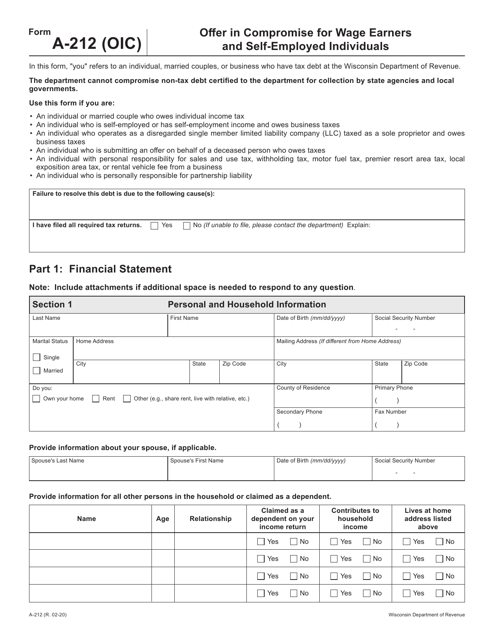

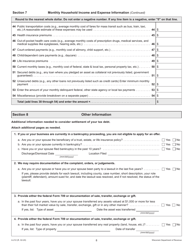

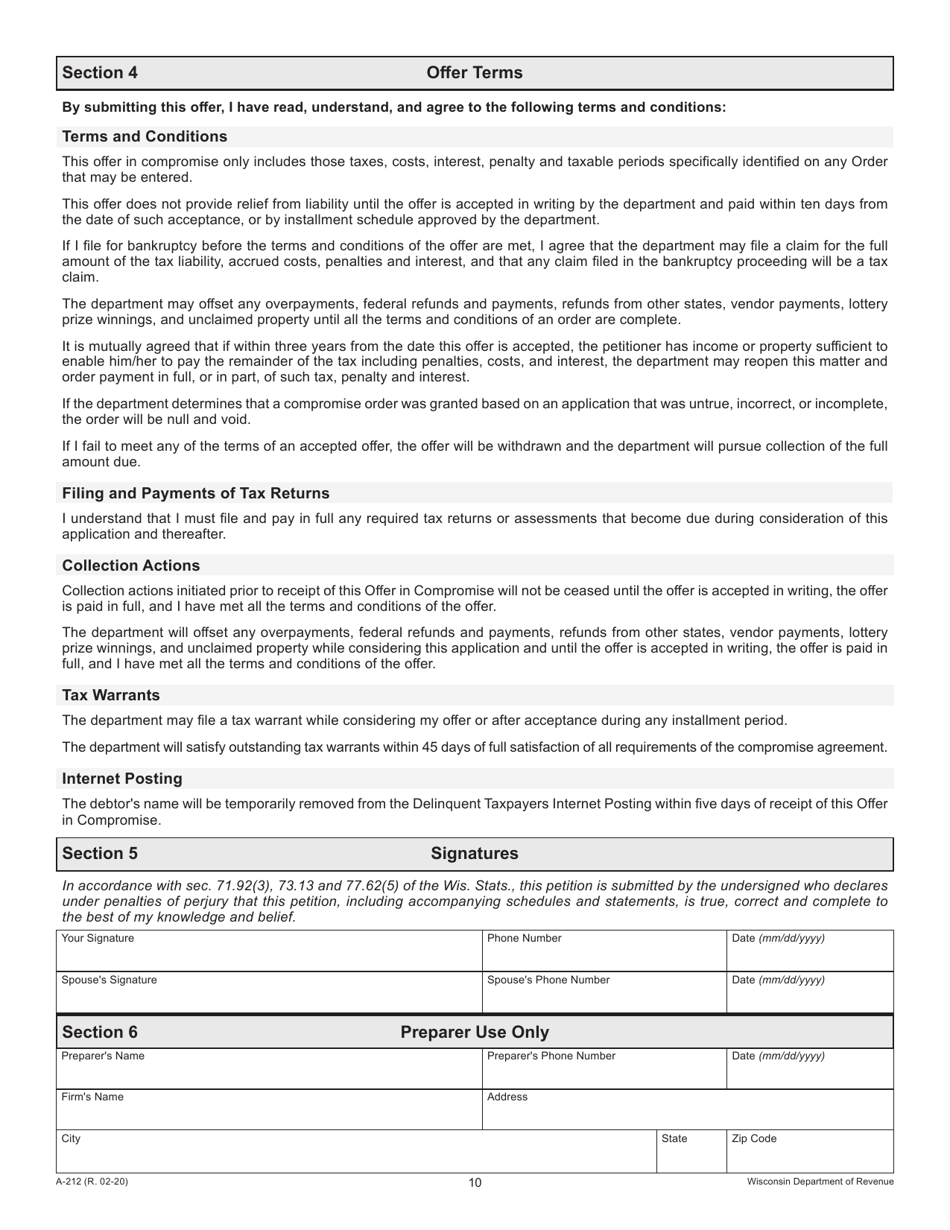

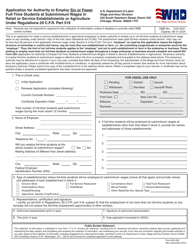

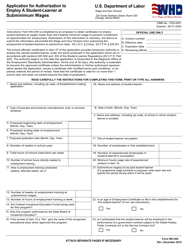

Form A-212 Offer in Compromise for Wage Earners and Self-employed Individuals - Wisconsin

What Is Form A-212?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-212?

