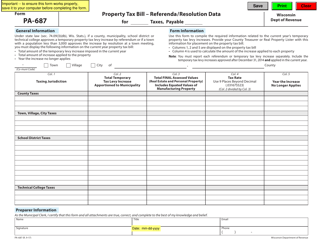

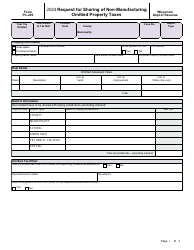

Form PA-5 / 659 Omitted Property Roll - Wisconsin

What Is Form PA-5/659?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form PA-5/659 Omitted Property Roll?

A: Form PA-5/659 Omitted Property Roll is a form used in Wisconsin to report any property that was unintentionally omitted from a previous assessment roll.

Q: Why would I need to file a Form PA-5/659 Omitted Property Roll?

A: You would need to file a Form PA-5/659 Omitted Property Roll if you discovered that you unintentionally left out certain properties from a previous assessment roll.

Q: How do I file a Form PA-5/659 Omitted Property Roll?

A: You can obtain a Form PA-5/659 Omitted Property Roll from your local assessor's office or the Wisconsin Department of Revenue. Fill out the form accurately and submit it to the appropriate authority.

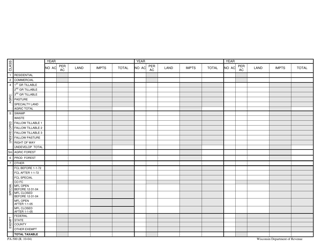

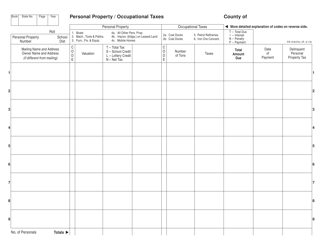

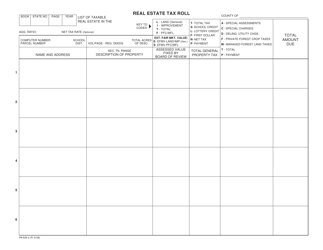

Q: What information do I need to include on the Form PA-5/659 Omitted Property Roll?

A: You will need to provide details about the omitted property, such as the property address, size, and value. You may also need to explain why the property was omitted.

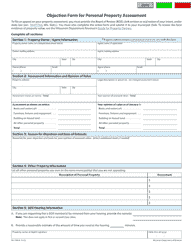

Q: Is there a deadline for filing a Form PA-5/659 Omitted Property Roll?

A: Yes, there is a deadline for filing a Form PA-5/659 Omitted Property Roll. The deadline is typically within 30 days from the date you discovered the omission.

Q: Are there any penalties for failing to file a Form PA-5/659 Omitted Property Roll?

A: Yes, there may be penalties for failing to file a Form PA-5/659 Omitted Property Roll. It is important to accurately report all properties to avoid any potential penalties or legal issues.

Form Details:

- Released on July 1, 2011;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-5/659 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.