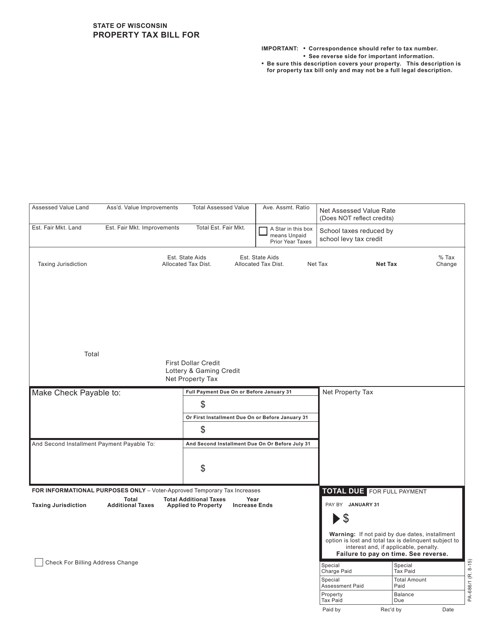

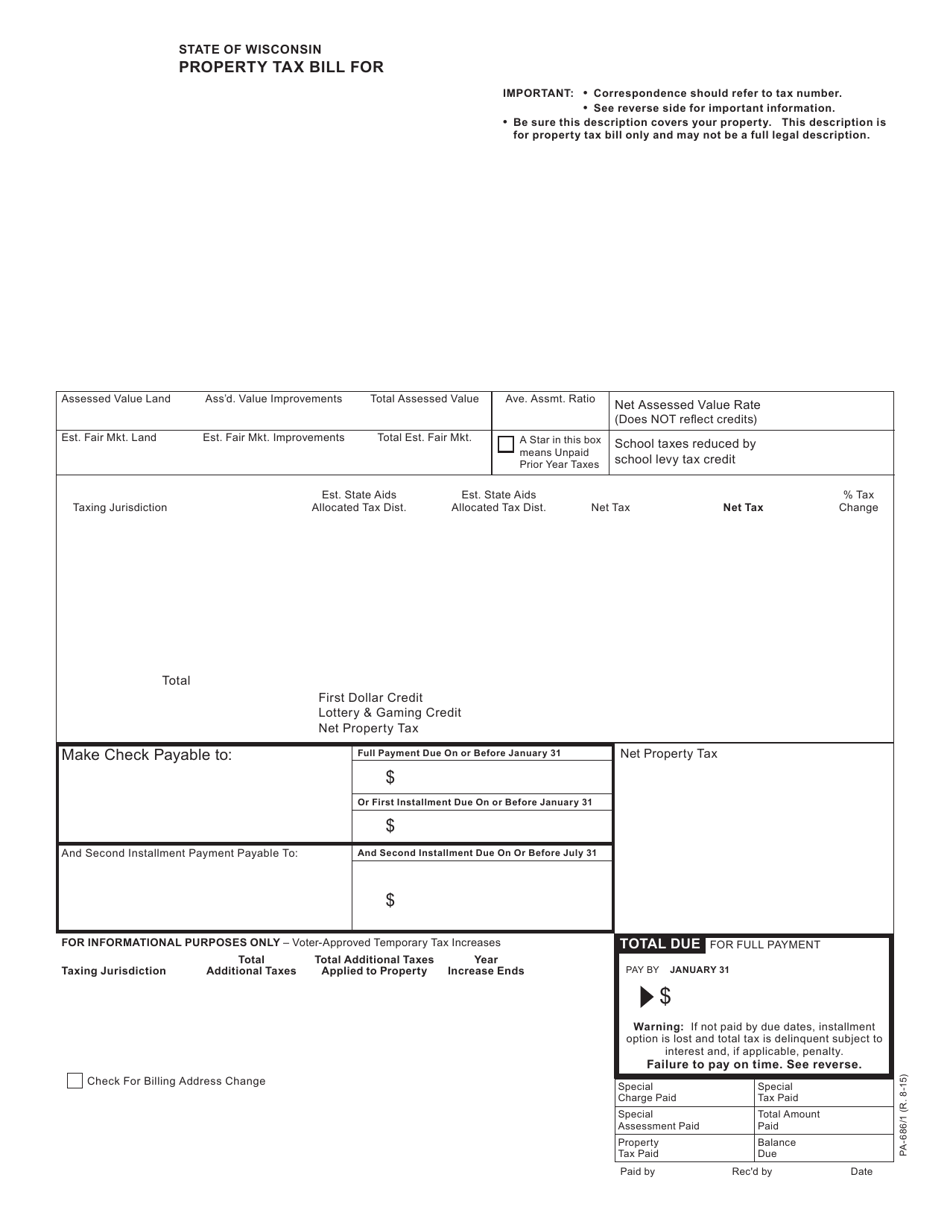

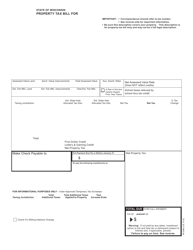

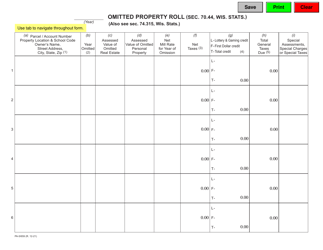

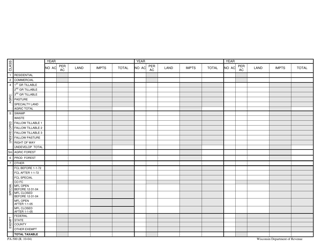

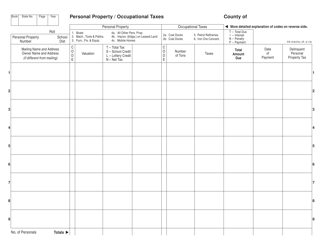

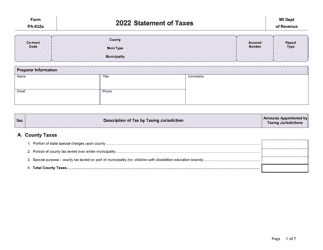

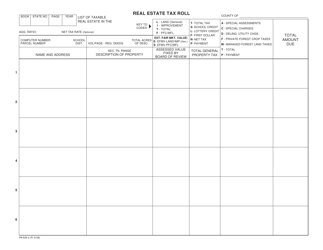

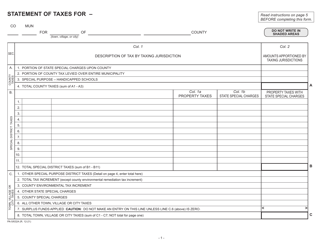

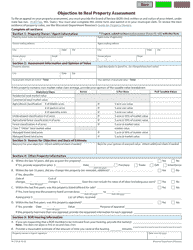

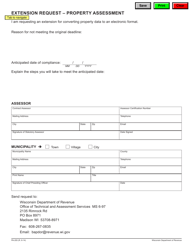

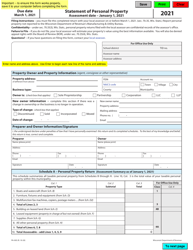

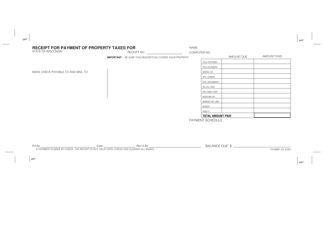

Form PA-686 / 1 Property Tax Bill - Wisconsin

What Is Form PA-686/1?

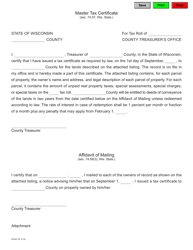

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form PA-686/1?

A: Form PA-686/1 is the Property Tax Bill used in Wisconsin.

Q: Who receives form PA-686/1 Property Tax Bill?

A: Property owners in Wisconsin receive form PA-686/1 Property Tax Bill.