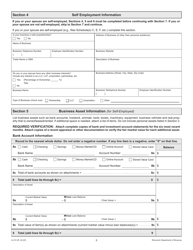

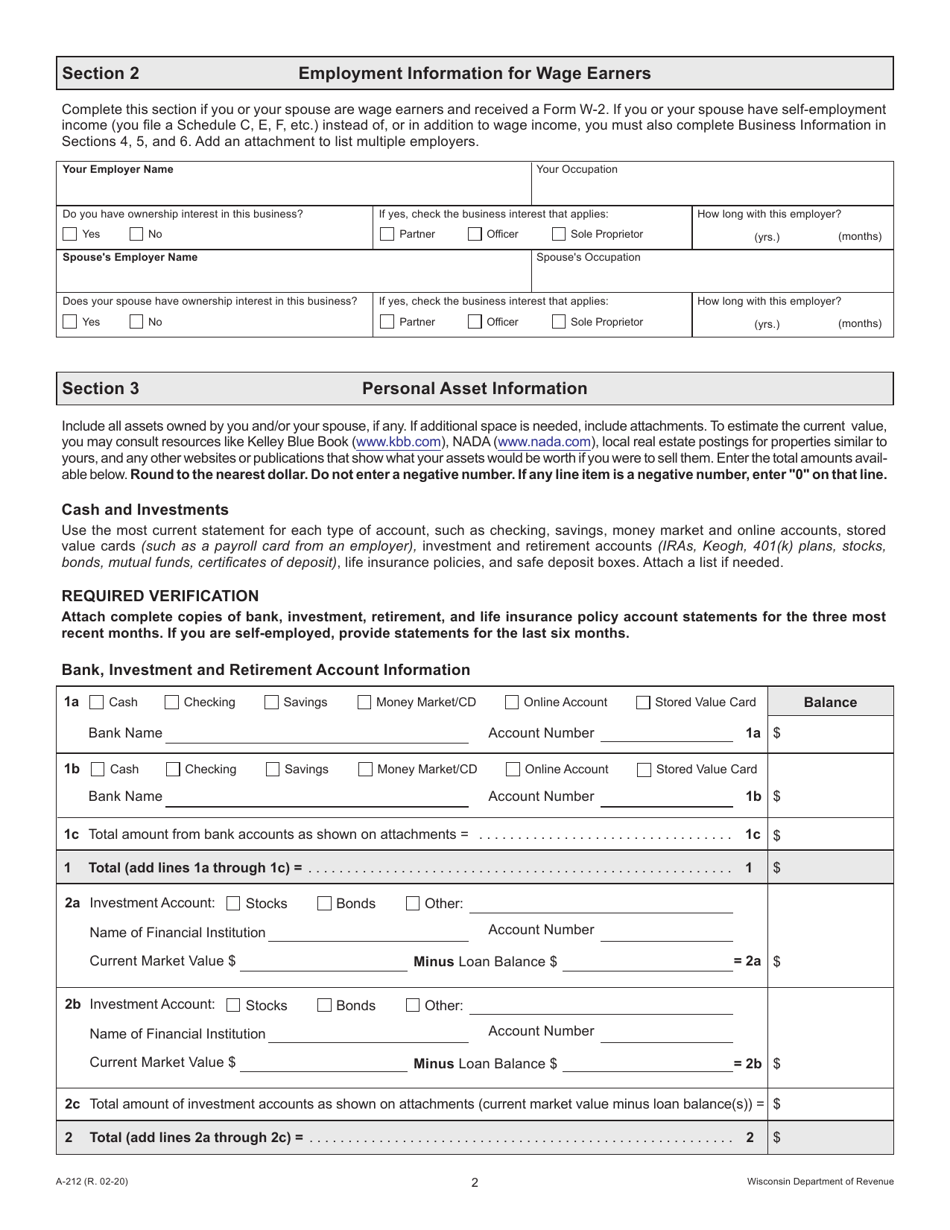

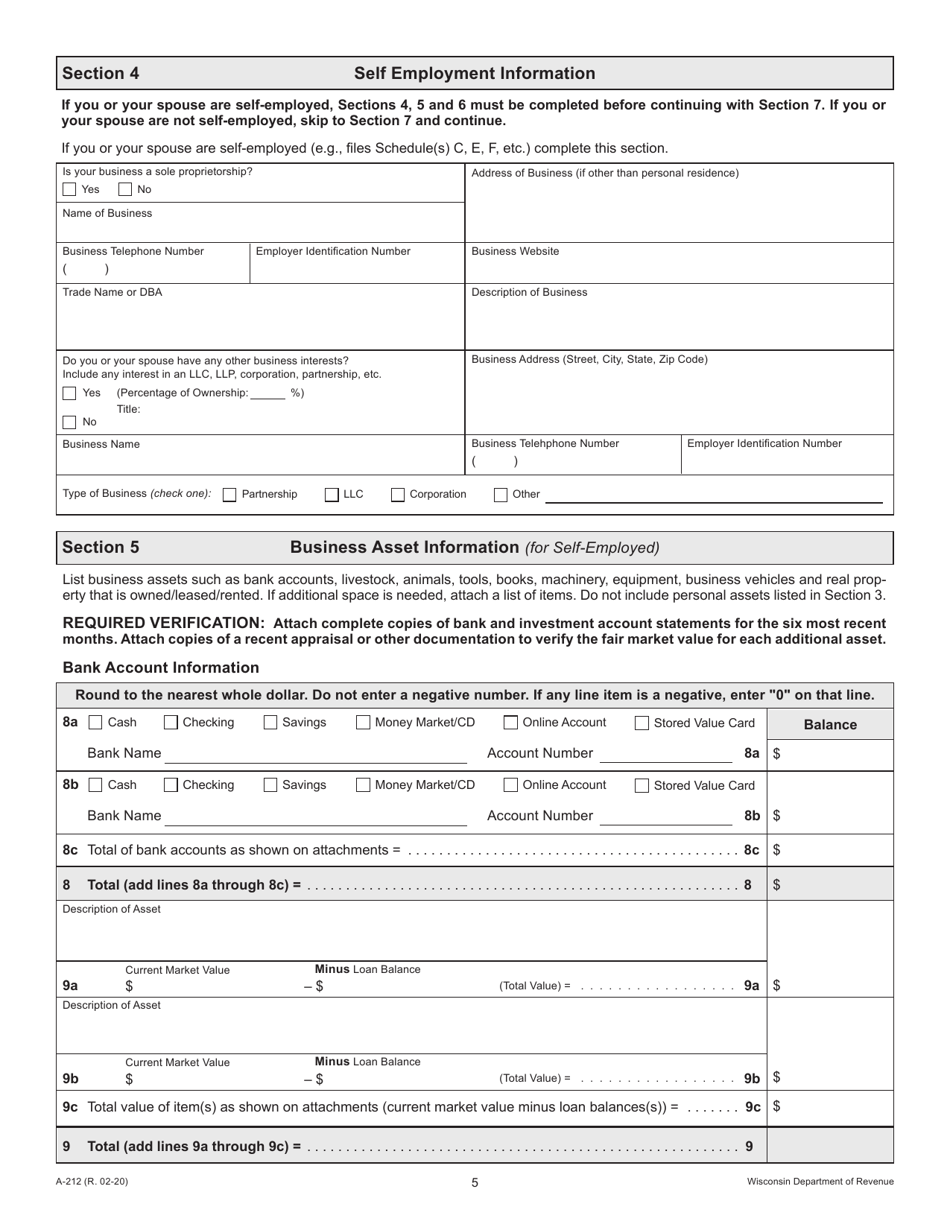

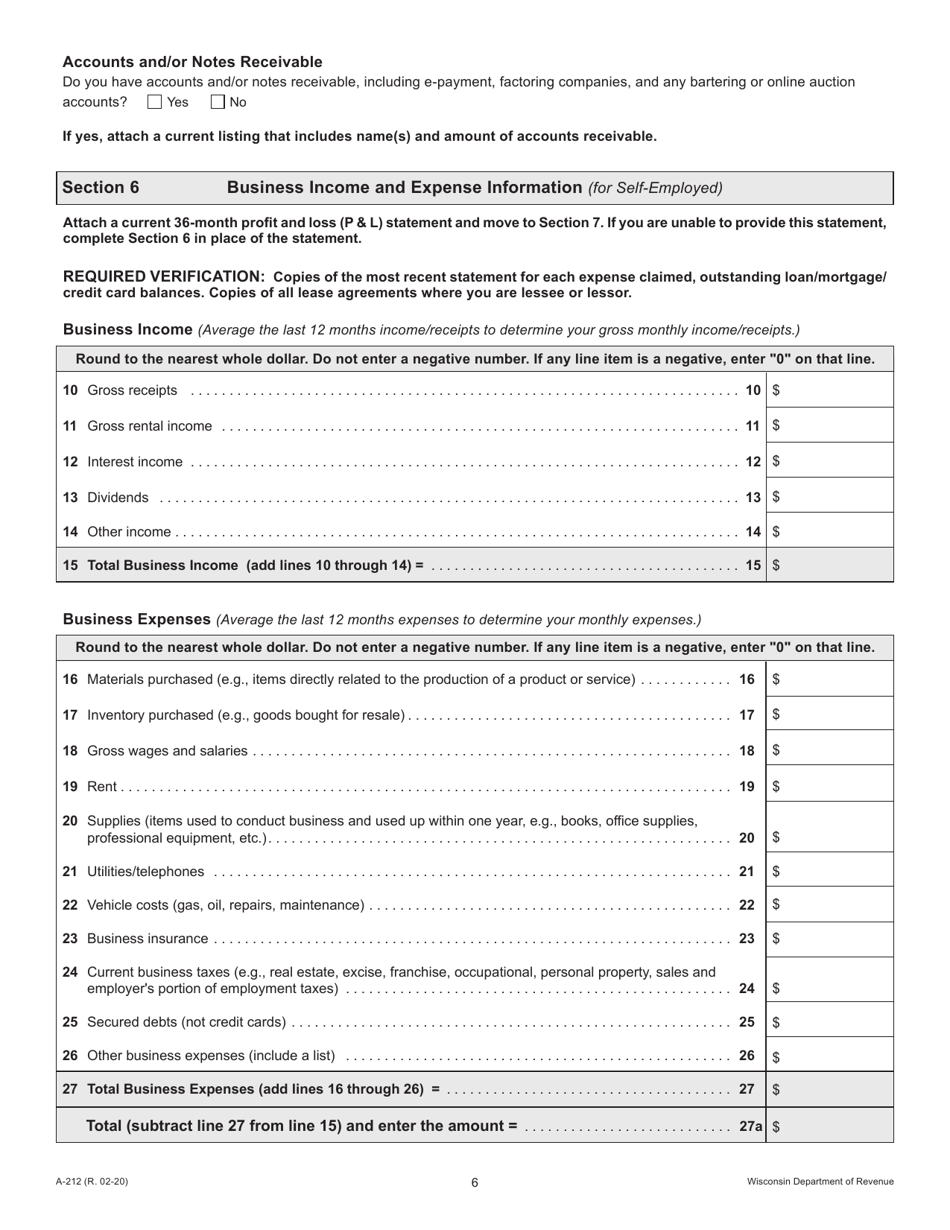

