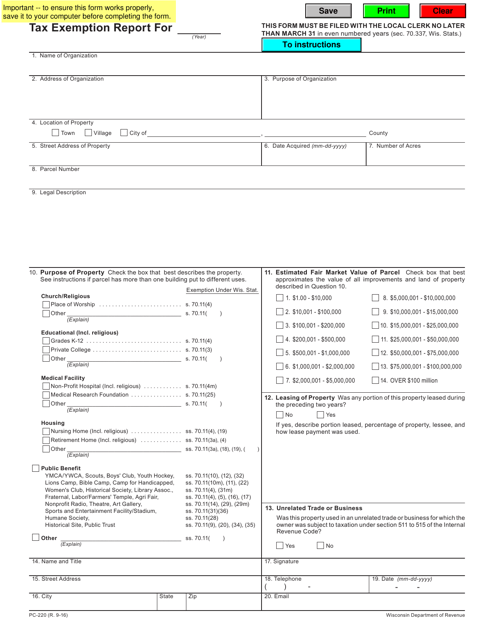

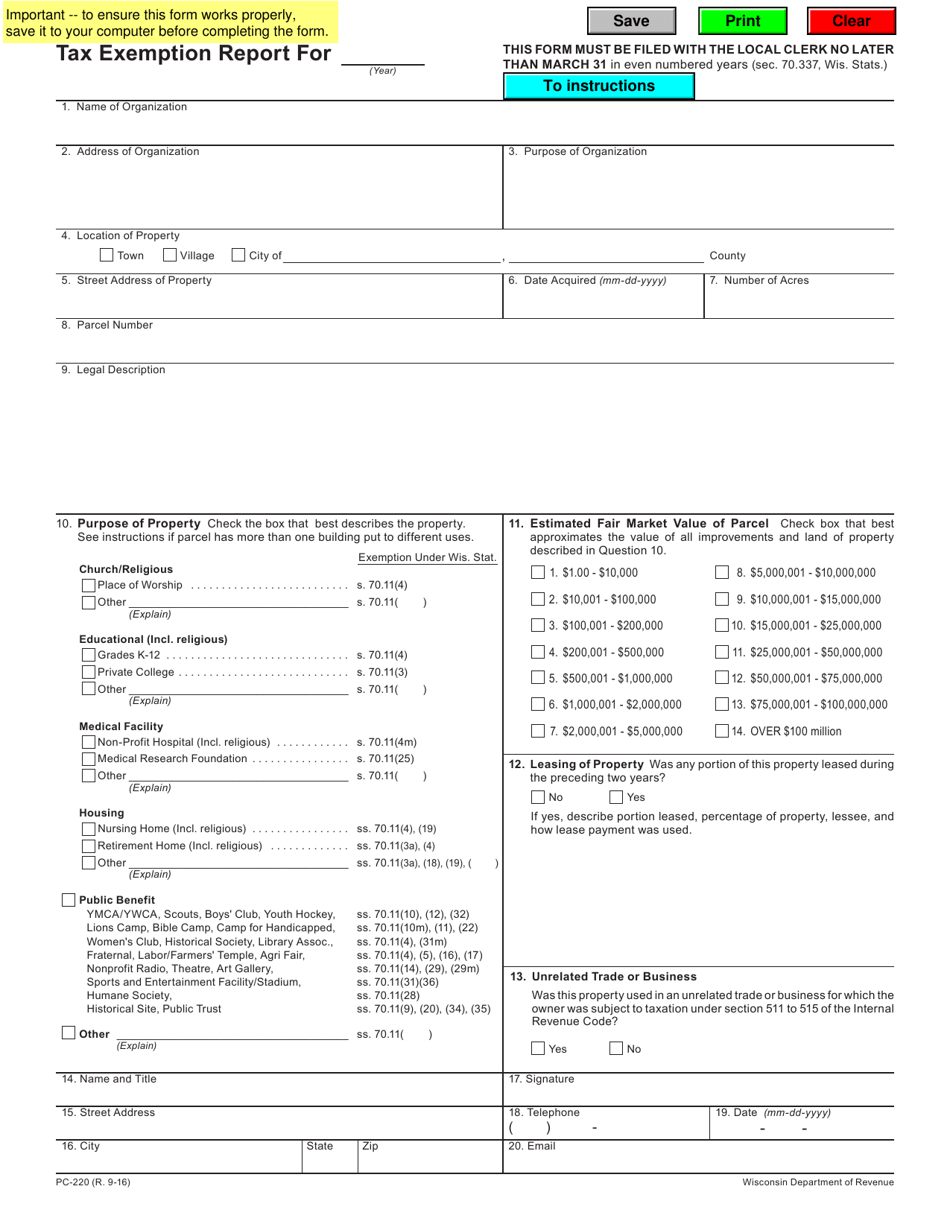

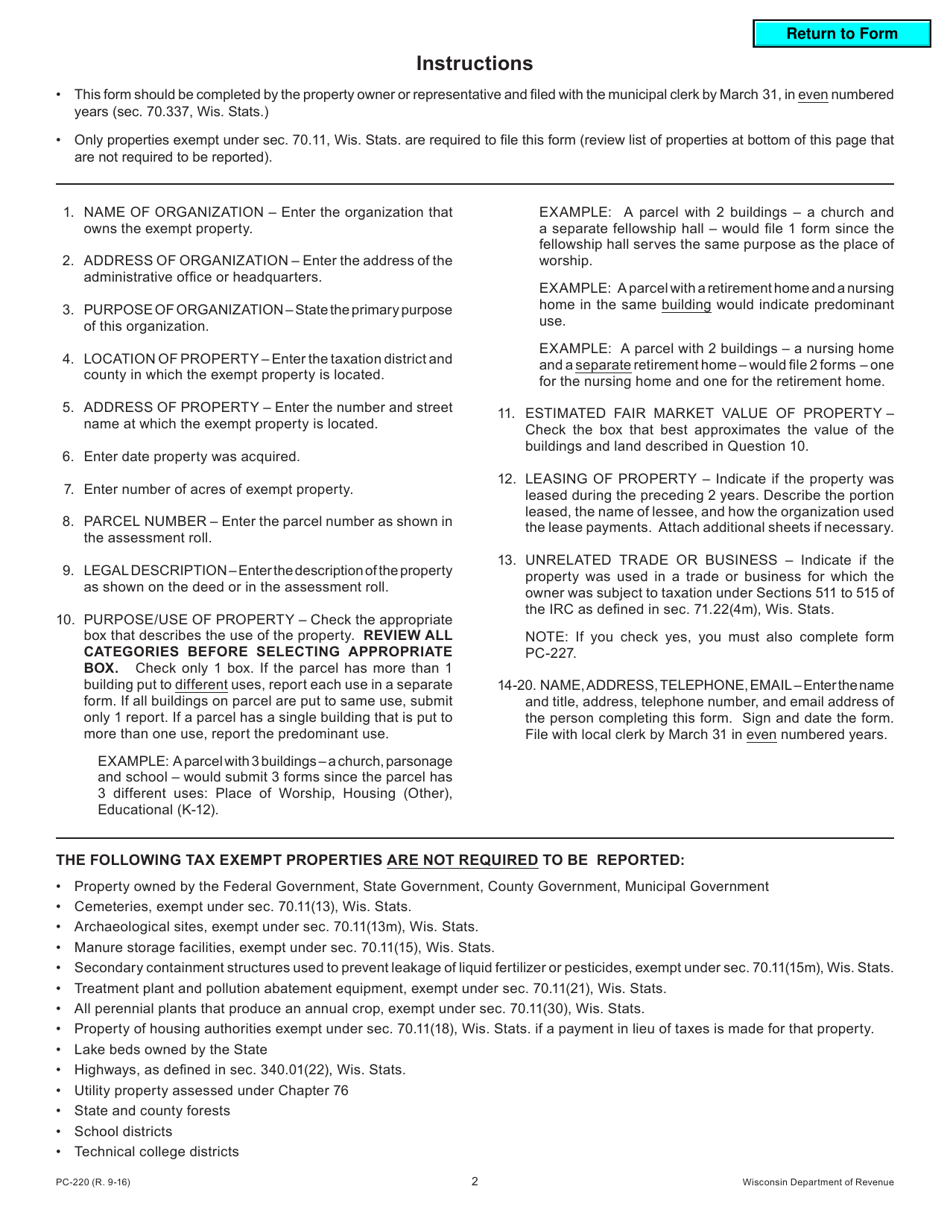

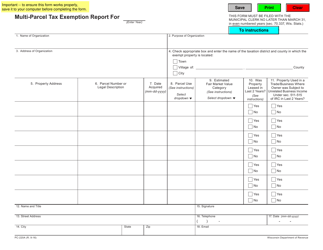

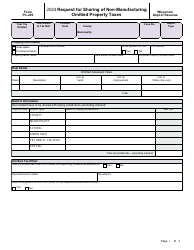

Form PC-220 Tax Exemption Report - Wisconsin

What Is Form PC-220?

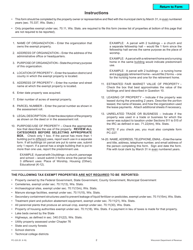

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PC-220?

A: Form PC-220 is the Tax Exemption Report for Wisconsin.

Q: Who needs to file Form PC-220?

A: Entities that are seeking tax exemptions in Wisconsin need to file Form PC-220.

Q: What is the purpose of Form PC-220?

A: The purpose of Form PC-220 is to report information about entities seeking tax exemptions in Wisconsin.

Q: What information is required on Form PC-220?

A: Form PC-220 requires information about the entity seeking the tax exemption, including its name, address, and federal tax identification number.

Q: When is Form PC-220 due?

A: Form PC-220 is due on or before the 15th day of the 5th month following the close of the entity's tax year.

Q: Is there a fee to file Form PC-220?

A: No, there is no fee to file Form PC-220.

Q: What happens after I file Form PC-220?

A: After filing Form PC-220, the Wisconsin Department of Revenue will review the information and determine if the entity qualifies for the requested tax exemption.

Q: What should I do if I have questions about Form PC-220?

A: If you have questions about Form PC-220, you can contact the Wisconsin Department of Revenue for assistance.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PC-220 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.