Q: What is the purpose of form PA-686/1 Property Tax Bill?

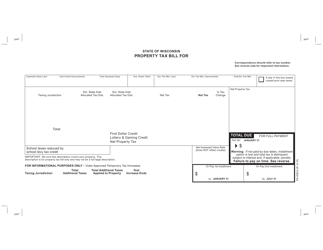

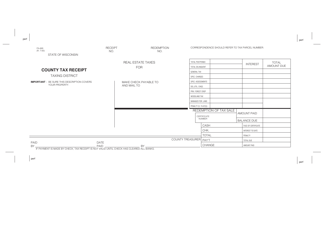

A: The purpose of form PA-686/1 Property Tax Bill is to assess and collect property taxes.

Q: How often is form PA-686/1 Property Tax Bill issued?

A: Form PA-686/1 Property Tax Bill is typically issued annually.

Q: Are there any exemptions or deductions available on form PA-686/1 Property Tax Bill?

A: Yes, there are various exemptions and deductions available on form PA-686/1 Property Tax Bill. Consult the instructions for the specific eligibility requirements.

Q: What happens if I don't pay my form PA-686/1 Property Tax Bill?

A: If you don't pay your form PA-686/1 Property Tax Bill, you may face penalties, interest, and potential legal action.

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PA-686/1 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.