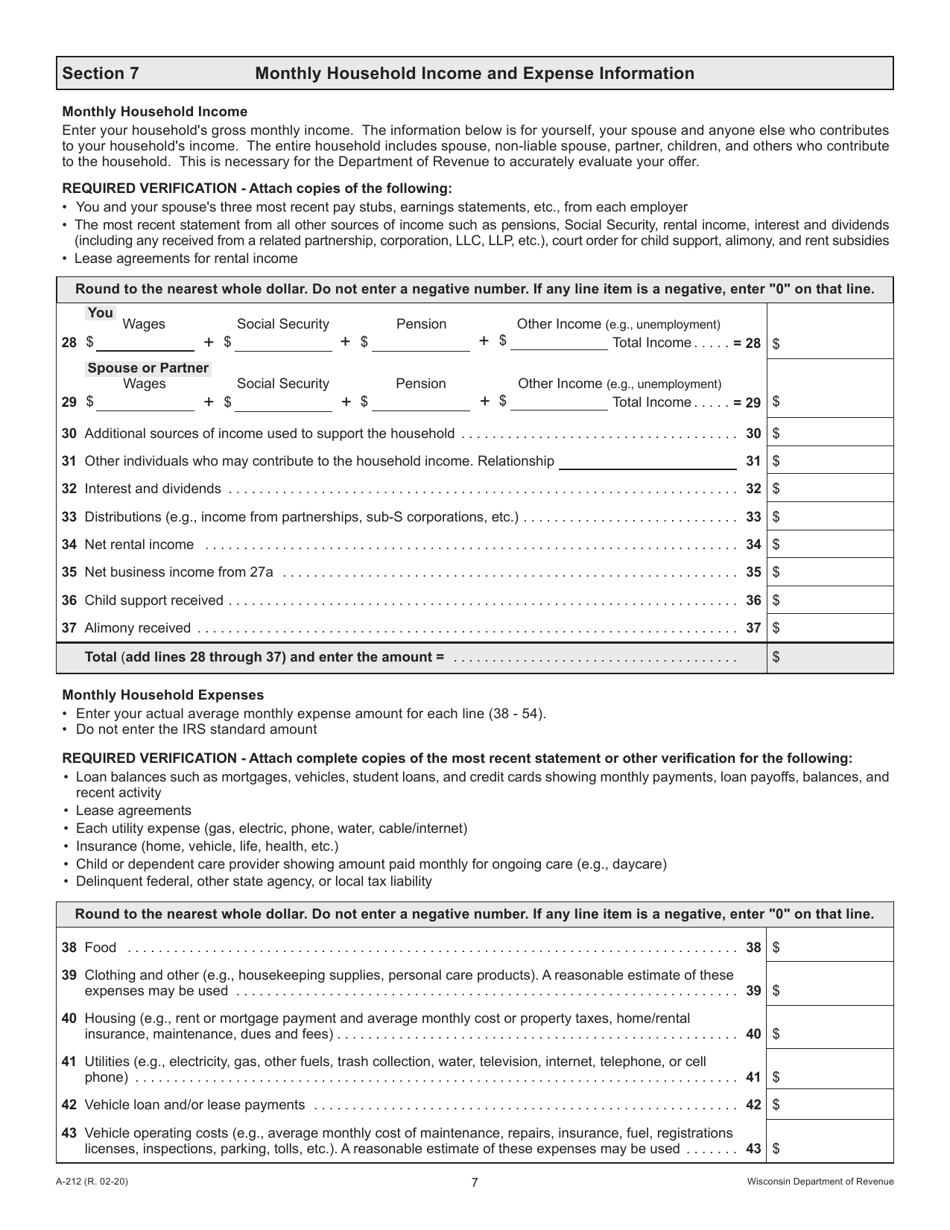

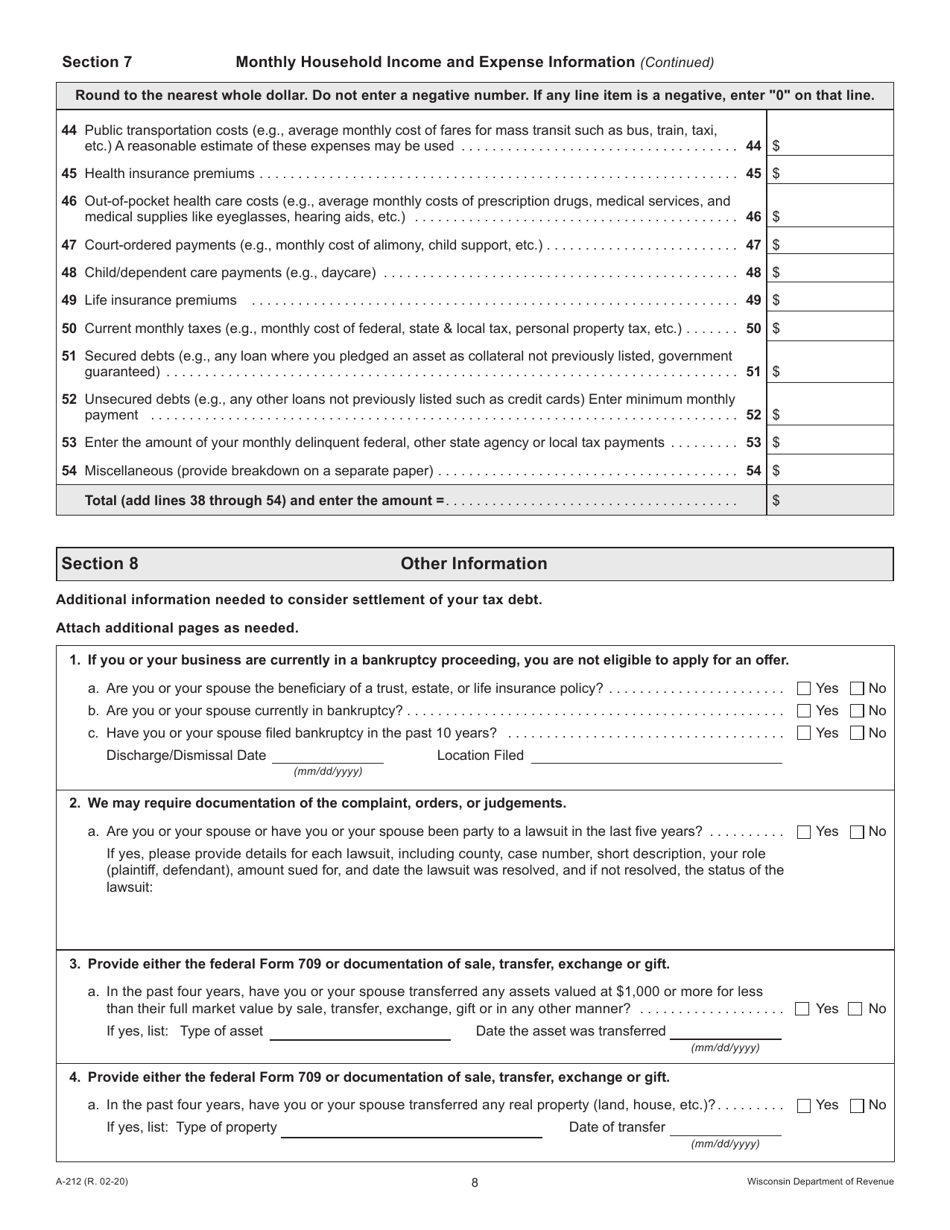

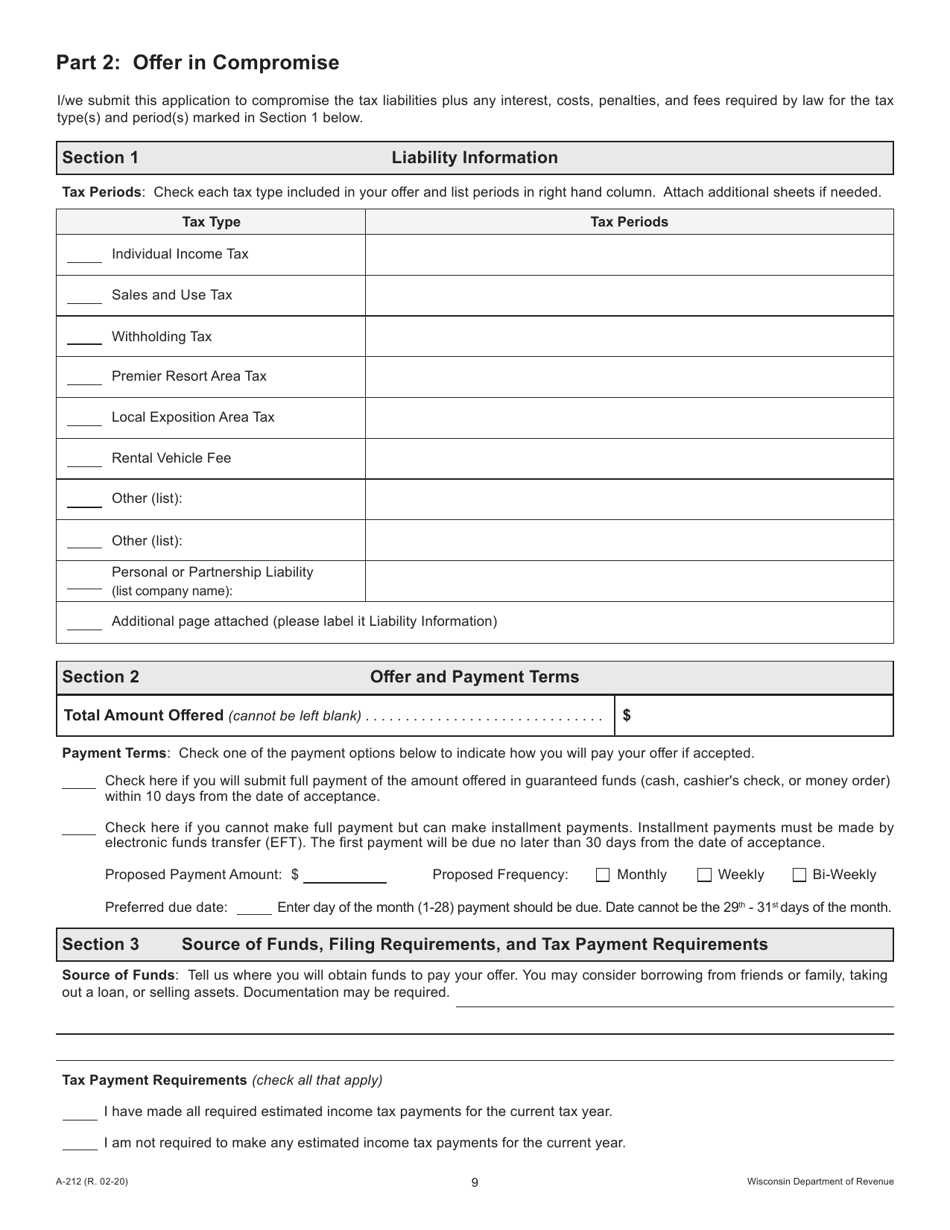

A: Form A-212 is an Offer in Compromise specifically designed for wage earners and self-employed individuals in Wisconsin.

Q: Who is eligible to use Form A-212?

A: Wage earners and self-employed individuals in Wisconsin are eligible to use Form A-212.

Q: What is an Offer in Compromise?

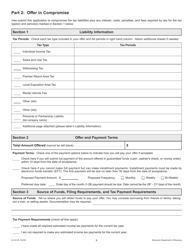

A: An Offer in Compromise is a program that allows taxpayers to settle their tax debts for less than the full amount owed.

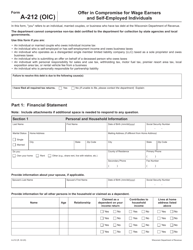

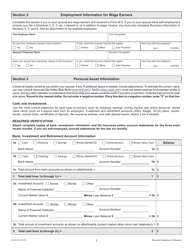

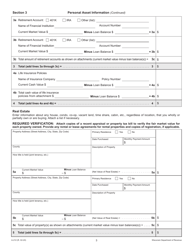

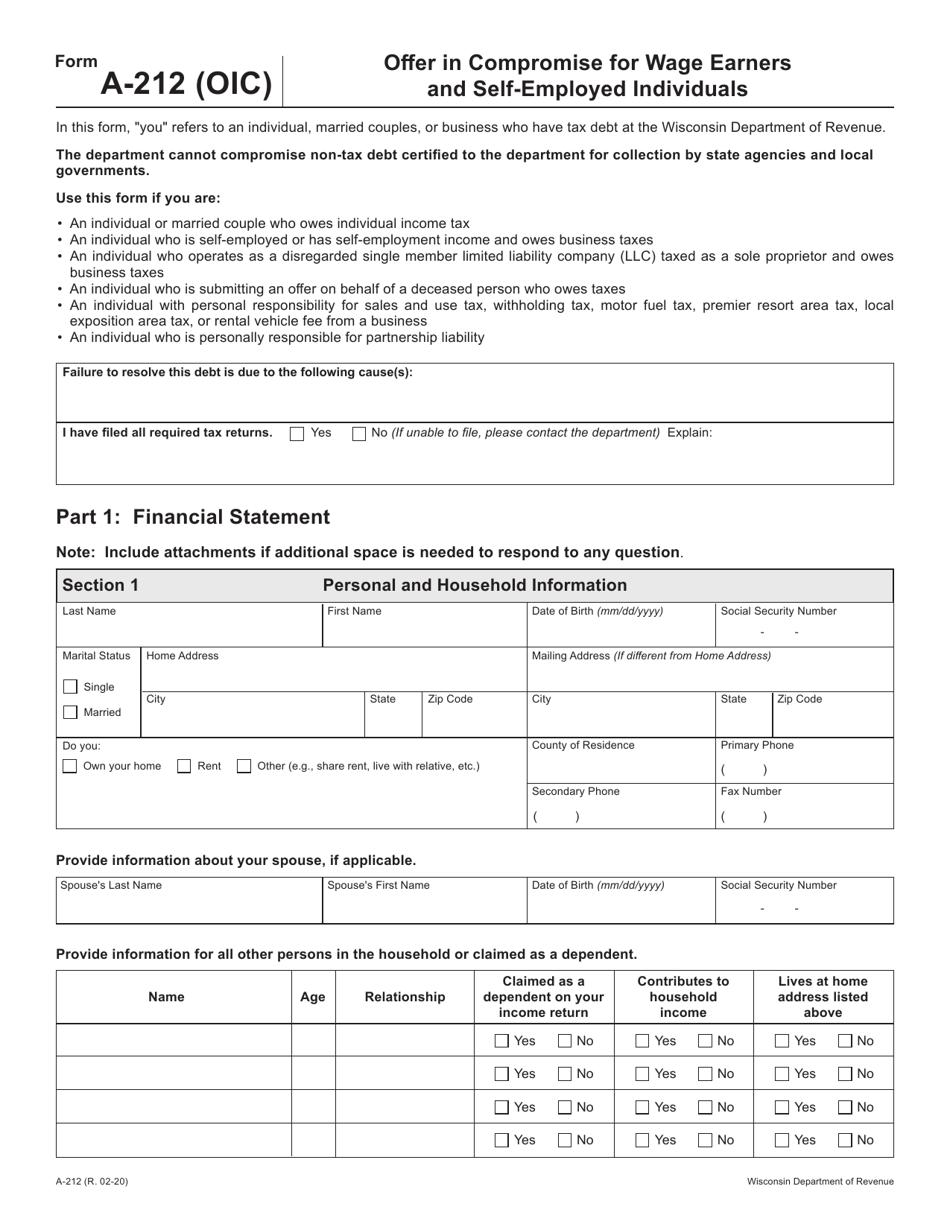

Q: How do I complete Form A-212?

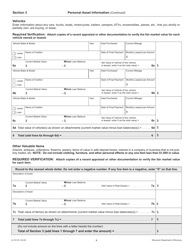

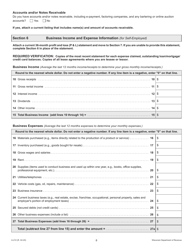

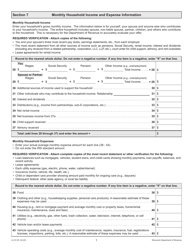

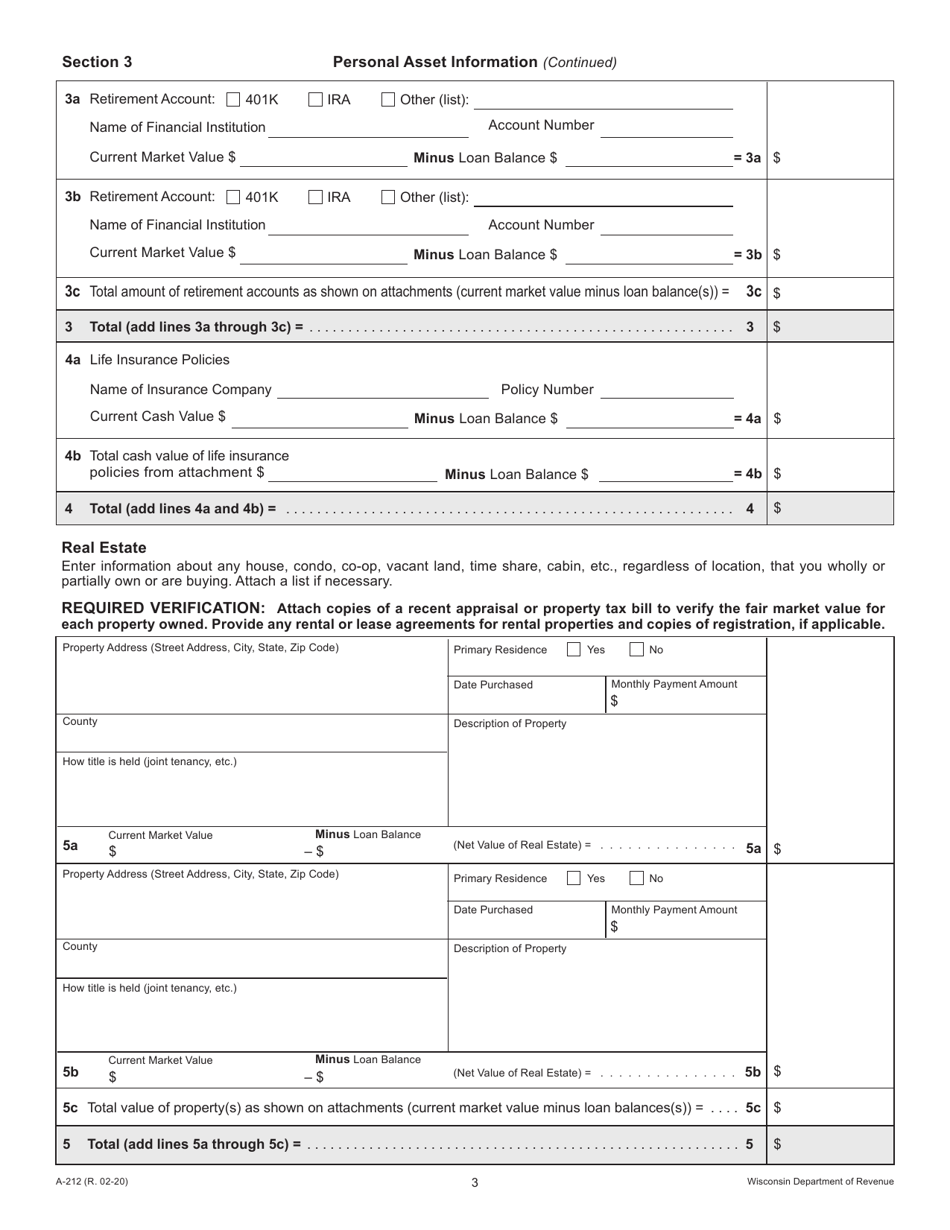

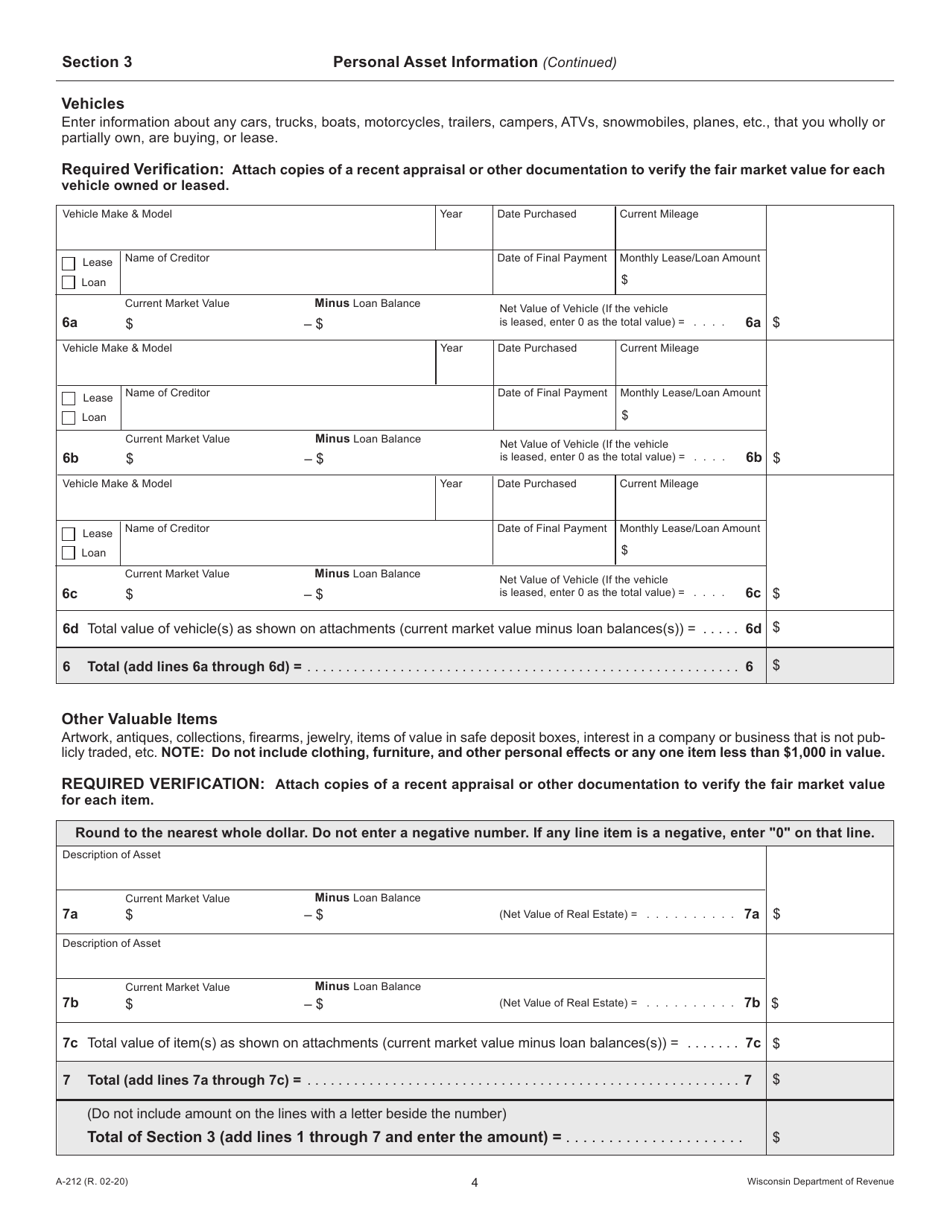

A: To complete Form A-212, you must provide detailed information about your income, expenses, assets, and liabilities.

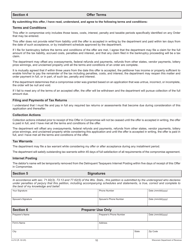

Q: What happens after I submit Form A-212?

A: After you submit Form A-212, the Wisconsin Department of Revenue will review your offer and determine whether to accept or reject it.

Q: Can I negotiate the amount of my tax debt with Form A-212?

A: Yes, Form A-212 allows you to propose a specific amount that you are willing and able to pay.

Q: Are there any fees associated with Form A-212?

A: Yes, there is a non-refundable $100 application fee for Form A-212.

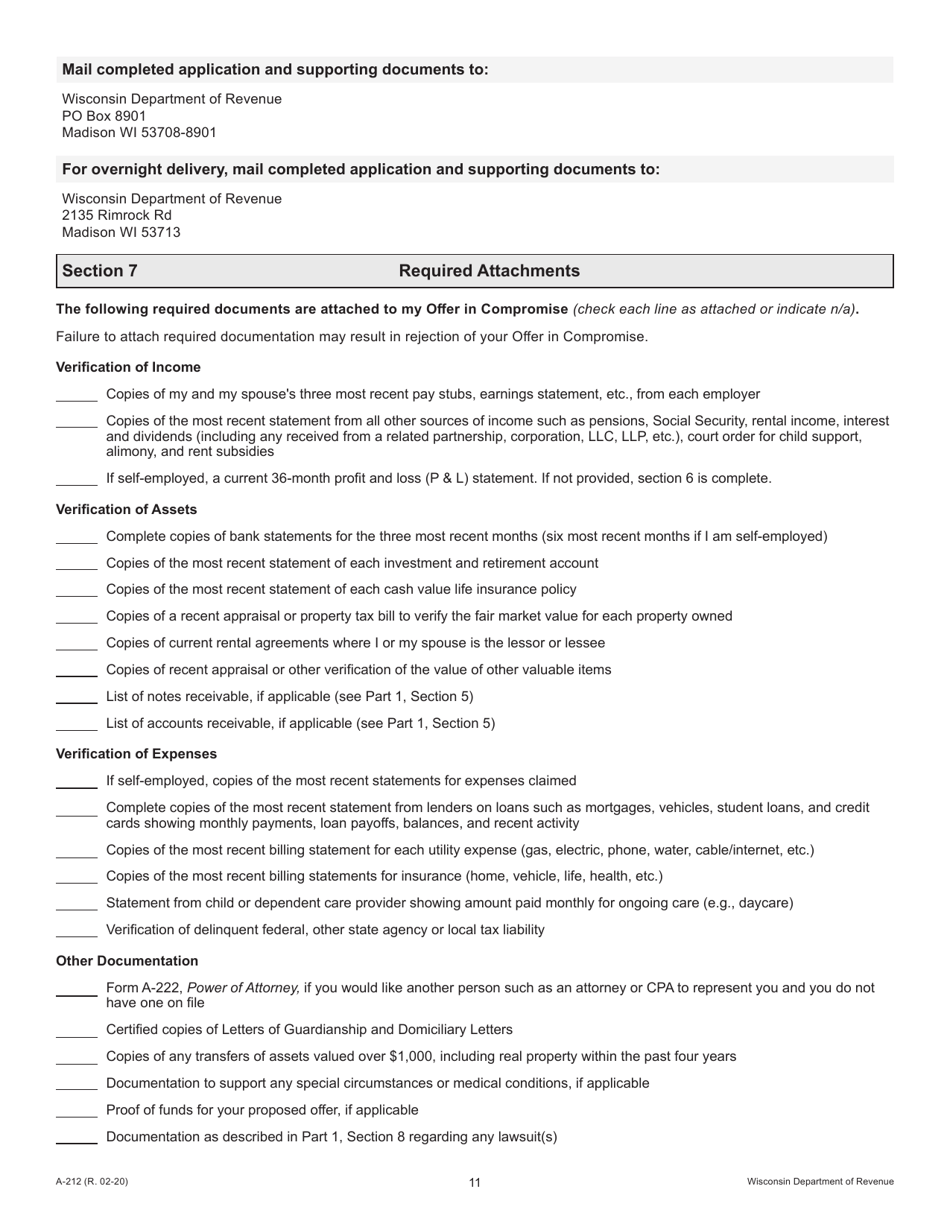

Q: What supporting documents do I need to include with Form A-212?

A: You will need to include supporting documents such as bank statements, pay stubs, and tax returns.

Q: How long does it take to process Form A-212?

A: The processing time for Form A-212 can vary, but it typically takes several months to receive a decision from the Wisconsin Department of Revenue.

Q: What happens if my Offer in Compromise is accepted?

A: If your Offer in Compromise is accepted, you will need to fulfill the terms of the agreement, which may include making regular payments or selling certain assets.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form A-212 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.